Interview with Joakim Nilsson, Social Monitor

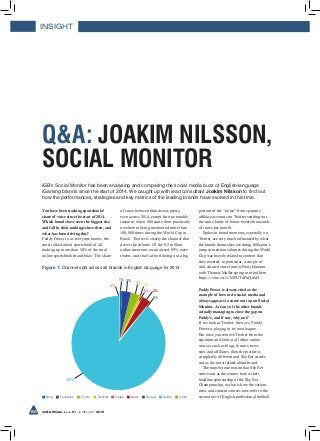

- 1. INSIGHT 60 iGB Affiliate Issue 51 JUNE/JULY 2015 iGB’s Social Monitor has been analysing and comparing the social media buzz of English-language iGaming brands since the start of 2014. We caught up with lead consultant Joakim Nilsson to find out how the performances, strategies and key metrics of the leading brands have evolved in this time. You have been tracking sportsbooks’ share of voice since the start of 2014. Which brands have seen the biggest rise and fall in their rankings since then, and what has been driving this? Paddy Power is, as everyone knows, the most talked-about sportsbook of all, making up more than 50% of the total online sportsbook brand buzz. The share of voice between brands was pretty even across 2014, except for one notable instance, when 888 came from practically nowhere to being mentioned more than 100,000 times during the World Cup in Brazil. Twitter is clearly the channel that drives the volume. Of the 8.2 million online mentions we analysed, 89% were tweets, and that’s after filtering out a big portion of the “noise” from spammy affiliate accounts on Twitter sending out the same kinds of bonus tweets thousands of times per month. Spikes in brand mentions, especially on Twitter, are very much influenced by what the brands themselves are doing. 888sport’s jump in mention volumes during the World Cup was heavily related to content that they tweeted, in particular, a couple of well-curated vines from @FootyHumour with Thomas Muller spring to mind here: https://vine.co/v/MFUTdPuQeAH Paddy Power is always cited as the example of how to do social media and always appears to come out top on Social Monitor. Are any of the other brands actually managing to close the gap on Paddy’s, and if not, why not? If we look at Twitter, then yes, Paddy Power is playing in its own league. But once you remove Twitter from the equation and look at all other online sources such as blogs, forums, news sites and affiliates, then the picture is completely different and Sky Bet comes out as the most talked-about brand. The number one reason that Sky Bet comes out as the winner here is their headline sponsorship of the Sky Bet Championship, as that is how the various news and content sources now refer to the second tier of English professional football. Q&A: JOAKIM NILSSON, SOCIAL MONITOR 0% 0% 1%0% 3% 3% 3% 89% 1% Blog Facebook Forum General Image News Review Twitter Video Figure 1: Channel split across all brands in English language for 2014

- 2. INSIGHT 62 iGB Affiliate Issue 51 JUNE/JULY 2015 Even though the title sponsorship for the Premier League might not yet be available to a betting company, if we’re to believe the words of CEO Richard Scudamore, it’s still a very bright move compared to being a shirt sponsor of a team in the same league, as the latter won’t yield anywhere near the same volume of online mentions. This is because when we refer to a team in writing, we don’t refer to them, for example, as “Dafabet Aston Villa” but simply as “Aston Villa”. Hence league title sponsorships have proved to be more effective in upping the amount of earned online buzz your brand receives. Have you noticed any major changes in the way operators use social media since you started tracking their activity last year? If I look at it from the perspective that I’ve been in the iGaming space for just over a decade now and involved in social media since the early days of both Facebook and Twitter, I have seen a major shift in how operators approach social media. At the risk of over generalising, social media “back then” was seen more as yet another set of channels for your products and promotions. Today, I think a section of the industry’s operators have now started to embrace social media more holistically across the organisation. They realise that the online landscape looks different from yesterday, with the customer’s voice notably amplified, hence this section of operators now asking themselves how they need to adapt and change throughout the organisation. Such questions are likely to include: What’s the role of customer service today? Do we need to proactively look for problem mentions outside our inbound channels? If so, should customer service be treated as a profit centre rather than cost centre? Does our six-month marketing plan and budget make sense in the advent of real-time marketing? Are we agile enough to respond to opportunities quickly enough? Focusing just on the last year and what changed during this period, we always see companies experimenting with the latest channels such as Snapchat, which is all well and good if you have the basics in place, but for most operators I think it risks becoming more of a distraction than a powerful marketing tool. You’ve stated that the combined voice of customers, affiliates and partners talking about a brand can be 25x the reach of the brand’s own social media channels. Which types of strategy or campaign have proved effective in delivering this reach for brands operating on more limited budgets? That figure does vary a lot across the brands, but we’ve seen many incidences of brands having a much larger combined reach from their audience talking about Dec 2013 0k 60k 40k 20k 80k 100k Jan 2014 Feb 2014 Mar 2014 Apr 2014 May 2014 Jun 2014 Jul 2014 Aug 2014 Sep 2014 Oct 2014 MentionVolume Nov 2014 Dec 2014 Jan 2015 Feb 2015 Mar 2015 Apr 2015 Paddy Power Sky BetBet365 Betfair Betway Boylesports Bwin888 CoralBetVictor Ladbrokes Totesport Unibet William HillBetfred Figure 2: Brand mention volume per month across all channels except Twitter Figure 3: Most popular topics and keywords related to Sky Bet Championship (March 2014) Sky Bet Championship promotion Sky Bet Championship side announced on Friday Watford Blackpool Barclays Premier League BirminghamSouthampton Kick Everton second-half first-team Bolton Leeds Stadium Hull Manchester City Nottingham Forest ForestFA Cup Football fourth roundCity QPR London club Allardyce Johnson Leicester Blackburn Derby County Reading Derby Burnley Wigan Premier League Sky Bet Championship club Sky Bet Championship rivals third round year-old Sky Bet Championship promotion hopefuls McClaren

- 3. INSIGHT With over a decade in the iGaming space and his background as Head of Social at Betclic Everest Group, JOAKIM NILSSON heads up the iGB Social Monitor solution, the industry’s first tailored and fully managed social media monitoring and analytics solution for iGaming. them than from their own social media channels. Unfortunately, limited budgets aren’t the answer here, but rather a well-executed PR stunt that gets people talking. If we’re going to borrow the space of our customers’ social media profiles, we need to give them something they want to talk about, something that makes them look smart, entertaining or good in some other way. Twitter is by far the dominant channel when it comes to social mentions – are there any emerging channels operators should be looking at? Instagram has slowly gained traction over the past year as a channel for players, affiliates and operators. From a player perspective, it’s mostly shared bet-slips that are being hashtagged with an operator’s brand, and affiliates are perusing the same strategy as they have on Twitter i.e. automation and volume. If you ask me if brands should be on Meerkat or Periscope, the answer is that although each of these new platforms brings new opportunities in how you can communicate and engage, they need to be backed up by a profound strategy outlining what the operator really wants to achieve. Looking more widely at the space, what share of total mentions are generated by sportsbooks compared to the other product groups such as casino, poker, bingo etc, and which brands lead the way in these verticals? No other product vertical can really challenge Paddy Power’s sportsbook in terms of mention volume. PokerStars would be the nearest contender outside the sportsbook segment, with around 60,000 mentions per month in English language and across all online channels. Another product vertical that is growing exponentially in terms of online buzz is fantasy sports. We see brands like FanDuel and DraftKings racking up in the region of 30,000 mentions per month, coming from virtually nowhere just a year ago. But mention volume isn’t necessarily the metric to always look at, as it runs the risk of becoming a mere vanity metric, such as the total number of website visitors. In the casino vertical, for example, a big chunk of mentions are from Twitter and affiliates, but the real insight are to be found in customer forums, where speed of deposits, bonuses, and other experiences are being discussed amongst players. THECLASSIC&RELIABLE APPROACHTHATNEVERGOES OUTOFSTYLE... inquire@incomeaccess.com Delivering PersonalisedServicestoAffiliatesSince2002 incomeaccessnetwork.com JointheiGamingIndustry’s Longest-ServingIndependent AffiliateNetwork