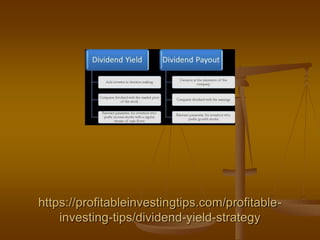

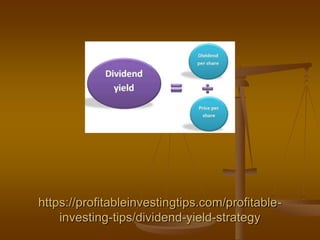

The document discusses the dividend yield strategy, highlighting risks associated with relying solely on dividend yield as indicators of company health. It explains the calculation of dividend yield, the distinction between dividend rate and yield, and introduces models used to assess stock value based on future dividend payments. Additionally, it emphasizes the importance of considering various factors in investment decisions, particularly the sustainability of dividend payments and potential for growth.