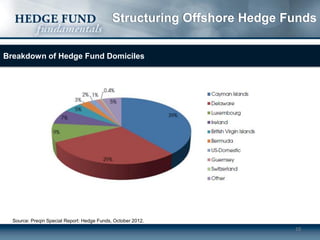

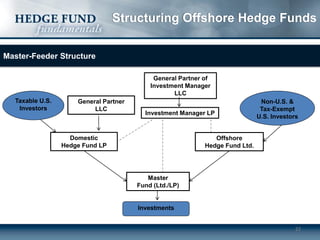

The document discusses the structuring of offshore hedge funds, focusing on tax efficiency for various types of investors, including taxable U.S. investors, tax-exempt U.S. investors, and non-U.S. investors. It outlines common investment structures, such as stand-alone, side-by-side, and master-feeder structures, emphasizing the advantages of using offshore entities in jurisdictions like the Cayman Islands for favorable tax treatment. Additionally, it highlights the regulatory environment and the importance of accommodating diverse investor needs in hedge fund structures.