Commodities - MARKETS OUTLOOK

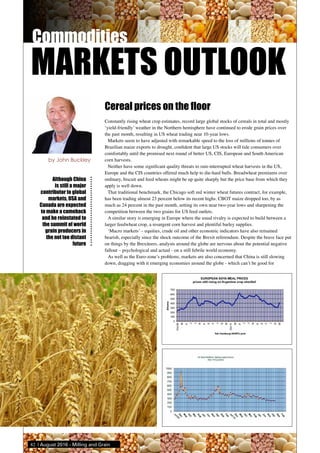

- 1. 82 | August 2016 - Milling and Grain Although China is still a major contributor to global markets, USA and Canada are expected to make a comeback and be reinstated to the summit of world grain producers in the not too distant future Cereal prices on the floor Constantly rising wheat crop estimates, record large global stocks of cereals in total and mostly ‘yield-friendly’ weather in the Northern hemisphere have continued to erode grain prices over the past month, resulting in US wheat trading near 10-year lows. Markets seem to have adjusted with remarkable speed to the loss of millions of tonnes of Brazilian maize exports to drought, confident that large US stocks will tide consumers over comfortably until the promised next round of better US, CIS, European and South American corn harvests. Neither have some significant quality threats to rain-interrupted wheat harvests in the US, Europe and the CIS countries offered much help to die-hard bulls. Breadwheat premiums over ordinary, biscuit and feed wheats might be up quite sharply but the price base from which they apply is well down. That traditional benchmark, the Chicago soft red winter wheat futures contract, for example, has been trading almost 23 percent below its recent highs. CBOT maize dropped too, by as much as 24 percent in the past month, setting its own near two-year lows and sharpening the competition between the two grains for US feed outlets. A similar story is emerging in Europe where the usual rivalry is expected to build between a larger feedwheat crop, a resurgent corn harvest and plentiful barley supplies. ‘Macro markets’ – equities, crude oil and other economic indicators have also remained bearish, especially since the shock outcome of the Brexit referendum. Despite the brave face put on things by the Brexiteers, analysts around the globe are nervous about the potential negative fallout – psychological and actual - on a still febrile world economy. As well as the Euro-zone’s problems, markets are also concerned that China is still slowing down, dragging with it emerging economies around the globe - which can’t be good for by John Buckley MARKETS OUTLOOK

- 2. expanding demand for key food and feed ingredients. The reversal in crude oil markets after their short-lived rally, is another negative for crop markets to deal with, signalling a less encouraging climate for bio-fuels made from grains and oilseed products. Among all this gloom and doom (for the suppliers), the odd man out has been the soyabean complex, which has risen by almost 40 percent over the second quarter of the year to reach its highest level in almost two years. The accompanying increase in soya meal prices has been even bigger as flood losses to Argentina’s bean crop curbed supplies from this, the largest meal exporter. That too may be ‘topping out’now, however, as traders take a more sanguine view of Latin American crop losses and the consequent surge in demand for US beans behind this unexpected rally. Cheaper grain and feed raw materials are, of course, good news for the consumer (soya meal aside). But with forward grain futures markets pointing to relatively modest potential for price recovery, the question is still posed, how long can cereal producers put up with the collapse of farmgate prices? The Latin Americans, Russia and Ukraine have been shielded to a large extent by their weak currencies, bringing in good returns from their dollar-traded commodity exports. But even amid the weak euro, European grain producers are disappointed with current returns, likewise their US, Australian and Canadian counterparts. While the large stocks will provide a buffer for one or two years going forward, growing markets will need a larger supply down the road. But the direction in which prices are pointing suggests that production gains will be increasingly coming from the weaker currency areas – Lat-Am and CIS countries while the US and other Northern hemisphere suppliers may have to think about reducing their contributions. Table 1: Main maize producers 2014/15 2015/16 2016/17 USA 361.1 345.5 366/386? China 215.6 224.6 218 Brazil 85 77.5 82 Ukraine 28.5 23.3 26 Argentina 28.7 27 34 EU 75.8 58 64.3 Russia 11.3 13.2 14 S Africa 10.6 6.5 13 World* 1013 966 1,012/1,032? *includes others The future of feed mill technology is here today. Introducing the CU Dynamic pellet mill, facilitating an optimized operation and production rate. The motor-operated roller adjustment represents more efficiency and real savings on maintenance. The intelligent active roller slip control virtually eliminates downtime caused by roller slip: a major leap forward in pellet mill technology. If you’re looking for an example of future-proof and state of the art technology from Van Aarsen you need look no further than the CU Dynamic pellet mill. www.aarsen.com Introducing a new generation of pellet mills, with intelligent roller control. The future today! www.aarsen.com 2016-05-31, Grain & Feed Milling.indd 1 31-5-2016 10:55:13 Milling and Grain - August 2016 | 83

- 3. 84 | August 2016 - Milling and Grain Yet more wheat The USDA’s world wheat crop estimate has gone up by almost 4m tonnes in the last month and the International Grains Council’s by 7m- both now around 730m tonne mark. Increases have been made for the USA, Europe, Russia and Australia. In recent weeks, the European picture has been slightly less optimistic with rain damaging the French crop – yields as well as quality. Some closely followed analysts looking for a drop of about 1.5m to 2m tonnes to trim the EU total which the USDA has at 157.5m versus year’s record 160m and the IGC’s 154.6m (including 145.7m common wheat and just under 9m durum). Against that, a new government estimate has raised US planted area to 50.8m from the March planting intentions report’s 49.6m, implying about 1.3m tonnes to add to the last USDA forecast of 56.5m tonnes. Private and government analysts in Russia have meanwhile been talking the coming crop up as high as 65m tonnes, which would be a post-Soviet era record and 1m to 2m over the USDA and IGC forecasts respectively. In contrast, Canada’s official estimate of planted wheat area was updated in late June to show a 9 percent fall in spring wheat plantings offset by a 5 percent increase in durum. That’s a bit lower than the markets expected and may require some trimming of crops estimates currently around 28.5/29.5m from USDA & the IGC respectively. Australia’s crop meanwhile seems on course for at least the 25/25.5m tonnes seen by these two bodies – which would be among its larger crops of the past decade. However, dependent upon exports for 70 percent of their crop disposals, Australian growers are reported to be concerned about the global price fall and could consider cutting back planting next season, according to some observers. But in response to recent trade liberalisations under its new government, Argentina is expected to give a big boost to wheat sowings, expanding the crop by 3m to 5m tonnes, consolidating its return to the fold as one of the world’s largest wheat exporting countries. The USA’s June count of domestic wheat stocks meanwhile turned out a bit larger than expected – a 29-year high of over 27m tonnes and about 30 percent up on last year’s. With EU starting stocks of wheat also estimated to have risen by 35.5 percent on the year and world total stocks in total running at 36 percent of consumption needs, it is easy to see why wheat prices are cracking again. Another bearish figure highlighted by the IGC is the volume of stocks held by the major exporting countries. This is estimated to have grown from 54m tonnes two years ago to almost 68m and is expected to rise again to 72m by the close of the new season that started on July 1. Lack of consumption growth is another part of the bear story for wheat. The IGC has 2016/17 off-take rising by a mere 1m tonnes or 0.1 percent as increased demand from the food sector is offset by lower feed use - livestock producers using more of an expected bigger maize harvest. The one, relatively, firm spot in the wheat market is better quality wheat, able to command bigger and bigger premiums as milling crops in the US, Western Europe and the CIS encounter wet harvest weather. In the past few weeks, premiums demanded for better quality (12.5 percent protein) over ordinary hard red winter wheat – the USA’s main export grade - have rocketed from around $9 to almost $30 per tonne on fob terms, if still quoted a lot cheaper than a few months ago. Although it started well, the usually high quality US spring wheat crop has seen its condition deteriorate amid dry weather recently, driving export fob prices for this class of wheat up recently, abeit from some of their cheapest levels of the last decade. In Europe, reports of lower proteins in the rain-affected French wheat crop, Europe’s largest, have been turning demand increasingly toward German wheat – not unaffected by the bad weather but probably mostly escaping the worst of its own rain interruptions. That in turn has been driving up German price premiums. The quality issue is also affecting EU export trade, with recent import tenders tending to favour either wheat from Germany or the unaffected Baltic States, able to offer better quality and more competitive prices. Thanks to better results this year in Hungary, Rumania, Bulgaria and Spain, the overall EU wheat crop will still be relatively large at around 157m tonnes but along with currency weakness, the concerns about quality are expected to keep prices firm at the top end. Maize crop set for recovery Maize prices have recently dropped to near two year lows on the CBOT futures market after the USDA estimated US sown area at 94.1m acres - the third largest in 72 years and 500,000 over the Department’s March forecast. Markets had actually been expecting a reduction of 1m to 2m acres based on uncooperative sowing weather and a steep rise in new-crop prices of soyabeans – which can be sown later than maize. Based on the old figure of 93.6m sown acres, USDA had 84 | August 2016 - Milling and Grain

- 5. 86 | August 2016 - Milling and Grain expected trend yields to extrapolate into a 366.5m tonne crop versus last year’s 345.5m. An extra 5.3 percent of land would equate to a crop closer to 386m tonnes, easily beating any previous record. Piling on the pressure the USDA also estimated June 1 US maize stocks at a larger than expected 120m tonnes, their largest since 1988. That suggests the USDA’s already comfortable stock forecast for the start of the new season in September (43.4m tonnes) can also be uprated. While the Brazilian crop has turned out far smaller than expected (see table 1) world total maize production this season has continued to run neck and neck with consumption so drawdown of the comfortable global stocks carried in from 2014/15 will be minimal. For the season ahead, the combination of resurgent production and still large carryovers will mean total supply increases by about 2.6 percent or some 31m tonnes. Maize consumption is, as mentioned above, expected to grow far more rapidly than that of wheat in the more abundantly supplied – and cheaper – season ahead. The current USDA forecast expects it to grow by 45m tonnes, the IGC by 30m. Even than, world stocks carried out of the new season (in September 2017) are seen holding fairly steady, extending the period of comfortable supply. The main uncertainty on that front is a potential heatwave for the US crop in the July/Sep period as the El Nino weather phenomenon flips over a La Nina effect. Even then, the long- range forecast is for adequate rains in that period which should help reduce heat stress – and the crop has already got well into its crucial pollination period under the desired mild conditions. Further forward we can expected maize production to increase in Argentina as the trade and currency liberalisations introduced by the new Macri government earlier this year pay dividends in higher [planted areas. Brazil’s government is also looking at incentives to swing more land into maize crops, which have taken second place in recent years to ever- expanding soyabeans. Nearer term, expect larger crops in the CIS countries to find their way onto export markets, before long, including top customer Europe; where the cheap coarse grain imports will continue to provide competition for locally produced and imported feedwheat. As the futures markets currently suggest, there is not much on the horizon to upset this ongoing picture of plentiful maize, with the usual caveat - normal, summer weather permitting. Protein price surge led by meal-rich soya Soya meal prices have seen a spectacular surge in second quarter 2016 – in US$ terms, monthly averages have risen by about 35 percent from March to June. The root cause has been the unexpected loss to floods of a least 2m tonnes Argentine and perhaps 3m of Brazilian production to flood and droughts respectively. That has led to world output actually declining by about 6.5m tonnes this season. While significant, the magnitude of this loss does seem to have invoked an over-reaction on the markets, helped by the usual culprits, the speculative funds. The current season did, after all, start with surplus stocks of 78m tonnes – 16m more than the year before, putting overall supply at 391.6m tonnes or 10m more than in 2014/15. Even with global crush rising by 16m tonnes, this still leaves soyabean ending stocks at a hefty 72m tonnes- which is hardly tight. In the immediate period before our press deadline, the markets seem to be gaining more of a sense of proportion with the CBOT futures reining back quite sharply from their near two-year highs. The reversal has been encouraged by the USDA raising its US planted area estimate from 82.2m to 83.7m acres, equating to a (potential) extra 2m tonnes or so of soyabean output. The USDA also estimated June stocks higher than the markets expected. Finally, the delayed South American harvests have accelerated and should now provide stiffer competition to US bean and meal exports, implying room for some price trimming. Further forward, the Latin American crops sown this autumn are expected by the USDA to expand by about 6m or 7m tonnes, contributing to an approximate 10m tonnes increase in global soyabean output. Other oilseed supplies will grow more slowly. European and Canadian rapeseed crops not far off last year’s levels suggest not much change in global supplies of the second most importat contributor to world oilmeal production. Sunflower supplies may expand by about 3m tonnes or 8 percent, however, with bigger European, Ukrainian, Russian and Argentine crops while cottonseed supplies are also expected to rise. Overall, oilmeal supplies should be large enough to cope with the coming season’s expected 10m or 3.2 percent increase in global consumption without further price rises and, as soya markets settle down, hopefully some reduction in costs. THE FUTURE OF FARM CERTIFICATION SUMMIT 2016 | 27 - 28 September JOIN US & THE GLOBALG.A.P. COMMUNITY TO CELEBRATE 20 Years of Global Partnership 15 Years of Good Agricultural Practices Certification 27.9 | News Conference www.summit2016.org 86 | August 2016 - Milling and Grain