ECS3019 Financial Decisions for Business – Assignment 2(A) Use

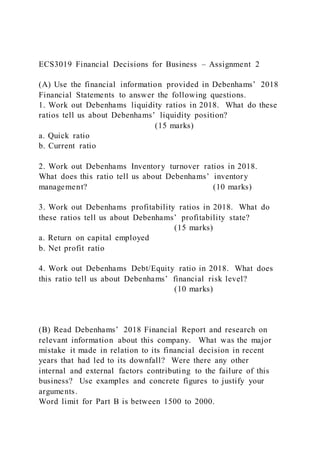

- 1. ECS3019 Financial Decisions for Business – Assignment 2 (A) Use the financial information provided in Debenhams’ 2018 Financial Statements to answer the following questions. 1. Work out Debenhams liquidity ratios in 2018. What do these ratios tell us about Debenhams’ liquidity position? (15 marks) a. Quick ratio b. Current ratio 2. Work out Debenhams Inventory turnover ratios in 2018. What does this ratio tell us about Debenhams’ inventory management? (10 marks) 3. Work out Debenhams profitability ratios in 2018. What do these ratios tell us about Debenhams’ profitability state? (15 marks) a. Return on capital employed b. Net profit ratio 4. Work out Debenhams Debt/Equity ratio in 2018. What does this ratio tell us about Debenhams’ financial risk level? (10 marks) (B) Read Debenhams’ 2018 Financial Report and research on relevant information about this company. What was the major mistake it made in relation to its financial decision in recent years that had led to its downfall? Were there any other internal and external factors contributing to the failure of this business? Use examples and concrete figures to justify your arguments. Word limit for Part B is between 1500 to 2000.

- 2. (50 marks) Submission Deadline: Monday 26th of April 2021 before 11:30 pm via Turnitin. 2 • – – – • – – – – •

- 10. • • • • • 26 27 28 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% • • • • •

- 17. sociable and fun 2018 has been a tough year for UK retail and this is reflected in our results for the year. However we are seeing the first positive signs of results from our Debenhams Redesigned strategy. We have built a plan that allows us to focus on priorities within our strategy that are scalable and will help us to mitigate the challenging retail environment. We are taking decisive action to drive further cost savings and generate cash whilst addressing the structural challenge of our store estate. This will create a solid financial platform for us to invest behind our strategy and create value for our shareholders and stakeholders. Our strategy is to deliver growth by becoming a Destination for Social Shopping and offering exciting new products and services; being driven by Digital, with mobile unifying our channels and our interaction with customers, as well as broadening our reach; and being Different in how we create and manage our brands and product, supported by a more innovative culture. This will be combined with a focus on driving efficiency by removing barriers to shopping both online and instore; Simplifying and Focusing our store estate and operating model; and making more effective use of our resources.

- 18. Financial highlights Strategic highlights Shareholder returns Gross transaction value1,* £2.9bn Digital sales growth* 12.3% Underlying EPS2,* 2.2p Profit before tax2,* £33.2m Beauty sales decline* (0.8)% Dividend per share 0.5p Net debt £321.3m UK Food sales growth* 9.6% ROCE (lease-adjusted)* 9.4% 1 Compares to £3.0bn for FY2017. 2 Pre exceptional items of £524.7m, statutory loss before tax of £491.5m, refer to page 36 for further detail. * Alternative performance measures are defined in the Glossary section of the Annual Report on pages 156 to 159.

- 19. 20 Doing our bit: Equality, Community & Environment Strategic report Business model and strategy 2 Market context 4 CEO’s strategic perspective 6 Strategy in action 10 Resources, relationships 20 and sustainability Key performance indicators 28 Risk management 30 Principal risks and uncertainties 32 Financial review 35 Viability statement 41 Corporate governance Chairman’s Introduction to Governance 42 Leadership 43 Board of directors 44 Corporate governance report 46 Nomination Committee report 52 Audit Committee report 54 Chair’s introduction 58 to Remuneration Remuneration policy 60 The annual report on remuneration 64 Directors’ report 76 Statement of directors’ 79 responsibilities Financial statements Independent auditors’ 80 report to the members of Debenhams plc

- 20. Consolidated income statement 90 Consolidated statement of 91 comprehensive income Consolidated balance sheet 92 Consolidated statement 93 of changes in equity Consolidated cash flow statement 94 Notes to the financial statements 95 Five year record income statements 144 Five year record balance sheets 145 Company balance sheet 146 Company statement of 147 changes in equity Notes to the Company 148 financial statements Additional information Store list 155 Glossary and references 156 Additional information 1606 CEO’s strategic perspective 10 Strategy in action: Destination, Digital, Different branding, Simplify & Focus and International Financial review of the year 35 S tra te g

- 22. m e n ts A d d itio n a l in fo rm a tio n 1 www.debenhams.com B U S I N E S S M O D E L A N D S T R A T E G Y Creating value for our stakeholders

- 23. Our resources and relationships How we create value today Innovation and culture We are developing a culture that puts our customers first, enabling product creation and development in an inspiring environment, supported by data-informed decision-making Developing and managing brands Approximately half our sales come from our own or exclusive brands. We use the insight from 19 million customers to inform brand development, and to edit and curate the choice of products and brands we sell Serving our customers We have worked hard to make shopping easier and more fun for our customers: reducing colleague tasks; equipping them with technology and data; and giving them more time in front of customers Creating inspiring places to shop We are reducing clutter in our stores, reducing stock options and improving visual merchandising. We have continued to upgrade our digital presentation for mobile display, to improve conversion Leveraging partnerships We continue to strengthen our relationships with third parties to broaden our reach. This includes accessing new customers both in the UK and overseas through partners for our own brands, and working with service providers to exploit growth categories, such

- 24. as food and beauty services in our stores The value we create We create value for our stakeholders and our business by carefully managing the use of, and the return on, our resources and relationships Gross transaction value £2.9bn Digital sales growth 12.3% EBITDA* £157.3m Return on capital** 9.4% Underlying EPS* 2.2p Direct employment c26,000 * Before exceptional charges. ** Lease-adjusted. People We employ around 26,000 colleagues in the UK, the Republic of Ireland, Denmark and in our sourcing offices in Hong Kong and Bangladesh. They support our own-operated stores in the UK and Europe and our digital operations, and serve around 19 million

- 25. customers Read more on page 20 Expertise and insight We recruit and train experts in design, buying and merchandising, supported by excellent creative, marketing, logistics, financial and administrati ve functions. Our customer insight unit provides us with valuable feedback on our customers’ spending habits and their view of our offer Read more on page 5 Channels We have 182 stores across major retail locations in the UK, the Republic of Ireland and Denmark. We also have franchised stores across a number of international markets, particularly in the Middle East. We have a flagship digital store in the UK and a localised online service in a number of overseas markets. Our UK website is one of the top online UK retail destinations with over 300 million visits each year Read more on pages 6 and 7 Suppliers and partners We have a well-established network of more than 1,000 suppliers, as well as concession, logistics and franchise partners, who provide us with high quality product, logistical support and local market expertise in locations where we trade with a partner Read more on page 22 Finance

- 26. We have a strong balance sheet, with flexible financing provision through a £320 million financing facility and a £200 million bond, which are available until 2020 and 2021 respectively. These resources are more than adequate to provide working capital and support our capital spending programme including investment in our strategic priorities. Read more on pages 38 and 39 Our value creation is underpinned by Risk management A systematic approach to managing risk to ensure strategic goals are met Read more on pages 30 and 31 Governance A governance framework designed to safeguard long-term shareholder value Read more on pages 46 to 51 Strategic report 2 Debenhams plc Annual Report & Accounts 2018 What we do We aim to make shopping confidence-boosting, sociable and fun for our customers, through our 240

- 27. department store destinations and online in more than 90 countries. We give our customers around the world a unique, differentiated and exclusive mix of own brands, international brands and concessions. The value we share How we aim to maximise value through our strateg y Destination By making Debenhams more of a Destination, especially for Beauty and beauty services; Fashion and accessories; and Food and events, we will grow “Social Shopping” and increase frequency of visits Digital By using mobile to integrate our channels and become the primary means of interacting with our customers, we will increase loyalty and personalisation and broaden our reach Different By being different in how we create and manage our brands and product, we will increase innovation and differentiation, building the desirability and value of our brands Underpinned by Simplify & Focus By simplifying our operations and processes and focusing on doing fewer things better, we will increase the efficiency of our business Read more on pages 10 to 17 By running a profitable, sustainable, responsible

- 28. business, we create value which is used to strengthen our financial position, invested to enable growth and shared with all of our stakeholders Customers We invest in our stores and integrated digital offer (2018 capex of £143.5 million in order to provide our customers with an inspiring environment and a convenient customer journey Read more on page 39 Shareholders We have paid a dividend (2018: £35.6 million) although the board has decided not to pay a final dividend to retain cash in the business and reduce debt at this time Read more on page 38 Colleagues We invest in training and support for our colleagues in order to enable them to create and manage brands and to serve our customers well Read more on page 20 Suppliers We source globally from more than 1,000 suppliers adopting ethical trading principles. We have increased our business through direct sourcing operations in Hong Kong and Bangladesh Read more on page 22 Communities

- 29. We raised £1.3 million through Group activities in 2018 to support charitable giving and community involvement Read more on page 24 Environment We seek to operate our stores, logistics and sourcing operations in a way that minimises the use of energy and resources Read more on page 25 Sustainability Introducing “doing our bit”, Debenhams’ new approach to CSR Read more on pages 20 to 27 Culture Taking a customer first approach, fostering innovative thinking underpinned by data Read more on page 15 Social Shopping Simplify & Focus Destination Digital Different S tra te g

- 31. te m e n ts 3 www.debenhams.com A d d itio n a l in fo rm a tio n M A R K E T C O N T E X T 2018: a tough year for retailers – and it’s not over yet

- 32. Our market context commentary comes from a research report, from broker Citi, published on 25 July 2018. “Two years on from the Brexit vote, we take a more positive view on Citi’s UK measure of Household Available Cashflow (HAC) for 2019 and 2020 although we expect disposable income to remain subdued for the remainder of 2018. So far in 2018, the UK has seen extreme weather conditions, from snow in March to a summer heatwave. This has had more of an impact on retail sales than any underlying change in consumer behaviour. Given the long-standing structural headwinds of online challenging the store-based retail model, we have remained cautious on the more traditional retailers, and sentiment has been negatively affected by high profile retail failures. Very weak footfall in 2018 -20 -15 -10 -5 0

- 35. n 1 8 Total consumer BRC Footfall (Total UK Retail) Source: Citi Research, BRC Online growth is slowing but the shift from instore to online continues 0 5 10 15 20 25 % 2 0 0 9 2 0 1

- 37. 6 2 0 1 7 2 0 1 8 y td Growth Penetration Source: Citi Research, BRC For the majority of UK consumers, the only real impact from Brexit has been higher inflation due to weak sterling and an increased cost of holidays. Arguably the economy has proven more resilient than many feared, albeit still at a slightly lower growth rate than would otherwise have been the case. However, given the impending deadline for an agreement, large domestic employers are now calling for information on exactly how Brexit will be enacted before they can confirm investment plans. Consumer confidence has bounced off

- 38. its recent lows but is still lower than the pre-Brexit vote level -20 -15 -10 -5 0 5 10 % Ju n 0 7 Ju n 0 8 Ju n 0 9

- 40. Ju n 1 6 Ju n 1 7 Ju n 1 8 Total consumer Source: Citi Research, GFK 0.3% growth in Household Available Cashflow in 2018 Strategic report 4 Debenhams plc Annual Report & Accounts 2018 UK consumers feeling better about

- 41. their personal financial situation 0 10 20 30 40 50 % C h an g e in p e rs o n al fi n

- 42. an ci al s it u at io n I feel much better I feel slightly better I feel the same I feel slightly worse I feel much worse Net

- 43. Compared to 12m ago Expectations in next 12m Source: Citi Research Looking at the data from our regular UK consumer survey of 1,200 respondents on their spending intentions, it supports a positive outlook for online and discount retail, while indicating continuing weakness in home-related spending. It does indicate an improving outlook for UK clothing – where spending intentions are better than expected. However, we believe that trends in spend still favour online and value players rather than the traditional retailers. Specific spending intentions by category -0.1 0.0 0.1 0.2 0.3 N e t ch an

- 47. s Previous 12 months Next 12 months Source: Citi Research The demand environment remains uncertain for 2018 with the final Brexit agreement creating significant volatility in terms of the outlook for the important peak trading period for retailers. As we look into 2019, a better demand and operating cost environment than in the previous two years should help offset any incremental gross margin pressure. • UK consumer demand likely to rebound in 2019 – 2018 is likely to be the low point for consumer disposable income with a recovery as inflation fades. The UK HAC points to just +0.3% implied like-for-like improvement in 2018 before a projected rebound to +1.3% in 2019 and +1.5% in 2020. Over the next year, by category the UK consumer survey sees net intentions to spend more in Food, Discount retail and Clothing with less in other categories. However, we are not expecting a strong increase in consumption compared to history and much of this spend will likely be transferred online. The direction of Brexit negotiations will also affect confidence and, therefore, willingness to spend

- 48. • Store closures are starting to see a benefit in terms of sales transfer both from own estate and competitor closures – The upside of the structural challenges for the remaining retailers is the benefit of a pick-up in sales from retailers such as House of Fraser, Homebase and Toys’R’Us closing stores as well as the benefit from sales transfer from reducing the size of their own store estates (Dixons Carphone, M&S) • Gross margin headwind for 2019 on FX and commodities – However, we assume a negative outlook for gross margins for UK clothing retailers as foreign exchange, cotton prices and freight have all moved against the sector • Less operating cost pressure than we have seen in recent years – This should be mitigated by the lower level of minimum wage inflation at c+4.5%, lower average rents as lease renewals drive downwards pressure, a possible freeze on business rates for retailers, and less of a step-up in IT and warehousing investment Where could we be wrong? The main risk to our more constructive view for 2019 is the increased political uncertainty over Brexit. This would likely delay investment and curtail employment growth, as well as negatively impact sterling. Citi’s view is that GBP/USD is the single most important macro driver of the UK retail sector followed

- 49. by consumer confidence, and both of these could be under pressure without a satisfactory Brexit agreement. There is also a risk that increasing employment fears drive an increase in the savings rate given its historic low level and the high level of consumer debt. This would see any increase in disposable income revert to shoring up personal finances. An upside risk is post-Brexit inward investment stepping back up given the removal of uncertainty, or a reversal of leisure spend back towards retail.” +4.5% National Minimum Wage inflation S tra te g ic re p o rt C o rp o

- 51. d d itio n a l in fo rm a tio n C E O ’ S S T R A T E G I C P E R S P E C T I V E “After a huge amount of change behind the scenes, we’re starting to see evidence of progress.” Sergio Bucher Chief Executive Officer ear shareholder, It has been a tough year for UK retail and our trading

- 52. performance in FY2018 reflects that. Nevertheless, we are encouraged by the signs that our transformation is gaining traction. We have been reshaping our business, taking some hard decisions, including announcing more store closures, to make sure that Debenhams is in a strong financial position to trade successfully in a highly competitive and promotional marketplace. I would like to thank all my colleagues for their resilience and support in delivering the necessary changes and building the foundations for our transformation of Debenhams. We announced our new strategy, Debenhams Redesigned, in April 2017. see the framework of our strategy below and Strategy In Action (SIA) pages 10 to 19. The strategy aimed to address the challenges that face department store retailing and to create a business that makes shopping confidence boosting, sociable and fun for our customers. In order to deliver our strategy, we needed to restructure the organisation to make it simpler, leaner and more nimble. We have made huge progress with this reorganisation and we have assembled a strong management team.

- 53. Five key priorities identified At our interims in April, acknowledging the rapid change in our industry, we identified five priority actions within our strategy that will help mitigate the trading environment; that are scalable; and that will deliver positive returns. These priorities are: • Delivering above-market digital sales growth driven by technological change focused on mobile • Sustaining leadership in Beauty through innovative customer engagement both instore and online • Revitalising fashion product under new leadership, with [email protected] reinvention under way • Changing the instore experience for customers through our redesigned service model and store presentation • Accelerating cost reduction activity to underpin announced annualised savings of £20 million Strategic report 6 Debenhams plc Annual Report & Accounts 2018

- 54. A strategy that aims to create shareholder value Debenhams Redesigned Our objective is to build a successful future for Debenhams against a fast changing background, with a mission to make shopping confidence- boosting, sociable and fun. Our plan is to transform the shopping experience at Debenhams, creating great reasons for our customers to come to us whether they are sitting at home, commuting to work or enjoying leisure time browsing in stores. The strategic framework illustrates our Debenhams Redesigned strategy: Destination 2 We aim to make Debenhams a destination for Social Shopping by focusing on three key areas to grow: Beauty and beauty services; Fashion via accessories; and food and events – which we call Meet me @ Debenhams. If we can be higher in our customer’s consideration for these categories, this will increase frequency of visits. Our customers visit us less frequently than some of our peers and by exploiting our market-leading position in premium beauty; encouraging cross-shopping between fashion and accessories and creating exciting places to eat and drink, we can increase traffic and spend per customer. Different 3 4 We are redesigning the culture at Debenhams, from being process-driven, to customer-led. We aim to foster creativity and innovation, underpinned by data-driven decision-making. We are reinventing [email protected], making the proposition more relevant and managing our brand portfolio more robustly. We are building ranges for our online customers first. By being different in how we create and manage our

- 55. brands and products; we will build their desirability and value. Digital 1 Growth in mobile demand is driving growth in UK non-food retail sales and is a significant opportunity overseas. We saw continuing rapid growth in mobile demand in 2018 of 20%, and it now accounts for almost 60% of UK Group digital sales. By using mobile to integrate our channels and become the primary means of interacting with our customers, we will increase loyalty and personalisation and broaden our reach. We intend to increase our digital distribution both through our own infrastructure and via strategic partnerships. Strength in digital sales growth Debenhams is one of the top ten most visited retail websites in the UK and a clear destination at peak shopping dates in the calendar. We have delivered strong growth in digital sales in FY2018, up 12% to £530 million. This accelerated well ahead of the wider market in H2, driven by continuing agile development focused on mobile. The smartphone is increasingly the centre of our interaction with customers and mobile demand accounts for over half our digital sales. Our partnership with Mobify, a digital experience platform, has successfully delivered a faster, more responsive mobile website and improved customer experience. We plan to extend this to our customers shopping via their desktops and expect to continue to drive profitable, above-market growth in the coming year. Sustaining leadership in Beauty Debenhams is a leader in the UK premium beauty market, which has slowed this year

- 56. after several years of strong growth. Our Beauty Redesigned strategy aims to sustain our leadership through making our beauty halls even more of a Destination, through driving Digital engagement with our customers and offering Different brands and categories where we see growth opportunities. We took a minority stake in digital beauty services provider blow LTD. Our Beauty Hall of the Future has opened in two locations; our new store in Watford and our modernised store at Meadowhall, with elements of our new thinking being rolled out to more stores. We have launched the BeautyClub Community, a social media platform for beauty devotees, where our 1.3m BeautyClub members and instore beauty consultants can share advice, tips and recommendations, building content and gaining rewards based on their participation. This is an exciting development, the first of its kind in the UK, that brings our channels together, tapping into a highly socially- engaged customer. Revitalising fashion product Under the leadership of Steven Cook (see overleaf), we have restructured the organisation of our Fashion & Home business unit: reducing complexity, aligning the management of the trading divisions and improving accountability. 1 Above market growth 2 Growth in beauty through digital/social

- 57. 3 Improve fashion product 4 Change instore experience 5 Deliver cost reduction activity Underpinned by Simplify & Focus 5 We have reviewed our processes and the way we do business in all areas to simplify them and improve our flexibility, with the aim of making more effective use of our people, our inventory and our infrastructure, including how we generate and deploy our cash. We have now started to address the structural challenge within our store estate: segmenting the portfolio between the investable core; those markets we plan to exit; and a low cost model for the balance of the UK chain. This strategy will deliver growth and efficiency over the next three years and beyond, delivering an enhanced experience for our customers, helping our colleagues to serve our customers better and creating value for our shareholders. S tra te g ic re p o rt C

- 59. 7 www.debenhams.com A d d itio n a l in fo rm a tio n Introducing our new CFO, Rachel Osborne Rachel joined in September 2018. She was previously CFO at Domino’s Pizza Group plc and has also held finance roles at both Kingfisher plc and

- 60. the John Lewis Partnership. Read more on page 44 C E O ’ S S T R A T E G I C P E R S P E C T I V E C O N T I N U E D This will underpin our work to differentiate our brands better. We are revitalising [email protected] Debenhams, which remains an important asset of the business, with some changes to our portfolio of Designers. The first collection from our newest partner, Richard Quinn, winner of the London Fashion Week Queen Elizabeth II award, was very well received. In those brands where our work is most advanced, we have seen a strong improvement in full price sell-through. Changing instore experience We started our work on instore experience by addressing some of the issues that have hindered our customers from enjoying their shopping experience with us. We introduced customer service measures to our KPIs and in FY2018 we have seen a significant improvement in our net promoter scores. Building on the lessons from our store “test-lab” at Stevenage we restarted our store investment programme, with six stores, Uxbridge, Westfield, Reading, Cambridge, Leicester and Meadowhall, being modernised in time for the autumn season. We have opened our “store of the future” at Watford, which brings together our latest thinking instore

- 61. presentation and layout. We are assessing how to focus our investment plans, within a lower capex budget to deliver the best returns. Accelerating cost reduction activity We announced in January that we were working on a new, more flexible operating model that would result in reorganisation and restructuring activity both in our stores and support centre. We have reduced the layers of management, taking out 320 roles in stores and c300 roles in the support centre, delivering £12 million of cost savings in FY2018, and secured further efficiencies to deliver the annualised £20 million identified. Market conditions remain volatile and challenging. We are therefore taking a prudent approach and assume no improvement in the trading environment for the foreseeable future. We have identified a further £30 million of cost savings for FY2019, annualising to c£50 million by FY2020. Strengthening our financial position As well as driving out further cost opportunities beyond those already announced, we are focusing on self-help and prioritising cash generation. In order to give us maximum flexibility amidst difficult trading conditions we are taking the opportunity to strengthen our balance sheet further. Whilst still pushing ahead with key strategic initiatives, we are planning for a material reduction in FY2019 capital expenditure to £70 million. As a result, we expect net debt to be lower in FY2019 than in FY2018. We are also conducting a strategic review of non-core assets,

- 62. aiming to focus investment behind our strategy. Debenhams management team The team delivering the transformation of Debenhams Executive committee (left to right): David Smith MD of International Angela Morrison Technology and Supply Chain Director Sally Hyndman HR Director Ross Clemmow MD of Retail, Digital, Food & Events Steven Cook MD of Fashion & Home Sergio Bucher CEO Rachel Osborne CFO Richard Cristofoli MD of Marketing & Beauty Services Read more

- 63. on page 47 8 Debenhams plc Annual Report & Accounts 2018 Strategic report Putting Debenhams on firmer foundations Early evidence of strategic progress SEPTEMBER 2017 Debenhams announces partnership with blow LTD to drive beauty services growth Opens first southern hemisphere store in Melbourne, Australia JANUARY 2018 Steven Cook joins as MD, Fashion & Home Debenhams reports tough Christmas trading, but strong digital performance Initiates move towards new operating model and confirms £20 million cost saving target

- 64. MAY 2018 New Designer collaboration with Richard Quinn launches MARCH 2018 Furniture trials with partners Maisons du Monde and Swoon open in Westfield JUNE 2018 Q3 trading update notes deterioration in market environment Announce strategic review of non-core assets APRIL 2018 Interims introduce five priority actions under Redesigned strategy Confirms de- layered management structure both in stores and at support centre AUGUST 2018 First Sweat! gym opens at Sutton, Surrey

- 65. Appointment of new CFO, Rachel Osborne OC TOBER 2017 Preliminary results and strategic update introducing new KPIs First downsized store launched at Uxbridge Looking different The Debenhams Redesigned strategy sets out to reinvent the shopping experience for customers. Whilst we have made real improvements to our stores and continue to improve our product offering, we also want to signify clearly to customers that Debenhams is changing and give them more reasons to come instore – our new brand identity signals the next phase in our continued transformation. You will see it on our website, in all our communications, especially on social and digital platforms, and in our new and modernised stores. Store of the future I am as convinced as ever that the high street has a big role to play in the future of retail. We invited some of our stakeholders to see our vision of the future of department stores, as displayed at our new store in Watford. It is obvious that online platforms, including ours, provide a very convenient way of shopping. However, shopping

- 66. is one of the favourite hobbies for many people around the world and particularly in the UK. If the high street wants to compete, we need to make sure that every shopping trip has a little something that is memorable: the product, the experience, the service, the environment, the food, the drinks, the friends. Watford brings to life what we call Social Shopping: that is, shopping as a fun experience you can do on your own or share with friends, with family, wrapped in a set of digital experiences. Watford will form the template for the future revitalisation of our store portfolio, which will underpin the transformation of your company. Changes to the senior team We have said Hello and Goodbye to some members of the senior team. In January, we welcomed an important new member of the executive committee, Steven Cook, who has joined from Holt Renfrew as Managing Director of Fashion & Home. I would like to take a moment to thank Matt Smith, our CFO, who left in August 2018, for his contribution to Debenhams over the past three years including developing and shaping the strategy and strengthening our financial position. I am delighted that we have appointed a very able successor to Matt in Rachel Osborne, who has joined us from Dominos plc, with invaluable experience across retail and consumer-facing businesses. I’d also like to thank Paul Eardley, who served most ably as Company Secretary for 11 years. We all hope he enjoys his well-earned retirement.

- 67. Sergio Bucher Chief Executive Officer 25 October 2018 1 Above market growth 2 Growth in beauty through digital/ social 3 Improve fashion product 4 Change instore experience 5 Deliver cost reduction activity S tra te g ic re p o rt C o rp

- 69. A d d itio n a l in fo rm a tio n S T R A T E G Y I N A C T I O N estination Our priority actions to sustain leadership in Beauty and to improve the shopping experience for our customers underpin our mission to make shopping fun, social and easy, as well as being key to encouraging our customers to visit us more often. Strategic report 10 Debenhams plc Annual Report & Accounts 2018

- 70. 2 Growth in beauty through digital/social Beauty products and services What we have done Our first two Beauty Halls of the Future have opened at Watford and Meadowhall. We have trialled a new multi-brand format – #beautyhub – that will extend choice in smaller stores. We launched three blow bars offering beauty services in our stores at London Oxford Street, Birmingham and Manchester. What we are going to do We plan to roll out elements of our Beauty Hall of the Future to 40 further stores before peak trading. We see opportunities in mini beauty products (for travel and gift) and growth in categories such as skincare and male grooming. 3 Improve fashion product Fashion via accessories What we have done Debenhams has maintained a 5% share in the UK clothing market, supported by leading market positions in important accessories categories (eg bags, swimwear, branded lingerie). We have assembled a new leadership team in Fashion & Home, with a restructured organisation.

- 71. What we are going to do We will see a step forward in product this autumn, particularly in womenswear. We are increasing the emphasis on newness, introducing new brands, “new this week” hubs and more capsule collections in our own brands. We have seen a strong customer response to trials of an enhanced service proposition in footwear and lingerie. 4 Change instore experience Meet me @ debenhams What we have done We have continued to roll out new food and drink offers with exciting new brand partners, such as Franco Manca and Nando’s. This has driven a record year in food sales. We trialled our own in-house developed fresh and healthy food offer, Loaf & Bloom, and upgraded menus and service in our instore restaurants. As well as our established VIP evenings before Christmas, we hosted a national “Summer School of Beauty” event in June. What we are going to do We are adding 75 pop-up food offers before Christmas, including gin bars, as seen at Watford. We are testing another in-house developed concept, The Kitchen, for a different customer demographic. As the nationwide destination for shopping events, we are expanding our event programme with privileged access for our VIP customers.

- 74. S T R A T E G Y I N A C T I O N igital One of our five priority actions is to continue to deliver above market growth in digital. Mobile is becoming the primary means of interacting with our customers; we aim to increase loyalty and personalisation. Strategic report 12 Debenhams plc Annual Report & Accounts 2018 1 Above market growth [email protected] everywhere What we have done FY2018 growth in UK digital sales of 10% compares with UK market growth of c7% (according to the BRC) and was powered by strong mobile demand, which now accounts for c60% of online orders. Through our partnership with progressive web application Mobify, our work to improve the customer journey has grown smartphone conversion rates by 17%. What we are going to do Our progressive web application development will gradually replace functionality in our

- 75. existing web platform and give us all the flexibility of an app. All our development work is mobile first as this is the focus of how we are building customer loyalty and personalisation. 4 Change instore experience Click & Collect What we have done Next day click & collect accounts for over 30% of online orders and drives store footfall. We have been testing a partnership with Doddle in 50 stores, providing collection services for other retailers’ orders. We have announced this will be extended to all stores. What we are going to do Our modernised stores show how we can transform the click & collect service to be engaging and sociable as well as a convenient and reliable service. Linking the service with personal shopping and other activities will make click & collect a leisure experience in its own right. 2 Growth in beauty through digital/social BeautyClub Community What we have done Our BeautyClub card loyalty scheme has more than 1.3m members and we have over half a million followers on Facebook and Instagram. We also have more than 6,000 beauty experts in our stores. We have developed our own social media platform

- 76. using an established software provider to access the community of highly digitally- engaged beauty consumers. What we are going to do We are creating a digital destination, accessed via Debenhams.com, bringing together beauty beginners, enthusiasts and experts in a fun, rewarding and safe space to connect and share their passion by asking questions, offering knowledge and giving authentic advice. Users will be able to earn rewards from their participation. The BeautyClub Community is the first of its kind in the UK and has met with an enthusiastic early response. S tra te g ic re p o rt C o rp o ra te

- 78. d itio n a l in fo rm a tio n S T R A T E G Y I N A C T I O N ifferent branding We aim to foster creativity and innovation, underpinned by data-driven decision-making. We have launched new branding and marketing which is consistent across all our communications and acts as a call to action to customers signalling changes to product, presentation and environment. Strategic report 14 Debenhams plc Annual Report & Accounts 2018

- 79. do a bit of 4 Change instore experience Innovation and culture What we have done We have reorganised the way we operate into three business units that are aligned with our strategy: Beauty & Beauty services; Fashion & Home; and Food & Events. With clearer lines of responsibility and a holistic view of each division we are already seeing better collaboration and visibility of data. Our “Service Redesigned” programme included dedicated training and incentives and a mystery shopper programme. As a result we have delivered a significant improvement in net promoter scores. What we are going to do Our new structure for Fashion & Home is buyer-led and design-driven, supported by a centralised planning function. This will improve accountability, align activity across channels and markets and lead to faster decision-making. 3 Improve fashion product Brand matrix What we have done We have a strong track record of brand creation, with a number of our brands generating annual

- 80. turnover of over £100 million, making them sizeable businesses in their own right. We have taken some of these brands back to their roots, restoring a clear brand identity, with positive early results, for example at Principles and Star by Julien Macdonald. What we are going to do We are rolling out a new brand identity – our first for 20 years – which aims to alert our customers to the changes at Debenhams and encourage brand reappraisal. We are proud of the Debenhams brand and are bringing together our entry level product in home under this label. We are managing our gift offer differently, with 70% of the range changed for this Christmas. We are starting to build ranges online first, editing store ranges based on online catchment data. 3 Improve fashion product [email protected] Debenhams What we have done Our long-standing collaboration with designers remains a core attraction for customers and an important point of differentiation for Debenhams. In line with a more robust portfolio approach, we are phasing out Ben de Lisi and John Rocha and have introduced a capsule collection from London Fashion Week award-winner Richard Quinn. What we are going to do

- 81. Following positive early results from upgrading fabric quality for some of our newer designers, we are extending this further across the portfolio. We plan to offer “little black dresses” from each designer to make Debenhams the destination for partywear this season. S tra te g ic re p o rt C o rp o ra te g o v e rn

- 83. rm a tio n S T R A T E G Y I N A C T I O N Simplify & Focus In light of rapid market change, we accelerated our cost reduction programme to deliver annualised savings of £20 million. A leaner operating model, with fewer management layers, is delivering faster decision- making and potential to drive out further efficiencies. Strategic report 16 Debenhams plc Annual Report & Accounts 2018 5 Deliver cost reduction activity New operating model What we have done

- 84. We identified the opportunity for £20 million cost savings. We reduced the number of roles across our store estate by 320 whilst increasing customer-facing hours. At our support centre, we have streamlined the number of management layers from 17 to nine and reduced the space and occupancy cost in our London office by 20%. What we are going to do We have identified further cost opportunities that should deliver additional cumulative annual savings of c£70 million by FY2020. Whilst the market remains volatile and uncertain, we will continue to look for further efficiency savings to offset inflationary headwinds. 5 Deliver cost reduction activity More efficient use of resources What we have done We have created two key sourcing hubs in Hong Kong and Bangladesh to drive standard and efficient ways of working that support a leaner and more flexible UK sourcing structure. What we are going to do Our aim is to achieve a more flexible and customer-led supply chain, supporting more frequent product newness whilst also delivering better availability on continuity lines. We are maintaining our investment in warehouse automation, which will reduce fulfilment costs.

- 85. 4 Change instore experience Store estate What we have done We closed two stores of the ten that we had identified for potential closure as a result of our initial portfolio review. We have modernised six stores, including a downsized store at Uxbridge, building on the lessons from our award-winning Stevenage store. What we are going to do We have again reviewed our store estate in light of the rapidly-changing market environment. As a result we have segmented our stores into those locations that will deliver a good return on investment, in line with the principles embodied at our “store of the future” in Watford; those locations in lower-performing markets where we see risk that they will become unprofitable and so will exit; and the balance which remain profitable but are unlikely to justify future investment. We are working closely with landlords to align rents to the market. S tra te g ic re p o rt

- 87. ts 17 www.debenhams.com A d d itio n a l in fo rm a tio n S T R A T E G Y I N A C T I O N International We are adapting Debenhams Redesigned to our International operations, looking to leverage and grow successful partnerships through both franchised and wholesale relationships, and increasing our digital presence.

- 88. We continue to exit lower-growth, lower-potential markets. Strategic report 18 Debenhams plc Annual Report & Accounts 2018 Leverage and grow successful partnerships What we have done We have strong partnerships in markets such as the Middle East, which account for around half our franchise operations. We opened a flagship store in Kuwait, and a new store in Riyadh. Wholesale customer sales grew over 50%, with strong growth via our digital partner Zalando. We have launched a mobile site for international e-commerce. What we are going to do Our international teams have been reorganised to align with our new business unit structure and this will underpin our future franchise service model. As we focus on fewer partners, we will be able to pursue our ambition to develop a multi-channel offering in key international markets. Simplify What we have done We are continuing to review our international market presence. In FY2018 we closed a net

- 89. five franchise stores, exiting two markets, mainly in Eastern Europe. What we are going to do We are testing and learning from marketplace and wholesale models in order to prioritise investment. We are working with our international partners to introduce customer-led methodology for product selection and we are developing an agile design, sourcing and buying operation to support targeted international product. Denmark What we have done Magasin du Nord remains the largest profit-generating entity within International. It has invested in its flagship Copenhagen store and introduced 75 new brands. Digital growth has continued to be exceptionally strong. What we are going to do Our first new store for 12 years opened in Aalborg in September, taking the chain to seven. We plan to take Magasin beyond its domestic market, as the destination for the best of Scandinavian design, with digital entry to another Nordic market planned this year. Debenhams Avenues, Kuwait Beauty Hall, Copenhagen, Kgs Nytorv S tra

- 91. l sta te m e n ts 19 www.debenhams.com A d d itio n a l in fo rm a tio n Equality Community Environment

- 92. doing our bitEquality Community Environment doing our bit Equality Community Environment doing our bit Equality Community Environment doing our bit Equality Community Environment doing our bit Equality Community Environment doing our bit Equality Community Environment doing our bit Equality Community Environment doing our bit

- 93. Equality Community Environment doing our bit Equality Community Environment doing our bit “ We are committed to five of the United Nation Sustainable Development Goals of the BRC Better Retail, Better World Initiative.” R E S O U R C E S , R E L A T I O N S H I P S A N D S U S T A I N A B I L I T Y This year we have launched our CSR strategy “Doing our bit” which is focused on three strands: Equality – striving for equality and diversity throughout our workforce and supply chain; Community – being an active part of the communities in which we serve; and Environment – reducing, reusing and recycling all that we do to the best of our abilities. We have executive committee sponsorship for the overall programme as well as members focusing on specific strands. We have underpinned our strategy by signing up to the BRC Better Retail, Better World Initiative which concentrates on five of the 17 United Nation Sustainability Development Goals which align

- 94. to our three strands (see diagram above). EQUALITY To ensure we strive for equality and diversity throughout our workforce and supply chain, we are focusing on our colleagues and our partners colleagues. Our colleagues We directly employ around 26,000 colleagues globally. We work hard at ensuring our colleagues are kept informed and offer two-way communications through a regular drumbeat of messages. These include newsletters, video diaries from our CEO and broader leadership group, leadership events and cascades, weekly huddles, live Yammer Q&A with the members of the executive committee, regular floor walks on major announcements and breakfast sessions. We also organise activities for colleagues, such as bring your dogs to work days and wellbeing days. Strategic report 20 Debenhams plc Annual Report & Accounts 2018 Our behaviours We have worked with colleagues from across the business to redefine our culture through

- 95. creating a set of behaviours (see above diagram) to support the delivery of Debenhams Redesigned, harnessing the best of what we have today together with the cultural shifts needed to achieve our mission of making shopping confidence-boosting, sociable and fun. Our new behaviours complement the customer service behaviours rolled out to stores which are designed to drive a customer-led business. Equal opportunities We are committed to ensuring that colleagues are treated equally, regardless of gender, sexual orientation, religion or belief, age, mental status, social class, colour, race, ethnic origin, creed, disability, political or philosophical beliefs, or marital or civil partnership status. Through our equal opportunities policy, we aim to create an environment that offers all colleagues the chance to use their skills and talent. Decisions on recruitment, training, promotion and employment conditions are based solely on objective, job-related criteria, and personal competence and performance. We seek wherever possible to make reasonable adjustments to ensure that a colleague who becomes disabled during the course of his or her employment is able to continue working effectively. This includes providing equipment or altering working arrangements; providing additional training; re-allocating on a temporary or permanent basis some of the colleague’s

- 96. duties to other members of staff; transferring the colleague to a suitable alternative role; and adjusting working times. Any such adjustment will be monitored and reviewed on a regular basis to ensure it continues to be effective. We are confident that our men and women are paid equally for doing equivalent jobs across our business and have an equal opportunity to participate in and earn incentives. Our current recruitment, progression, performance, reward and benefit policies and practices are not gender biased and we will continue to monitor them to ensure they remain fair and equitable. We use gender pay data to inform talent targets, policies and processes to support the progression of women into more senior roles. Our gender pay and bonus gap calculations include all UK colleagues employed by Debenhams Retail plc and in the spirit of being open and transparent we have chosen to include executive directors to give a complete picture. Our next gender pay gap report will be published in March 2019. Building a pipeline of future leaders We adopt a consistent approach to identify and develop talent across the stores and the support centres. We also use a consistent framework to develop our leaders of the future. We participate in the 30% club mentoring scheme, delivered by Women Ahead. This aims to develop a broader pipeline of women and achieve a gender

- 97. balance at all levels. We also have three female leaders taking part in Retail Week’s Be Inspired Senior Leadership Academy. Diversity of candidates is key to us. We are growing followers on our social media recruitment channels, including LinkedIn, and the launch of a Debenhams Facebook Careers Page to build engagement and stay connected with a diverse audience of potential candidates for roles within Debenhams. ENERGY We are proud to work here; we’re passionate about our products and passionate about customers. ONE TEAM Together we are stronger, we trust and support each other to deliver results. OWNERSHIP We take personal responsibility for results, we thrive on change and make things happen.

- 98. AMBITION We love a challenge; we stretch ourselves to be successful; we’re bold, we’re brave, we’re creative. OUR BEHAVIOURS S tra te g ic re p o rt C o rp o ra te g o v

- 100. l in fo rm a tio n During FY2018 the Ethical Trade team conducted over 450 factory visits, to support remediation, conduct training and support implementation of corrective actions identified within the third party audit. This would have included: critical non-compliances, indicators of Modern Slavery, young workers, health and safety issues, wage violations, excessive working hours, lack of legal employment contracts and discrimination against migrant labour. Top ten sourcing countries Countries Factory Count Total workers China 486 125,081 Bangladesh 67 165,043 India 122 44,608 Cambodia 23 17,200 Turkey 45 11,262

- 101. Sri Lanka 34 19,003 Vietnam 24 8,003 Romania 18 4,555 Pakistan 16 31,368 United Kingdom 23 2,198 Source: Aug 2018 34 sourcing countries 475 suppliers 450+ visits to factories We continue to support suppliers through training and awareness so that they can take ownership of their remediation plans, which would include collaboration with other retailers and local actors to work on key issues. We have achieved this by providing training on the empowerment of women and their communities, focusing on: • Challenging gender stereotypes • Health & wellbeing • Financial literacy & inclusion

- 102. Open to both male and female employees, with the aim to educate and reduce gender inequality, whilst promoting diversity and inclusion. R E S O U R C E S , R E L A T I O N S H I P S A N D S U S T A I N A B I L I T Y C O N T I N U E D Apprenticeships We continue to support apprenticeships in retail with 50 colleagues in England now getting ready for end point assessment in spring 2019, when they will achieve the Level 3 Team Leader Standard. In line with our plan, we have started to explore the introduction of apprenticeships in specialist areas in the support centres, creating career paths for school leavers, with the appropriate skill set, who prefer a work-based learning programme to university. Recruiting externally and upskilling existing colleagues through apprenticeships provides us with a pipeline of talent for the future. We continue to feed back to the National Apprenticeship Service on the development of occupational standards and quality of apprenticeships. Our partners’ colleagues Our partners’ programme is primarily supported by the Ethical Trade and Corporate Responsibility teams who sit

- 103. within the sourcing division, forming part of the wider business function Fashion & Home. This structure supports alignment of the Ethical Trade strategy with the over- arching Sourcing strategy, focusing on the salient risks and labour rights issues, therefore embedding responsible sourcing into the companies purchasing practices. We operate a continuous monitoring programme which assesses all factories making own brand product, against the Supplier Code of Conduct. This is done through either an independent third party ethical audit or a remediation visit by Ethical Trade team members based in the UK, Hong Kong and Bangladesh. China Capacity programme • sharing working best practices • 39 factories • 16,000 workers in China Strategic report 22 Debenhams plc Annual Report & Accounts 2018 HUMAN RIGHTS & MODERN SLAVERY As a fundamental part of our Supplier Code of Conduct, we respect International principles of Human Rights, including but not limited to

- 104. those expressed in our Human Rights Policy, UN Declaration of Human Rights, United Nations Guiding Principles, Sustainable Development Goals and those principles contained within the Modern Slavery Act 2015. All Ethical Trade policies have ownership at company board level, with the aim to protect the employee welfare and basic human rights within our supply chains. These policies have been made in line with the UN guiding principles and are influenced by civil society, unions, NGOs, multi-stakeholder and brand collaboration. Over the past 12 months we have made the following changes to our company policies and processes, to support improvement of Human Rights within the supply chain: • Modern Slavery clause is now integrated into all contracts (Conditions of Trading), including those made with our supplier partners and service providers • We re-evaluated the Supplier Code of Conduct and made amendments referring to conventions related to International Principles of Human Rights, United Nation Guiding Principles and Modern Slavery Act • The scope of our policies has been expanded to include goods not for resale (GNFR), service and labour providers, who support and operate

- 105. within our business • Continued the use of the Fast Forward programme to assess our own brand manufacturing sites in the UK, including warehouses and GNFR. The assessment programme helps us identify indicators of Modern Slavery and includes worker- voice feedback • The full Tier 1 factory list is now publicly disclosed on our website as part of our ongoing pledge to support transparency • Reinforce our partnership with our suppliers by providing capacity building through programmes such as China Capacity Building and ILO Better Work A full version of Debenhams’ statement on Modern Slavery is on our website at www.sustainability.debenhamsplc.com. SWASTI LIFE • Focuses on Health & Wellbeing, Financial Literacy and Gender Violence Awareness. • Impacts 5,000 workers in India We have already seen positive results with the current SWASTI LIFE women empowerment programme in India, which we now plan to expand into other sourcing countries within the supply chain. Other existing programmes include, HER Finance supporting digital

- 106. banking for Bangladesh factory workers and sexual harassment training conducted by ILO Better Work in Vietnam and Cambodia. For more information, visit our webpage at www.sustainability.debenhamsplc.com/ ethical-trade. S tra te g ic re p o rt C o rp o ra te g o v e rn

- 108. rm a tio n COMMUNITY Supporting the local communities in which we serve is very important. For many years we have raised funds for national charity partners that have a presence across the UK and ROI and more recently, we have built on this foundation as part of our Doing Our Bit strategy. Fundraising This year we raised £1.3 million for our national charity partners: Look Good Feel Better; Help For Heroes; Breast Cancer Now; Children In Need; and Make A Wish Ireland. These funds are generated from a variety of activities including: a donation of profits from the sale of exclusive products; the sale of charity partners’ merchandise; an annual supplier and business partner funded charity ball; as well as a range of colleague challenges from a 500km bike ride to bake sales. Customer and colleague donations raised throughout the year, linked to specific events and causes, complete the effort in both stores and our support centres. We also raise funds and make donations

- 109. to the Debenhams Retirement Association, the retailTRUST and Regent’s Place Community Fund. In addition, outdated and surplus stock is donated to the Salvation Army Trading Company. Volunteering This year we have developed a number of volunteering initiatives to enable our colleagues to support our partner charities. Over 400 of the beauty sales consultants have voluntarily completed training with Look Good Feel Better to advise those undergoing treatment for cancer on how to deal with physical side effects. A number of our London Support Centre colleagues have more recently volunteered to become mentors for the C4WS Jobs Club as part of its support for the Regent’s Place Community Fund. In addition, colleagues are also invited to support fundraising activities in stores on a voluntary basis. Local communities We have a number of initiatives in place to support activities taking place in the areas that we serve including hosting Look Good Feel Better workshops in a number of our stores where customers can receive advice and support from trained colleagues. In addition, we have worked with Help For Heroes to support the Band of Sisters programme, creating respite areas in our restaurants for partners of service personnel who have been wounded, injured or sick as a result of their service, to meet and socialise.

- 110. Colleague awards This year we invested in recognising our colleagues for the work that they do to raise funds, reduce our impact on the environment and support the local community with the first Doing Our Bit Awards. Colleagues were presented with awards by our Chief Executive at our annual charity ball in recognition for their efforts in these areas. R E S O U R C E S , R E L A T I O N S H I P S A N D S U S T A I N A B I L I T Y C O N T I N U E D £1.3m raised for national charities Strategic report 24 Debenhams plc Annual Report & Accounts 2018 ENVIRONMENT Reducing, reusing and recycling all that we do to the best of our abilities is a far reaching challenge. We have created five focus areas to ensure we minimise our impact on the environment, namely: energy; emissions; waste; water; and sustain.

- 111. Energy We are committed to continuously improving the energy efficiency of our buildings and operations. This has driven a material reduction in this year’s carbon footprint. In FY2018; we invested over £3 million and retrofitted LED lighting in 12 stores. These projects have not only delivered excellent results in reducing energy use, but have also led to a more comfortable customer environment. For FY2019 we will be focusing on energy savings that can be achieved through behavioural change, primarily through the use of energy alerts that will be sent to store management teams if they breach energy thresholds. Emissions We cover emissions in three ways: greenhouse gas; carbon; and chemicals. We have reported our greenhouse gas (GHG) emissions for our UK, Irish and Danish operations since FY2008. Since then, our footprint boundary has evolved to include areas such as other international offices, packaging, production of hangers, and manufacture of catalogues, brochures and direct mail. This section provides a breakdown of our GHG emissions for this year. Further details of our GHG emissions can be found on our website www.sustainability.debenhamsplc.com. With the support of Ricardo Energy &

- 112. Environment, we have applied the GHG Protocol Corporate Accounting and Reporting Standard (revised edition), and the UK Government Conversion Factors for Company Reporting, 2018, to calculate our carbon emissions. Our annual reporting year is 3 September 2017 to 1 September 2018 and we report GHG emissions in line with this period. We have followed the GHG Protocol’s new, scope 2 emissions reporting guidance and used two different quantification methods: location-based1 and market-based, as in previous years. Scope 2 emissions, using the market-based method, are lower than with the location-based approach, mainly because of our decision to purchase 100% renewable electricity in the Republic of Ireland and Northern Ireland. This year, our overall carbon footprint has decreased by 21%, from 177,611 tonnes CO2e in FY2017 to 140,352 tonnes CO2e (using the location-based approach). Table 1 below provides a breakdown of these figures. 1 The location-based method reflects the average emissions intensity of grids on which energy consumption occurs, whereas the market-based method reflects emissions from the electricity that companies have chosen in the market (or their lack of choice). Table 1: Absolute GHG emissions from scope 1, 2 and 3 shown in tonnes CO2e FY2013 FY2014 FY2015 FY2016 FY2017 FY2018

- 113. Scope 1 17,786 15,989 19,668 14,241 13,721 9,135 Scope 2 (location-based) 139,607 149,068 139,354 125,453 103,754 81,887 Scope 2 (market-based) Not calculated; market-based method was introduced in FY2016 113,134 81,914 78,091 Scope 3 16,687 28,308 31,908 64,442 60,137 49,329 Total 174,080 193,365 190,930 204,136* 177,611* 140,352* * Total emissions calculated using the location-based scope 2 emissions figure. Carbon footprint down 21% S tra te g ic re p o rt C o

- 115. www.debenhams.com A d d itio n a l in fo rm a tio n Emissions data are made more meaningful when compared to a core business variable. We have used intensity ratios, alongside the absolute figures provided above, to report our GHG emissions in the context of our annual turnover and premises floor area. Table 2 (below) shows the total annual turnover and floor area for the whole business. The total absolute emissions are then divided by these figures to provide tonnes of CO2e per million pounds of turnover and tonnes of CO2e per m2 of floor area, respectively, as shown

- 116. in Table 3 (below). These tables show that the tonnes CO2e for both intensity metrics have also decreased. Table 2: Data used for intensity measurements FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 Turnover (GTV £m) 2,777 2,824 2,860 2,939 2,954 2,900 Total floor area*(m2) 1,808,398 1,850,874 1,867,291 1,876,533 1,873,568 1,904,937** * This total floor area includes back of store, offices and distribution centres. ** For FY2018 the accuracy of the calculation of the back of store areas was improved, causing an increase in total floor area. Table 3: Assessment of absolute footprint emissions FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 Absolute emissions (tCO2e) 174,080 193,365 190,930 204,136* 177,611* 140,352* Absolute tCO2e / £m Turnover 63 68 67 69 60 48 Absolute tCO2e / m2 0.096 0.104 0.102 0.109 0.095 0.074 * Total emissions calculated using the location-based scope 2 emissions figure.

- 117. The carbon footprint has decreased across all three scopes this year compared to FY2017. The main reasons for the decrease in the overall emissions is due to a reduction in: electricity consumption, including the associated grid losses (32% reduction) and air imports (27% reduction). We have a carbon reduction target to reduce Group-wide scope 1 and 2 absolute operational CO2e emissions by 10% by FY2020 against our FY2008 baseline. The FY2018 scope 1 and scope 2 total emissions have reduced by 47% compared to the scope 1 and 2 CO2e emissions in FY2008. Overall, the progress on improvement and monitoring management remains stringent and during the next few years towards FY2020, we aim to continue to positively contribute to the Better Retail Climate as part of our drive to save energy and protect the environment. Our aim is to further reduce and or eradicate harmful chemicals where industry alternatives are available. Restricted Substances List is available for suppliers whereby limit values are stated in line with REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and governed by global regulations. Waste As a business 97% of our waste doesn’t go

- 118. to landfill, the majority of this is a result of recycling our product packaging. To further improve this, we have a number of initiatives to reduce, reuse and recycle all that we touch. This year we introduced 100% recycled bags for Life and also standardised our hangers, reducing the number of types from 1000 to 50, enabling much easier reuse. We have a relationship with Salvation Army to recycle our stores’ “not quite perfect” product. In FY2017 we donated 6.3 tonnes of product. Within our support centres, TRAID collected 6.9 tonnes of samples in FY2018. Going forward the Salvation Army will cover both stores and the support centres. R E S O U R C E S , R E L A T I O N S H I P S A N D S U S T A I N A B I L I T Y C O N T I N U E D 100% Bags for life are made from 100% recycled plastic Reused and recycled Hangers have been standardised and are reused and recycled back into the supply chain several times Strategic report

- 119. 26 Debenhams plc Annual Report & Accounts 2018 Water As part of our supply chain mapping programme, we will be reviewing the environmental impact of manufacturing, including reducing the consumption of water. The priority will be to focus on beyond Tier 1 supplier production sites, that require heavy water use, such as fabric mills, tanneries and other wet processing units, to actively work with our supplier partners to monitor and reduce their water usage through sustainable alternatives. For denim production we are already using Avol oxy white, which reduces water usage and eliminates use of hazardous chemicals. Sustain We aim to continue the work around responsible sourcing and consumption through: • Purchasing practices: Creating improvements around purchasing practices to provide a positive social and environmental impact within our supply chains. This will be done through education of our support centres’ colleagues and engagement with collaborative industry initiatives, such as ACT Living Wage and

- 120. the ETI (Ethical Trading Initiative) • Sustainable Product Initiatives: Establishing the Sustainable Product Working group, with an aim to focus on sustainable CSR initiatives from a product perspective with a shared approach across Fashion & Home. The first activity for the working group was to research the current sustainable cotton initiatives, and to recommend the most suitable initiative for us. Future projects are to focus on other sustainable materials and fibres. Sustainable product is already within the business – REPREVE Denim. This contains recycled materials such as plastic bottles and so results in the reduction of the use of petroleum and the emission of greenhouse gases • Educating our customers: We continue to share information around sustainability via our public website and as of FY2019 we will be introducing instore CSR Ambassadors, who will engage with our customers to promote Debenhams sustainability initiatives. Debenhams carries out testing to ensure all products we sell are fit for purpose, also educating our customers on caring for their items post purchase. This is with the aim to significantly and positively extend the longevity of the product life cycle NON-FINANCIAL REPORTING COMPLIANCE STATEMENT The following table lists the policies we have in place to

- 121. support and govern our CSR strategy, “Doing our bit”. In accordance with the Non-Financial Reporting regulations, details of each policy, our governance, their implementation and management, can be found on our website www.sustainability.debenhamsplc.com. Non-financial reporting matter Our policies Environmental Matters • Environmental and Chemical • Supplier Code of Conduct Employees • Code of Business Conduct • Health & Safety at Work • Bullying and Harassment • Colleague Privacy Human Rights • Human Rights • Modern Slavery Statement • Information Security • Data Protection Social Matters • Supporting Charities Anti-corruption and anti-bribery • Anti-bribery and Corruption • Whistleblowing S tra te

- 123. te m e n ts 27 www.debenhams.com A d d itio n a l in fo rm a tio n We established Key Performance Indicators (KPIs) under the Debenhams Redesigned strategy,

- 124. linked to the Destination categories where Debenhams is targeting growth. More information on how management remuneration is linked can be found in the remuneration report starting on page 64. We have also maintained sustainable KPIs that ensure that the management of resources and relationships remains core to our business model. All income statement numbers for FY2016 are given on a 52 week basis. Group financial KPIs Strategic KPIs Sustainability KPI Like-for-like sales change (%) 2016 0.6 2017 2018 (2.3) 2.1 Underlying profit before tax* (£m) 2016 114.1 2017 2018 33.2

- 125. 95.2 Beauty & beauty services – gross transaction value growth (%) 2016 2017 2018 (0.8) 6.0 4.8 Growth in UK Food, drink & events – gross transaction value growth (%) 2016 13.1 2017 2018 9.6 8.6 Carbon emissions (CO2e 000 tonnes) 2016 204 2017

- 126. 2018 140 178 Rationale Like-for-like (LFL) is a measure of the annual performance of stores that have been open for at least one year, plus digital sales growth, from our UK and international business. 2018 performance Group LFL sales decreased by 2.3%. When adjusted for foreign exchange translation, constant currency LFL decreased by 2.7%, with a UK LFL decrease of 3.4% and international LFL growth of 0.2%. Rationale Underlying profit before tax (PBT) is our principal measure of profitability, and excludes items that are one-off in nature. 2018 performance Underlying PBT* declined by 65.1% to £33.2 million. This follows a 27.5% decline in EBITDA, with an increase in depreciation charges as a result of previous capital investment. * Before exceptional items (FY2018: £524.7 million; FY2017: £36.2 million; FY2016: £12.4 million).

- 127. Rationale Core destination category in which Debenhams will sustain market leadership. 2018 performance In a market where growth has slowed, Beauty category sales declined by 0.8%. This reflected a decline in the make-up market, mitigated by growth in perfumery and skincare, and a strong performance in digital. Rationale “Meet me @ Debenhams” is a core destination category that drives frequency of visits. 2018 performance UK Food and drink gross transaction value (GTV) grew by 9.6% driven by further new third party brand introductions, and improved performance from our own in-house restaurants. Rationale CO2e is used as a measure of environmental impact. It takes into account harmful emissions from the six greenhouse gases identified by the Kyoto Protocol. 2018 performance Emissions declined by 21%. This reflects a reduction in electricity consumption, supported by rolling out LED store

- 128. lighting, and reduced air freight. Underlying earnings per share* (pence) 2016 7.5 2017 2018 2.2 6.4 Return on capital employed* (%) 2016 11.8 2017 2018 9.4 11.1 Net debt (£m) 2016 279.0 2017 2018 321.3 275.9 Growth in mobile penetration – mix

- 129. of demand (%) 2016 48.2 2017 2018 58.0 55.0 Accelerating warehouse automation – online cost improvement (bps improvement to GTV) 2016 40 2017 2018 80 70 Rationale Basic earnings per share (EPS) divides earnings attributable to ordinary shareholders by the weighted average number of ordinary shares outstanding during the financial year. 2018 performance Underlying EPS* declined by 65.6% to 2.2p, after a reduction in profit after tax. * Before exceptional items (FY2018: £524.7 million; FY2017: £36.2 million;

- 130. FY2016: £12.4 million). Rationale Return on capital employed (ROCE) measures the profitability of the Company relative to the size of assets used to generate returns. 2018 performance Underlying ROCE declined from 11.1% to 9.4% reflecting the fall in profitability in the year. * Lease-adjusted before exceptional items. Rationale Net debt measures Group borrowings net of cash held at the balance sheet date, and reflects the movement in cash generated by the business after cash expenses. 2018 performance Including cash outflow relating to the exceptional restructuring charges, year end net debt has increased to £321.3 million. Rationale [email protected] will be the primary form of customer interaction unifying channels and building loyalty. 2018 performance Mobile demand grew by 20%, outpacing desktop demand and

- 131. accounting for 58% of digital orders. Rationale Driving efficiency through investment in warehouse automation to improve digital profitability. 2018 performance Fulfilment cost ratios improved by 80 bps as a result of efficiencies made. K E Y P E R F O R M A N C E I N D I C A T O R S Strategic report 28 Debenhams plc Annual Report & Accounts 2018 We established Key Performance Indicators (KPIs) under the Debenhams Redesigned strategy, linked to the Destination categories where Debenhams is targeting growth. More information on how management remuneration is linked can be found in the remuneration report starting on page 64. We have also maintained sustainable KPIs that ensure that the management of resources and relationships remains core to our business model. All income statement numbers for FY2016 are given on a

- 132. 52 week basis. Group financial KPIs Strategic KPIs Sustainability KPI Like-for-like sales change (%) 2016 0.6 2017 2018 (2.3) 2.1 Underlying profit before tax* (£m) 2016 114.1 2017 2018 33.2 95.2 Beauty & beauty services – gross transaction value growth (%) 2016 2017 2018 (0.8)

- 133. 6.0 4.8 Growth in UK Food, drink & events – gross transaction value growth (%) 2016 13.1 2017 2018 9.6 8.6 Carbon emissions (CO2e 000 tonnes) 2016 204 2017 2018 140 178 Rationale Like-for-like (LFL) is a measure of the annual performance of stores that have been open for at least one year, plus digital sales growth, from our UK and international business. 2018 performance Group LFL sales decreased by 2.3%.

- 134. When adjusted for foreign exchange translation, constant currency LFL decreased by 2.7%, with a UK LFL decrease of 3.4% and international LFL growth of 0.2%. Rationale Underlying profit before tax (PBT) is our principal measure of profitability, and excludes items that are one-off in nature. 2018 performance Underlying PBT* declined by 65.1% to £33.2 million. This follows a 27.5% decline in EBITDA, with an increase in depreciation charges as a result of previous capital investment. * Before exceptional items (FY2018: £524.7 million; FY2017: £36.2 million; FY2016: £12.4 million). Rationale Core destination category in which Debenhams will sustain market leadership. 2018 performance In a market where growth has slowed, Beauty category sales declined by 0.8%. This reflected a decline in the make-up market, mitigated by growth in perfumery and skincare, and a strong performance in digital.

- 135. Rationale “Meet me @ Debenhams” is a core destination category that drives frequency of visits. 2018 performance UK Food and drink gross transaction value (GTV) grew by 9.6% driven by further new third party brand introductions, and improved performance from our own in-house restaurants. Rationale CO2e is used as a measure of environmental impact. It takes into account harmful emissions from the six greenhouse gases identified by the Kyoto Protocol. 2018 performance Emissions declined by 21%. This reflects a reduction in electricity consumption, supported by rolling out LED store lighting, and reduced air freight. Underlying earnings per share* (pence) 2016 7.5 2017 2018 2.2 6.4

- 136. Return on capital employed* (%) 2016 11.8 2017 2018 9.4 11.1 Net debt (£m) 2016 279.0 2017 2018 321.3 275.9 Growth in mobile penetration – mix of demand (%) 2016 48.2 2017 2018 58.0 55.0 Accelerating warehouse automation – online cost improvement (bps

- 137. improvement to GTV) 2016 40 2017 2018 80 70 Rationale Basic earnings per share (EPS) divides earnings attributable to ordinary shareholders by the weighted average number of ordinary shares outstanding during the financial year. 2018 performance Underlying EPS* declined by 65.6% to 2.2p, after a reduction in profit after tax. * Before exceptional items (FY2018: £524.7 million; FY2017: £36.2 million; FY2016: £12.4 million). Rationale Return on capital employed (ROCE) measures the profitability of the Company relative to the size of assets used to generate returns. 2018 performance Underlying ROCE declined from 11.1% to 9.4% reflecting the fall in profitability in the year.

- 138. * Lease-adjusted before exceptional items. Rationale Net debt measures Group borrowings net of cash held at the balance sheet date, and reflects the movement in cash generated by the business after cash expenses. 2018 performance Including cash outflow relating to the exceptional restructuring charges, year end net debt has increased to £321.3 million. Rationale [email protected] will be the primary form of customer interaction unifying channels and building loyalty. 2018 performance Mobile demand grew by 20%, outpacing desktop demand and accounting for 58% of digital orders. Rationale Driving efficiency through investment in warehouse automation to improve digital profitability. 2018 performance Fulfilment cost ratios improved by 80 bps as a result of efficiencies made. S tra