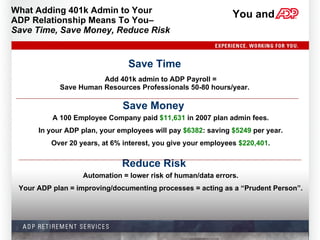

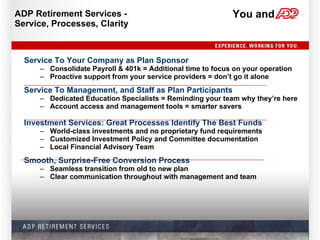

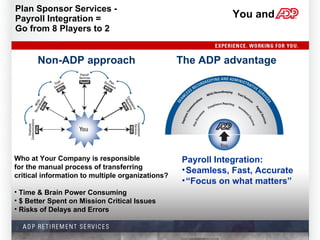

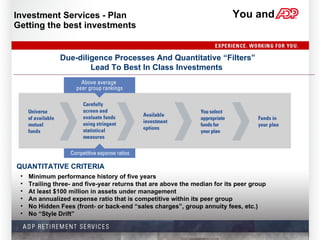

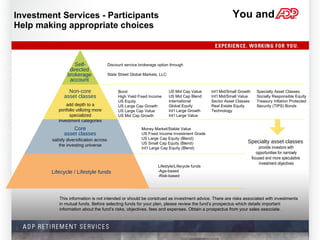

The document discusses the benefits of adding 401k administration to an existing ADP payroll relationship, including saving time, money, and reducing risks. It claims companies can save 50-80 hours per year of HR time and thousands in fees. It also says automation reduces errors compared to manual processes. The document then provides details on ADP's 401k administration services, including education support, automated account features to help participants save and invest, investment options and screening processes, and a sample conversion timeline.