Energy & Climate Market Map.pdf

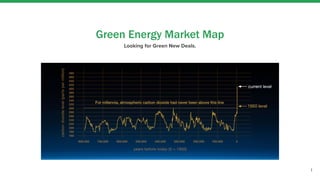

- 1. Green Energy Market Map Looking for Green New Deals. 1

- 2. Big Picture: Finding Investments That Reduce CO2 Emissions 1. The climate crisis represents an outsized threat to humanity. 2. The climate crisis is caused by greenhouse gasses, which trap heat in the atmosphere. 76% of global greenhouse emissions is carbon dioxide. 3. ⅓ of carbon dioxide emissions in the US is from electricity, as ⅔ of US electricity is from burning fossil fuels. Another ⅓ of US CO2 emissions is from transportation such as freight, shipping and flights. 4. One big sector USV can invest in is companies that help move us to 100% renewable energy or become carbon neutral to reduce or remove CO2 trapping heat in the earth’s atmosphere. 2

- 3. This is for SURE a network-styled market ● Electrons (similar to ISPs) ● $ (Financial Markets) ● Data networks And so we can apply the existing thinking and theses: Looking for USV-style networks in the green energy space 3 Core Thesis Idea Applied To Energy Thesis 1.0 Large networks Networks of meters, buildings, EV chargers, etc. Thesis 2.0 Less obvious network effects Energy and storage marketplaces, demand response Thesis 2.0 Infrastructure Devices and grid are becoming programmable Thesis 3.0 Trusted brands Carbon offsets are a high confusion market with a trust gap Thesis 3.0 Broadening access Community solar and energy finance

- 4. Generally we are looking for green energy investments that: ● Fit with core thesis ideas (network effects, broadening access, building trust) ● Can grow through bottom-up adoption w/out requiring permission from gatekeepers like utilities or gov ● Are usable in single player mode but get significantly better in networked, multiplayer mode ● Are superior products to the current system, even when not accounting for their sustainability benefits ● Move bits and $ as well as e- ● Have true environmental impact ● Are capital efficient ● Have technology leverage 4

- 5. Focus areas that potentially seem most interesting Category Customer Reason Clean energy suppliers Residential, Commercial ● It’s a software-defined network that moves bits and $ as well as e- ● There is a network effect where the more EUM, the better the company can move $ and e- ● Adoption is bottom-up ● By leading with savings and simplicity, can reach users beyond those who care about green energy ● It’s set and forget, once you have customers you have them ● It’s a low trust space with an entrypoint for a high trust brand Virtual Power Plants Commercial ● It’s a software-defined network that moves bits and $ as well as e- ● There is a network effect where the more EUM, the better the company can move $ and e- ● The product is useful in single-player mode and powerful in multiplayer network mode ● If positioned as a savings/revenue product, can reach beyond those who care about green energy ● Large impact by going through big energy-consuming buildings Automatic Demand Response Commercial Residential ● Can be built in a software-only way. It’s a software-defined network that moves bits and $ as well as e- ● There is a network effect where the more EUM, the better the company can move $ and e- ● The product is useful in single-player mode and powerful in multiplayer network mode ● If positioned as a savings/revenue product, can reach beyond those who care about green energy Group PPA Buying Commercial ● Physical same-grid PPAs are actually impactful in changing the makeup of the power grid ● Today PPAs are only accessible to large corporations because they are custom contracts ● Group PPA buying is an emerging behavior and a platform could broaden access to that ● PPAs are a growing market because of increased demand from enterprises for clean energy Carbon Markets That Expand Offset Supply Consumer Commercial ● Carbon offset purchasing is a high confusion space with an entry point for a high trust brand ● Software-based verification can increase the amount of trust and transparency ● Software-based verification lowers the cost of verifying a project, so it makes it possible for new types of carbon sequestering behaviors to occur (such as individual farmers changing their practices) ● Voluntary offset purchasing is a growing market as more companies and individuals want to offset ● There are no gatekeepers in the voluntary offset market so new companies can lead the charge Consumer offset subscription Consumer ● There is no clear answer for consumers how to offset their emissions, one brand could build that ● It’s set and forget, once you have customers you have them ● It’s a low trust space with an entrypoint for a high trust brand 5

- 6. Basic Power Flow Renewable Energy Generators Wholesale Energy Market Day Ahead Market Imbalance (aka Day Of) Market Traditional Energy Generators Suppliers bid on energy day ahead, and deliver it through utility company to buildings Delivered through power grid, run by utility cos Renewable energy generators also generate Renewable Energy Certificates Green energy suppliers buy RECs to make the energy ‘green’ Capacity Market (aka 6 mo ahead) 6

- 7. Table of Contents Renewable Energy and Carbon Market sections refer to voluntary markets, not compliance markets. Sector Desc Slide Renewable Energy Market Map 8 Renewable Energy Market Overview 10 Carbon Offsets Market Map 24 Carbon Offsets Market Overview 27 EV Charging Market Map 35 EV Charging Market Overview 37 Energy Storage The beginnings of an overview 47 7

- 8. Renewable Energy Market Map 8

- 9. 1. Buying renewable power is a high-confusion market with a real opportunity to build a trusted voice/brand 2. The grid is on a path towards greater decentralization where electricity is created everywhere and flows of power are bidirectional. 3. There are electrons AND bits in these systems. It is about the energy transmission itself but also about moving money and data (bits). 4. Energy storage is the holy grail for renewables and a more decentralized grid but it is prohibitively expensive today. 5. Even in deregulated markets, utilities still have a monopoly on transmission and utilities can slow down a process in changes to electricity flow in any grid. 6. In retail electricity, it may be beneficial to position a renewable product as a savings or convenience product than an impact product where the product will be niche and nice-to-have. Themes We’ve Run Across In Renewable Energy 9

- 10. Bi-directional One-Way Flow of Power Behind-The-Meter Manage the energy use of the building Supply the building with energy This can be in-grid or out-of-grid, in-grid is most impactful This can be on-site generation (solar panels) or virtual (community solar) Offset other non-renewable energy usage This can be like a broker (3Degrees) or a two-sided marketplace (Nori) Financing energy generation Finance on-site energy generation such as solar and batteries Sell Back Negawatts (Power that wasn’t used) Sell Power Back To Grid Power can also be sold to other buildings and vehicles (but not directly, it has to go through the grid) This can be generated power or stored power Electricity Markets Markets connecting generators to energy buyers either for spot or long term power purchasing agreements Electricity Traders Financial players buying and selling electricity for arbitrage 10

- 11. US Voluntary Renewable Energy Market Overview 11

- 12. The price of solar and wind in US has fallen by 90%+ in 40yrs 12

- 13. And that is driving exponential growth in deployment We have deployed > 1TW of clean electricity 13

- 14. There are many ways to buy renewable energy 25% of all renewables buying is voluntary, 75% is compliance by utilities to meet Renewable Portfolio Standards (RPS). Commercial buying makes up 68% of $ but 4% of customers. Residential is 32% of sales but 96% of customers. Type Description Customer Sales (MWh) Participants Unbundled RECs Sales of unbundled RECs (just the RECs, not the power) Mostly commercial 51.7 M 192 K Power Purchase Agreement Long term one-off purchasing contract with renewable generator Commercial 21 M 273 Competitive Suppliers Non-utility energy suppliers like Arcadia and Drift All 18 M 1.7 M Community Choice Aggregation Municipality-run electricity supplier where municipality chooses where to buy power Mostly residential, small commercial 8.9 M 2.7 M Utility Green Pricing Programs Utility sells RECs to users through added fee on utility bill Residential, small commercial 8.9 M 885 K Utility Renewable Contracts Long term green power purchasing with utility acting as broker of long term bilateral contract Commercial 2.8 M 15 Community Solar Buy a piece of shared solar project Residential 80 K 4.7 K 14

- 15. The big growing categories are PPAs, CCAs and community solar. 15

- 16. 16

- 17. 17

- 18. Power Purchase Agreements In a physical PPA, customer pays outright for energy. In a financial (virtual) PPA, customer pays for the difference between wholesale rate generator sells on the local grid for and guaranteed PPA price. Tech companies are the biggest buyers of PPAs. ~65% of PPAs is wind power. 18

- 19. New Purchasing Behavior: PPA Buyer Aggregation ● Multiple purchasers pooling together to sign a PPA with the same generators. ● This is a new purchasing behavior that allows smaller buyers to participate in PPAs, reduces transaction costs because PPAs are one-off custom contracts. ● Etsy, Akamai, and Swiss Re partnered in 2018 to buy 290 MW of renewable energy (125 MW of wind in Illinois and 165 MW from solar in Virginia). ● This is not commonplace yet. 19

- 20. Community Choice Aggregation ● CCAs are opt-out not opt-in for customers ● Can only exist within an investor-owned utility territory ● Investor-owned utility remains responsible for transmission and distribution ● There are 97 CCAs in 5 states: California, Illinois, Massachusetts, New York, Ohio ● In 2017, CCAs sold 8.9 million MWh of green power to 2.7 million customers ● CCAs don’t have to procure more green power than required by RPS ● CCAs in CA serve ~140,000 customers, compared to ~11,000 customers in MA and ~9,000 customers in IL ● Utilities don’t like CCAs, in 2010, PG&E spent $43M lobbying against the Marin CCA 20

- 21. Community Solar About 70% of community solar projects operate in states with virtual net metering. 14 states + DC have VNM: CA, CT, CO (solar only), DE (solar only), MA, MN (solar only), ME, MD, NH, NY (solar only), PA, RI, VT, WI (solar only) and DC 21

- 22. Utilities and monopolies: regulated vs deregulated markets ● 17 states and DC have deregulated energy markets ● Deregulated: there is competition for energy generation and supply, buyers can choose their electricity supplier ● These are states where competitive suppliers like Clean Choice Energy, Green Mountain Energy and Drift can play ● Physical PPAs and competitive suppliers only work in these markets 22

- 23. Utilities hold a monopoly on transmission ● Even in deregulated markets, utilities have a monopoly on transmission ● Can’t setup electric wires and transmit electricity without permission of the utility ● That means that if one building generates or stores excess electricity, that building cannot setup a cable to connect to another building and sell that building its excess energy ● All energy sales are instead done indirectly - energy can be sold back into the grid, but not directly to another building ● In that way, electricity is different from ISPs/cables/internet ● One exception is EV chargers, you can connect an EV charger to a building and sell it electricity directly 23

- 24. Carbon Offsets Market Map 24

- 25. 1. Buying carbon offsets is a high confusion activity. Even knowing how much carbon you need to offset is highly confusing. And then understanding which projects are impactful, knowing that you want carbon removals, not offsets, where your spend is going, etc. 2. There are many ways to sequester carbon but not all of them can be verified by the big agencies today. This is an opportunity for startups to build software-based verification mechanisms to verify new types of projects and sell their offsets. 3. The carbon offset system is becoming bundled and more streamlined. Software-defined marketplaces are replacing auditors, verification agencies, registries, and project planning and financing. 4. This may cause market expansion where the number of offset projects grow from today’s 2,000. There may be opportunities for projects that serve the offset projects themselves such as equity project financing and planning software. 5. Buying carbon offsets is a manual process without any automation (such as offset automatically every time a book a flight ticket). Themes We’ve Run Across In Carbon Markets 25

- 26. Project Developers Farmers, organizations and project developers who build projects and sell their offsets Third-Party Auditors Trusted by the verification agencies, are paid to send people to the offset projects and verify their legitimacy Verification Agencies & Registries Maintain the verification protocols and often also maintain a registry of verified projects that marketplaces source from i.e. American Carbon Registry, The Gold Standard Marketplaces/Retailers List available offsets from verification agencies and allow consumers to sell them. Resellers Typically consumer retail - buys offsets and resells them Brokers/Services Full-service agencies that help enterprises navigate the offset-procuring process. Traditional Stack: Lots of different players End Buyers End customer who buys and retires the offset. Emerging Stack: One marketplace expands supply and serves demand End Buyers All-In-One Carbon Offset Platforms ● Use data to provide project planning insights and financing to the project developers ● Create their own verification systems/protocols ● Verify projects using software and networks ● Lend their trusted brand stamp of approval ● Sell their own offset supply on their marketplace ● Work with enterprises in a services capacity to help them purchase offsets Project Developers Project Financing & Planning Software A layer of services that supports project development, including planning software and upfront financing 26

- 27. US Voluntary Carbon Offset Market Overview 27

- 28. 2,008 projects have issued offsets since 2005 72% of all voluntary carbon projects are located in the top five project-hosting countries: India (442), China (426), the United States (351), Turkey (124), and Brazil (97). Project Landscape Category Description # Energy Efficiency improving energy efficiency or switching to cleaner fuel sources. 663 Renewable Energy installing solar, wind, and other forms of renewable energy production. 611 Waste Disposal reducing methane emissions from landfills or wastewater, often by collecting converting it to usable fuel. 238 Forestry / Land Use managing forests, soil, grasslands, and other land types to avoid releasing carbon and/or increasing the amount of carbon the land absorbs. 170 Household Devices distributing cleaner-burning stoves or water purification devices to reduce or eliminate the need to burn wood (or other inefficient types of energy). 161 Agriculture modifying agricultural practices to reduce emissions by switching to no-till farming, reducing chemical fertilizer use, etc 87 Industrial Manufacturing modifying industrial processes to emit fewer greenhouse gases. 72 Transportation increasing access to public and/or alternative transportation (like bicycling) and reducing emissions from private transportation like cars and trucks. 43 28

- 29. But actually, there are many types of offsets, many of which can’t be sold in markets today because there’s no verification protocol used by a trusted verification agency ● What offsets can be sold is limited by today’s verification process. ● A verification agency must have a protocol for verifying that type of offset, and it must be cost-effective to verify that type of offset ● There is a big market-expansion opportunity to develop a trusted verification protocol for an unserved offset type and build a marketplace for those offsets 29

- 30. Voluntary offset purchasing is growing supply purchased 30

- 31. Prices vary, global avg price in 2018: $2.4/tCO2 31

- 32. There is so much confusion in offset purchasing. Take a simple question: how many tons of carbon does USV need to offset for our flights in 2019? Emissions Calculator Estimate Blue Sky Model 36 tCO2 ICAO 38 tCO2 Myclimate 87 tCO2 Cool Climate 148 tCO2 Unclear questions in purchasing offsets: ● How many tons of carbon do I need to offset? No standard protocol for calculating amount of offsets to purchase ● What type of offset should I purchase? No easy way to understand what is the most impactful way to spend offset $. ● How much should I pay? Where does the money go? Price is determined by compliance market, where price is set by government. 32

- 33. There is warranted low trust in the quality of offsets 33 ● There has been some fraud amongst offset projects who sold offsets that would have been planted/built anyway, and for projects that emitted more carbon than they sequester (see ProPublica article) ● Some people argue that carbon offsets are less impactful than just lowering carbon emissions directly (i.e. a power plant offsetting 10% of emissions is not as impactful as actually lowering their emissions 10%) ● Also because of carbon offsets sold in such a way where 1 ton carbon offsetted is treated the same as 1 ton carbon removed, where people in industry generally agree removing a ton of carbon from the earth’s atmosphere is more impactful than preventing future carbon emissions and both are called carbon offsets.

- 34. So many middlemen, projects often keep 30% of offset price 34

- 35. EV Charging Market Map 35

- 36. EV Charging Market Map Hardware: Charging Points Services: Financing and installation Software: Single or Fleet of Chargers Services (Billing, whitelabel app, energy manager, clean energy supplier/RECs) Hardware and Software Network: Sell chargers and create a network of chargers. Software Charging Network: Let EV charger owners connect their EVs to a network of chargers Software Energy Network: Demand Response for a network of chargers 36

- 37. EV Charging Market Overview 37

- 38. The price of battery storage has dropped 85% in 10 years. 38

- 39. That is enabling EVs to take off - now 2% of all new cars sold 39

- 40. 5m EVs worldwide, 1m in US, 1m in EU, 2m in China ● There were 5m EVs globally in 2018, up from 3m in 2017 ● There are also 260m electric scooters (as of 2018) ● EVs only avoid GHG emissions if the electricity source is not emitting and if the manufacturing process is clean. This remains a challenge. 40

- 41. Public charging stations growing, but not at pace of EVs ● 5.2m EV chargers globally, 540k of which are publicly accessible. ● Fast chargers can charge in < 30 minutes, gas station experience, 144k public fast chargers globally. ● Public charger growth rate slowing, growing 25% yoy globally, 20% yoy in US. ● For comparison, 22k public charging stations in the US (3.5k are fast charging) vs 168k gas stations. 41

- 42. For gas station experience, you mostly just want fast charging DCFC (Direct Current Fast Charge) can charge 75% of an EV battery in 30 min. Only 16% of US public chargers are fast chargers. In a network of public chargers, it matters how many fast chargers are in network. 42

- 43. 3 types of EV charging connectors, not that fragmented 3 types of plug connectors (plus a 4th in China): 1. SAE Combined Charging Solution (CCS), used by US and German car companies 2. CHAdeMO connector, used by Japanese and French car companies 3. Tesla 4. GBT, only used in China Public charging stations usually have the 2 main connectors, or they are a Tesla station, so not too fragmented, not too many limits on where drivers can go recharge. 43

- 44. Lots of vertical charging networks where the network operator owns or sells the hardware. 60% of public chargers belong to one of 4 networks (ChargePoint, Tesla, Blink, and SemaCharge) Consolidation is happening: the three largest networks (ChargePoint, Electrify America, EVgo) have signed an interoperability agreement. These networks all own or sell the hardware. Most networks own/operate/sell the hardware. Some software plays too. The charging networks require drivers to have an account with them so drivers need to have multiple apps and cards to access all stations. Goal is like gas stations: standardized pumps and credit card readers. 44

- 45. Software-Only Charging Networks Are Emerging Too They don’t go through the EV charging OEM, instead the EV charge point owner adds the charger to the network. Made possible through open protocols: Open Charge Point Protocol (OCPP) and the Open Smart Charging Protocol (OSCP). 45

- 46. There is a demand response opportunity in EV charging Software networks can aggregate EUM (energy under management) from EV chargers and make revenue through grid demand response programs. Only in deregulated energy markets. The utility pings the demand-response provider about current demand related events, and the DR provider changes electricity consumption to sell back unconsumed kW. Additional revenue stream for the EV charger owner. 46

- 47. The Beginnings Of An Energy Storage Market Overview 47

- 48. Storage has grown 8x in 5 years. Most of that is driven by utilities deploying lithium-ion batteries (the cost of which has dropped 85% in 10 years). US grid energy storage is growing 48

- 49. Pumped hydro is the most utilized, Li-ion is fastest growing There are several existing ways to store energy: ● Pumped Hydro ● Batteries ● Compressed Air ● Flywheel ● Thermal 94% (23.6 GW) of energy stored in the US is through pumped hydro. Then another 5% is lithium-ion batteries. Half of US grid energy storage is owned by independent power producers, half is owned by utilities. 49

- 50. Pumped-Storage Hydro (PSH) 94% of U.S. grid energy storage is from PSH (23.6 GW), 42 PSH sites in the US High efficiency: 76-85% efficiency How it works: ● Water is pumped to a higher elevation for storage during low-cost energy periods ● When electricity is needed, water is released back to the lower pool, generating power through turbines Permit and construction takes 3-5 years each, 6-10 yrs total to build a PSH project. But then PHS plants have long lifetimes (50-60 years). Geographically limited where PSH can be built. Largest PSH is from 1985 in Bath County, VA, supplies 3 GW of energy to 750K homes. Geographically limited, though you don’t need a continuously flowing source of water 50

- 51. Batteries Price of Lithium Ion batteries ↓ 85% in 10 years, Li-ion now makes up 80% of US large scale battery storage Efficiency between 60-95%, li-on batteries at 95% How it works: ● Batteries contain 2 electrodes (anode and cathode) ● An electrolyte lets ions flow between the two electrodes and external wires to allow for electrical charge to flow Types: lead-acid (way less now), lithium-ion (high-growth), nickel-based (less now), sodium-based (less now), flow batteries (promising), solid state (less flammable, more expensive than li-ion) How flow batteries work: ● two tanks of liquids, pumped into a reactor where they generate a charge cheaper than lithium ion grid scale storage and offer longer lifespan 51

- 52. Compressed Air Energy Storage (CAES) Moderately efficient: 42-55% efficiency, can be 70% if heat is retained. How it works: ● Air is pumped into an underground hole (usually a salt cavern) when electricity is cheap ● When energy is needed, air from the underground cave is released back into the facility, where it is heated and the expanding of the air turns a generator. As of June 2018, there are 4 operating CAES systems in the U.S. with a combined rated power of 0.114 GW. There are only two operating CAES facilities: one in McIntosh, Alabama (110 MW) and one in Huntorf, Germany. Geographically limited 52

- 53. Thermal Moderately to very efficient: 50% - 90% depending on the type of thermal energy used. How it works: ● When energy is cheap, typically rocks, salt, or water are heated and kept in insulated environments. ● When energy is needed, the thermal energy is released by pumping cold water onto the hot rocks, salts, or hot water in order to produce steam, which spins turbines. 53

- 54. Hydrogen Fuel Cells Moderately efficient: 60% efficiency How it works: ● Generates electricity by combining hydrogen and oxygen, produces hydrogen when electricity is cheap, and later use that hydrogen to generate electricity ● Release no emissions (when running on pure hydrogen, the only byproduct is water) ● The process is cyclical, water produces hydrogen and oxygen and then you can use those to do storage again Hydrogen can be produced in one place and used in another Hydrogen can also be produced by reforming biogas, ethanol, or hydrocarbons, a cheaper method that emits carbon pollution Requires platinum which is an expensive metal, so hydrogen fuel cells are expensive 54

- 55. Flywheels & Supercapacitors High efficiency: between 85-87% Used for power management rather than longer-term energy storage, not suitable for long-term energy storage but good for load shifting / load leveling How it works: ● Motors store energy into flywheels by accelerating their spins to very high rates (up to 50,000 rpm). The motor can later use that stored kinetic energy to generate electricity by going into reverse ● Flywheels are commonly left in a vacuum so as to minimize air friction, which would slow the wheel ● Supercapacitors are similar to flywheels but store power electrically (versus in flywheel stored in kinetic energy). they store energy as a static charge. there is no chemical reaction during charging or discharging 55

- 56. Liquified Air ● By cooling air down to -196 deg C it is turned into a compressed liquid, which can be stored ● When ambient air is exposed to this liquid it re-gasifies and expands in volume rapidly, rotating a turbine in the process 56

- 57. Fusion is a big part of the answer but it’s not here yet https://continuations.com/post/190177544425/calling-all-billionaires-fund-fusion-now 57

- 58. Appendix 58

- 59. Basic Power Flow Renewable Energy Generators Wholesale Energy Market Day Ahead Market Imbalance (aka Day Of) Market Traditional Energy Generators Suppliers bid on energy day ahead, and deliver it through utility company to buildings Delivered through power grid, run by utility cos Renewable energy generators also generate Renewable Energy Certificates Green energy suppliers buy RECs to make the energy ‘green’ Capacity Market (aka 6 mo ahead) 59

- 60. Notes About Basic Power Flow Diagram By default there is no energy storage in this system so power is generated at the same time it is consumed. Suppliers take the lowest price energy first, but they can also do bilateral trades to make an agreement with a specific provider (Drift for instance aggregates renewable generators and then buys from them instead of taking the lowest price). There are two energy markets: the day ahead market bid on energy needs the day ahead and the imbalance market where you can buy at the time you need it, it’s to fix the “imbalances” in what was purchased in the DAM versus what is actually needed. Once energy is put into the grid you can’t distinguish it so there’s no way to route just the clean energy to someone’s home, once they are in the grid, the electrons are fungible. In some states you can choose your energy supplier, in others your utility company is your energy supplier. New retail green energy suppliers such as Arcadia buy offsets on your behalf to offset your energy usage. The idea is that you buy energy from the grid, and then you buy the ‘greenness’ of the energy (aka you are subsidizing the green energy) from the renewable generators via renewable energy certificates (RECs). 60

- 61. How electricity works ● The power plant splits electrons from their atoms ● The electrons want to resolve themselves back into the whole atom again ● The electrons without atoms (-) move towards atoms without electrons (+) ● The grid provides a route (the wires) for the electrons to go towards their atoms ● The route is a giant loop. The electrons pass through the wires and all the devices we put in their way. ● Electrons will take all possible routes simultaneously with preference for paths of lower resistance, regardless of distance. ● When you turn on a light switch you have lowered the resistance so electricity goes into the light bulb circuit and turns it on. 61

- 62. The potential for decentralized networks here If there really is demand for renewable energy, then you can start to setup incentivized bottoms-up networks to supply renewable energy generation and renewable energy storage. Just like how there’s demand for file storage so there can be an incentivized network for providing that (FileCoin), if there is demand for renewable energy, people will set up wind farms and batteries the same way people today set up Bitcoin mining rigs and FileCoin nodes. Having said that, this all relies on there being demand for renewable energy and that may be much easier to achieve with regulation than with convincing businesses and consumers to care. 62

- 63. Smart Meter Rollout In US 63

- 64. Smart wifi-enabled thermostats in the US 64

- 65. Parts of the world that have carbon pricing (April 2019) 65

- 66. Renewable Portfolio Standards ● Mandated % of utility’s energy that must come from green power ● 29 states have RPS ● 21 states and DC’s RPS include carve outs (requirement for specific type of green energy) or credit multipliers (a specific type of green energy counts for more units) ● 20 states and DC have cost caps for RPS to not raise prices for consumers 66