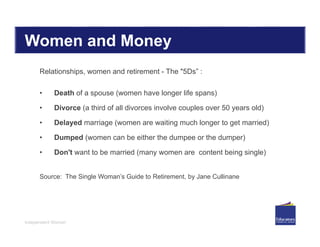

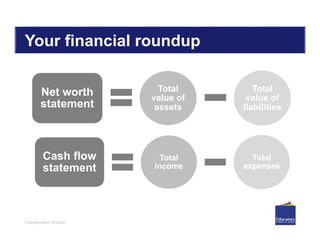

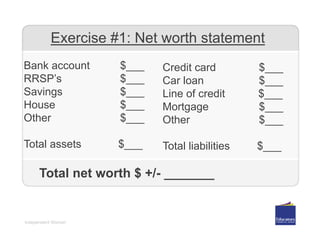

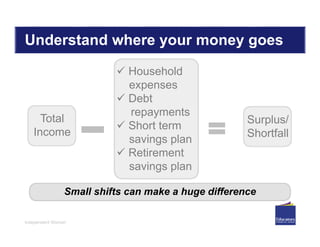

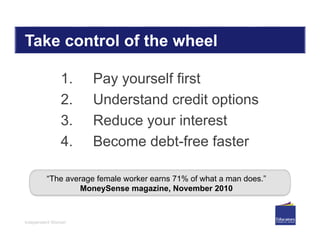

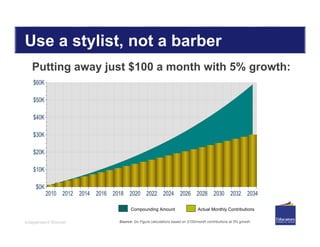

The document outlines a financial webinar aimed at female educators, focusing on key topics such as financial literacy, budgeting, and goal setting. It emphasizes the importance of understanding personal finances, managing debt, and preparing for retirement, while providing practical exercises and resources. Additionally, it highlights specific financial challenges faced by women and encourages proactive financial planning and advice seeking.