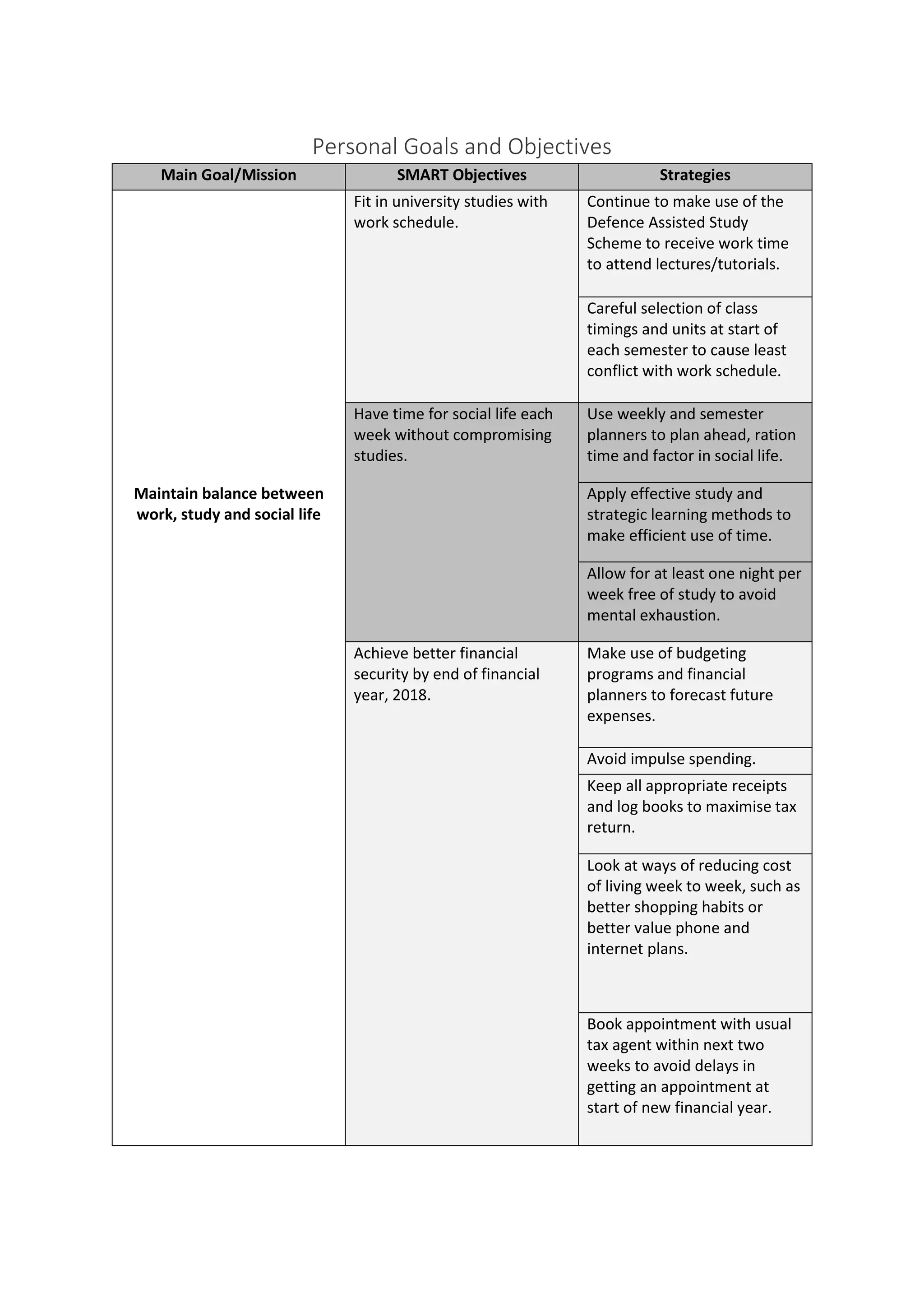

This document outlines personal goals and objectives for maintaining balance between work, study and social life. The goals are to fit university studies around a work schedule using an assisted study scheme, have time for social life each week without compromising studies, and achieve better financial security by the end of 2018 through budgeting, reducing costs, and maximizing tax returns. Strategies are provided for each objective to carefully select class times, plan ahead, apply effective study methods, avoid mental exhaustion, avoid impulse spending, keep receipts, and book an early tax appointment.