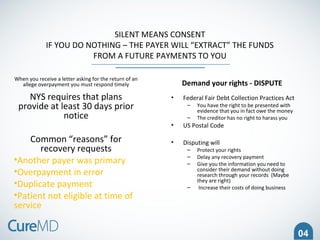

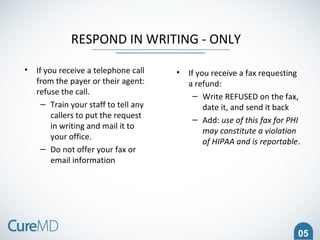

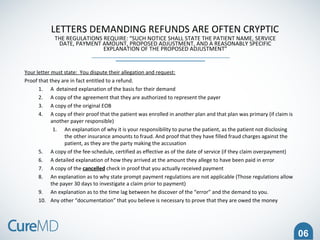

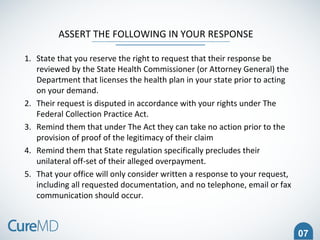

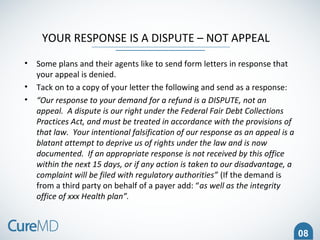

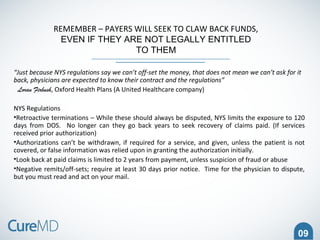

Robert E. Goff, who recently retired as CEO of University Physicians Network, discusses strategies for confronting payer claw-backs in healthcare payments. He emphasizes the importance of responding promptly and disputing any demand for refunds, highlighting legal rights and proper documentation needed to protect against unauthorized recovery efforts. Goff warns that failing to act can lead to increased financial losses for physicians due to excessive refund demands.