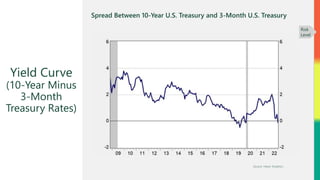

The November 2022 market risk update highlights ongoing recession risks tied to past patterns, with the economic recovery remaining uncertain due to potential slowdowns and tighter monetary policy from the Federal Reserve. Key indicators such as the inverted yield curve, declining valuations, and decreasing margin debt suggest caution as market conditions evolve, with a potential pathway to recovery anticipated but fraught with risks. Overall, despite some positive market performance, inflation and interest rates remain significant immediate concerns for investors.