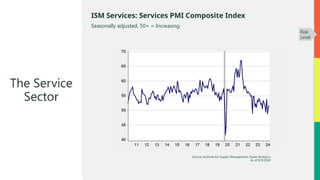

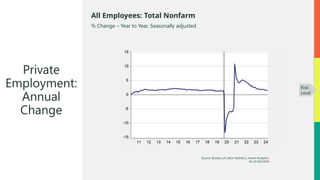

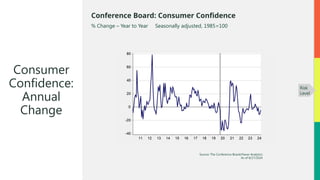

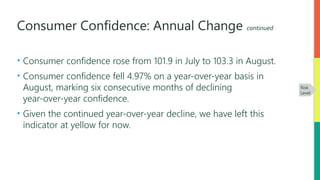

In September 2024, the service sector saw a slight improvement in confidence, with the PMI index rising to 51.5, although it has trended downwards over the year. Private employment continued to grow with 142,000 jobs added in August, leading to a decrease in the unemployment rate to 4.2%. Despite these positive signs, consumer confidence remains weak on a year-over-year basis, indicating potential economic challenges ahead.