CommSec August 2015 Reporting Season - Full Results

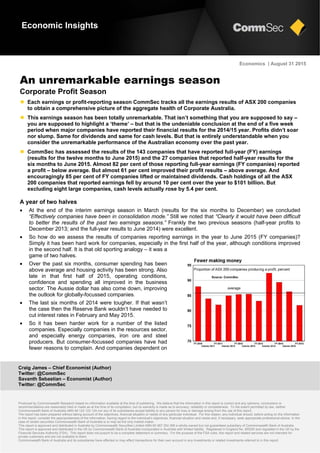

- 1. Craig James – Chief Economist (Author) Twitter: @CommSec Savanth Sebastian – Economist (Author) Twitter: @CommSec Produced by Commonwealth Research based on information available at the time of publishing. We believe that the information in this report is correct and any opinions, conclusions or recommendations are reasonably held or made as at the time of its compilation, but no warranty is made as to accuracy, reliability or completeness. To the extent permitted by law, neither Commonwealth Bank of Australia ABN 48 123 123 124 nor any of its subsidiaries accept liability to any person for loss or damage arising from the use of this report. The report has been prepared without taking account of the objectives, financial situation or needs of any particular individual. For this reason, any individual should, before acting on the information in this report, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice. In the case of certain securities Commonwealth Bank of Australia is or may be the only market maker. This report is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399 a wholly owned but not guaranteed subsidiary of Commonwealth Bank of Australia. This report is approved and distributed in the UK by Commonwealth Bank of Australia incorporated in Australia with limited liability. Registered in England No. BR250 and regulated in the UK by the Financial Services Authority (FSA). This report does not purport to be a complete statement or summary. For the purpose of the FSA rules, this report and related services are not intended for private customers and are not available to them. Commonwealth Bank of Australia and its subsidiaries have effected or may effect transactions for their own account in any investments or related investments referred to in this report. Economics | August 31 2015 An unremarkable earnings season Corporate Profit Season Each earnings or profit-reporting season CommSec tracks all the earnings results of ASX 200 companies to obtain a comprehensive picture of the aggregate health of Corporate Australia. This earnings season has been totally unremarkable. That isn’t something that you are supposed to say – you are supposed to highlight a ‘theme’ – but that is the undeniable conclusion at the end of a five week period when major companies have reported their financial results for the 2014/15 year. Profits didn’t soar nor slump. Same for dividends and same for cash levels. But that is entirely understandable when you consider the unremarkable performance of the Australian economy over the past year. CommSec has assessed the results of the 143 companies that have reported full-year (FY) earnings (results for the twelve months to June 2015) and the 27 companies that reported half-year results for the six months to June 2015. Almost 82 per cent of those reporting full-year earnings (FY companies) reported a profit – below average. But almost 61 per cent improved their profit results – above average. And encouragingly 85 per cent of FY companies lifted or maintained dividends. Cash holdings of all the ASX 200 companies that reported earnings fell by around 10 per cent over the year to $101 billion. But excluding eight large companies, cash levels actually rose by 5.4 per cent. A year of two halves At the end of the interim earnings season in March (results for the six months to December) we concluded “Effectively companies have been in consolidation mode.” Still we noted that “Clearly it would have been difficult to better the results of the past two earnings seasons.” Frankly the two previous seasons (half-year profits to December 2013; and the full-year results to June 2014) were excellent. So how do we assess the results of companies reporting earnings in the year to June 2015 (FY companies)? Simply it has been hard work for companies, especially in the first half of the year, although conditions improved in the second half. It is that old sporting analogy – it was a game of two halves. Over the past six months, consumer spending has been above average and housing activity has been strong. Also late in that first half of 2015, operating conditions, confidence and spending all improved in the business sector. The Aussie dollar has also come down, improving the outlook for globally-focussed companies. The last six months of 2014 were tougher. If that wasn’t the case then the Reserve Bank wouldn’t have needed to cut interest rates in February and May 2015. So it has been harder work for a number of the listed companies. Especially companies in the resources sector, and especially energy companies, iron ore and steel producers. But consumer-focussed companies have had fewer reasons to complain. And companies dependent on Economic Insights

- 2. August 31 2015 2 Economic Insights: An unremarkable earnings season home building have done well. That is not to say that the financial health of Corporate Australia has deteriorated markedly. It hasn’t. It is just that the operating environment has been tougher. Harder to generate revenue, harder to generate profits and harder to improve the bottom- line results. But dividends have generally been maintained or increased. Cash levels are still high, although there have been notable cases of companies paring cash levels. The majority of companies are still reporting statutory profits, while debt levels remain low and conservative. An earnings season devoid of key themes Earnings seasons tend to be characterised by a central theme, or themes. But that wasn’t the case with the last earnings season concluding at the end of February. And that has been the case with the latest earnings season. Companies have not generally been slashing costs, although resource companies in particular have certainly been aiming at improving productivity and efficiency. A number of companies have identified significant “impairment charges” or write-downs and provisions in their profit and loss accounts affecting bottom-line results (Worley, Seven Group, Seven West Media, Beach Energy, UGL, South32). Companies that are dependent on activity in the resources sector have highlighted the tough operating conditions (UGL, Boart Longyear, and Arrium). The housing construction boom has been positive for many (Sunland, Cedar Woods, and Folkestone). There were a few ‘turnaround’ stories, notably Qantas – although this was previewed at the interim earnings period. There were a few standout results such as Aurizon, Austal (not in the ASX 200) and Newcrest. Two packaging companies (Pact Group and Orora) achieved cost savings, thus serving to boost bottom-line profit results. Recall Holdings highlighted the benefits of the “solid platform established after the demerger.” Outlook statements are always going to vary from company to company and industry to industry. But probably on the back of a better economy in the first half of 2015, companies were generally positive on the period ahead. Interestingly the optimism was shown by some companies that reported “challenging” conditions over the past year (Coca Cola Amatil, Cabcharge and ARB). Some companies were more cautious (Seven Group). Some companies noted mixed prospects ahead (Worley Parsons). And both Transpacific and Pacific Brands expect further challenging market conditions. Companies continue to be focussed on either lifting or maintaining dividends. But there is no sense that companies have blinkers on with a single-minded determination to pay dividends at all costs. Rather companies are competing for the affection of current or prospective shareholders. Cash levels are still healthy, giving companies scope to maintain dividends. But that doesn’t mean that reinvestment of earnings back in the business

- 3. August 31 2015 3 Economic Insights: An unremarkable earnings season is being shunned. Certainly there continues to be conservatism. But the results on dividend payments are not markedly out of kilter with overall financial performances. And it is worth noting another trend that was identified in the last reporting season – the volatility or variability of bottom-line earnings results. Of the 143 FY companies, just under a third reported statutory earnings results (net profit after tax) that were more than 100 per cent above or below results from a year ago. In some respects that is to be expected given the tough conditions in mining, energy and engineering sectors but favourable conditions in housing- dependent sectors and some consumer-focussed businesses (Harvey Norman, JB Hi-Fi). The 2014/15 profit reporting season (twelve months to June 2015) The only way to assess whether the recent profit-reporting season has been a success or failure is to add up the numbers. And that’s what we’ve done. It’s certainly not a case of comparing results to the expectations of analysts due to continuous disclosure and because companies are routinely successful in managing expectations. And the expectations of analysts are really only there to provide a reference point for the short-term investment direction of individual companies. Instead investors want to know how Corporate Australia is fairing more broadly. And you can only know that by aggregating and dissecting the key metrics of all the companies. So to the numbers. CommSec has assessed the results of 143 companies from the ASX 200 index that reported earnings for the year to June 2015. In aggregate, revenue grew by 0.4 per cent to $579.3 billion while expenses grew by 3.1 per cent to $477.6 billion, leading to a 31.9 per cent fall in net profit to $35.9 billion (in the half-year earnings to December, profit fell by 26.2 per cent). But as noted, there has been a sharp lift in the variability of bottom-line earnings. And some companies have chosen to take “impairments” to bottom-line earnings. Stripping out ‘outliers’, we estimate that underlying aggregate revenues rose by 2.0 per cent, expenses rose by 2.2 per cent and aggregate profits fell by 3.0 per cent. The bad news is that only 117 of 143 companies (81.8 per cent) reported a profit – below the long-term average. But of companies reporting profits this season, 71.7 per cent lifted profits, compared with 65 per cent in the interim reporting season. And just short of 61 per cent of all companies actually improved bottom-line results. In the last earnings season (six months to December) cash levels fell by 10.1 per cent. In the latest results, cash holdings were down by 13.6 per cent. But 74 companies lifted cash levels and 69 cut cash levels on a year ago. Excluding ‘outliers’, cash levels were up 3.9 per cent on a year ago.

- 4. August 31 2015 4 Economic Insights: An unremarkable earnings season In fact if you put all companies together (170 companies) total cash earnings were $100.7 billion. Of these companies, eight large companies have each reduced cash holdings by a $1 billion or more. If these ‘outliers’ are excluded, then aggregate cash levels actually lifted by 5.4 per cent. Dividends have been complicated to some extent because a number of companies have indicated that they will pay special dividends or return cash to shareholders but not pay a formal “final” dividend. Including special dividends, dividends rose in aggregate by 6.5 per cent despite variable profits and lower cash reserves. And 89.5 per cent of all companies chose to pay a dividend, above the long-term average of 83.7 per cent. Of all companies issuing a dividend, 63 per cent lifted dividends, 22 per cent maintained dividends while 15 per cent cut dividends. The interim 2015 profit results (six months to June 2015) So how did the companies reporting half-year 2015 results fare? As is always the case this is a much smaller sample, just 27 of the ASX 200 companies reported annual profits for six months to June 2015. In aggregate, profits totalled $12.6 billion, down 45.5 per cent on a year earlier (excluding Rio Tinto and Scentre Group, down 20.5 per cent). Importantly every company reported a profit – an extraordinary event. But 16 of the 29 lifted profits compared with a year ago, down from 18 (of 29 companies) in the full-year reporting period. Excluding outliers, aggregate sales in the six months to June fell by 0.3 per cent while the cost of sales or expenses fell by 1.6 per cent. Earnings per share rose by 3.3 per cent, dividends rose by 3.5 per cent and cash holdings fell by 0.5 per cent to $31.4 billion. All but one company provided a dividend with all companies that paid a dividend electing to lift or maintain dividend payments. Outlook When we assessed the interim reporting season in March 2015 our forecast for the ASX 200 in June 2015 was 5,900-6,100 points with the ASX 200 projected to hit 6,000-6,200 points by end year. Our June forecast was realised early (the ASX 200 stood at 5,948 as late as April 28). But the Greek debt crisis, bank capital raisings and concerns over the Chinese economy have white-anted the ASX 200 in the period since. Total returns on the Australian sharemarket – as measured by the All Ordinaries Accumulation index (XAOAI, dividends plus share price changes) – hit record highs on April 27 at 51,568 points. On August 28, the XAOAI was 10 per cent down from record highs. Currently total returns on Australian shares are down 2 per cent on the year. Corporate Australia is at the cross-roads. Earnings have been hard to generate in the past year, and if anything this is likely to continue. The ‘speed limit’ for the economy appears to have fallen from around 3 per cent to at least around 2.75 per cent. At the same time, the Chinese economy continues to mature with the growth rate for the economy understandably expected to slow over coming years. China is rebalancing away from production to consumption, but at the same time the Indian economy doesn’t seem poised – at least not yet – to go down the ‘Chinese path’, that is, recording strong rates of investment and production. Australian companies are in strong financial shape. The main criticism is that too many companies are comfortable staying on the treadmill – paying out dividends rather than expanding, investing, looking for merger or acquisition opportunities or embarking on major exercises to boost productivity or efficiency. The strong shape of Corporate Australia, growing population, proximity of Australia to the fast growing Asia region and weaker Aussie dollar won’t be lost on foreign companies looking for takeover targets. That has already been apparent. But further acquisitions of Aussie companies may raise community concerns. In a cyclical sense, we expect that the better economic momentum generated in the first half of 2015 will continue over the next six months. Annual growth of consumer spending is above long-term averages. Businesses are spending. Residential building is at record highs and housing will drive the Australian economy over the coming year. A lower Aussie dollar will also help lift business activity. The Aussie sharemarket is slightly over-valued (5-10 per cent) on the basis of forward price-earnings, and earnings will remain hard to come by over the coming year. The Australian sharemarket may struggle over the next few months before lifting later in 2015. We currently expect the ASX 200 to stand at 5,650-5,850 points at the end of 2015 with the index lifting to 5,850-6,050 by June 2016. Craig James, Chief Economist, CommSec; Twitter: @CommSec Savanth Sebastian, Economist, CommSec; Twitter: @CommSec

- 5. August 31 2015 5 Economic Insights: An unremarkable earnings season

- 6. August 31 2015 6 Economic Insights: An unremarkable earnings season

- 7. August 31 2015 7 Economic Insights: An unremarkable earnings season

- 8. August 31 2015 8 Economic Insights: An unremarkable earnings season

- 9. August 31 2015 9 Economic Insights: An unremarkable earnings season

- 10. 4 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec SUNCORP GROUP (SUN) RESULTS FY15 FY14 CHANGE Net Profit After Tax (NPAT) ($m) 1,133 730 55.2% NPAT ($m) Consensus 1,140 General Insurance NPAT ($m) 756 1,010 -25% Bank NPAT 354 228 55% Special Dividend ($) 0.12 0.30 Final Dividend ($) 0.38 0.40 Total Annual Dividend ($) 0.88 1.05 Suncorp Group (SUN) meets expectations despite more natural disasters Suncorp Group reported that net profit after tax (NPAT) met consensus expectations, rising by 55.2% to $1,133 million compared to $730 million for the same period last year. The group reported a strong performance in the banking business which was driven by improvements in lending growth and the Net Interest Margin (NIM). Bank lending grew by 3.9% while impairment losses were down substantially, falling by 53.2%. Non-performing loans were down by 20%. Bank NPAT rose significantly to $354 million compared to $228 million for the same period last year with the NIM rising to 1.85% from 1.72% a year ago. The General Insurance business reported a 25% decline in NPAT to $756 million from $1,010 million a year earlier. The result reflected the worst year for natural disasters in SUN’s history totalling $1,068 million which was $473 million above the full year allowance. This included the net impact of around $650 million from five major weather events in Queensland and New South Wales. Gross Written Premium (GWP) was flat at $8,872 million. Personal Insurance GWP reduced by 2.5%; Commercial Insurance GWP grew by 2.2%, while Compulsory Third Party (CTP) GWP grew 5.9% Suncorp Life reported a NPAT of $125 million, an increase of 35.9%. Underlying profit was $113 million, up 34.5% which benefited from cost controls which helped operating expenses fall by 7.3%. SUN declared a fully franked, final dividend payment for the period of 38 cents per ordinary share and a 12 cent special dividend per fully paid ordinary share. The record date for the payments is Thursday August 13, 2015 with a payment date of Tuesday September 22, 2015.

- 11. 5 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec BWP TRUST (BWP) RESULTS FY15 FY14 CHANGE Total Income ($m) 144.9 127.4 +14% Total Income ($m) Consensus 143.4 Underlying Profit ($m) 101.6 92.0 +10% Underlying Profit ($m) Consensus 101.3 Final Distribution (cents) 8.17 7.88 +3.7% Final Distribution (cents) Consensus 8.17 Total Annual Distributions (cents) 15.84 14.7 +7.7 BWP Trust (BWP) posts a solid result and trades near record high BWP Trust (BWP) posted a $101.6m Underlying Profit for the 12 months ended 30 June 2015 and was in-line with the market’s expectations. BWP is a listed managed investment scheme which invests in commercial real estate throughout Australia. The majority of its properties (80 of 82) are Bunnings Warehouses tenanted by the Wesfarmers owned hardware chain. Wesfarmers is also BWP’s largest shareholder. The result was boosted most by rental growth from its existing property portfolio and additional rental income from developments completed over the year. While borrowings rose by 8.2% to $485.4m, the cost of debt fell thanks to lower interest rates. BWP generated $71.6m from the divestment (sale) of six non-core properties. In terms of developments and purchases, BWP spent $124.6m to buy the Australind Bunnings Warehouse site in WA and completed the development of Manly West, West Ipswich, Brendale and Maribyrnong Bunnings Warehouse stores. An 8.17c Final Distribution was declared as expected. The ex-distribution date was 26 June 2015 and will be payable to eligible investors on 27 August 2015. BWP had flagged distribution details in late June and has a 4.8% yield. BWP shares were unchanged following the result, however are rising for the fourth consecutive year and have improved by 21% Year-To-Date. BWP is near all-time highs on the ASX.

- 12. 6 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec DOWNER EDI LIMITED (DOW) RESULTS FY15 FY14 CHANGE Net Profit After Tax (NPAT) ($m) 210.2 216.0 -2.7% NPAT ($m) Consensus 205.0 EBIT ($m) 309.7 341.1 -9.2% EBITDA ($m) 562.8 607.5 -7.4% Total Revenue ($m) 7,430.1 7,734.6 -3.9% Final Dividend ($) 0.12 0.12 Final Dividend ($) Consensus 0.13 Downer EDI Limited (DOW) – Headwinds from the resource sector continue Downer EDI provides engineering, construction and maintenance services. The group relies heavily on the domestic resource sector to generate revenue. The mining facing business provides a range of services through each stage of the mining lifecycle. EBIT for the division fell by 20% to $1.59 billion reflecting factors such as the continued decline in commodity prices, the early termination and completion of contracts and the reduced volumes on existing contracts. Another leading contributor to revenue is the Engineering, Construction and Maintenance (EC&M) unit. The unit provides design, engineering and construction services to a range of industries including oil and gas, commercial infrastructure, power generation and mining. Full year EBIT fell by 28% to $51.5 million due to a downturn in the resource sector and the impact on DOW’s consultancy businesses and the underperformance of projects in Western Australia. DOW’s rail division builds freight and passenger trains in addition to providing operations and maintenance services. EBIT for this division rose by 4.8% to 27.5 million, although revenue fell 13% to $873 million. The lower revenues were due to the completion of passenger manufacture contracts and the increased EBIT was driven by productivity improvements and lower restructuring costs. Providing guidance for the 2016 financial year has proven difficult for DOW with the group saying it is hard to predict the flow of uncontracted revenue, which is slightly higher than it was this time last year. For the 2016 financial year, Downer is targeting NPAT of around $190 million. Downer declared a fully franked final dividend of 12.0 cents per share, payable on 17 September 2015 to shareholders on the register at 20 August 2015.

- 13. 6 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec RIO TINTO LIMITED (RIO) RESULTS HY15 HY14 CHANGE Underlying earnings (US$m) 2,923 5,116 -43% Underlying earnings Consensus 2,66 Iron ore earnings (US$m) 2,099 4,683 -55% Impairments (US$m) 421 843 Capital expenditure (US$m) 2,474 3,845 -36% Net earnings (US$m) 806 4,402 -82% Final Dividend (USc) 107.5 96.0 +12% Rio Tinto Limited (RIO) HY15 tough half but cost control helped RIO beat expectations RIO posted a 43% fall in HY profit to US$2.9billion ahead of market expectations. The result was impacted by lower commodity prices (down US$3.6billion over the year) but partly offset by favourable exchange rates, lower energy costs and higher sales volumes. RIO confirmed its view that global growth is set to continue because although China’s transitioning into a major developed economy has slowed, it is occurring off a higher base. RIO’s iron ore division earnings fell 55% to US$2.1billion even though their production of 154 million tonnes was 11% higher than this time last year on the ramp up in the Pilbara. RIO’s low-cost advantage helped the company withstand the iron ore price slide - 1H15 cash unit cost was $16.2/t (21% lower than $20.4/t in 1H14). RIO’s bauxite and aluminium business did well with aluminium earnings up 67% and diamonds & minerals delivering strong margins despite challenging market conditions. RIO’s focus on financial and operating discipline helped deliver first half cost savings of $641million. By delivering a CAPEX lower than the market had expected, RIO helped to improve their balance sheet in the short term, but in the long term they do need to ramp up spending on projects to boost future output and returns. RIO’s dividend was in line with market expectations of USc107.5 and will be paid out on 10 September 2015

- 14. 7 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec VIRGIN AUSTRALIA HOLDINGS LTD (VAH) RESULTS FY15 FY14 CHANGE Revenue ($m) 4,749.0 4,307.0 +10.2% Revenue ($m) Consensus 4,605.0 Underlying Loss Before Tax ($m) (49.0) (211.7) - Net Loss After Tax ($m) (93.8) (353.8) - Net Loss After Tax ($m) Consensus (93.8) Interest Bearing Liabilities ($m) 2,762.2 1,950.7 +41.6% Final Dividend ($) 0.0 0.0 Virgin Australia Holdings (VAH) expects to return to profitability in FY16 Virgin Australia (VAH) posted a $93.8m loss for the 12 months ended June 30. The result was a $261.8m improvement on 2014 and in-line with consensus. VAH flagged the result a week earlier. The result was held back most by its underperforming International business, which posted a $69m loss over the year; $23m worse than FY14. Its Domestic unit improved earnings by $226m, generating $218m in profit. Low-cost carrier, Tigerair Australia has lost $8.6m from the date of its full acquisition by VAH on 17 October 2014. Its Velocity Frequent Flyer loyalty business increased earnings by $81.2m; adding 900,000 customers over the year. The airline announced an overhaul to its international operations, ceasing services from Perth, Melbourne, Adelaide and Bali. Tigerair is expected to pick up these routes. This decision is due to weak demand for premium air travel. Supplementary Trans-Tasman routes will be added. VAH hasn’t been profitable since 2012, but is eying a return to profitability in FY16. Tigerair is expecting full profitability this year and its International unit by next year. The market estimates profit of more than $100m for its next annual result. With Australia’s second largest airline still not in the black, no dividend was declared. February 2008 was the last time VAH shared its profits. VAH shares were unchanged following the result. Its 11% improvement over the past year is a substantial underperformance compared to Qantas (QAN). QAN shares have tripled in 12 months.

- 15. 10 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec ANSELL LIMITED (ANN) RESULTS FY15 FY14 CHANGE Net Profit After Tax (NPAT) (US$m) 188 157 +19.7% NPAT Consensus (US$m) 185.4 Revenue (US$m) 1,645 1,590 +4% Revenue (US$m) Consensus 1,785 Earnings Before Interest & Tax (US$m) 245 84 +191% Final Dividend (US$) 0.23 0.22 +4.5% Final Dividend (US$) Consensus 0.23 Ansell Limited (ANN) – Outlook statement clouds result Ansell (ANN) has reported an increase in underlying Net Profit After Tax (NPAT) of almost 20% to $US188 million. The underlying result excludes a one off restructuring cost of $US123 million. Factors driving the result included an encouraging performance from the emerging market business, which makes up 24% of total sales. Sales for this segment rose by only 2.4%, however by excluding the contribution of Russia and Brazil, sales rose by 12.4% (challenging economic conditions in the latter jurisdictions saw sales fall by 37% in Russia and by 7% in Brazil). In broad terms the results was shy of consensus expectations in terms of revenue although the biggest impact on the share price, was the outlook offered by ANN. The group was cautious in its outlook due to the influence of volatile currency markets and the impact of higher rates of taxation. ANN indicated that if currency markets maintain levels seen towards the end 2015, Earnings Per Share (EPS) will be negatively impacted by as much as 20 cents p/share. At the same time the underlying tax rate is seen rising to as much as 21%. However positive contributions to the performance of the core business are expected to include the continued delivery of restructuring benefits, contributions from completed acquisitions and price increases which will partially offset the impact of currency movements. Together these elements are predicted to have a positive influence of between 10-20 cents per share which will see FY16 EPS in the range of $US1.05- $1.20 compared to $1.225 in FY15. ANN declared a final dividend of 23 cents p/share for a full-year payout of 43 cents. The final payment has a record date of 17 August 2015 which will be made on 10 September 2015.

- 16. 10 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec BENDIGO AND ADELAIDE BANK (BEN) RESULTS FY15 FY14 CHANGE Cash earnings ($m) 432.4 382.3 +13.1% Statutory NPAT ($m) 423.9 372.3 +13.9% Statutory NPAT ($m) Consensus 436.5 Total income ($m) 1,550 1,441 +7.6% Total income ($m) Consensus 1,560 NIM (%) 2.20 2.24 -4bp Final Dividend ($) 0.33 0.33 Bendigo and Adelaide Bank (BEN) earnings up 13% but numbers did not impress. Bendigo and Adelaide Bank (BEN) posted a 13.1% lift in FY earnings and a 14% lift in net profit after tax. The BEN result was disappointing as the regional bank’s cash profit, especially in the last 6 months of the FY15 were below market expectations. Over the year BEN saw a strong build in business and rural revenues (Rural Finance Corporation joined the group and as a result has significantly increased the depth of BEN’s agribusiness offering) but profits from its wealth unit fell. Expenses were down as the firm continued to focus on efficiencies but its bad debts were up from $30M in 1H15 to $38m in 2H15. BEN's Net Interest Margin (NIM) fell in the second half of the year and fell 4bp over the year, reflecting the competitive lending environment and the 50bp cut to the cash rate by the RBA in 2H15. The increase in 2H15 BDD expense was primarily driven by the $15.9M collective provision for Great Southern (a class action agreement approved by the Supreme Court of Victoria). The July 2015 APRA announcements on changes to risk weights on mortgages has positively impacted the competitive environment. BENs Tier 1 funding lifted by 15bps to 8.17%. BEN will pay out a final dividend of $0.33 on Wednesday September 30, 2015.

- 17. 10 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec JB HI-FI LIMITED (JBH) RESULTS FY15 FY14 CHANGE Sales ($m) 3,652.1 3,483.8 +4.8% Sales ($m) Consensus 3,632.0 EBIT ($m) 200.9 191.1 +5.1% Net Profit After Tax (NPAT) ($m) 136.5 128.4 +6.4% NPAT ($m) Consensus 131.1 Final Dividend ($) 0.31 0.29 +6.9% Final Dividend ($) Consensus 0.30 JB Hi-Fi Limited (JBH) improves earnings despite cautious consumers JB Hi-Fi (JBH) posted a slightly better than forecast $136.5m profit for the 12 months ended 30 June. The result was driven by strong sales at its 173 Australian stores over the second half and the rollout of new sites. Software sales (music, games & movies) fell 8.2% over FY15, while what it defines as hardware & services (i.e. everything else) rose strongly and accounted for 83.3% of revenue. Sales at its 14 New Zealand stores failed to contribute to the result, with revenue down 0.1%. JB Hi-Fi Home – its 2012 launched home and kitchen appliance unit continues to expand. A strong property market has prompted the opening of 4 new Home stores over the year to 43 stores. Online sales surged by 16.9%, although still only represent 2.4% of the retailer’s total sales. There were ~1.2m visitors to JBH’s website each week in FY15. JBH has announced an on-market buy-back program worth ~$16m, purchasing as many as 0.8 million shares from September to December 2015. This capital management is a little lighter than what the market had expected, although it highlights JBH’s strong cashflow and balance sheet. A final dividend of 31.0c/share fully-franked was declared, payable to eligible investors on 11 September 2015. The ex-dividend date is 26 August. JBH currently has a 4.5% yield. Looking ahead to FY16, JBH plans to open 6 new stores, to convert 16 existing stores to JB Hi-Fi Home and for ~$3.85bn in sales. Sales growth in July was 7.6% above revenue from a year earlier. JBH shares surged following the result and are up more than 30% since 1 Jan 15. JBH is ~10% below all-time record highs.

- 18. 11 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec TRANSURBAN GROUP (TCL) RESULTS FY15 FY14 CHANGE Net Profit After Tax (NPAT)($m) (373) 252 -248% Underlying Profit After Tax ($m) 45 252 -82.1% Revenue ($m) 1,860 1,150 +61.7% Revenue Consensus ($m) 1,660 Proportional EBITDA ($m) 1,017 934 +13.1% Total Final Distribution ($) 0.205 0.18 +13.8% Final Distribution ($) Consensus 0.20 Transurban Group (TCL) reports FY loss due to acquisition of Transurban Queensland Toll road operator Transurban (TCL) has reported a full year net loss of $373 million. The loss was driven by the significant transaction and integration costs related to the acquisition of Transurban Queensland (TQ). Excluding these significant items, a lower statutory profit was influenced by higher depreciation and amortisation charges associated with the consolidation of Transurban Queensland, their US assets and the Cross City Tunnel. Revenue was underpinned by contributions from new assets including: TQ which generated $247million, The Cross City Tunnel which brought in $55 million, 95 Express Lanes generating $24 million and further growth in TCL’s existing assets of $118 million. TCL said it expects to deliver double digit growth in distributions again this year providing FY16 distribution guidance of 44.5 cents per share, which would be an increase of more than 11% compared to 2015. TCL had previously declared its final distribution of 20.5 cents per share bringing the full year payment to 40 cents per share. The record date for determining entitlements was 30 June 2015. The payment date is 14 August 2015.

- 19. 11 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec BRADKEN LIMITED (BKN) RESULTS FY15 FY14 CHANGE Sales ($m) 965.9 1,135.2 -15% Sales ($m) Consensus 958.6 Underlying EBITDA ($m) 136.1 173.3 -21% Underlying EBITDA ($m) Consensus 137.0 Unadjusted Net Loss after Tax ($m) -241.3 21.5 Underlying Net Loss after Tax ($) 33.9 55.1 -38% Final Dividend ($) Nil 0.26 Bradken (BKN) No surprises – full year loss and merger talks continue. Mining and engineering services firm Bradken (BKN) reported a net loss after tax of $241.3Million broadly in line with market expectations. There were no real surprises in today’s numbers as Bradken has been consistently updating the market over the last 6months with the details of its restructure costs, write-downs and possible takeover news. Bradken updated the market in late June by stating that they expected a FY15 underlying EDITDA of $136-$138Million and today posted $136.1Million in earnings. The result was impacted by restructuring and impairment costs while being boosted by one off property sales. Bradken’s sales fell by 14% to $965.9Million due to competition in rail wagon sales and the pullback in the mining sector, which impacted demand for BKN’s services and products. Bradken expects the rate of decline in the resources industry CAPEX to slow in the current financial year as the company has seen order intake trends improving. BKN said its restructuring is largely complete and its balance sheet has strengthened on the back of its $70Million Redeemable Convertible Preference Securities (RPS) to Sigdo Koppers and CHAMP. BKN said merger talks are continuing with the Sigdo’ Magotteaux Group - the current exclusivity period is set to expire on August 29. Bradken management agreed not to pay out a final dividend to shareholders in line with expectations.

- 20. 11 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec COCHLEAR LIMITED (COH) RESULTS FY15 FY14 CHANGE Sales ($m) 925.6 804.9 +15% Sales ($m) Consensus 937.1 EBIT ($m) 206.4 149.6 +38% Net Profit After Tax (NPAT) ($m) 145.8 93.7 +56% NPAT ($m) Consensus 156.8 Final Dividend ($) 1.00 1.27 -21% Final Dividend ($) Consensus 0.95 Cochlear Limited (COH) missed profit forecasts despite strong earnings growth Cochlear (COH) posted a weaker than expected $145.8m profit for the 12 months ended June 2015. Sales at the world’s largest maker of inner-ear hearing implants also fell short of consensus. The result was driven by favourable currency moves and a 3.2% rise in unit sales of its Cochlear implant systems. The Australian dollar’s depreciation against the greenback over the year boosted sales by $32.7m, as COH earned 83% of its sales offshore. Revenue in the Americas (its largest market) surged 26% on FY14 and accounted for 43% of sales. 40% of revenue was earned in Europe (second biggest market) and COH generated just 17% of income in Asia Pacific. Note that despite the 56% surge in earnings, the result came off a low base from a challenging 2014. Profits slid sharply by 29% in the prior year when regulators stalled the release of its Nuclear 6 implant – a device designed to automatically adjust to ambient noise. COH shares slumped following the weaker than anticipated result. Outgoing CEO Chris Roberts will be replaced by COH’s head of North America, Chris Smith at the end of August. COH declared a $1/s fully franked dividend, payable 1 Oct 15. Looking ahead, COH’s profit guidance for FY16 is for NPAT between $165m to $175m at FX rates of ~US$0.75. This represents between 13% and 20% growth in earnings.

- 21. 12 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec AGL ENERGY LIMITED (AGL) RESULTS FY15 FY14 CHANGE Sales ($m) 10,678 10,445 +2.2% Sales ($m) Consensus 10,380 EBITDA ($m) 1,505 1,330 +13.2% Underlying Profit ($m) 630 562 +12.1% Underlying Profit ($m) Consensus 585 Final Dividend ($) 0.34 0.33 EPS ($) 0.333 0.982 -66.1% AGL Energy (AGL) posts a 62% fall in statutory profit as expected AGL Energy (AGL) released a FY15 result that was at the top end of market guidance. AGL posted a 61.8% fall in statutory profit to $218M down from $570M. The company initially updated the market in July that it would declare a $435M write-down for the one off impairment cost related to its upstream gas assets. In their official result, AGL added the $117M costs associated with the Macquarie Generation acquisition resulting in total significant items of $578M. AGL had already told the market that it is in the process of restructuring its business to allow for it to cut down on operational costs and streamline its retail energy business. AGL has already said it is looking to sell off another ~$1B worth of underperforming assets by the end of FY16. It expects pre-tax restructuring costs of approximately $20M that will be recorded as significant items in FY16 and expects to see a reduction of $100M in real sustaining CAPEX by FY17. AGL posted a small lift in gross margin per customer account up to $198 from $187 the previous year even with a 1.7% slide in the number of AGL retail clients to 3.7Million. AGL will pay a final dividend of $0.34 p/share in September 2015. AGL said it will provide formal guidance of its FY16 earnings outlook at its Annual General Meeting (AGM) on 30 September 2015.

- 22. 12 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec OZ MINERALS LIMITED (OZL) RESULTS HY15 HY14 CHANGE Sales ($m) 390.1 351.0 +11.1% Sales ($m) Consensus 489.0 Net Profit After Tax NPAT ($m) 51.8 (7.4) NPAT ($m) Consensus 58.4 Earnings/(loss) Per Share (cents) 17.1 (2.4) Interim Dividend ($) 0.06 0.10 -40% Interim Dividend ($) Consensus 0.10 OZ Minerals Limited (OZL) returns to profitability despite softer copper prices OZ Minerals (OZL) posted a $51.8m profit for the 6 months ended June 2015. Despite the return to profitability its earnings, sales and dividend fell short of the market’s expectations. The South Australia based copper and gold miner’s result was driven by a 59% lift in copper production, together with improved operational efficiency and productivity at its Prominent Hill mine. Earnings were held back by recent copper price weakness (copper price slumped by ~20% over the half). More than three quarters of its revenue was generated from the sale of copper. Gold production fell to 57,664/oz over the half; contributing around $11m less to revenue than 12 months earlier. Lower waste movement has helped reduce mining expenditure over the half, while favourable currency fluctuations added $14m to underlying profit. $8m in restructuring costs (incl. employee redundancy expenses) held back the result slightly. An unfranked interim dividend of 6c/share was declared, payable 24 September and has a 2.8% yield. OZL shares are down on the result and are trading near five-month lows. The miner’s shares are still slightly outperforming the broader Australian market. Looking ahead, the company expects production to finish at the upper end of guidance with 110,000 to 120,000 tonnes of copper likely for 2015. It expects a ~4.5% fall in production over 2016 and 2017 and a more substantial fall in 2018.

- 23. 12 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec COMPUTERSHARE LIMITED (CPU) RESULTS FY15 FY14 CHANGE Net Profit After Tax (NPAT) ($m) 153.6 254.5 -39% Net Profit After Tax ($m) Consensus 156.17 Management NPAT 332.7 335.0 -0.7% Management EBITDA ($m) 554.1 540.6 +2.5% Revenue ($m) 1,971.25 2,015.11 -2.2% Final Dividend ($) 0.16 0.15 +6.7% Final Dividend ($) Consensus 0.15 Computershare Limited (CPU) write-downs and lower earnings forecasts weigh on CPU Computershare (CPU) has reported a full year statutory net profit after tax of $153.6 million, which represented a fall of 38.9% over the previous corresponding period. The fall was mainly a result of the non-cash impairment charge of $109.5 million which was booked against the value of the UK Voucher Services business. Earnings were also negatively impacted by the strengthening of the US dollar during FY2015 and the Group’s effective tax rate has increased from 21.8% for the year ended 30 June 2014 to 35.3% in the current financial year. At the same time maturing deposits which were reinvested at lower yields and a fall in the Canadian and Australian cash rates also impacted earnings. Other factors that weighed on the result included the loss of Serviceworks’ largest client and a major sub-servicing contract in the loan servicing business, the sale of Highlands Insurance LLC and increased regulatory costs, particularly in the US and the UK. In contrast corporate actions in Canada and Australia, improved results in Hong Kong and the Indian mutual funds business helped mitigate the weaker earnings outcomes. Cost management, synergies from previous acquisitions and lower financing costs were factors that favourably impacted full year earnings. Looking to the year ahead, CPU expects underlying business performance to be broadly similar to FY15, however, the impact of the stronger USD and the anticipated lower yields on client balances are again expected to create significant earnings headwinds. The business is also anticipating increased costs including those associated with investments in product development and efficiency initiatives. Taking these factors into account the Company expects Management EPS for FY16 to be around 7.5% lower than the previous year. A final dividend of 16 cents per share, franked to 25% was declared with a record date of 20 August 2015 and a payment date of 15 September 2015.

- 24. 13 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec TELSTRA CORPORATION LIMITED (TLS) RESULTS FY15 FY14 CHANGE Sales Revenue ($m) 25,845.0 25,119 +2.9% Sales Revenue ($m) Consensus 25,967.0 Net Profit After Tax (NPAT) ($m) 4,231.0 4,275.0 -1% NPAT ($m) Consensus 4,233.0 Earnings Per Share (c) 34.5 34.4 +0.3% Final Dividend ($) 0.155 0.15 +3.3% Final Dividend ($) Consensus 0.156 Telstra Corporation Limited (TLS) posts slight fall in profit as expected Telstra Corp (TLS) posted a 1% drop in profit to an in-line with consensus $4,231m over FY15. Australia’s largest telco’s revenue continues to be driven by its Mobile division. Profit was partly held back by the sale of its CSL Hong Kong mobile business in May 2014, which added $561m in profit from its sale in the FY14 result. Mobile continues to be its biggest earner, accounting for 41% of sales. New mobile client subscribers rose 298k to 16.7m over the year (7.2m above Optus and 11.4m more than Vodafone). TLS is expected to raise spending in its Mobile business by an additional $500m over FY16. The strongest growth in revenue was in its NAS (Network Application & Services) division, which contributed $2.4bn to sales and surged 23.2% over the year. Despite the unit’s solid growth it only accounted for 9% of total revenue. NAS’ jump in revenue has easily offset its decreasingly popular Fixed line unit. NAS provides network services for both corporate and government customers domestically and internationally. Foxtel from Telstra (previously Premium Pay TV) revenue rose 9.4% to $662m. The result was boosted by close to 20% growth in subscribers and competitive pricing (Foxtel’s basic package pricing was almost halved in late 2014). Streaming services like Netflix are estimated to have as many as 800k subscribers in Australia. The merger of iiNet & TPG could add further competition in the broadband space. A 15.5c/share fully franked dividend was announced, payable to investors on 25 Sept. A Dividend Reinvestment Plan has been introduced by TLS for this payment. TLS has a ~4.9% yield. Although TLS undertook a successful $1bn buyback in 2015, no additional capital controls were announced. Looking ahead, TLS’s FY16 guidance was slightly disappointing to the market - forecasting low-single digit growth in underlying profit. TLS shares fell in response to the result; however has surged in recent years partly thanks to its dividend payments. TLS shares have more than doubled in value over the past five years.

- 25. 13 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec TABCORP HOLDINGS LTD (TAH) RESULTS FY15 FY14 CHANGE Net Profit After Tax (NPAT) ($m) 334.5 129.9 +158% Net Profit After Tax ($m) Consensus 330.3 Underlying Net Profit After Tax ($m) 171.3 149.4 +14.7% Total Revenue ($m) 2,155.5 2,039.8 +6% Total Revenue ($m) Consensus 2,143.0 EBIT ($m) 334.6 321.7 +4% Final Dividend ($) 0.10 Tabcorp Holdings Limited (TAH) full year profit jumps by almost 15% Tabcorp (TAH) has reported Net Profit After Tax (NPAT) for the financial year of $334.5 million, which was 157.5% above the previous financial year. The result was bolstered by tax benefits relating to licence payments in Victoria and Trackside product in NSW. The impact of the former was a benefit of $128.9 million, and a $120 million benefit associated with the latter. In addition to interest income, the benefits totalled $163.2 million. NPAT from continuing operations for the financial year excluding these income tax benefits and related interest was $171.3 million, which was 14.7% above the previous financial year. Total revenue was $2,155.5 million, which was 5.7% above the previous financial year. TAH’s operations are comprised of three businesses: Wagering and Media, Gaming Services, and Keno. Wagering and Media was the stand out performer with revenues in the period rising to $1,856.9 million, an increase of 6.9%. Operating expenses, including one-off ACTTAB acquisition and integration costs, were $381.7 million, up 6.8%. EBITDA was $375.8 million, up 7.2%. Gaming Service revenues edged higher to $99.6 million, up 1.5%. Operating expenses were flat at $31.2 million, while EBITDA was $67.6 million, up 0.9%. Keno revenues were $199.0 million, down 2.4%, impacted by jackpot activity. Operating expenses were $44 million, up 6.8% and EBITDA was $66.4 million, down 8.0%. TAH declared a final dividend of 10 cents per share. This dividend will be fully franked and payable on 24 September 2015 to shareholders registered by 20 August 2015. The ex-dividend date is 18 August 2015.

- 26. 13 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec GOODMAN GROUP (GMG) RESULTS FY15 FY14 CHANGE Revenue ($m) 2,356.6 1,679.0 +40.4% Operating profit ($m) 653.5 601.1 +8.7% Operating profit ($m) Consensus 651.2 Statutory profit ($m) 1,208.0 657.3 +83.8% Earnings Per Shares (EPS) (c) 37.2 34.8 +6.9% Final Distribution (c) 11.1 10.35 +7.2% Final Distribution (c) Consensus 11.1 Goodman Group (GMG) profit surges thanks to property revaluations Goodman Group (GMG) has posted an 84% surge in annual profit to $1,208m – driven most by $710m of favourable asset revaluations. The global property group’s operating profit (which strips out revaluations and one-offs) was $653.5m; a more modest 8.7% rise and in-line with consensus. GMG enjoyed slightly higher profits across its three business units – Investment, Development and Management. More than half its earnings were generated from Investment, 35% from Development and 17% from Fund Management. GMG is continuing progress with its ‘urban renewal strategy’ – essentially working on rezoning its industrial property portfolio and selling to residential property developers - with more than 35,000 apartments in the pipeline domestically. Its Management unit posted a 7% rise in earnings to $125.2m with AUM (Assets Under Management) rising by 12.5% to $25.2bn. As far as the Development business is concerned, GMG posted a 19% rise in ‘work in progress’ to $3.1bn. An 11.1c/share final distribution was previously declared, payable to investors on 26 August. The ex-dividend date was on 26 June, meaning investors purchasing shares today are no longer eligible to receive the final distribution. Looking ahead, GMG said it’s expecting earnings growth of 6% in FY16, while further reducing debt. GMG shares rose following the result and are outperforming the broader Australian market.

- 27. 13 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec MIRVAC GROUP (MGR) RESULTS FY15 FY14 CHANGE Total revenue ($m) 2,151.9 1,974.2 +9% Total revenue ($m) Consensus 2,150.0 Profit ($m) 609.9 447.3 +36% Operating profit ($m) 454.8 437.8 +4% Funds from operations ($m) 468.2 448.1 +4% Dividends (distributions) ($) 0.049 0.046 +6.5% Operational EPS ($) 0.123 Mirvac Group (MGR) reaps rewards through strong housing market Mirvac Group’s (MGR) 2015 full year result came in at the top end of the company and market’s guidance. Strong demand in residential and commercial property boosted the result. Positive returns and increased valuations of newly purchased assets also allowed Mirvac’s operating profit to beat market expectations. Development profit margins lifted to 10.7% from 8.6%. MGR is targeting 12% development return on invested capital (ROIC) by FY17 after posting 11.1% in FY15. Mirvac listed a 23.6% improved residential gross margins. Mirvac’s Net income increased by 36% to $609.9million, with the value of all properties on its books totalling $172.1Million. Mirvac’s occupancy in its investment portfolio is now just below 97%, with an average lease expiry of 4.5 years. Today Mirvac said it is looking into the possible acquisition of the Investa Office Management Platform, alongside part ownership of Investa Commercial Property Fund, Investa Property Trust and Investa Office Fund. Mirvac announced it is expecting FY16 operational profit of between $470- $482Million. This is slightly below market guidance, with earnings per share (EPS) to normalise back to $0.127- $0.13. Mirvac will pay a distribution to shareholders of $0.49 a share on 26 August 2015

- 28. 17 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec NEWCREST MINING LIMITED (NCM) RESULTS FY15 FY14 CHANGE Net Profit After Tax (NPAT) ($m) 546 -2,221 Underlying NPAT ($m) 515 432 +19% Underlying NPAT ($m) Consensus 481.6 EBITDA ($m) 1,673 1,514 +11% Revenue ($m) 4,344 4,040 +8% Gearing (%) 29.3 33.8 -13% Final Dividend ($) 0.0 0.0 Newcrest Mining Limited (NCM) – No dividend as gold miner returns to profit Australia's largest gold miner Newcrest Mining (NCM) returned to profitability in 2015 after write-downs dominated the performance of the group in 2014. NCM reported a Statutory Net Profit After Tax (NPAT) of $546 million compared to a loss of $2.2 billion in the previous corresponding period. Increased production and lower costs were a feature of the 2015 result. Excluding one off items, underlying profit rose 19% to $515 million - an increase of $83 million reflecting the contribution of the higher production from Cadia East which enjoys larger margins and the net benefit on revenue of a lower Aussie dollar against the US dollar. A total of 82% of Newcrest’s sales revenue continues to be attributable to gold. Gold revenue of $3,555 million was 6% higher than the previous corresponding period largely due to a 5% increase in the average realised AUD gold price. NCM’s All-in Sustaining Cost (AISC) of $941 per ounce sold in the current period was 4% lower than the corresponding period, reflecting lower costs of extraction in addition to higher by-product revenue associated with higher copper sales volume. This was partially offset by the 9% deterioration in the average Australian Dollar against the corresponding period (which Increased USD-denominated costs). The ASIC of $US789 per ounce sold was 12% lower than in the corresponding period. In the outlook for 2016 NCM expects group gold production to be in the range of 2.4 to 2.6 million ounces; copper production is expected to be in the range of 80 to 90 thousand tonnes. Total capital expenditure is expected to be in the range of $700 to $825 million, while total exploration expenditure is expected to be in the range of $60 to $70 million.

- 29. 17 August 2015 PROFIT REPORTING SEASON Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec CHARTER HALL RETAIL REIT (CQR) RESULTS FY15 FY14 CHANGE Revenue ($m) 201.2 184.5 +9.1% Operating earnings ($m) 110.8 105.3 +5.2% Operating earnings ($m) consensus 141.0 Operating earnings per unit (c) 29.7 29.6 +0.3% Statutory profit ($m) 162.5 85.2 +90.7% Final Distribution (c) 13.8 13.65 +1.1% Full Year Distribution (c) 27.5 27.3 +0.7% Charter Hall Retail REIT (CQR) profit boosted by favourable property valuations Charter Hall Retail (CQR) posted a weaker than expected 5.2% rise in operating earnings to $110.8m for the year ended June 30. The 90.7% surge in its statutory profit was driven by $66.8m in favourable property valuations and a 9% rise in gross rental income. CQR is heavily focused on supermarkets and the non-discretionary part of the retail market, particularly in rural areas. CQR generates more than half of its annual base rent from leasing properties to Woolworths and Wesfarmers subsidiaries. Over the year, two supermarket anchored shopping centres were purchased for $97.1m in QLD and SA at an average yield of 7.2%. Two major redevelopments were completed in VIC and QLD while six non-core retail properties were sold for $37.6m. The property group entered a trading halt ahead of a capital raising announcement this morning. The REIT (Real Estate Investment Trust) aims to raise $50m via an institutional placement to help purchase two shopping centres worth $94.9m. The first is the Goulburn Plaza centre in NSW, with Coles and Kmart as anchor tenants. The second is Katherine Central in NT, which has Woolworths and Target Country as major tenants. A 13.8c/unit distribution has already been declared, payable to eligible investors on 31 August. The ex-dividend date was 26 June. Looking ahead, CQR said it expects FY16 operating earnings between 30.25c and 30.75 cents per unit; a 1.8% to 3.5% improvement on FY15. CQR shares are in a halt today, however are up by only ~1% so far this calendar year.