INCOME PAYMENT SUBJECT TO CREDITABLE WITHHOLDING TAX.docx

•Download as DOCX, PDF•

0 likes•29 views

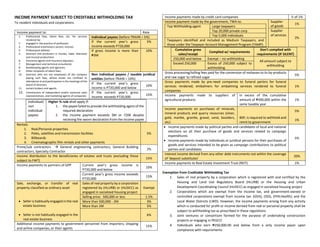

This document outlines creditable withholding tax rates that apply to various types of income payments in the Philippines. It provides withholding tax rates for professional fees, talent fees, rentals, contractors, income distributions, partnership income, real estate sales, additional government personnel income, credit card payments, supplier payments, interest income, and REIT income. It also lists some exemptions from creditable withholding tax, such as socialized housing projects, certain non-profit corporations, joint construction ventures, and low-income individuals. The withholding tax rates range from 1% to 15% depending on the type of income and amount.

Report

Share

Report

Share

Recommended

Recommended

Income tax and other related financial information 2019-20 INDIA uploaded by T james joseph AdhikarathilIncome tax and other related financial information 2019-20 INDIA uploaded by ...

Income tax and other related financial information 2019-20 INDIA uploaded by ...Jamesadhikaram land matter consultancy 9447464502

More Related Content

Similar to INCOME PAYMENT SUBJECT TO CREDITABLE WITHHOLDING TAX.docx

Income tax and other related financial information 2019-20 INDIA uploaded by T james joseph AdhikarathilIncome tax and other related financial information 2019-20 INDIA uploaded by ...

Income tax and other related financial information 2019-20 INDIA uploaded by ...Jamesadhikaram land matter consultancy 9447464502

Similar to INCOME PAYMENT SUBJECT TO CREDITABLE WITHHOLDING TAX.docx (20)

Taxing powers, scope and limitations of nga and lgu

Taxing powers, scope and limitations of nga and lgu

Income tax and other related financial information 2019-20 INDIA uploaded by ...

Income tax and other related financial information 2019-20 INDIA uploaded by ...

Nepal Budget Synopsis FY 2074 75 (FY 2017-18) BRSA-ELITE

Nepal Budget Synopsis FY 2074 75 (FY 2017-18) BRSA-ELITE

TDS (Tax Deducted at Source ) rates Charts FYI 2023-2024 .pdf

TDS (Tax Deducted at Source ) rates Charts FYI 2023-2024 .pdf

FEMA regulations on Inward & Outward Investment - overview

FEMA regulations on Inward & Outward Investment - overview

Business rules and regulations for investment in Vietnam, Cambodia, Myanmar, ...

Business rules and regulations for investment in Vietnam, Cambodia, Myanmar, ...

More from ChelseaAnneVidallo

More from ChelseaAnneVidallo (14)

Chapter 12 - International Trade Practices and Policies.pptx

Chapter 12 - International Trade Practices and Policies.pptx

Chapter 3 - An Introduction to Demand and Supply.ppt

Chapter 3 - An Introduction to Demand and Supply.ppt

Chapter 2 - The Circular Flow of Economic Activity.pptx

Chapter 2 - The Circular Flow of Economic Activity.pptx

Recently uploaded

Hosted by GIZ, this Expert Exchange presented a new assessment tool for just energy transition plans.Sustainability by Design: Assessment Tool for Just Energy Transition Plans

Sustainability by Design: Assessment Tool for Just Energy Transition PlansJust Energy Transition in Coal Regions Knowledge Hub

Top Rated Pune Call Girls Dapodi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Dapodi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

Top Rated Pune Call Girls Dapodi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...Call Girls in Nagpur High Profile

Top Rated Pune Call Girls Bhosari ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Bhosari ⟟ 6297143586 ⟟ Call Me For Genuine Sex Ser...

Top Rated Pune Call Girls Bhosari ⟟ 6297143586 ⟟ Call Me For Genuine Sex Ser...Call Girls in Nagpur High Profile

Recently uploaded (20)

WORLD DEVELOPMENT REPORT 2024 - Economic Growth in Middle-Income Countries.

WORLD DEVELOPMENT REPORT 2024 - Economic Growth in Middle-Income Countries.

PPT BIJNOR COUNTING Counting of Votes on ETPBs (FOR SERVICE ELECTORS

PPT BIJNOR COUNTING Counting of Votes on ETPBs (FOR SERVICE ELECTORS

VIP Model Call Girls Shikrapur ( Pune ) Call ON 8005736733 Starting From 5K t...

VIP Model Call Girls Shikrapur ( Pune ) Call ON 8005736733 Starting From 5K t...

best call girls in Pune - 450+ Call Girl Cash Payment 8005736733 Neha Thakur

best call girls in Pune - 450+ Call Girl Cash Payment 8005736733 Neha Thakur

Sustainability by Design: Assessment Tool for Just Energy Transition Plans

Sustainability by Design: Assessment Tool for Just Energy Transition Plans

An Atoll Futures Research Institute? Presentation for CANCC

An Atoll Futures Research Institute? Presentation for CANCC

Top Rated Pune Call Girls Dapodi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

Top Rated Pune Call Girls Dapodi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

Top Rated Pune Call Girls Bhosari ⟟ 6297143586 ⟟ Call Me For Genuine Sex Ser...

Top Rated Pune Call Girls Bhosari ⟟ 6297143586 ⟟ Call Me For Genuine Sex Ser...

Akurdi ( Call Girls ) Pune 6297143586 Hot Model With Sexy Bhabi Ready For S...

Akurdi ( Call Girls ) Pune 6297143586 Hot Model With Sexy Bhabi Ready For S...

VIP Model Call Girls Narhe ( Pune ) Call ON 8005736733 Starting From 5K to 25...

VIP Model Call Girls Narhe ( Pune ) Call ON 8005736733 Starting From 5K to 25...

The U.S. Budget and Economic Outlook (Presentation)

The U.S. Budget and Economic Outlook (Presentation)

2024: The FAR, Federal Acquisition Regulations, Part 30

2024: The FAR, Federal Acquisition Regulations, Part 30

Get Premium Budhwar Peth Call Girls (8005736733) 24x7 Rate 15999 with A/c Roo...

Get Premium Budhwar Peth Call Girls (8005736733) 24x7 Rate 15999 with A/c Roo...

Scaling up coastal adaptation in Maldives through the NAP process

Scaling up coastal adaptation in Maldives through the NAP process

Antisemitism Awareness Act: pénaliser la critique de l'Etat d'Israël

Antisemitism Awareness Act: pénaliser la critique de l'Etat d'Israël

INCOME PAYMENT SUBJECT TO CREDITABLE WITHHOLDING TAX.docx

- 1. INCOME PAYMENT SUBJECT TO CREDITABLE WITHHOLDING TAX To resident individuals and corporations Income payment to: Rate 1. Professional fees, talent fees, etc. for services rendered by: 2. engaged in the practice of profession 3. Professional entertainers (actors, emcees 4. Professional athletes 5. directors and producers in movies, radio, television and musical productions 6. Insurance agents and insurance adjusters 7. Management and technical consultants; 8. Bookkeeping agents and agencies; 9. Other recipients of talent fees; 10. directors who are not employees of the company paying such fees, whose duties are confined to attendance at and participation in the meetings of the board of directors 11. certain brokers and agents 12. Commissions of independent and/or exclusive sales representatives, and marketing agents of companies Individual payees (before TRAIIN = 5%) If the current year’s gross income exceeds P720,000 5% If gross income is more than ₱3M 10% Non individual payees / taxable juridical entities (before TRAIN = 10%) If the current year’s gross income is P720,000 and below 10% If the current year’s gross income exceeds P720,000 15% Individual/ non individual payees Higher % rule shall apply if: 1. the payee failed to provide the withholding agent of the required declaration 2. the income payment exceeds 3M or 720K despite receiving the sworn declaration from the income payee Rentals 1. Real/Personal properties 2. Poles, satellites and transmission facilities 3. Billboards 4. Cinematographic film rentals and other payments 5% Prime/sub contractors General engineering contractors, General Building contractors, Specialty Contractor 2% Income distribution to the beneficiaries of estates and trusts (excluding those subject to FWT) 15% Income payments to partners of GPP Current year’s gross income is P720,000 and below 10% Current year’s gross income exceeds P720,000 15% Sale, exchange, or transfer of real property classified as ordinary asset Seller is habitually engaged in the real estate business Seller is not habitually engaged in the real estate business Sales of real property by a corporation registered by (HLURB) or (HUDCC) as engaged in socialized housing project Exempt Selling price: 500,000 or less 1.5% More than 500,000 - 2M 3% More than 2M 5% 6% Additional income payments to government personnel from importers, shipping and airline companies, or their agents 15% Income payments made by credit card companies ½ of 1% Income payment made by the government, TWA to: Top Withholding agent Large taxpayers Top 20,000 private corp Top 5,000 individuals Taxpayers identified and included as Medium Taxpayers, and those under the Taxpayer Account Management Program (TAMP). Supplier of goods 1% Supplier of services 2% Cumulative gross sales/receipt Complied w/ requirements Don’t complied with requirements (IF SILENT) 250,000 and below Exempt – no withholding All amount subject to withholding Exceed 250,000 Excess of 250,000 subject to withholding Gross processing/tolling fees paid for the conversion of molasses to its by-products and raw sugar to refined sugar 5% Gross payments made by pre-need companies to funeral parlors for funeral services rendered; embalmers for embalming services rendered to funeral companies 1% Income payments made to suppliers of agricultural products in excess of the cumulative amount of ₱300,000 within the same taxable year 1% Income payments on purchases of minerals, mineral products and quarry resources (silver, gold, marble, granite, gravel, sand, boulders, etc) BSP, is required to withhold and remit to government 5% 1% Income payments made by political parties and candidates of local and national elections on all their purchase of goods and services related to campaign expenditures Income payments made by individuals or juridical persons for their purchases of goods and services intended to be given as campaign contributions to political parties and candidates 5% Interest income derived from any other debt instruments not within the coverage of ‘deposit substitutes’ 20% Income payments to Real Estate Investment Trust (REIT) 1% Exemption from Creditable Withholding Tax 1. Sales of real property by a corporation which is registered with and certified by the Housing and Land Use Regulatory Board (HLURB) or the Housing and Urban Development Coordinating Council (HUDCC) as engaged in socialized housing project 2. Corporations which are exempt from the income tax, and government-owned or controlled corporations exempt from income tax: (GSIS), (SSS), (PHILHealth); and the Local Water Districts (LWD). However, the income payments arising from any activity which is conducted for profit or income derived from real or personal property shall be subject to withholding tax as prescribed in these regulations 3. Joint ventures or consortium formed for the purpose of undertaking construction projects or engaging in PEGCO 4. Individuals who earn ₱250,000.00 and below from a only income payor upon compliance with requirements