Rama Ltd Plant Initial Cost Calculation Case Study

•

1 like•931 views

Report

Share

Report

Share

Download to read offline

More Related Content

Viewers also liked

Viewers also liked (20)

Case study on recognition of assets and liabilities 1

Case study on recognition of assets and liabilities 1

Similar to Rama Ltd Plant Initial Cost Calculation Case Study

Similar to Rama Ltd Plant Initial Cost Calculation Case Study (20)

More from Hyderabad Chapter of ICWAI

More from Hyderabad Chapter of ICWAI (14)

Recently uploaded

Recently uploaded (20)

Cash Payment 9602870969 Escort Service in Udaipur Call Girls

Cash Payment 9602870969 Escort Service in Udaipur Call Girls

Creating Low-Code Loan Applications using the Trisotech Mortgage Feature Set

Creating Low-Code Loan Applications using the Trisotech Mortgage Feature Set

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

Regression analysis: Simple Linear Regression Multiple Linear Regression

Regression analysis: Simple Linear Regression Multiple Linear Regression

Russian Faridabad Call Girls(Badarpur) : ☎ 8168257667, @4999

Russian Faridabad Call Girls(Badarpur) : ☎ 8168257667, @4999

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Keppel Ltd. 1Q 2024 Business Update Presentation Slides

Keppel Ltd. 1Q 2024 Business Update Presentation Slides

Tech Startup Growth Hacking 101 - Basics on Growth Marketing

Tech Startup Growth Hacking 101 - Basics on Growth Marketing

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

VIP Call Girls In Saharaganj ( Lucknow ) 🔝 8923113531 🔝 Cash Payment (COD) 👒

VIP Call Girls In Saharaganj ( Lucknow ) 🔝 8923113531 🔝 Cash Payment (COD) 👒

Ensure the security of your HCL environment by applying the Zero Trust princi...

Ensure the security of your HCL environment by applying the Zero Trust princi...

VIP Kolkata Call Girl Howrah 👉 8250192130 Available With Room

VIP Kolkata Call Girl Howrah 👉 8250192130 Available With Room

Grateful 7 speech thanking everyone that has helped.pdf

Grateful 7 speech thanking everyone that has helped.pdf

Rama Ltd Plant Initial Cost Calculation Case Study

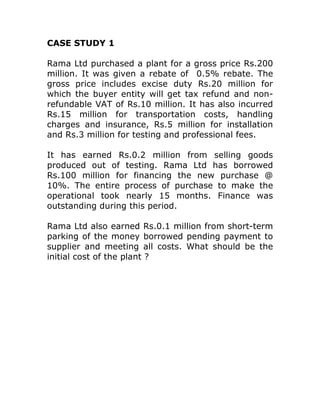

- 1. CASE STUDY 1 Rama Ltd purchased a plant for a gross price Rs.200 million. It was given a rebate of 0.5% rebate. The gross price includes excise duty Rs.20 million for which the buyer entity will get tax refund and non- refundable VAT of Rs.10 million. It has also incurred Rs.15 million for transportation costs, handling charges and insurance, Rs.5 million for installation and Rs.3 million for testing and professional fees. It has earned Rs.0.2 million from selling goods produced out of testing. Rama Ltd has borrowed Rs.100 million for financing the new purchase @ 10%. The entire process of purchase to make the operational took nearly 15 months. Finance was outstanding during this period. Rama Ltd also earned Rs.0.1 million from short-term parking of the money borrowed pending payment to supplier and meeting all costs. What should be the initial cost of the plant ?