More Related Content

Similar to Intnl Construction Loan - 8-13

Similar to Intnl Construction Loan - 8-13 (20)

Intnl Construction Loan - 8-13

- 1. © Sterling Commercial Capital, Aug 2013. Subject to Change Without Notice

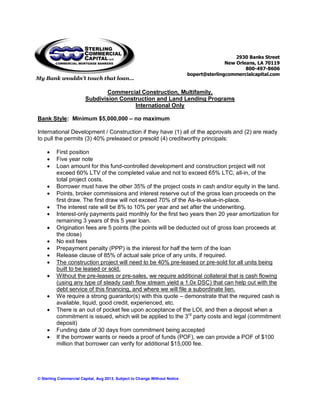

My Bank wouldn’t touch that loan…

2930 Banks Street

New Orleans, LA 70119

800-497-8606

bopert@sterlingcommercialcapital.com

Commercial Construction, Multifamily,

Subdivision Construction and Land Lending Programs

International Only

Bank Style: Minimum $5,000,000 – no maximum

International Development / Construction if they have (1) all of the approvals and (2) are ready

to pull the permits (3) 40% preleased or presold (4) creditworthy principals:

First position

Five year note

Loan amount for this fund-controlled development and construction project will not

exceed 60% LTV of the completed value and not to exceed 65% LTC, all-in, of the

total project costs.

Borrower must have the other 35% of the project costs in cash and/or equity in the land.

Points, broker commissions and interest reserve out of the gross loan proceeds on the

first draw. The first draw will not exceed 70% of the As-Is-value-in-place.

The interest rate will be 8% to 10% per year and set after the underwriting.

Interest-only payments paid monthly for the first two years then 20 year amortization for

remaining 3 years of this 5 year loan.

Origination fees are 5 points (the points will be deducted out of gross loan proceeds at

the close)

No exit fees

Prepayment penalty (PPP) is the interest for half the term of the loan

Release clause of 85% of actual sale price of any units, if required.

The construction project will need to be 40% pre-leased or pre-sold for all units being

built to be leased or sold.

Without the pre-leases or pre-sales, we require additional collateral that is cash flowing

(using any type of steady cash flow stream yield a 1.0x DSC) that can help out with the

debt service of this financing, and where we will file a subordinate lien.

We require a strong guarantor(s) with this quote – demonstrate that the required cash is

available, liquid, good credit, experienced, etc.

There is an out of pocket fee upon acceptance of the LOI, and then a deposit when a

commitment is issued, which will be applied to the 3rd

party costs and legal (commitment

deposit)

Funding date of 30 days from commitment being accepted

If the borrower wants or needs a proof of funds (POF), we can provide a POF of $100

million that borrower can verify for additional $15,000 fee.

- 2. © Sterling Commercial Capital, Aug 2013. Subject to Change Without Notice

Private Money: Minimum $5,000,000 – no maximum

A. Requires (1) all of the approvals (2) are ready to pull the permits, (3) no pre-

sales/leases required – maximum 60% LTV:

First position.

One year or two year Note

Loan amount for this fund-controlled development and construction project will not to

exceed 60% LTV of the projected completed value.

Points, broker fees and commissions and the interest reserve paid out of the gross loan

proceeds on the first draw.

With this quote we will not make any lien pay downs or pay offs.

Liens may remain but in a subordinate position.

No cash out and No acquisition money – funds used for construction costs only

The interest rate will be 15% to 18% per year and set after the underwriting.

Interest only payments paid monthly.

Origination fee 12 points (the points will be deducted out of gross loan proceeds at the

close)

Prepayment penalty (PPP) is six months of interest payments.

Release clause of 85% of sale price for units sold as needed

There is an out of pocket fee upon acceptance of the LOI, and then a deposit when a

commitment is issued, which will be applied to the 3rd

party costs and legal (commitment

deposit)

If the borrower wants or needs a proof of funds (POF) we can provide a POF of $100

million that borrower can verify for additional $15,000.

B. Requires (1) all of the approvals (2) are ready to pull the permits; (3) no

presales/preleasing required – maximum 60% LTC.

First position ...

One year to two year note,

Loan amount for this fund controlled development and construction project will not to

exceed 60% LTV of the completed value and not to exceed 60% LTC all-in.

Borrower must have the other 40% of the total project costs

Points and the interest reserve paid out of the gross loan proceeds on the first draw

The first draw will not exceed 60% LTV of the As-Is value

The interest rate will be 15% to 18% per year and set after the underwriting.

Interest only payments paid monthly …

The costs is 12 points gross (the points will be deducted out of gross loan proceeds at

the close)

Prepayment penalty (PPP) is six months of interest payments for six months ...

Release clause of 85% of sale price if needed …

Out of Pocket fee upon the LOI a funding date of 30 days from the LOI being accepted .

If the borrower wants or needs a proof of funds (POF) we can provide a POF of $100

million that borrower can verify for additional $15,000.

- 3. © Sterling Commercial Capital, Aug 2013. Subject to Change Without Notice

C. Requires (1) do or do not have all of the approvals (2) if they are ready or not

ready to pull the permits - 60% LTC/LTV

First position

Two year note

Not to exceed 60% LTV As-Is market value, or not to exceed 60% LTC of the total

project costs (with this quote the “As-Is” market value is what the collateral can sell for

after marketing the collateral for up to six months)

The interest rate will be 15% to 18% per year and set after the underwriting ...

Interest only payments paid monthly

Any needed interest reserve will be deducted out of the gross loan proceeds at the

close

The origination fee is 12 points (the points will be deducted out of gross loan proceeds

at closing)

Prepayment penalty (PPP) is six months of interest payments.

Out of pocket fees due upon acceptance of the LOI, and then when a commitment is

issued, a commitment fee will be due and applied to the 3rd party and legal

costs (commitment fee)

Funding date of 30 days from commitment being accepted

If the borrower wants or needs a proof of funds ( POF ) we can provide a POF of $100

million that borrower can verify for additional $15,000.00 ...

Private Money and Great Credit $1 million to $3 million maximum loan - 80%-100% LTC

Three ( 3 ) to five (5) strong U.S. Guarantors required with 700 or better FICO scores

First position or 2nd position

$1,000,000 minimum loan and $3,000,000 maximum loan

With 3 Guarantors, loan not to exceed 75% LTV of the completed value and not to

exceed 80% LTC all-in of the total project costs

With five ( 5 ) Guarantors loan of 100% LTC or 80% LTV gross

For a land only loan, not to exceed 60% LTV of the As-Is value

9% to 12% interest per year and set after the underwriting,

4 points total

20 year amortization

Loan matures in 10 years

Interest only payments year one, amortizes beginning year 2.

Prepayment penalty (PPP) is 5% for five yrs.

Release clause of 85% of sale price

Out of pocket fees due upon acceptance of the LOI, and then when a commitment is

issued, a commitment fee will be due and applied to the 3rd party and legal

costs (commitment fee)

Funding date of 30 days after the LOI being accepted

Escrow:

Any requirement to escrow the commitment deposit with a law firm, instead of with Sterling, the

costs will be higher. They must use our attorneys (http://www.bakerlaw.com ). If they require the

law firm to escrow, then a retainer of $5,000 is required so our attorney can bill against this

deposit to draw up escrow instructions/contract, and they bill at $730.00 per hour.