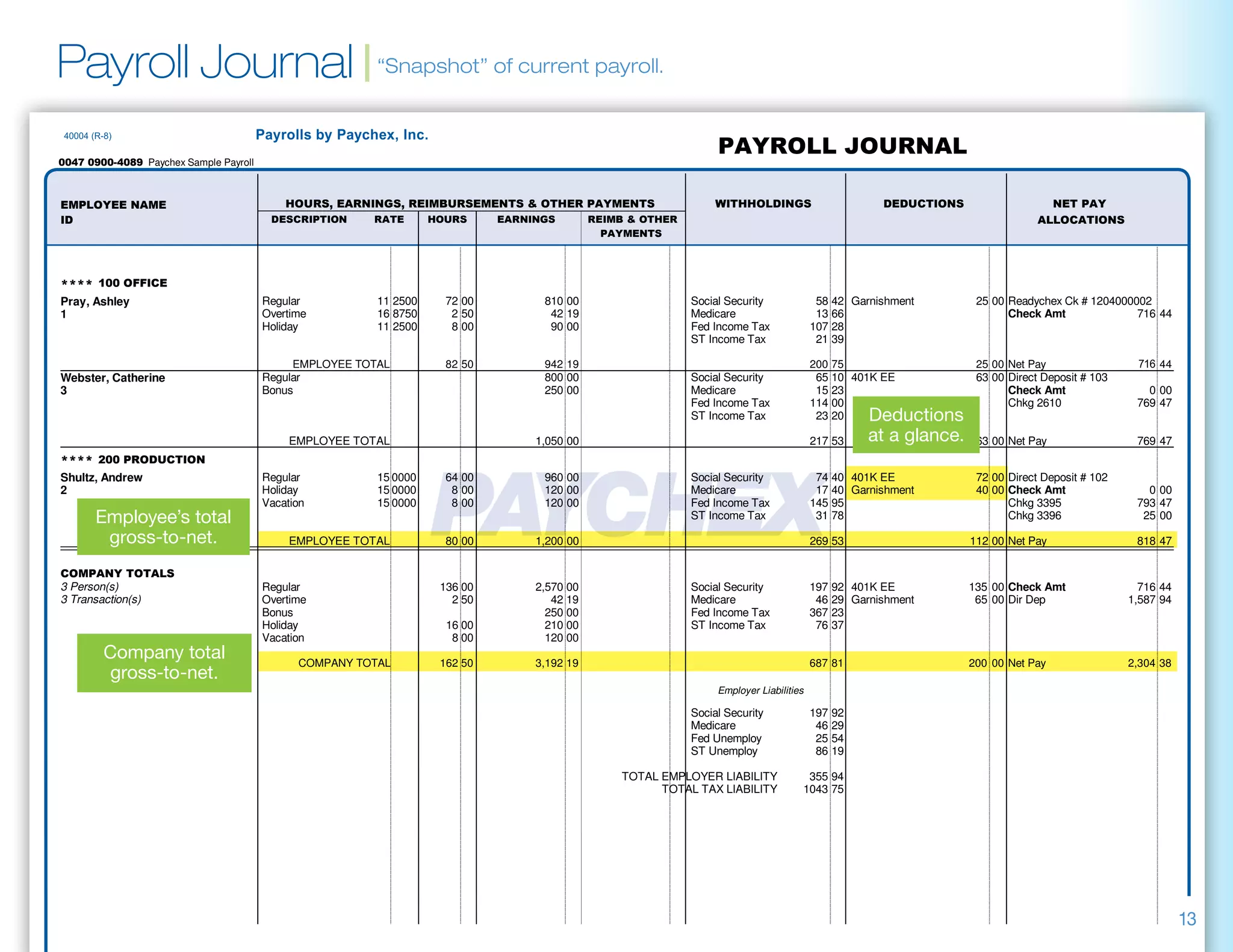

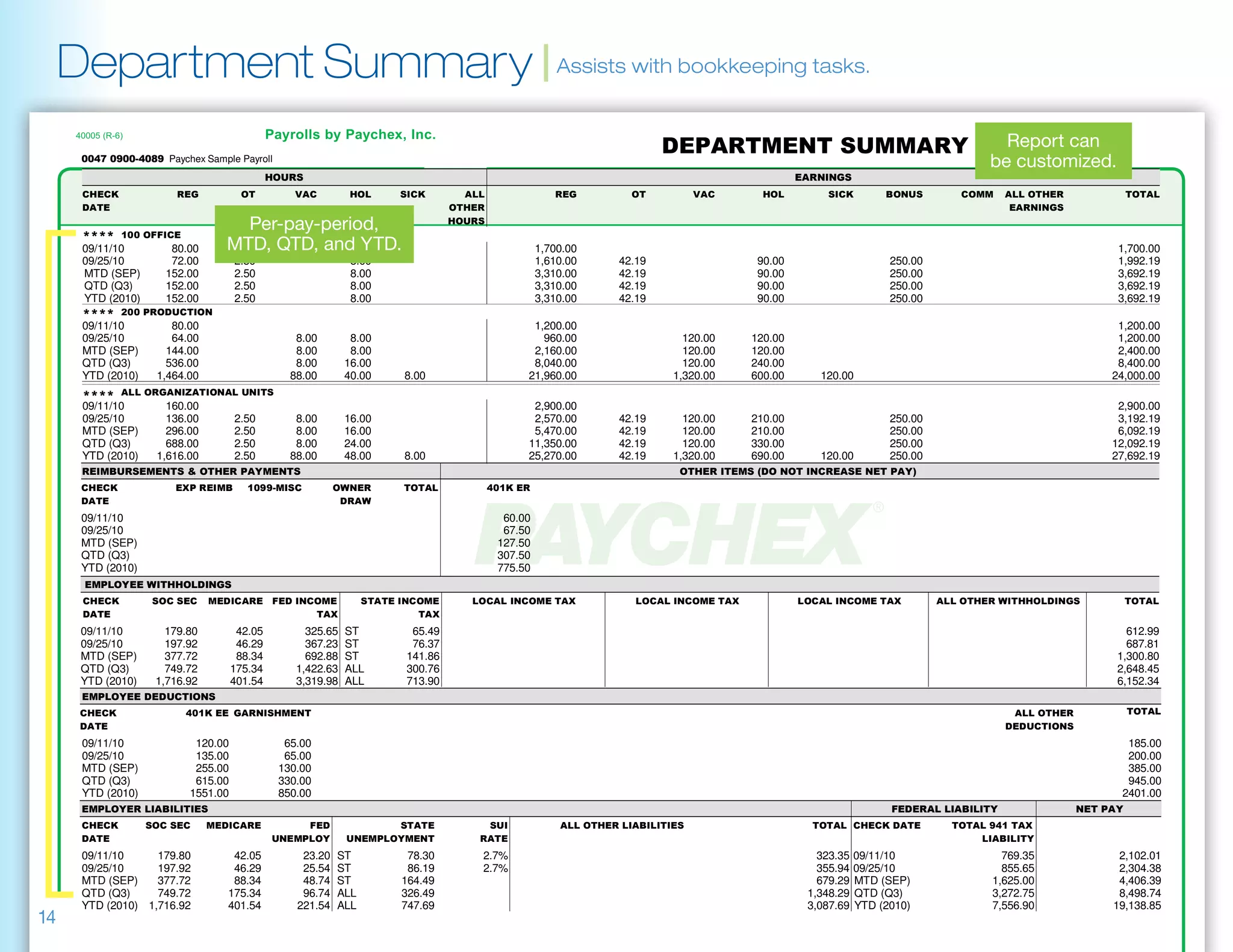

This payroll journal provides a summary of payroll information for 3 employees. It shows each employee's earnings including regular pay, overtime, bonuses, and deductions such as taxes and 401k contributions. Totals are given for each category including the company totals. The journal acts as a "snapshot" to review the current payroll processing and payments.