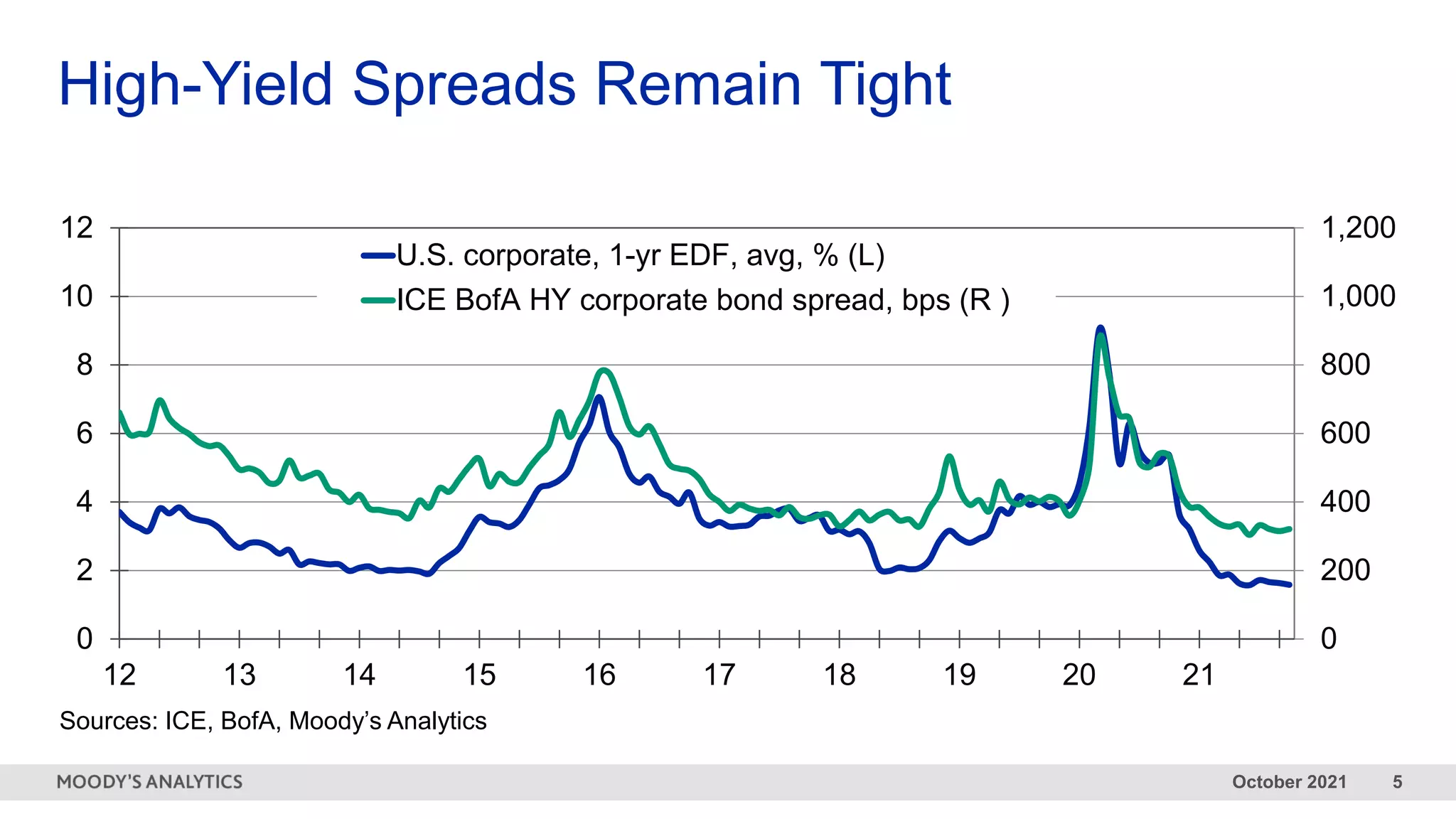

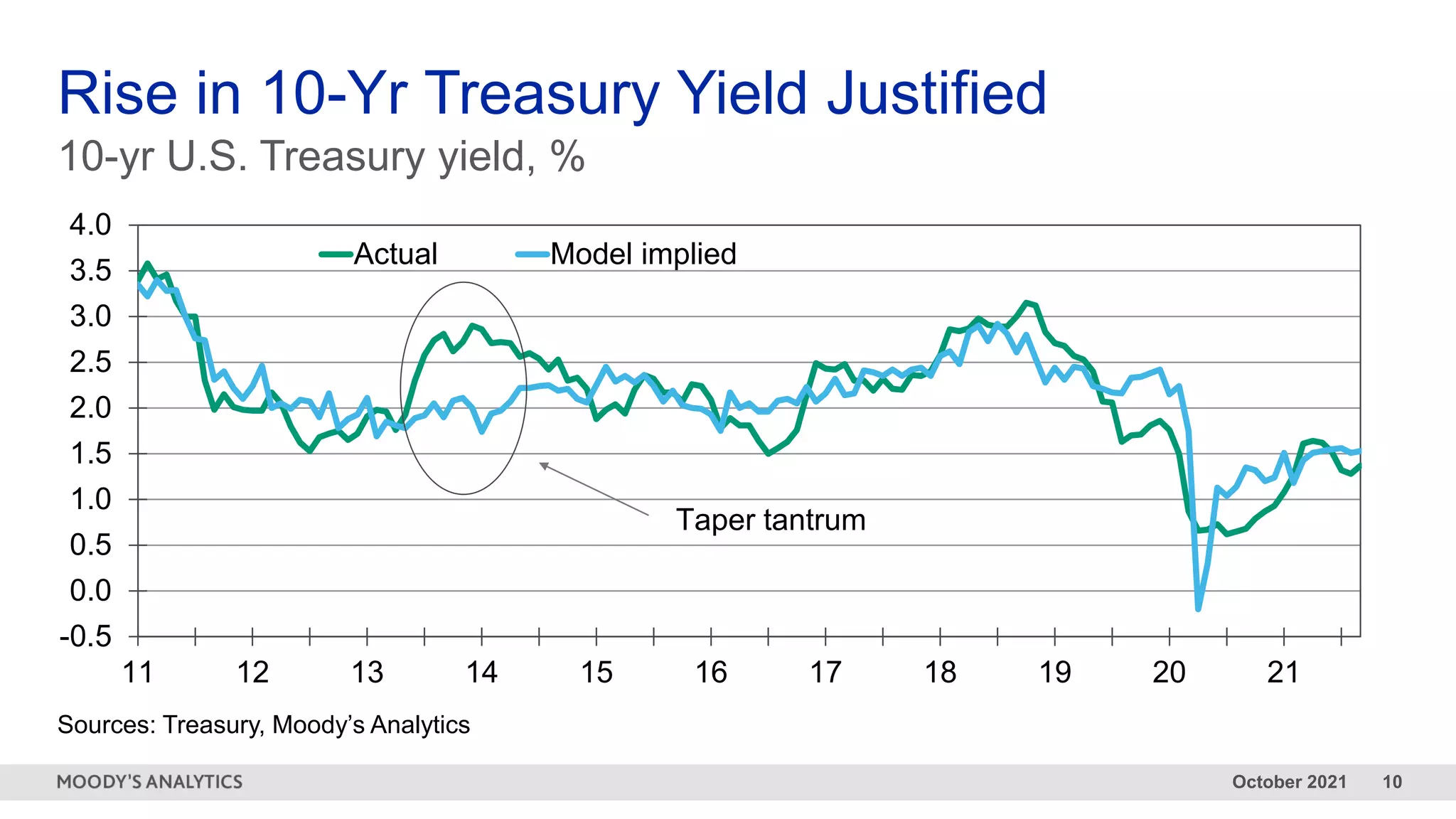

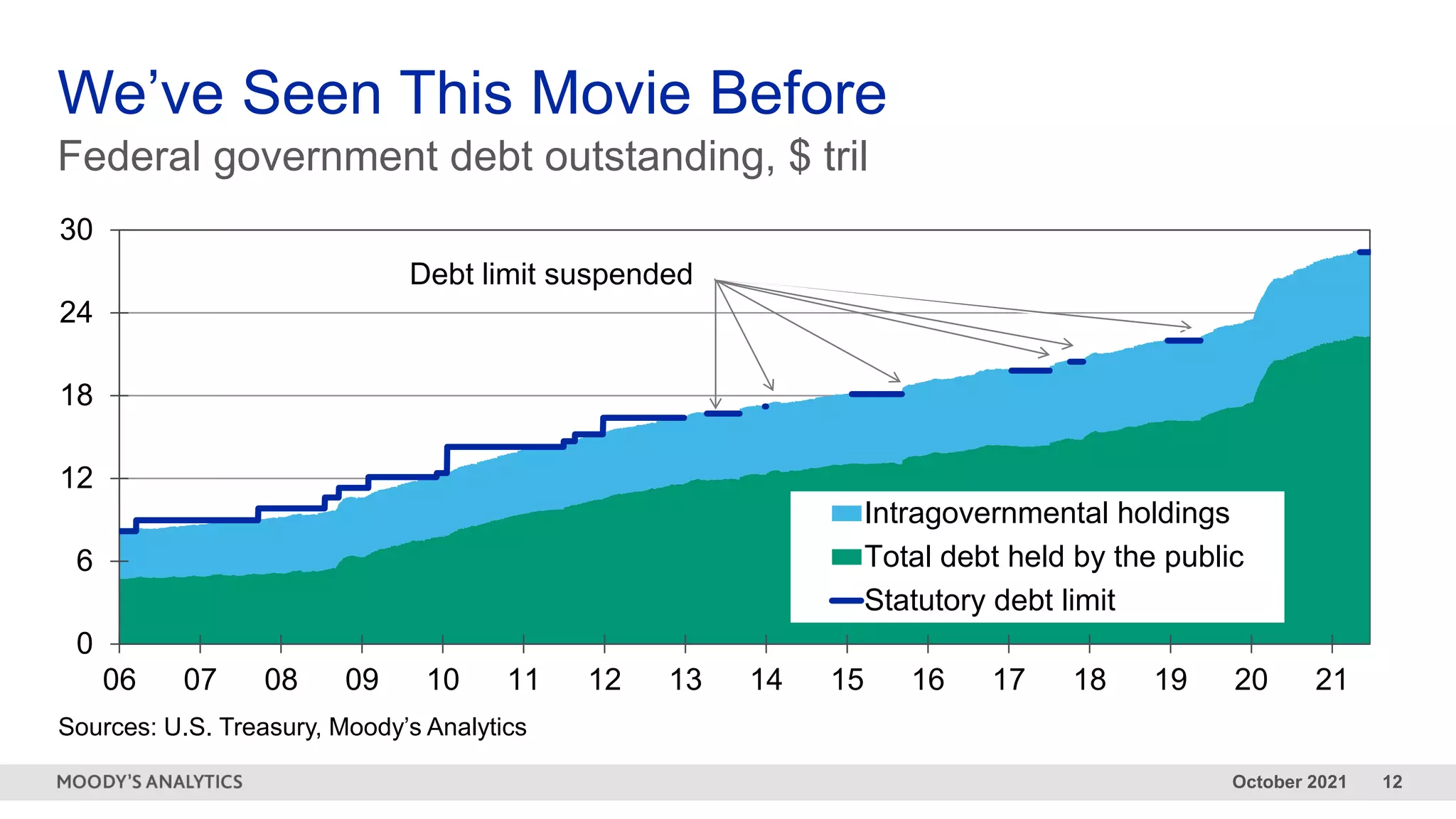

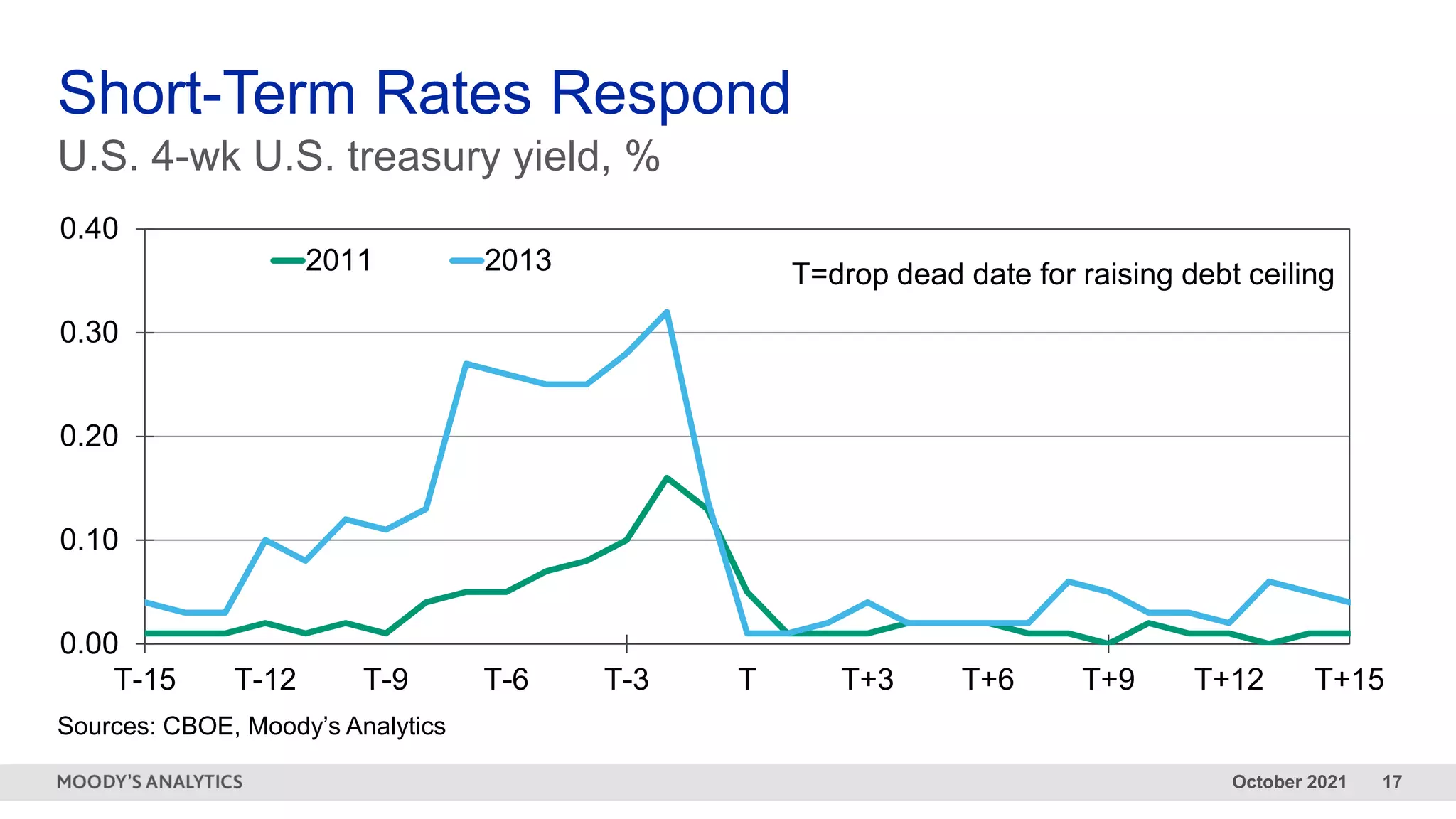

The document outlines economic research as of October 2021, focusing on the pressure for a U.S. budget deal and the Federal Reserve's tapering strategy amid rising inflation expectations and corporate debt trends. Key concerns include the potential economic impact of the debt ceiling and a fragile consumer sentiment, as well as tight high-yield corporate bond spreads. The analysis suggests that the financial markets are adjusting to a changing interest rate environment, which could have significant implications for economic stability.