More Related Content

Similar to ECX-EC3 - Ret Ed_Corp Brochure_email

Similar to ECX-EC3 - Ret Ed_Corp Brochure_email (20)

ECX-EC3 - Ret Ed_Corp Brochure_email

- 1. UNDERSTANDING

RETIREMENT OPTIONS

An increasing number of

corporations today are

providing retirement, life

management and financial

education to their employees.

Human Resource

professionals are recognizing

that employees require better

education concerning their

pension options and how the

pension arrangements fit into

the planning process.

Today’s economic

environment requires

employees to assume

responsibility for their lives

and finances. The corporation

needs to provide the

education and tools necessary

to assist the employee in

achieving self-responsibility

and self sufficiency.

HELPING YOUR

EMPLOYEES

Our programs have been

created to assist both Human

Resources and Legal needs by:

• Teaching employees how to

develop life goals and

objectives.

• Going beyond the facts and

figures and shifting the

focus to lifestyle transition

planning combined with

retirement education.

The bottom line for the

corporation is that by

providing this kind of

education and training it is

better able to recruit and

retain qualified employees.

Why is corporate North

America concerned about

the retention of experienced

employees? Simple.

To remain competitive.

BENEFITTING

YOUR COMPANY

A company's productivity in

the future will be tied to how

well it can maintain and

support its workforce. This is

coming at a time when many

employees are reassessing the

definition of traditional

retirement as well as their

own place in both their career

and life.

This reassessment on the

part of your employees will

happen whether you

participate or not.

“An employer who provides

life management education

to the employee population

sends a very powerful

message about the

organization’s values and

culture.” (Dr. Lloyd Field)

Once this becomes known,

the employer is on the path

to becoming the Employer

of Choice.

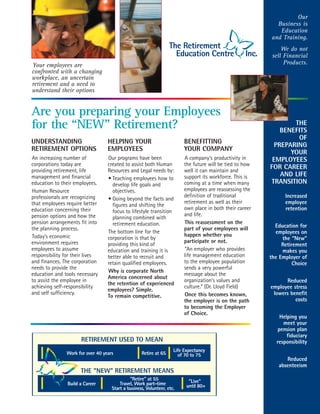

Are you preparing your Employees

for the “NEW” Retirement? THE

BENEFITS

OF

PREPARING

YOUR

EMPLOYEES

FOR CAREER

AND LIFE

TRANSITION

Increased

employee

retention

Education for

employees on

the “New”

Retirement

makes you

the Employer of

Choice

Reduced

employee stress

lowers benefit

costs

Helping you

meet your

pension plan

fiduciary

responsibility

Reduced

absenteeism

www.iretire.org Our

Business is

Education

and Training.

We do not

sell Financial

Products.

Are you

preparing

your

Employees

for the

“NEW”

Retirement?

Your employees are

confronted with a changing

workplace, an uncertain

retirement and a need to

understand their options

What people are writing about our programs

Our tools for helping your

employees take self-responsibility

The Lifestyle Transition

Planning Program©

Manual

Our program manual will

assist the employee in

developing a vision of a new

life structure for the future.

The Lifestyle

Modeling Software©

This is provided to every

employee. It is designed to

help the employee find the

balance between their

lifestyle vision and the

financial realities and how to

find a fit between the two.

151 Frobisher Drive, Unit #B-108

Waterloo, Ontario N2V 2C9

Toll Free: 1.800.637.6140

Phone: 519.576.1575

Fax: 519.576.5934

Email: info@iretire.org

Visit us at our website:

www.iretire.org

Our business is Education and Training

We do not sell Financial Products

The Retirement Education

Centre Inc. was formed in

1996. The company is an

education, advocacy and

research organization focusing

on the “New” Retirement and

Lifestyle Transition Planning.

The mandate of the

Retirement Education Centre

Inc. is to provide individuals

with the tools they will need

to help them make the

transition to the next stage

of their lives. Through our

seminar program or our web

based e-learning program, we

work with your employees to

develop a clear vision of their

future.

“I wanted to personally thank

you for the fantastic presen-

tation on Retirement

Planning.”

“The information gained by

attending the seminar gave

us the necessary tools to plan

for a successful retirement. It

was much easier for us to set

firm goals with realistic time

lines.”

“Thanks again. You have no

idea how less stressed we feel

about our future retirement,

especially now that we have

a better understanding about

how to get there.”

Educate employees in how

to manage their life goals and

resources. This is an ideal

template for self-responsibili-

ty and self sufficiency.

Because life goals change

regularly, learning how to

objectively and realistically

manage one’s own affairs

easily transferred to the

regular needs that an

organization has to change

its direction, systems and

processes.

Identify participation and

responsibility: establish early

in the employee’s career with

your organization that you,

the employer, view the

employee as a responsible

adult who has to manage

his/her career and financial

affairs independent of you.

You are concerned enough

(within your values) to

provide the life management

skills training and signal that

dependence on the employer

is not always in the

employee’s best interests.”

An excerpt from

“A Guide to Positive

Employee Relations”

by Lloyd M. Field, Ph.D.

“In my view, this approach

should win an award for

its brilliance …”

- 2. There is a growing awareness

of the need for companies to

provide appropriate

independent, third-party

education to their employees,

in order to satisfy the

fiduciary issues surrounding

the company’s pension

arrangements.

This is particularly true for

those companies with

defined contribution pension

plans or Group Registered

Retirement Savings Plans

(GRSP).

Developed by the Pension

Industry, the Capital

Accumilation Plan Guidelines

are now considered to be the

benchmark against which the

courts may judge how

successful a company has

been in providing appropriate

education concerning the

Pension Plan arrangements,

to its employees.

“We’ve just completed the

first session of the Retirement

Education Program, which

introduced a number of

employees and their spouses

to the concept of the “new”

retirement. Feedback from

the session was very positive

and exceeded expectations.”

“We look forward to

continuing to offer these

valuable sessions to our

employees and their spouses.”

Aegon Canada

“… the results were over-

whelmingly in favour of hold-

ing future training sessions …

it is refreshing to see that the

training is being done on its

own merit, and not to sell

product.”

Local 527 United Association of

Plumbers, Steamfitters and Welders of

Canada

“During the workshop you

took us through the planning

stages, encouraged us to

make changes, adjust our

saving expectations and goals

and to become realistic in

moving towards retirement

rather than away from work.

Your relaxed, humourous

demeanor, created a special

atmosphere that encouraged

participation.”

“Thank you for providing the

education and tools to

enlighten the journey to

retirement as well as the

financial aspects.”

Energizer Canada

“Av, another successful session

of the Personal Retirement

Education Program has been

completed at our head office

locations in Toronto and

Kitchener/Waterloo. You have

developed a very professional

program with excellent deliv-

ery, organization and an

atmosphere that encourages

participation. Survey

comments, completed by

participants over the past 3

years, have been very enthusi-

astic.”

“Thanks Av and we look

forward to working with you

again in the spring.”

Manulife Financial

The Personal Retirement

Education Program will assist

employees in addressing key

life issues such as:

– How will I spend my time?

– What do I really like to do?

– What will keep me

motivated?

– How will I react to not

having a career?

- Is phased or semi

retirement a viable option

for me?

– How will my family be

affected by my retirement?

– Are my finances capable

of supporting the lifestyle

I want?

Typically the program is

delivered through an

introductory meeting(s) and

follow-up workshop(s).

Spouses are encouraged

to attend.

Your Fiduciary Responsibility

Retirement Education

and Lifestyle Transition Planning Program©

Our Facilitation of the Transition Process

What people are saying about our programs

Our business

is Education

and Training.

We do not sell

Financial

Products.

See an overview of our web based online e-learning program

by clicking on the link on the home page of our website:

There are

two programs

available:

Our seminar

program and our

web based online

e-learning

program which

allows employees

to take

themselves

through the

program when

it is convenient

for them

The purpose of the

introductory meeting is to

explain the company’s

pension plan, its role in the

planning process and how it

fits into our program.

In addition, we position our

approach to lifestyle planning

and why it is important to

the transition process.

Another option is our web

based e-learning program.

Visit us at our website: www.iretire.org

Recently there has been a

significant change in the

nature of retirement. Your

employees are faced with

personal issues such as:

• The length of time they

may be in the “new”

retirement

• Uncertainty about the

workplace

• Overall concern about the

retirement transition

• Consideration of early

retirement options

• The desire to remain

productive in the work

force.

As an employer, you are

faced with a need to address

these issues in order to

maintain your present

workforce and attract

qualified new employees.

The Lifestyle Transition Planning

Program represents a major step

forward in providing pre-retirement

education as an employer sponsored

benefit.

• What are some of the

major transitions in life

and which ones are likely

to occur for me?

• What do I know about

getting older and

progressing through life’s

stages?

• What are the advantages

and disadvantages

associated with a

transition?

• What is the relationship

between life as it is now

and life as it will be in the

future?

• What are the personal

qualities and abilities that I

can count on?

• What job/career issues,

lifestyle issues and

significant life events

issues should I consider?

The Program

www.iretire.org

- 3. There is a growing awareness

of the need for companies to

provide appropriate

independent, third-party

education to their employees,

in order to satisfy the

fiduciary issues surrounding

the company’s pension

arrangements.

This is particularly true for

those companies with

defined contribution pension

plans or Group Registered

Retirement Savings Plans

(GRSP).

Developed by the Pension

Industry, the Capital

Accumilation Plan Guidelines

are now considered to be the

benchmark against which the

courts may judge how

successful a company has

been in providing appropriate

education concerning the

Pension Plan arrangements,

to its employees.

“We’ve just completed the

first session of the Retirement

Education Program, which

introduced a number of

employees and their spouses

to the concept of the “new”

retirement. Feedback from

the session was very positive

and exceeded expectations.”

“We look forward to

continuing to offer these

valuable sessions to our

employees and their spouses.”

Aegon Canada

“… the results were over-

whelmingly in favour of hold-

ing future training sessions …

it is refreshing to see that the

training is being done on its

own merit, and not to sell

product.”

Local 527 United Association of

Plumbers, Steamfitters and Welders of

Canada

“During the workshop you

took us through the planning

stages, encouraged us to

make changes, adjust our

saving expectations and goals

and to become realistic in

moving towards retirement

rather than away from work.

Your relaxed, humourous

demeanor, created a special

atmosphere that encouraged

participation.”

“Thank you for providing the

education and tools to

enlighten the journey to

retirement as well as the

financial aspects.”

Energizer Canada

“Av, another successful session

of the Personal Retirement

Education Program has been

completed at our head office

locations in Toronto and

Kitchener/Waterloo. You have

developed a very professional

program with excellent deliv-

ery, organization and an

atmosphere that encourages

participation. Survey

comments, completed by

participants over the past 3

years, have been very enthusi-

astic.”

“Thanks Av and we look

forward to working with you

again in the spring.”

Manulife Financial

The Personal Retirement

Education Program will assist

employees in addressing key

life issues such as:

– How will I spend my time?

– What do I really like to do?

– What will keep me

motivated?

– How will I react to not

having a career?

- Is phased or semi

retirement a viable option

for me?

– How will my family be

affected by my retirement?

– Are my finances capable

of supporting the lifestyle

I want?

Typically the program is

delivered through an

introductory meeting(s) and

follow-up workshop(s).

Spouses are encouraged

to attend.

Your Fiduciary Responsibility

Retirement Education

and Lifestyle Transition Planning Program©

Our Facilitation of the Transition Process

What people are saying about our programs

Our business

is Education

and Training.

We do not sell

Financial

Products.

See an overview of our web based online e-learning program

by clicking on the link on the home page of our website:

There are

two programs

available:

Our seminar

program and our

web based online

e-learning

program which

allows employees

to take

themselves

through the

program when

it is convenient

for them

The purpose of the

introductory meeting is to

explain the company’s

pension plan, its role in the

planning process and how it

fits into our program.

In addition, we position our

approach to lifestyle planning

and why it is important to

the transition process.

Another option is our web

based e-learning program.

Visit us at our website: www.iretire.org

Recently there has been a

significant change in the

nature of retirement. Your

employees are faced with

personal issues such as:

• The length of time they

may be in the “new”

retirement

• Uncertainty about the

workplace

• Overall concern about the

retirement transition

• Consideration of early

retirement options

• The desire to remain

productive in the work

force.

As an employer, you are

faced with a need to address

these issues in order to

maintain your present

workforce and attract

qualified new employees.

The Lifestyle Transition Planning

Program represents a major step

forward in providing pre-retirement

education as an employer sponsored

benefit.

• What are some of the

major transitions in life

and which ones are likely

to occur for me?

• What do I know about

getting older and

progressing through life’s

stages?

• What are the advantages

and disadvantages

associated with a

transition?

• What is the relationship

between life as it is now

and life as it will be in the

future?

• What are the personal

qualities and abilities that I

can count on?

• What job/career issues,

lifestyle issues and

significant life events

issues should I consider?

The Program

www.iretire.org

- 4. UNDERSTANDING

RETIREMENT OPTIONS

An increasing number of

corporations today are

providing retirement, life

management and financial

education to their employees.

Human Resource

professionals are recognizing

that employees require better

education concerning their

pension options and how the

pension arrangements fit into

the planning process.

Today’s economic

environment requires

employees to assume

responsibility for their lives

and finances. The corporation

needs to provide the

education and tools necessary

to assist the employee in

achieving self-responsibility

and self sufficiency.

HELPING YOUR

EMPLOYEES

Our programs have been

created to assist both Human

Resources and Legal needs by:

• Teaching employees how to

develop life goals and

objectives.

• Going beyond the facts and

figures and shifting the

focus to lifestyle transition

planning combined with

retirement education.

The bottom line for the

corporation is that by

providing this kind of

education and training it is

better able to recruit and

retain qualified employees.

Why is corporate North

America concerned about

the retention of experienced

employees? Simple.

To remain competitive.

BENEFITTING

YOUR COMPANY

A company's productivity in

the future will be tied to how

well it can maintain and

support its workforce. This is

coming at a time when many

employees are reassessing the

definition of traditional

retirement as well as their

own place in both their career

and life.

This reassessment on the

part of your employees will

happen whether you

participate or not.

“An employer who provides

life management education

to the employee population

sends a very powerful

message about the

organization’s values and

culture.” (Dr. Lloyd Field)

Once this becomes known,

the employer is on the path

to becoming the Employer

of Choice.

Are you preparing your Employees

for the “NEW” Retirement? THE

BENEFITS

OF

PREPARING

YOUR

EMPLOYEES

FOR CAREER

AND LIFE

TRANSITION

Increased

employee

retention

Education for

employees on

the “New”

Retirement

makes you

the Employer of

Choice

Reduced

employee stress

lowers benefit

costs

Helping you

meet your

pension plan

fiduciary

responsibility

Reduced

absenteeism

www.iretire.org Our

Business is

Education

and Training.

We do not

sell Financial

Products.

Are you

preparing

your

Employees

for the

“NEW”

Retirement?

Your employees are

confronted with a changing

workplace, an uncertain

retirement and a need to

understand their options

What people are writing about our programs

Our tools for helping your

employees take self-responsibility

The Lifestyle Transition

Planning Program©

Manual

Our program manual will

assist the employee in

developing a vision of a new

life structure for the future.

The Lifestyle

Modeling Software©

This is provided to every

employee. It is designed to

help the employee find the

balance between their

lifestyle vision and the

financial realities and how to

find a fit between the two.

151 Frobisher Drive, Unit #B-108

Waterloo, Ontario N2V 2C9

Toll Free: 1.800.637.6140

Phone: 519.576.1575

Fax: 519.576.5934

Email: info@iretire.org

Visit us at our website:

www.iretire.org

Our business is Education and Training

We do not sell Financial Products

The Retirement Education

Centre Inc. was formed in

1996. The company is an

education, advocacy and

research organization focusing

on the “New” Retirement and

Lifestyle Transition Planning.

The mandate of the

Retirement Education Centre

Inc. is to provide individuals

with the tools they will need

to help them make the

transition to the next stage

of their lives. Through our

seminar program or our web

based e-learning program, we

work with your employees to

develop a clear vision of their

future.

“I wanted to personally thank

you for the fantastic presen-

tation on Retirement

Planning.”

“The information gained by

attending the seminar gave

us the necessary tools to plan

for a successful retirement. It

was much easier for us to set

firm goals with realistic time

lines.”

“Thanks again. You have no

idea how less stressed we feel

about our future retirement,

especially now that we have

a better understanding about

how to get there.”

Educate employees in how

to manage their life goals and

resources. This is an ideal

template for self-responsibili-

ty and self sufficiency.

Because life goals change

regularly, learning how to

objectively and realistically

manage one’s own affairs

easily transferred to the

regular needs that an

organization has to change

its direction, systems and

processes.

Identify participation and

responsibility: establish early

in the employee’s career with

your organization that you,

the employer, view the

employee as a responsible

adult who has to manage

his/her career and financial

affairs independent of you.

You are concerned enough

(within your values) to

provide the life management

skills training and signal that

dependence on the employer

is not always in the

employee’s best interests.”

An excerpt from

“A Guide to Positive

Employee Relations”

by Lloyd M. Field, Ph.D.

“In my view, this approach

should win an award for

its brilliance …”