Estée Lauder Equity Research Report

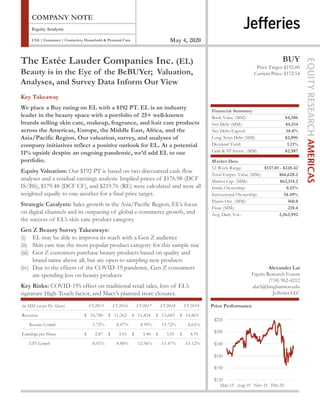

- 1. Alexander Lai Equity Research Extern (718) 962-4212 alai5@binghamton.edu Jefferies LLC USA | Consumer | Cosmetics, Household & Personal Care Equity Analysis COMPANY NOTE May 4, 2020 The Estée Lauder Companies Inc. (EL) Beauty is in the Eye of the BeBUYer; Valuation, Analyses, and Survey Data Inform Our View Key Takeaway We place a Buy rating on EL with a $192 PT. EL is an industry leader in the beauty space with a portfolio of 25+ well-known brands selling skin care, makeup, fragrance, and hair care products across the Americas, Europe, the Middle East, Africa, and the Asia/Pacific Region. Our valuation, survey, and analyses of company initiatives reflect a positive outlook for EL. At a potential 11% upside despite an ongoing pandemic, we’d add EL to our portfolio. Equity Valuation: Our $192 PT is based on two discounted cash flow analyses and a residual earnings analysis. Implied prices of $176.98 (DCF IS/BS), $179.48 (DCF CF), and $219.76 (RE) were calculated and were all weighted equally to one another for a final price target. Strategic Catalysts: Sales growth in the Asia/Pacific Region, EL’s focus on digital channels and its outpacing of global e-commerce growth, and the success of EL’s skin care product category. Gen Z Beauty Survey Takeaways: (i) EL may be able to improve its reach with a Gen Z audience (ii) Skin care was the most popular product category for this sample size (iii) Gen Z customers purchase beauty products based on quality and brand name above all, but are open to sampling new products (iv) Due to the effects of the COVID-19 pandemic, Gen Z consumers are spending less on beauty products Key Risks: COVID-19’s effect on traditional retail sales, loss of EL’s signature High-Touch factor, and Macy’s planned store closures. BUY Price Target: $192.00 Current Price: $172.54 Price Performance Financial Summary 0.7 Book Value (MM): $4,386 Net Debt (MM): $4,514 Net Debt/Capital: 38.0% Long-Term Debt (MM) $2,896 Dividend Yield: 1.11% Cash & ST Invest. (MM) $2,987 Market Data 52 Week Range: $137.01 - $220.42 Total Entprs. Value (MM): $66,628.2 Market Cap. (MM): $62,114.2 Inside Ownership: 0.21% Institutional Ownership: 34.49% Shares Out. (MM): 360.0 Float (MM): 218.4 Avg. Daily Vol.: 2,563,992 (in MM except Per Share) FY2015 FY2016 FY2017 FY2018 FY2019 Revenue 10,780$ 11,262$ 11,824$ 13,683$ 14,863$ Revenue Growth -1.72% 4.47% 4.99% 15.72% 8.62% Earnings per Share 2.87$ 3.01$ 3.40$ 3.01$ 4.91$ EPS Growth -8.01% 4.88% 12.96% -11.47% 63.12%

- 2. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 2 of 15 Table of Contents COMPANY BACKGROUND.................................................................. 3 Business Description............................................................................ 3 INDUSTRY ANALYSIS............................................................................ 4 Beauty Market........................................................................................ 4 Market Trends........................................................................................ 4 VALUATION METHODOLOGY......................................................... 5 Valuation Summary............................................................................... 5 Weighted Average Cost of Capital..................................................... 5 Discounted Cash Flow Analysis......................................................... 6 Residual Earnings Analysis.................................................................. 7 SUPPORTING CATALYSTS................................................................... 8 Asia/Pacific Region Growth............................................................... 8 Digital Focus.......................................................................................... 8 Perseverance of Skin Care................................................................... 8 GEN Z BEAUTY SURVEY...................................................................... 9 Survey Results........................................................................................ 9 BUSINESS RISKS....................................................................................... 10 COVID-19 Slowing Retail Sales......................................................... 10 Losing the High-Touch Factor........................................................... 10 Macy’s Store Closures.......................................................................... 10 BOARD OF DIRECTORS....................................................................... 11 Board Composition.............................................................................. 11 CORPORATE GOVERNANCE............................................................ 12 ISS Governance Quality Score Analysis.............................................12 CONCLUDING THOUGHTS............................................................... 12 APPENDICES.................................................................................................. 3 3 4 4 4 5 5 5 6 7 8 8 8 8 9 9 10 10 10 10 11 11 12 12 12 13

- 3. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 3 of 15 Company Background Business Description: The Estée Lauder Companies Inc. is one of the world’s leading manufacturers and marketers of quality skin care, makeup, fragrance, and hair care products – see Chart 1. The company’s products are sold in approximately 150 countries and territories under a number of brand names including Estée Lauder, Clinique, Origins, M.A.C., Bobbi Brown, Jo Malone London, and Too Faced – see Charts 2 and 3. They are also the global licensee for fragrances, cosmetics, and/or related products sold under various designer brand names, such as Tommy Hilfiger, Donna Karan, Michael Kors, Tom Ford, and Coach. The company sells their prestige products principally through limited distribution channels to complement the images associated with their brands. These channels consist primarily of department stores, specialty-multi retailers, upscale perfumeries and pharmacies and prestige salons and spas. In addition, these products are sold in the Company’s own and authorized freestanding stores, their own and authorized retailer websites, third-party online malls, stores in airports and on cruise ships, in-flight, and duty-free shops. Chart 3: Brand Map Classic Premium Progressive Entry Price Point Source: Company Reports Chart 2: Net Sales by Region Source: Company Reports Chart 1: Net Sales by Product Category Source: Company Reports Table 1: Key Information Source: Company Reports Year Founded 1946 Headquarters New York, NY Employee Count 48,000

- 4. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 4 of 15 Industry Analysis Beauty Market: Beauty is currently a $500B+ industry and in the next five years is expected to grow at a 5-7% CAGR to exceed $800B by 2025. The beauty industry falls within the consumer staples sector, which is less sensitive to economic cycles. Macroeconomics factors that drive the consumer staples industry are employment, consumer confidence, inflation rates, and commodity costs, however, the sensitivity of this industry to these factors is relatively low compared to other industries. The main products sold by companies in this space relate to hair care, skin care, cosmetics, fragrance, personal products, and ancillary products. Hair care and skin care alone make up over half of the revenue in the industry at 61% market share while other categories take less than 20% each of overall market share. – see Chart 4. Industry peers include players such as Coty, Johnson & Johnson, Nu Skin, P&G, Revlon, Sally Beauty, and Ultra, among others - see Chart 5. Market Trends: There is a growing trend in recent years of beauty companies shifting away from wholesale selling to more direct-to-consumer channels. This allows companies to own the entire customer experience and cut out the middle man, allowing them to understand their target audience more deeply as well as reap high profit margins. Influencer marketing is also becoming more prevalent, with companies choosing to employ brand ambassadors instead of utilizing traditional advertising. Modern consumers are educating themselves on products and demand quality and transparency from companies. Recent initiatives such as the Personal Care Products Safety Act of 2019 work to regulate ingredients in beauty products, causing companies to be more conscious of consumer health while conducting research and development efforts. Chart 5: Industry Peers Source: Statista Chart 4: Market Share by Product Category Comparable Companies (as of 6/30/19) Company Ticker Market Cap (BN) Net Debt (BN) Enterprise Value (BN) Share Price Revenue (MN) EBITDA (MN) Net Income (MN) EPS Stockholder's Equity (MN) Outstanding Shares (MN) Book Value Coty Inc. COTY 10$ 7$ 2$ 12.95$ 8,649$ (2,736)$ (3,784)$ 0.65 4,587$ 751 6.11$ Johnson & Johnson JNJ 361$ 28$ 333$ 136.42$ 82,059$ 25,012$ 15,119$ 5.72 59,471$ 2,645 22.48$ Nu Skin Enterprises Inc. NUS 3$ 0$ 2$ 47.69$ 2,420$ 344$ 174$ 3.13 875$ 56 15.77$ Procter & Gamble Co. PG 269$ 46$ 223$ 107.61$ 67,684$ 8,311$ 3,897$ 1.45 47,479$ 2,504 18.96$ Revlon Inc. REV 1$ 4$ (3)$ 19.33$ 2,420$ 147$ (171)$ -3.11 (1,221)$ 53 (23.01)$ Sally Beauty Holdings Inc. SBH 2$ 2$ (0)$ 13.34$ 3,876$ 566$ 272$ 2.27 (60,323)$ 120 (504.22)$ Ulta Beauty Inc. ULTA 20$ 1$ 19$ 346.89$ 7,398$ 1,134$ 706$ 12.21 1,902$ 58 32.89$ Source: Company Reports

- 5. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 5 of 15 Valuation Methodology Valuation Summary: Our price target of $192 is based off of three valuation models; a discounted cash flow analysis based on the income statement and the balance sheet, a discounted cash flow based on the cash flow statement, and a residual earnings analysis. All three methods were weighted equally to come to a price target – see Charts 6 and 7. Chart 8: Weighted Average Cost of Capital Breakdown Weighted Average Cost of Capital: To arrive at a discount rate for the analyses, a weighted average coast of capital (WACC) had to be found. The cost of equity was calculated using the Capital Asset Pricing Model using both an industry beta and a regression analysis on the market. The cost of debt was calculated based on current borrowings, the yield to maturity method, the actual rating, and a synthetic rating. 7.88% was arrived at for the cost of equity, 4.06% was arrived at for the cost of debt, and based on these inputs, a WACC rate of 7.56% was arrived at – see Chart 8. Chart 6: Valuation Ranges Chart 7: Valuation Ranges Breakdown Current Price: $172.54 Price Target: $192.00 Source: Company Reports, Jefferies Source: Company Reports, Jefferies Debt Market Value of Debt (MM) $2,896 Weight of Debt 6.72% Cost of Debt 4.06% Equity Market Value of Equity (MM) $40,220 Weight of Equity 93.28% Cost of Equity 7.88% Weighted Average Cost of Capital Beta 0.76 Risk-Free Rate of Return 4.88% Market Risk Premium 4.83% Tax Rate 22.24% WACC 7.56% Source: Company Reports, Jefferies Low Q1 Median Q3 High Residual Earnings $174.75 $194.35 $220.33 $254.01 $302.76 Discounted Cash Flow (IS/BS) $121.80 $144.84 $176.98 $224.95 $304.27 Discounted Cash Flow (CF) $123.58 $146.91 $179.48 $228.08 $308.44 52 Week Range $137.01 $175.62 $188.12 $197.42 $220.42

- 6. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 6 of 15 Discounted Cash Flow Analysis: The discounted cash flow (DCF) analysis was chosen because EL has relatively stable cash flows that have had an upward trend over the last decade. Two methods were used to determine EL’s free cash flows; one drawing from the income statement and the balance sheet and the other drawing from the cash flow statement. A WACC of 7.56% was used as a discount rate. A perpetual growth rate of 2.5% was used as a conservative estimate of the company’s growth, mirroring the growth of U.S. GDP in recent years. Values of $176.95 and $179.45 were obtained using the income statement/balance sheet method and the cash flow statement method, respectively – see Charts 9 and 11. Chart 11: DCF (CF) Breakdown Chart 12: DCF (CF) Sensitivity Analysis Source: Company Reports, Jefferies Cash Flow Statement Method (in MM except Per Share) FY2017 FY2018 FY2019 Reported Cash Flow From Operations 1,790$ 2,562$ 2,517$ After Tax Net Interest Payment 49$ 41$ 57$ Cash Flow From Operations 1,839$ 2,603$ 2,574$ Capital Expenditures (504)$ (629)$ (744)$ Payments for Acquired Businesses (1,671)$ -$ -$ Proceeds from Sales of Investments 1,226$ 749$ 1,229$ Purchase of Investments (1,267)$ (478)$ (14)$ Cash Investment in Operations (2,216)$ (358)$ 471$ Free Cash Flow 4,055$ 2,961$ 2,103$ WACC= 7.56% g= 2.50% Total Firm Value 42,596$ Net Debt 2,896$ Intrinsic Value of Equity 39,700$ Shares Outstanding 221.22 Implied Share Price 179.48$ Source: Company Reports, Jefferies 6.56% 7.06% 7.56% 8.06% 8.56% 1.50% $177.60 $160.45 $146.13 $133.99 $123.58 2.00% $199.55 $178.54 $161.30 $146.91 $134.72 2.50% $226.91 $200.59 $179.48 $162.16 $147.70 3.00% $261.95 $228.08 $201.63 $180.42 $163.01 3.50% $308.44 $263.28 $229.25 $202.68 $181.35 PerpetualGrowth Weighted Average Cost of Capital Source: Company Reports, Jefferies Chart 9: DCF (IS/BS) Breakdown Income Statement & Balance Sheet Method (in MM except Per Share) FY2017 FY2018 FY2019 EBIT 1,704$ 2,055$ 2,313$ Marginal Tax Rate 27.90% 43.60% 22.20% NOPAT 1,229$ 1,159$ 1,800$ Deprecation and Amortization 464$ 531$ 557$ Capital Expenditure (2,216)$ (358)$ 471$ Net Working Capital 96$ (263)$ (190)$ Free Cash Flow 3,813$ 2,311$ 2,076$ WACC = 7.56% g= 2.50% Total Firm Value 42,044$ Net Debt 2,896$ Intrinsic Value of Equity 39,148$ Shares Outstanding 221.22 Implied Share Price 176.98$ Chart 10: DCF (IS/BS) Sensitivity Analysis Source: Company Reports, Jefferies 6.56% 7.06% 7.56% 8.06% 8.56% 1.50% $175.12 $158.20 $144.06 $132.09 $121.80 2.00% $196.79 $176.05 $159.04 $144.84 $132.80 2.50% $223.79 $197.82 $176.98 $159.89 $145.61 3.00% $258.38 $224.95 $198.85 $177.91 $160.73 3.50% $304.27 $259.70 $226.10 $199.88 $178.83 PerpetualGrowth Weighted Average Cost of Capital

- 7. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 7 of 15 Residual Earnings Analysis: The residual earnings analysis was chosen because EL is projected to consistently produce excess cash in future years. A 7.88% cost of equity was used as the discount rate. A earnings per share growth rate of 8.66% was used based off analyst estimates. A perpetual growth rate of residual earnings was predicted to be 6.54%. A value of $219.76 was obtained using this analysis – see Chart 13. Chart 13: Residual Earnings Analysis Breakdown Source: Company Reports, Jefferies Residual Earnings Analysis FY2019 FY2020 FY2021 FY2022 FY2023 FY2024 FY2025 FY2026 FY2027 FY2028 Earnings per Share 4.91$ 4.61$ 5.43$ 5.90$ 6.41$ 6.97$ 7.57$ 8.23$ 8.94$ 9.71$ EPS Growth - -6.11% 17.79% 8.66% 8.66% 8.66% 8.66% 8.66% 8.66% 8.66% Dividends per Share 1.67$ 1.85$ 2.04$ 2.26$ 2.50$ 2.77$ 3.07$ 3.39$ 3.75$ 4.15$ DPS Growth - 10.65% 10.65% 10.65% 10.65% 10.65% 10.65% 10.65% 10.65% 10.65% Book Value per Share 19.94$ 22.70$ 26.09$ 29.72$ 33.63$ 37.83$ 42.33$ 47.17$ 52.35$ 57.91$ BPS Growth - 13.85% 14.91% 13.94% 13.15% 12.48% 11.91% 11.42% 10.99% 10.62% Cost of Equity 7.88% Book Value of Equity (MM) 4,411 Shares Outstanding (MM) 221 Required Earnings - 1.57$ 1.79$ 2.06$ 2.34$ 2.65$ 2.98$ 3.34$ 3.72$ 4.12$ Residual Earnings 4.91$ 3.04$ 3.64$ 3.85$ 4.07$ 4.32$ 4.59$ 4.89$ 5.22$ 5.59$ RE Growth - -38.10% 19.82% 5.59% 5.84% 6.08% 6.32% 6.55% 6.78% 7.00% RE Growth after 2028 6.54% Terminal Value 344.97$ PV of Residual Earnings $200.76 Implied Share Price $219.76 Chart 14: Residual Earnings Sensitivity Analysis Source: Company Reports, Jefferies 7.68% 7.78% 7.88% 7.98% 8.08% 6.34% $225.74 $210.35 $196.95 $185.18 $174.75 6.44% $240.34 $222.73 $207.56 $194.35 $182.75 6.54% $257.50 $237.11 $219.76 $204.80 $191.78 6.64% $277.95 $254.01 $233.91 $216.81 $202.07 6.74% $302.76 $274.15 $250.56 $230.76 $213.90 ResidualEarningsGrowth Cost of Equity

- 8. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 8 of 15 Supporting Catalysts Asia/Pacific Region Growth: From Q1 to Q2, EL saw growth of 29% in the Asia/Pacific region jumping from $1,020MM to $1,319MM. The greater China area had double-digit net sales growth in part due to events such as Singles’ Day, an unofficial holiday where consumers go on a shopping spree to celebrate, similar to Black Friday in the U.S. Tall is the world’s third most visited website and is a popular online retailer in Asia. EL’s online sales on this platform saw a dramatic 135% increase from March 2019 to March 2020 of 129MM RMB, beating out other retailers, such as Lancôme, on the platform – see Chart 15. Upcoming events such as Mother’s Day, Children’s Day, Father’s Day, Youth Day, and Mall's Mid Year Sale in the coming months are expected to generate spikes in sales. Although historically this region produces less net sales than the Americas, Europe, the Middle East, and Africa, changing consumer habits in the region are contributing to this category’s growth. Digital Focus: EL noted that their online sales accelerated during February and March as the effects of the COVID-19 virus spread across Europe and the Americas. E-commerce represents ~30% of EL’s sales in top markets, and EL’s CAGR for online sales is nearly 30% over the past 5 years, outpacing the global e-commerce market CAGR of 21% in that same time frame. EL expects to continue double-digit growth in e-commerce and aims to double its online sales profit by 2023. In FY2019, EL shifted its advertising budget so that 75% of it went towards digital media, whereas beforehand, EL only spent 22% of its spend on digital channels. Perseverance of Skin Care: EL’s skin care products generate the most revenue out of all it’s product categories and, with the effects of the coronavirus pandemic, skin care sales across the entire industry have been increasing. According to NPD, skin care sales jumped 13% from January 2020 to February 2020, and Nielsen states that skin care sales are up 2% from March 2019 to March 2020. Historically, this category typically grows faster than the overall cosmetics market as well – see Chart 16. CEO Fabrizio Freda noted that “[c]consumers may cut back on buying cosmetics and perfumes as they are quarantined at home, but they continue to buy products that address their health and wellness while locked inside”, and it seems the effects of the pandemic cause consumers to purchase more than they usually would. Chart 15: Tall Flagship Sales (MM RMB) Source: Alltech Chart 16: Skin Care and Cosmetics Market Growth Source: L’Oréal

- 9. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 9 of 15 Gen Z Beauty Survey Survey Methodology: We surveyed 40 college students within the United States from a public university in the upstate New York area to gauge their shopping and usage patterns in regards to beauty products as well as their brand preferences. By age, 100% of them fell within the Generation Z category, indicating that their ages were between 7-22 years old. By gender, 47.5% of responders noted they were male and 52.5% noted they were female. Survey Results Our survey indicated that those in our sample size preferred EL over popular companies such as Avon or Coty – see Chart 17. This may indicate opportunities for EL to expand their core demographic. The typical EL customer is aged 35-55, falling in the Millennial or Gen X buckets, but developing products and marketing campaigns that appeal to a younger Gen Z audience could improve EL’s market share. Skin care was found to be the category with the top spend in our sample size, showing that perhaps skin care’s growth as an overall category is true for Gen Z as well and not just with EL’s target consumers – see Chart 18. The most important purchasing factor for our sample size was quality, with brand being a close second – See Chart 19. This supports the notion that Gen Z is highly knowledgeable when it comes to what they buy and that they understand what goes into an item and support only the brands they resonate with. However, 45% of our sample size noted they were open to trying new brands or products they were unfamiliar with – see Chart 20. It seems that during the COVID-19 pandemic, our sample size spent less on overall beauty products, most likely due to decrease in usage of cosmetics – see Chart 21. Chart 19: Beauty Product Purchasing Factors Chart 20: Willingness to Try New Beauty Products Chart 21: COVID-19 Pandemic Beauty Purchasing Habits Chart 17: Gen Z Beauty Company Preferences Source: Jefferies Chart 18: Beauty Product Spend by Category Source: Jefferies Source: Jefferies Source: Jefferies Source: Jefferies

- 10. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 10 of 15 Business Risks COVID-19 Slowing Retail Sales: The effects of COVID-19 have slowed in-person retail sales worldwide, and most physical stores across the world have been temporarily shut down. With the ongoing pandemic, many major cities with EL stores or third-party retailers in them have experienced a decrease in foot traffic as a result – see Chart 22. Traditional retail sales make up a large portion of the company’s revenue, and long-term closures of stores could severely impact their top line. EL’s retail stores remain shuttered in the Americas, Europe, the Middle East, and Africa at the moment, however, EL has begun to reopen stores in the Asia/Pacific region and are assessing when they can reopen the remaining locations in accordance with the authorities. Losing the High-Touch Factor: EL is known for their signature High-Touch approach, where they aim to create strong emotional bonds with their consumers through personalized experiences. This concept was founded over 60 years ago by the company’s founder, Estée Lauder, and manifests itself in stores through expert advice given by beauty consultants on the sales floor. Due to the pandemic, EL has lost its ability to connect with their target audience in person and this may result in them losing sales from loyal customers, but EL is attempting to change this through digital means. EL continues to innovate digitally and aims to interact with their consumers during this pandemic through online channels. Gary Chu, an online general manager for EL mentioned that “[l]livestreaming was something brand new [that they] tried” and that it “boomed during the pandemic”. They are also heavily promoting products featured on their e-commerce store through their social media accounts to help bolster online sales. Macy’s Store Closures: One of EL’s largest retail partners is Macy’s, which in the past has accounted for nearly 10% of the company’s overall revenue. Recently, Macy’s has been struggling to stay afloat, and as a cost-cutting measure, from now until 2023, Macy’s plans to shutter 125 stores, which is nearly a fifth of its locations. This plan by Macy’s may significantly impact EL’s revenues stemming from department stores over the next three years. Macy’s locations are currently closed due to the COVID-19 pandemic, so sales during this period may look similar to 2023 sales when Macy’s completes this initiative. However, in the next six to eight weeks, Macy’s plans to open all 775 of its stores, which may help recoup some sales for EL. Chart 22: Average Change in Major City Foot Traffic (5/4/20 – 5/11/20) Source: The Economist

- 11. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 11 of 15 Board of Directors Chart 23: Board of Directors Breakdown Source: Estée Lauder Name Current Position Previous Roles Education Stock Ownership Charlene Barshefsky Senior International Partner at Wilmer Hale U.S. Trade Representative Director at Intel and Starwood Hotels University of Wisconsin-Madison: Bachelor’s in English and Political Science The Catholic University of America: JD 61,411 shares (.03%) Rose Marie Bravo, CBE Retail and Marketing Consultant CEO at Burberry President at Saks Fifth Avenue Fordham University: Bachelor’s in English 8,000 shares Wei Sun Christianson MD & Co-CEO of Asia Pacific and CEO of China at Morgan Stanley Chairman of China at Citigroup Amherst College: BA in Political Science Columbia University: JD in International Law 4,104 shares Fabrizio Freda President and Chief Executive Officer at Estée Lauder President at Proctor and Gamble Strategic Planning at Gucci University of Naples Federico II: Economics and Business Administration 68,174 shares (.03%) Paul J. Fribourg Chairman and Chief Executive Officer at Continental Grain Company Director at Apollo Global Management, Loews, and Restaurant Brands International Amherst College: Bachelor’s in Business Administration and Economics 4,000 shares Irvine O. Hockaday Jr. CEO at Hallmark CEO at Kansas City Southern Industries Princeton University: AB in English University of Michigan: JD 11,740 shares (.01%) Jennifer Hyman Co-Founder and Chief Executive Officer at Rent the Runway Director at IMG Senior Manager at Starwood Hotels Harvard University: BA in Social Studies and MBA 2,000 shares Leonard A. Lauder Chairman Emeritus at Estée Lauder Chief Executive Officer at Estée Lauder Officer at U.S. Navy University of Pennsylvania: Bachelor’s Columbia University: Master’s Jane Lauder Global Brand President at Clinique Global President and General Manager of Origins, Joon, and Dauphin Brands Stanford University: Bachelor’s Ronald S. Lauder Chairman at Clinique Laboratories LLC Deputy Assistant Secretary of Defense at the U.S. Department of Defense University of Pennsylvania: Bachelor’s in International Business 6,364 Class A shares 9,409,895 Class B Shares (6.86%) William P. Lauder Executive Chairman at Estée Lauder CEO and COO at Estée Lauder Marketing Director at Clinique University of Pennsylvania: BS in Economics and International Marketing 10,468 Class A shares 8,515,960 Class B shares (6.21%) Richard D. Parsons Senior Advisor at Providence Equity Partners LLC Director and Chairman at Citigroup Albany Law School: JD 4,442 shares Lynn Forester de Rothschild Chair at E.L. Rothschild LLC Co-Chair of Field Fresh Foods Pomona College Columbia University 4,000 shares Barry S. Sternlicht Chairman and Chief Executive Officer at Starwood Capital Group Director at Baccarat, Restoration Hardware, Riviera Holdings, and TRI Pointe Brown University Harvard University: MBA 66,932 shares (.03%) Jennifer Tejada Chief Executive Officer at PagerDuty Inc. President and CEO at Keynote Systems EVP and CSO at Mincom University of Michigan: BA in Business Management and Organizational Behavior 2,000 shares Richard F. Annino Managing Director at CCMP Capital Advisors LLC CEO at Dow Jones EVP at Liz Claiborne Bentley College: BS in Finance and Economics Pace University: MBA in Finance

- 12. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 12 of 15 Board Composition: EL’s Board of Directors has 16 members, five of which serve as executives at EL – see Chart 23. Many of the board members come from financial backgrounds, hailing from firms such as Morgan Stanley, Providence Equity Partners, E.L. Rothschild, Starwood Capital Group, and CCMP Capital Advisors. Most members of the Board of Directors own a stake in the company, giving them incentive to help EL grow. Corporate Governance ISS Governance Quality Score Analysis: EL has an overall ISS Governance Quality Score of 10, scoring a 10 for both Shareholder Rights and Board, a 6 for Compensation, and a 1 for Audit – see Table 2. This overall score is the highest score possible and indicates that EL may have a high level of governance risk. The Audit component earning the lowest score of 1 indicates a low risk regarding the company’s audit policies. The Board component earned the highest score of 10, indicating a potential high risk in the board’s composition, practices, and policies. One potential reason why a 10 was earned could be due the Board of Directors having 16 members, when “[g]enterally, boards should not have . . . more than 15 members” (Institutional Shareholder Services). Another reason may be that the Board of Directors does not entirely consist of members independent of the company, and five of the 16 members of the board hold leadership roles within the company. The Shareholder Rights component earning the highest score of 10 indicates a potential high risk regarding shareholder voting practices. One potential reason why a 10 was earned could be due to most of the voting power stemming from Lauder-owned organizations. The Compensation component earning a mid-to-high score of 6, indicating a potential mid-to-high risk in the board’s compensation practices. This may be due the overly high compensation for the CEO, Fabrizio Freda. In 2019, Fabrizio’s compensation was ~$19M including base salary, bonuses, and performance share units (PSUs) when it was expected to be around 33% lower at around ~$14M based on performance objectives including corporate goals and objectives. Concluding Thoughts EL is prepared to handle the effects of COVID-19 and maintain a competitive advantage over is peers in the beauty industry going forward. We will have to closely monitor the company’s actions over the coming months. Our analyses, valuation, and catalysts imply a positive outlook for the firm’s performance and justify our Buy rating. Table 2: ISS Governance Quality Score Breakdown Source: Institutional Shareholder Services Audit 1 Board 10 Shareholder Rights 10 Compensation 6

- 13. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 13 of 15 Appendices

- 14. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 14 of 15 Source: Company Reports 1Q17 2Q17 3Q17 4Q17 FY 1Q18 2Q18 3Q18 4Q18 FY 1Q19 Q219 Q319 Q419 FY Sep-16 Dec-16 Mar-17 Jun-17 2017 Sep-17 Dec-17 Mar-18 Jun-18 2018 Sep-18 Dec-18 Mar-19 Jun-19 2019 Cash & equivalents 1,189 1,675 1,840 1,741 1,741 1,825 2,499 2,524 2,715 2,715 1,993 2,401 2,902 2,987 2,987 Accounts receivable 1,624 1,508 1,528 1,395 1,395 1,799 1,699 1,761 1,487 1,487 2,214 2,000 2,036 1,831 1,831 Inventories (incl. promotional merchandise) 1,296 1,278 1,310 1,479 1,479 1,518 1,445 1,533 1,618 1,618 1,681 1,651 1,814 2,006 2,006 Prepaid expenses & other current assets 292 328 294 349 349 365 332 351 348 348 361 388 408 388 388 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Total current assets 4,401 4,789 4,972 4,964 $4,964 5,507 5,975 6,169 6,168 $6,168 6,249 6,440 7,160 7,212 $7,212 Property, plant and equipment 1,569 1,563 1,576 1,671 1,671 1,695 1,728 1,726 1,823 1,823 1,838 1,859 1,891 2,068 2,068 Operating lease right-of-use assets 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Other assets 3,378 4,860 4,897 4,933 4,933 5,000 4,901 4,877 4,576 4,576 4,456 4,377 3,880 3,876 3,876 TOTAL ASSETS 9,348 11,212 11,445 11,568 $11,568 12,202 12,604 12,772 12,567 $12,567 12,543 12,676 12,931 13,156 $13,156 Short-term debt 592 2,143 519 189 189 552 413 296 183 183 183 18 516 516 516 Accounts payable 546 617 597 835 835 679 738 884 1,182 1,182 913 995 1,068 1,490 1,490 Accrued income taxes 0 0 0 0 0 0 0 0 0 0 0 0 0 Operating lease liabilities 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Other current liabilities 1,574 1,698 1,744 1,799 1,799 1,911 2,252 2,208 1,945 1,945 2,467 2,763 2,647 2,599 2,599 Total current liabilities 2,712 4,458 2,860 2,823 $2,823 3,142 3,403 3,388 3,310 $3,310 3,563 3,776 4,231 4,605 $4,605 Long-term debt 1,908 1,890 3,377 3,383 3,383 3,383 3,374 3,363 3,361 3,361 3,361 3,373 2,883 2,896 2,896 Other non-current liabilities 1,053 1,056 1,073 960 1,046 924 1,238 1,284 1,186 1,046 1,189 1,194 1,200 1,244 1,046 Minority interest 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Long-term operating lease liabilities 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Total liabilities 5,673 7,404 7,310 7,166 $7,166 7,449 8,015 8,035 7,857 $7,857 8,113 8,343 8,314 8,745 $8,745 Total stockholders equity 3,675 3,808 4,135 4,402 4,402 4,753 4,589 4,737 4,710 4,710 4,430 4,333 4,617 4,411 4,411 Chart 25: Historical Balance Sheet Chart 24: Historical Income Statement 1Q17 2Q17 3Q17 4Q17 FY 1Q18 2Q18 3Q18 4Q18 FY 1Q19 Q219 Q319 Q419 FY Sep-16 Dec-16 Mar-17 Jun-17 2017 Sep-17 Dec-17 Mar-18 Jun-18 2018 Sep-18 Dec-18 Mar-19 Jun-19 2019 Net sales $2,865 $3,208 $2,857 $2,894 $11,824 $3,274 $3,744 $3,370 $3,295 $13,683 $3,524 $4,005 $3,744 $3,590 $14,863 % Change 1.1% 2.7% 7.5% 9.4% 5.0% 14.3% 16.7% 18.0% 13.9% 15.7% 7.6% 7.0% 11.1% 9.0% 8.6% Cost of sales 596 637 591 613 2,437 711 751 683 697 2,842 823 910 819 835 3,387 Gross profit $2,269 $2,571 $2,266 $2,281 $9,387 $2,563 $2,993 $2,687 $2,598 $10,841 $2,701 $3,095 $2,925 $2,755 $11,476 % Gross margin 79.2% 80.1% 79.3% 78.8% 79.4% 78.3% 79.9% 79.7% 78.8% 79.2% 76.6% 77.3% 78.1% 76.7% 77.2% SG&A 1,825 1,917 1,780 1,947 7,469 1,961 2,214 2,093 2,288 8,556 2,008 2,257 2,170 2,422 8,857 Operating income $418 $617 $427 $230 $1,692 568 712 497 277 $2,054 652 771 674 216 $2,313 % Operating margin 14.6% 19.2% 14.9% 7.9% 14.3% 17.3% 19.0% 14.7% 8.4% 15.0% 18.5% 19.3% 18.0% 6.0% 15.6% Interest expense, net 15 17 20 23 75 19 20 17 16 72 19 23 17 16 75 Other Expense (Income) (70) 1 (69) EBT $403 $600 $407 207 $1,617 549 692 480 261 $1,982 633 748 727 199 $2,307 D&A 106 112 107 139 464 127 129 133 142 531 132 137 135 149 553 EBITDA $524 $729 534 369 $2,156 695 841 630 419 $2,585 784 908 809 365 $2,866 Taxes 107 170 107 (23) 361 119 565 106 73 863 131 171 170 41 513 Minority interest (2) (2) (2) (1) (7) (3) (2) (2) (2) (9) (2) (4) (2) (1) (9) Net Income $294 $428 $298 $229 $1,249 $427 $125 $372 $186 $1,110 $500 $573 $555 $157 $1,785 Source: Company Reports

- 15. EL May 4, 2020 Equity Analysis Alexander Lai, Equity Research Extern, (718) 962-4212, alai5@binghamton.eduPage 15 of 15 Chart 26: Historical Cash Flow Statement 1Q17 2Q17 3Q17 4Q17 FY 1Q18 2Q18 3Q18 4Q18 FY 1Q19 2Q19 Q319 Q419 FY Sep-16 Dec-16 Mar-17 Jun-17 2017 Sep-17 Dec-17 Mar-18 Jun-18 2018 Sep-18 Dec-18 Mar-19 Jun-19 2019 Net earnings 296 726 1,026 1,256 1,256 430 555 929 1,117 1,117 502 1,079 1,636 1,794 1,794 Adjustments to reconcile net earnings to net cash flows: Depreciation and amortization 106 218 337 464 464 127 256 389 531 531 132 269 404 557 557 Amortization of purchased royalty rights 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Deferred income taxes (32) (55) (84) (118) (118) (3) 106 84 175 175 (9) (46) (46) (66) (66) Non-cash stock compensation 88 134 175 219 219 57 132 196 236 236 58 131 201 0 0 Excess tax benefits from stock-based compensation arrangements (10) (14) (37) (45) (45) 0 0 0 0 0 0 0 0 0 0 Loss on disposal of fixed assets (7) (7) (4) 5 5 3 7 12 15 15 3 5 6 0 0 Minority interest 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Non-cash portion of restructuring and other non-recurring expenses 1 3 3 3 3 0 1 1 1 1 0 0 0 0 0 Other non-cash items 16 25 24 (5) (5) 8 15 (30) (77) (77) (3) 39 14 234 234 Discontinued operations, net of tax 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Cumulative effect of change in accounting principle 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Changes in operating assets and liabilities: Increase in accounts receivable, net (365) (243) (242) (92) (92) (390) (281) (325) (105) (105) (546) (343) (377) (169) (169) Decrease (increase) in inventory and promotional merchandise, Net (31) 78 59 (85) (85) (16) 66 0 (147) (147) (36) (21) (184) (375) (375) Increase in other assets 4 (32) (30) (80) (80) 13 12 1 12 12 (18) (53) (73) (62) (62) Decrease in accounts payable (170) (143) (168) 54 54 (166) (111) 20 349 349 (262) (174) (105) 604 604 Increase in accrued income taxes (46) 0 0 224 224 0 0 0 0 0 0 0 0 0 0 Increase in other accrued liabilities 0 134 193 - - 30 692 654 466 466 60 387 280 0 0 Decrease in other non-current liabilities 0 0 0 0 0 0 Net cash flows used for operating activities of discontinued operations 0 0 0 0 Net cash provided by (used in) operating activities ($150) $824 $1,252 $1,800 $1,800 $93 $1,450 $1,931 $2,573 $2,573 ($119) $1,273 $1,756 $2,517 $2,517 Capital expenditures (85) (208) (316) (504) (504) (116) (263) (368) (629) (629) (128) (292) (441) (744) (744) Capital expenditures of discontinued operations 0 0 0 0 0 0 0 0 0 0 0 0 0 Acquisition of businesses (net of acquired cash) (10) (1,690) (1,690) (1,681) (1,681) (11) (11) (11) (11) (11) 0 0 0 0 0 Proceeds from disposition of long-term investments 365 637 955 1,226 1,226 0 609 716 749 749 173 271 1,229 1,215 1,215 Purchase of long-term investments (336) (466) (1,067) (1,267) (1,267) (148) (479) (492) (478) (478) (14) (14) (14) (100) (100) Proceeds from divestitures/other 12 12 12 311 0 0 0 0 0 0 0 0 0 Net cash used in investing activities ($66) ($1,727) ($2,106) ($2,214) ($2,214) $36 ($144) ($155) ($369) ($369) $31 ($35) $774 $371 $371 Increase (decrease) in short-term debt, net 263 1,817 194 165 165 362 222 106 (8) (8) (3) (169) (167) (167) (167) Proceeds from issuance of long-term debt, net (2) (3) 1,498 1,498 1,498 0 (1) 0 0 0 0 0 (1) (466) (466) Debt issuance costs 0 0 (10) (11) (11) 0 0 0 0 0 0 0 0 0 0 Proceeds from the net settlement of Treasure Lock agreements 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Repayments and redemptions of long-term debt 0 0 (4) (306) (306) 0 0 (1) (2) (2) 0 0 0 0 0 Net proceeds from employee stock transactions 26 41 94 186 186 48 83 157 182 182 0 0 0 0 0 Excess tax benefits from stock-based compensation arrangements 10 14 37 0 0 0 0 0 0 0 33 59 154 154 154 Acquisition of treasury stock (222) (363) (363) (413) (413) (111) (398) (676) (759) (759) (530) (1,126) (1,344) (1,555) (1,555) Dividends paid (111) (236) (361) (486) (486) (126) (267) (407) (546) (546) (141) (297) (453) (609) (609) Distributions made to minority holders & other 0 0 (2) (3) (3) 0 (1) (1) (39) (39) (1) (3) (3) (75) (75) Proceeds from the issuance of commercial paper 0 0 0 0 0 0 0 0 0 0 0 0 0 Net cash provided by (used in) financing activities ($36) $1,270 $1,083 $630 $630 $173 ($362) ($822) ($1,172) ($1,172) ($642) ($1,536) ($1,814) ($2,718) ($2,718) Source: Company Reports