Spain - First penalties relating to SII

•

1 like•716 views

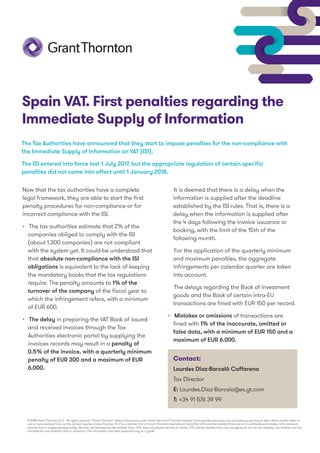

The Spanish tax authorities have begun imposing penalties for non-compliance with Immediate Supply of Information (ISI) VAT reporting requirements, now that the legal framework for penalties is in place. Approximately 1,300 companies, or 2% of those required to comply, have not yet implemented ISI. Penalties include fines of 1% of annual turnover for complete non-compliance, 0.5% of invoices for late reporting, and €150 per unreported transaction. Authorities will also fine inaccurate, omitted, or false reporting by 1% of the erroneous amounts, with a minimum of €150 and maximum of €6,000.

Report

Share

Report

Share

Download to read offline

Recommended

Fiscal bulletin regarding the VAT split payment mechanism - Țucă Zbârcea & As...

Fiscal bulletin regarding the VAT split payment mechanism - Țucă Zbârcea & As...Țuca Zbârcea & Asociații

More Related Content

What's hot

Fiscal bulletin regarding the VAT split payment mechanism - Țucă Zbârcea & As...

Fiscal bulletin regarding the VAT split payment mechanism - Țucă Zbârcea & As...Țuca Zbârcea & Asociații

What's hot (20)

Fiscal bulletin regarding the VAT split payment mechanism - Țucă Zbârcea & As...

Fiscal bulletin regarding the VAT split payment mechanism - Țucă Zbârcea & As...

The fiscal regime in Albania for upstream oil and gas operations

The fiscal regime in Albania for upstream oil and gas operations

10 facts about taxation in Slovakia | Infographic 2017

10 facts about taxation in Slovakia | Infographic 2017

Brexit Broadcast: What we know so far and where is the momentum heading

Brexit Broadcast: What we know so far and where is the momentum heading

Francis Clark Tax Consultancy - London Conference 2018

Francis Clark Tax Consultancy - London Conference 2018

Similar to Spain - First penalties relating to SII

Similar to Spain - First penalties relating to SII (20)

The most important changes foreseen by the new 2018 Tax Code in Romania

The most important changes foreseen by the new 2018 Tax Code in Romania

Grant Thornton Vietnam Tax Newsletter - August 2016

Grant Thornton Vietnam Tax Newsletter - August 2016

Tuca Zbarcea & Asociatii - Fiscal Bulletin - GEO 114

Tuca Zbarcea & Asociatii - Fiscal Bulletin - GEO 114

Grant Thornton Hungary Tax News - November 2014 en (2)

Grant Thornton Hungary Tax News - November 2014 en (2)

International Indirect Tax - Global VAT/GST update (June 2018)

International Indirect Tax - Global VAT/GST update (June 2018)

Albania Taxation, 2014: Growing tax compliance for ensuring government’s publ...

Albania Taxation, 2014: Growing tax compliance for ensuring government’s publ...

Evaluation of Tax Inspection on Annual Information Income Taxes Corporation T...

Evaluation of Tax Inspection on Annual Information Income Taxes Corporation T...

Sherman Nigretti - Finland - corporate and tax highlights 2016

Sherman Nigretti - Finland - corporate and tax highlights 2016

Doing Business In Spain 2012 Borrador Modificado.Ppt

Doing Business In Spain 2012 Borrador Modificado.Ppt

More from Alex Baulf

More from Alex Baulf (20)

UK: VAT alert - Government publicises VAT changes if there is “no-deal” on B...

UK: VAT alert - Government publicises VAT changes if there is “no-deal” on B...

USA: Georgia Enacts Legislation Imposing Bright-Line Nexus Collection or Repo...

USA: Georgia Enacts Legislation Imposing Bright-Line Nexus Collection or Repo...

U.S. Supreme Court Holds Hearing in South Dakota v. Wayfair

U.S. Supreme Court Holds Hearing in South Dakota v. Wayfair

China: Tax Bulletin-Latest update on VAT Regulations

China: Tax Bulletin-Latest update on VAT Regulations

India: Recommendations from GST Council in 25th meeting

India: Recommendations from GST Council in 25th meeting

Serbia: Tax Alert - Amendments of Serbian Tax Laws (Dec 2017)

Serbia: Tax Alert - Amendments of Serbian Tax Laws (Dec 2017)

USA: NY - New York Appellate Division Holds Certain Data Information Services...

USA: NY - New York Appellate Division Holds Certain Data Information Services...

UK: Briefing Paper - Are you ready for Making Tax Digital?

UK: Briefing Paper - Are you ready for Making Tax Digital?

Cyprus: VAT Alert - VAT on building land, leasing of commercial immovable pro...

Cyprus: VAT Alert - VAT on building land, leasing of commercial immovable pro...

Germany VAT Alert: Call-Off stock - Changes in VAT treatment in Germany

Germany VAT Alert: Call-Off stock - Changes in VAT treatment in Germany

Recently uploaded

🔝+919953056974 🔝young Delhi Escort service Pusa Road

🔝+919953056974 🔝young Delhi Escort service Pusa Road9953056974 Low Rate Call Girls In Saket, Delhi NCR

call girls in Nand Nagri (DELHI) 🔝 >༒9953330565🔝 genuine Escort Service 🔝✔️✔️

call girls in Nand Nagri (DELHI) 🔝 >༒9953330565🔝 genuine Escort Service 🔝✔️✔️9953056974 Low Rate Call Girls In Saket, Delhi NCR

Recently uploaded (20)

Monthly Market Risk Update: April 2024 [SlideShare]![Monthly Market Risk Update: April 2024 [SlideShare]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Monthly Market Risk Update: April 2024 [SlideShare]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Monthly Market Risk Update: April 2024 [SlideShare]

Andheri Call Girls In 9825968104 Mumbai Hot Models

Andheri Call Girls In 9825968104 Mumbai Hot Models

Financial institutions facilitate financing, economic transactions, issue fun...

Financial institutions facilitate financing, economic transactions, issue fun...

Unveiling the Top Chartered Accountants in India and Their Staggering Net Worth

Unveiling the Top Chartered Accountants in India and Their Staggering Net Worth

How Automation is Driving Efficiency Through the Last Mile of Reporting

How Automation is Driving Efficiency Through the Last Mile of Reporting

VIP Call Girls LB Nagar ( Hyderabad ) Phone 8250192130 | ₹5k To 25k With Room...

VIP Call Girls LB Nagar ( Hyderabad ) Phone 8250192130 | ₹5k To 25k With Room...

20240417-Calibre-April-2024-Investor-Presentation.pdf

20240417-Calibre-April-2024-Investor-Presentation.pdf

🔝+919953056974 🔝young Delhi Escort service Pusa Road

🔝+919953056974 🔝young Delhi Escort service Pusa Road

Independent Lucknow Call Girls 8923113531WhatsApp Lucknow Call Girls make you...

Independent Lucknow Call Girls 8923113531WhatsApp Lucknow Call Girls make you...

call girls in Nand Nagri (DELHI) 🔝 >༒9953330565🔝 genuine Escort Service 🔝✔️✔️

call girls in Nand Nagri (DELHI) 🔝 >༒9953330565🔝 genuine Escort Service 🔝✔️✔️

VIP Call Girls Service Dilsukhnagar Hyderabad Call +91-8250192130

VIP Call Girls Service Dilsukhnagar Hyderabad Call +91-8250192130

VIP Kolkata Call Girl Jodhpur Park 👉 8250192130 Available With Room

VIP Kolkata Call Girl Jodhpur Park 👉 8250192130 Available With Room

letter-from-the-chair-to-the-fca-relating-to-british-steel-pensions-scheme-15...

letter-from-the-chair-to-the-fca-relating-to-british-steel-pensions-scheme-15...

Spain - First penalties relating to SII

- 1. Now that the tax authorities have a complete legal framework, they are able to start the first penalty procedures for non-compliance or for incorrect compliance with the ISI. • The tax authorities estimate that 2% of the companies obliged to comply with the ISI (about 1.300 companies) are not compliant with the system yet. It could be understood that that absolute non-compliance with the ISI obligations is equivalent to the lack of keeping the mandatory books that the tax regulations require. The penalty amounts to 1% of the turnover of the company of the fiscal year to which the infringement refers, with a minimum of EUR 600. • The delay in preparing the VAT Book of issued and received invoices through the Tax Authorities electronic portal by supplying the invoices records may result in a penalty of 0.5% of the invoice, with a quarterly minimum penalty of EUR 300 and a maximum of EUR 6.000. Spain VAT. First penalties regarding the Immediate Supply of Information It is deemed that there is a delay when the information is supplied after the deadline established by the ISI rules. That is, there is a delay when the information is supplied after the 4 days following the invoice issuance or booking, with the limit of the 15th of the following month. For the application of the quarterly minimum and maximum penalties, the aggregate infringements per calendar quarter are taken into account. The delays regarding the Book of investment goods and the Book of certain intra-EU transactions are fined with EUR 150 per record. • Mistakes or omissions of transactions are fined with 1% of the inaccurate, omitted or false data, with a minimum of EUR 150 and a maximum of EUR 6.000. The Tax Authorities have announced that they start to impose penalties for the non-compliance with the Immediate Supply of Information on VAT (ISI). The ISI entered into force last 1 July 2017, but the appropriate regulation of certain specific penalties did not come into effect until 1 January 2018. © 2018 Grant Thornton S.L.P. - All rights reserved. “Grant Thornton” refers to the brand under which the Grant Thornton member firms provide assurance, tax and advisory services to their clients and/or refers to one or more member firms, as the context requires. Grant Thornton S.L.P is a member firm of Grant Thornton International Ltd (GTIL). GTIL and the member firms are not a worldwide partnership. GTIL and each member firm is a separate legal entity. Services are delivered by the member firms. GTIL does not provide services to clients. GTIL and its member firms are not agents of, and do not obligate, one another and are not liable for one another’s acts or omissions. This information has been prepared only as a guide. Contact: Lourdes Díaz-Barceló Caffarena Tax Director E: Lourdes.Diaz-Barcelo@es.gt.com T: +34 91 576 39 99