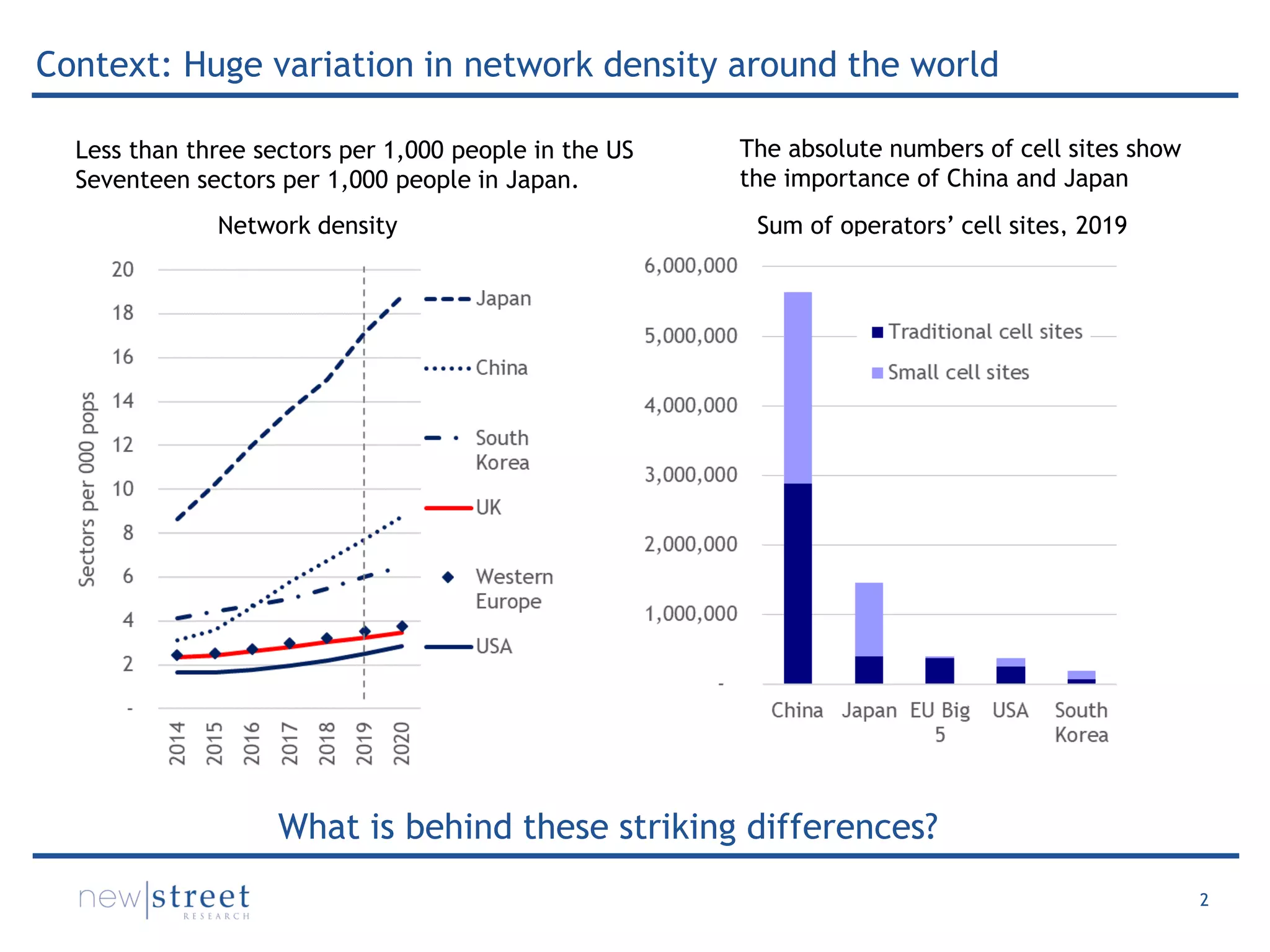

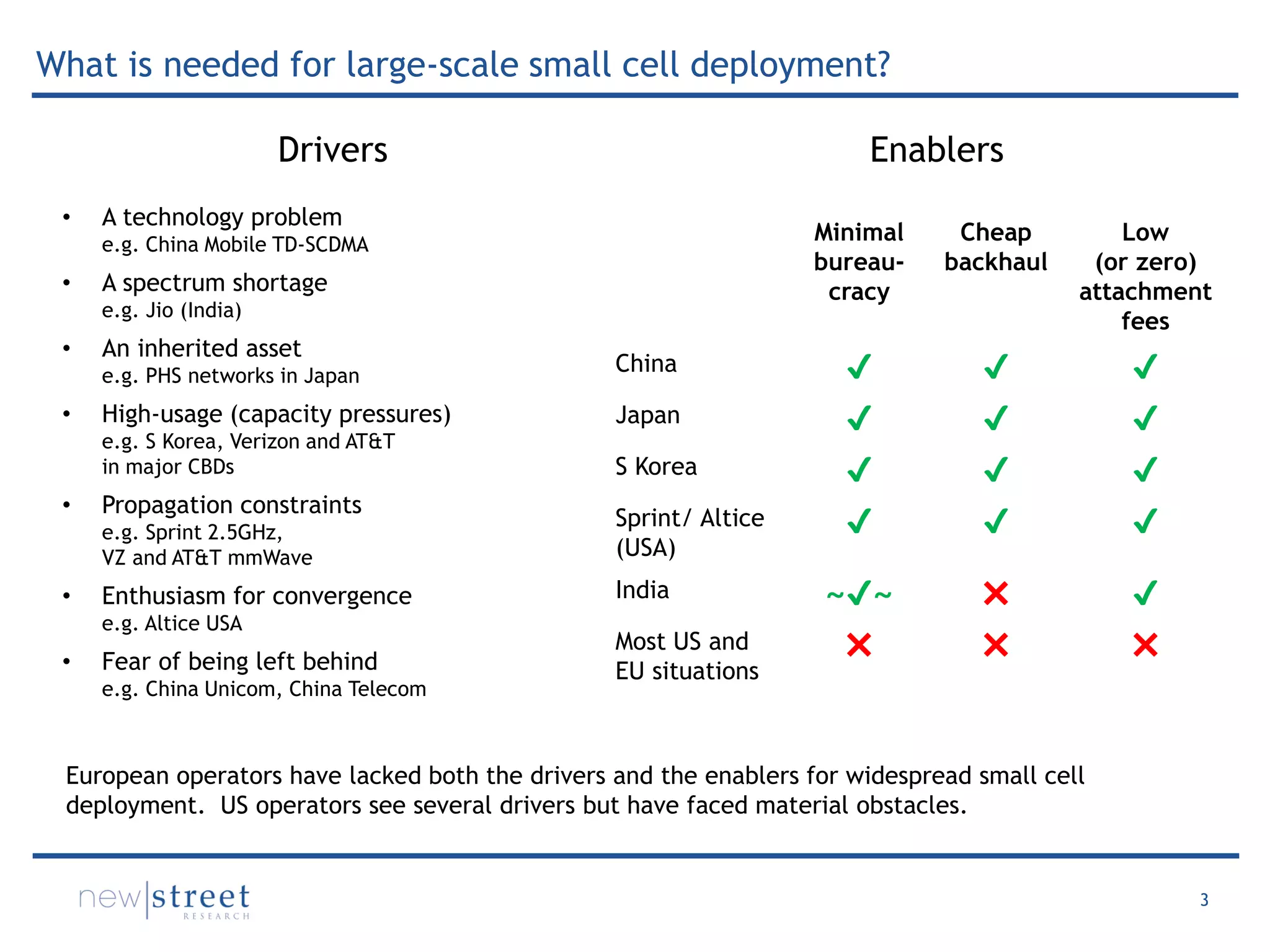

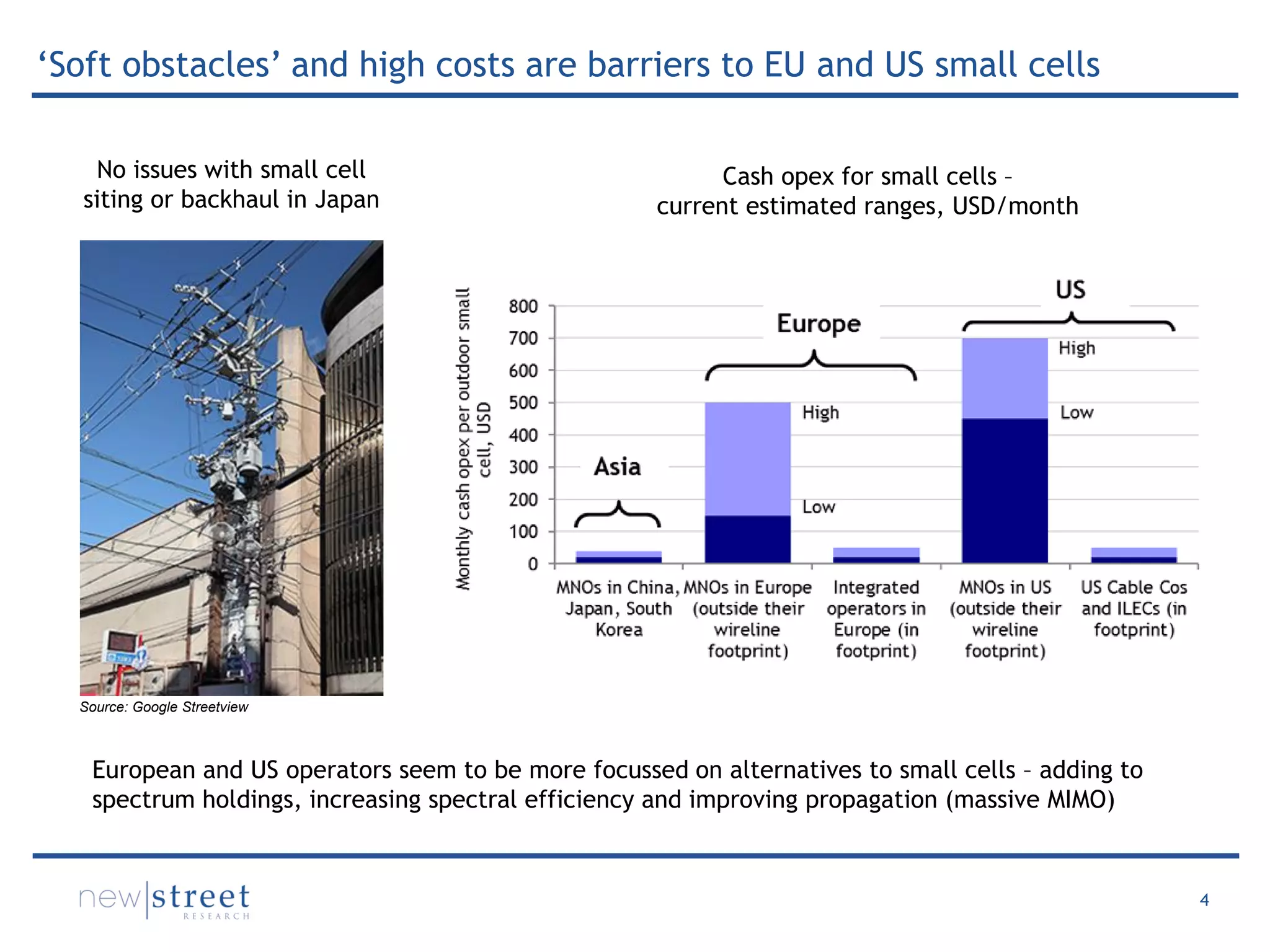

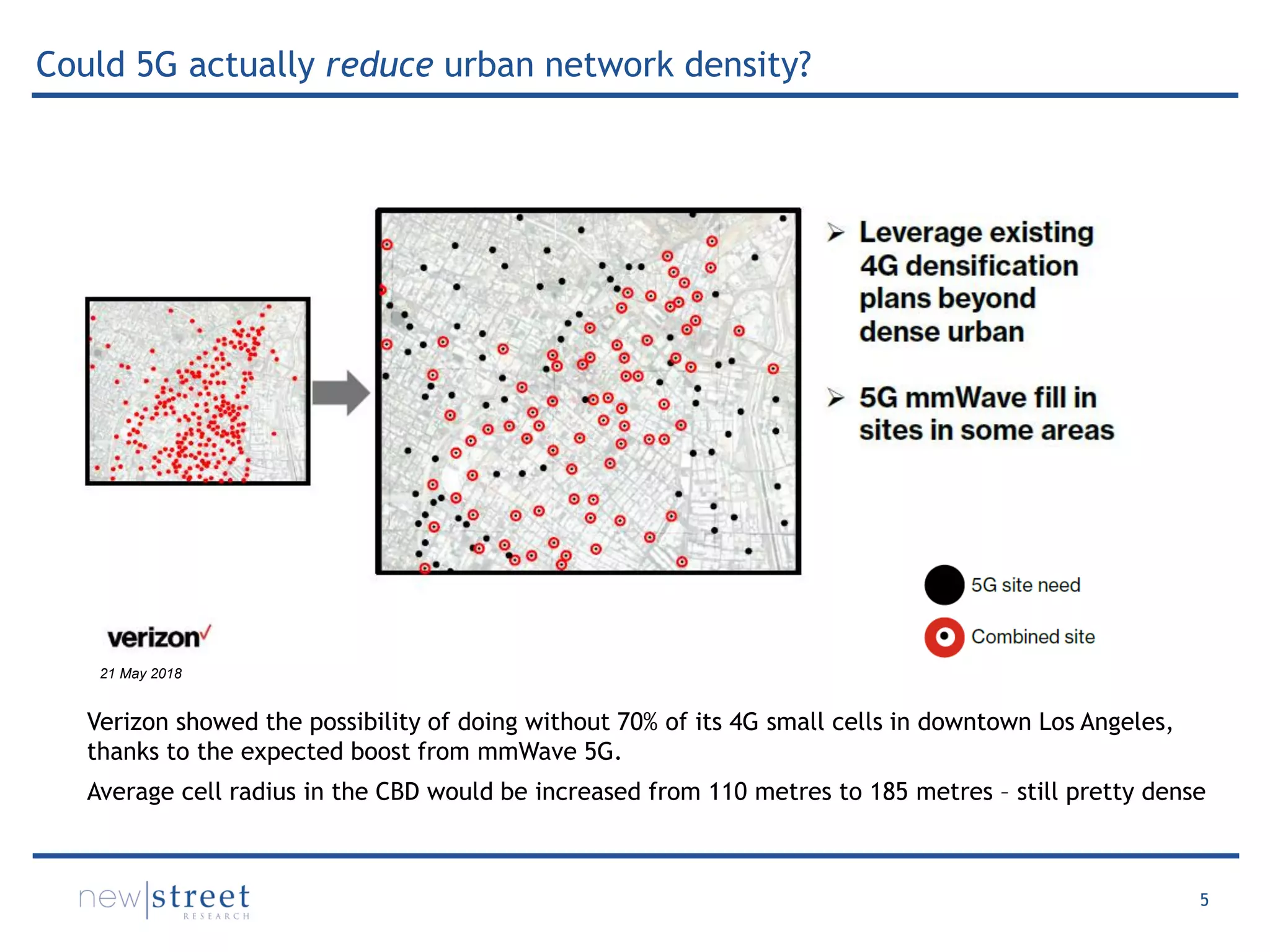

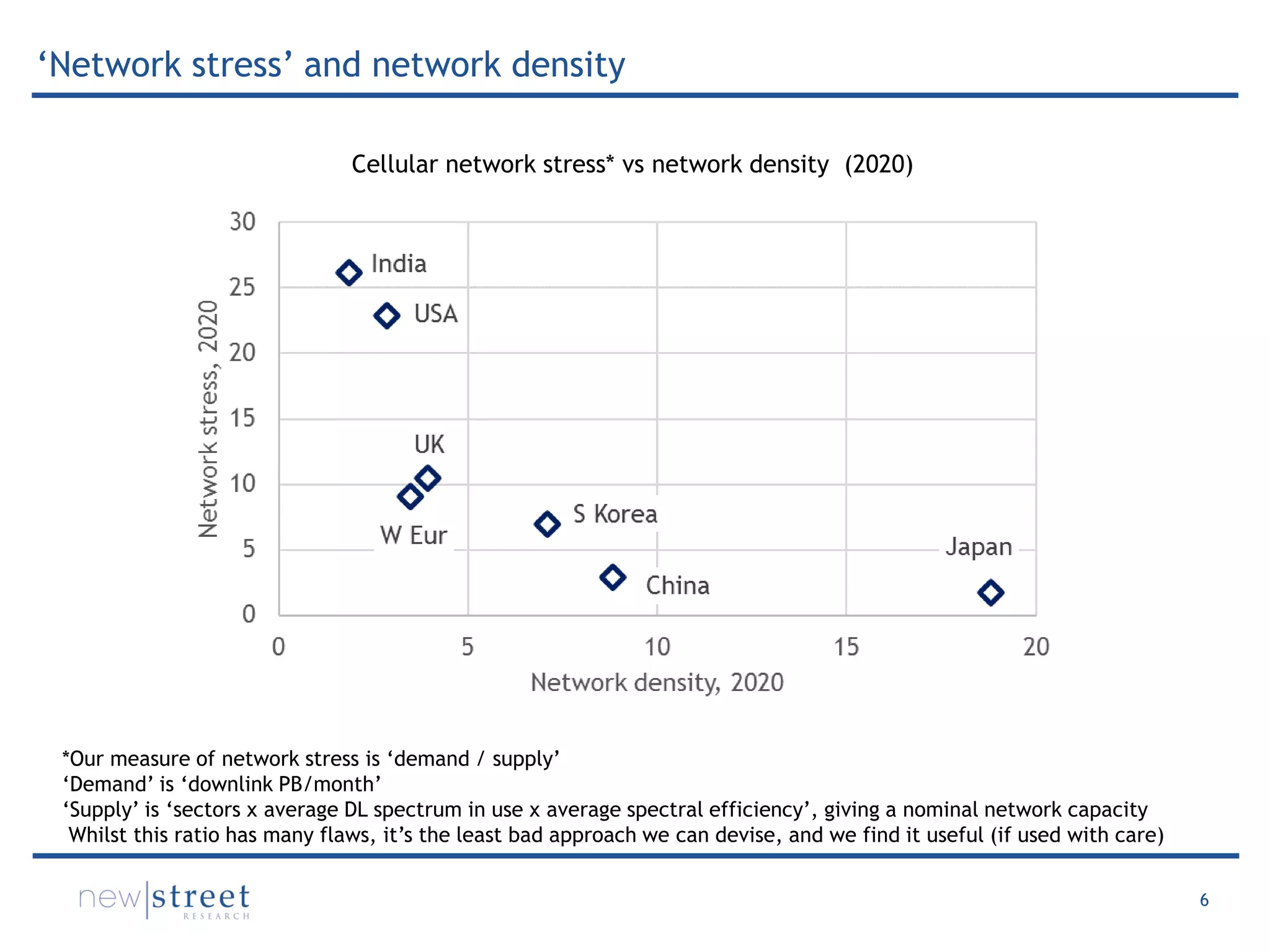

The document discusses the global landscape of small cell deployment in telecommunications, highlighting a significant variation in network density across countries such as the US, Japan, and China. It identifies key drivers and enablers for effective small cell adaptation, emphasizing challenges faced by European and US operators due to regulatory and financial obstacles. Additionally, it raises questions about the future of small cells in relation to 5G technology and urban network density.