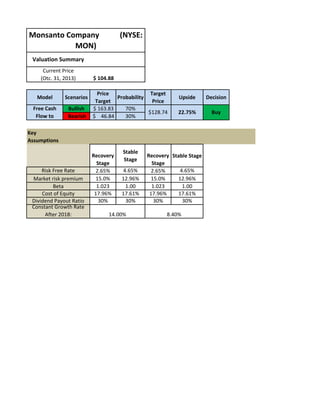

More Related Content Similar to Free cash flow monsanto (20) 1. Monsanto Company

MON)

(NYSE:

Valuation Summary

Current Price

(Otc. 31, 2013)

Model

Scenarios

Free Cash

Flow to

Bullish

Bearish

$ 104.88

Price

Target

Probability

Target

Price

$ 163.83

70%

$128.74

$ 46.84

30%

Upside

Decision

22.75%

Buy

Key

Assumptions

Risk Free Rate

Market risk premium

Beta

Cost of Equity

Dividend Payout Ratio

Constant Growth Rate

After 2018:

Recovery

Stage

2.65%

15.0%

1.023

17.96%

30%

Stable

Stage

4.65%

12.96%

1.00

17.61%

30%

14.00%

Recovery Stable Stage

Stage

4.65%

2.65%

15.0%

12.96%

1.023

1.00

17.96%

17.61%

30%

30%

8.40%

2. (Dollars in millions, except per share amounts)

Net Sales

Cost of goods sold

Gross Profit

Operating Expenses:

Selling, general and administrative expenses

Research and development expenses

Acquired in-process research and development

Restructuring charges, net

Total Operating Expenses

Income from Operations

EBITDA

Interest expense

Interest income

Solutia-related income, net

Other expense, net

Income from Continuing Operations Before Income Taxes

Income tax provision

Income from Continuing Operations Including

Portion Attributable to Noncontrolling Interest

Discontinued Operations:

Income from operations of discontinued businesses

Income tax provision

Income on Discontinued Operations

Net Income

Less: Net income attributable to noncontrolling interest

Net Income Attributable to Monsanto Company

Amounts Attributable to Monsanto Company:

Income from continuing operations

Income on discontinued operations

Net Income Attributable to Monsanto Company

Basic Earnings per Share Attributable

to Monsanto Company:

Income from continuing operations

Income on discontinued operations

Net Income Attributable to Monsanto Company

Diluted Earnings per Share Attributable

to Monsanto Company:

Income from continuing operations

Income on discontinued operations

Net Income Attributable to Monsanto Company

EPS growth

Weighted Average Shares Outstanding:

Basic

Diluted

2008

$11,365

5,188

6,177

2009

$11,724

4,962

6,762

2010

$10,502

5,416

5,086

2011

$11,822

5,743

6,079

2012

$13,504

6,459

7,045

2013

$14,861

7,208

7,653

2,312

980

164

2,037

1,098

163

361

3,659

3,103

3,651

129

(71)

2,064

1,205

2,190

1,386

2,390

1,517

2,550

1,533

210

3,479

1,607

2,209

162

(56)

1

3,577

2,502

3,115

162

(74)

(10)

3,897

3,148

3,770

191

(77)

4,083

3,570

4,185

172

(92)

78

2,967

7

1,494

40

2,374

46

2,988

61

3,429

899

2,027

845

2,122

370

1,124

717

1,657

901

2,087

915

2,514

20

3

17

2,044

20

$2,024

19

8

11

2,133

24

$2,109

4

4

1,128

19

$1,109

3

1

2

1,659

52

$1,607

10

4

6

2,093

48

$2,045

17

6

11

2,525

43

$2,482

$2,007

17

$2,024

$2,098

11

$2,109

$1,105

4

$1,109

$1,605

2

$1,607

$2,039

6

$2,045

$2,471

11

$2,482

$3.66

0.03

$3.69

$3.83

0.02

$3.85

$2.03

0.01

$2.04

$2.99

0.01

$3.00

$3.82

0.01

$3.83

$4.63

0.02

$4.65

$3.59

0.03

$3.62

$3.78

0.02

$3.80

4.97%

$2.01

$2.96

$2.01

-47.11%

$2.96

47.26%

$3.78

0.01

$3.79

28.04%

$4.58

0.02

$4.60

21.37%

548.90

559.70

547.10

555.60

543.70

550.80

536.50

542.40

534.10

540.20

533.70

539.70

3,456

2,721

3,294

110

(132)

(187)

4

2,926

2014

15740.22

2015

16758.26

2016

18408.26

2017

20120.48

2018

21793.7

2019

23306.81

3. (Dollars in millions, except share amounts)

Assets

Current Assets:

Cash and cash equivalents (variable interest

entities restricted - 2013: $140 and 2012:$120

Short-term investments

Trade receivables, net (variable interest

entities restricted - 2013: $0 and 2012:$52

Miscellaneous receivables

Deferred tax assets

Inventory, net

Other current assets

Total Current Assets

Total property, plant and equipment

Less: Accumulated depreciation

Property, Plant and Equipment, Net

Goodwill

Other Intangible Assets, Net

Noncurrent Deferred Tax Assets

Long-Term Receivables, Net

Other Assets

Total Assets

Liabilities and Shareowners Equity

Current Liabilities:

Short-term debt, including current portion

of long-term debt

Accounts payable

Income taxes payable

Accrued compensation and benefits

Accrued marketing programs

Deferred revenues

Grower production accruals

Dividends payable

Customer payable

Restructuring reserves

Miscellaneous short-term accruals

Total Current Liabilities

Long-Term Debt

Postretirement Liabilities

Long-Term Deferred Revenue

Noncurrent Deferred Tax Liabilities

Long-Term Portion of Environmental and

Litigation Liabilities

Other Liabilities

Shareowners Equity:

Common stock (authorized: 1,500,000,000 shares, par value

$0.01)

2009

2010

2011

2012

2013

$1,956

$1,485

$2,572

$3,283

$3,668

1,556

1,590

302

2,117

302

1,897

254

1,715

654

662

2,934

121

7,883

7,158

3,549

3,609

3,218

1,371

743

557

496

$17,877

717

511

2,739

80

7,122

8,068

3,841

4,227

3,204

1,263

1,014

513

524

$17,867

629

446

2,591

152

8,809

8,697

4,303

4,394

3,365

1,309

873

475

619

$19,844

620

534

2,839

183

9,658

8,835

4,470

4,365

3,435

1,237

551

376

602

$20,224

748

579

2,947

166

10,077

9,491

4,837

4,654

3,520

1,226

454

237

496

$20,664

$79

$241

$678

$36

$51

676

79

263

934

219

139

145

307

286

629

3,756

1,724

793

488

153

197

752

66

179

839

219

130

151

83

197

684

3,541

1,862

920

395

137

188

839

117

427

1,110

373

87

161

94

24

819

4,729

1,543

509

337

152

176

794

75

546

1,281

396

194

200

14

995

91

492

1,078

517

60

228

12

685

4,221

2,038

543

245

313

213

812

4,336

2,061

357

138

469

193

641

681

682

615

382

6

6

6

6

6

Issued 601,631,267 and 596,136,929 shares, respectively

Outstanding 529,029,712 and 534,373,880 shares, respectively

Treasury stock 72,601,555 and 61,763,049

shares, respectively, at cost

Additional contributed capital

Retained earnings

Accumulated other comprehensive loss

Reserve for ESOP debt retirement

Total Monsanto Company Shareowners Equity

Noncontrolling Interest

Total Shareowners Equity

Total Liabilities and Shareowners Equity

Non-cash Working Capital

(1,577)

(2,110)

(2,613)

(3,045)

(4,140)

9,695

2,682

(744)

(6)

10,056

69

10,125

$17,877

2,171

9,896

3,208

(897)

(4)

10,099

44

10,143

$17,867

2,096

10,096

4,174

(116)

(2)

11,545

171

11,716

$19,844

1,508

10,371

5,537

(1,036)

10,783

7,188

(1,278)

11,833

203

12,036

$20,224

2,154

12,559

169

12,728

$20,664

2,073

$1,803

$2,103

$2,221

$2,074

$2,112

($153)

3651

-0.04

$618

($351)

($1,209)

($1,556)

2209

3115

3770

4185

0.28

-0.11

-0.32

-0.37

-0.11

4. (Dollars in millions)

Operating Activities:

Net Income

Adjustments to reconcile cash provided

by operating activities:

Items that did not require (provide) cash:

Depreciation and amortization

Bad-debt expense

Receipt of securities from Solutia settlement

Stock-based compensation expense

Excess tax benefits from stock-based compensation

Deferred income taxes

Restructuring charges, net

Equity affiliate income, net

Acquired in-process research and development

Net gain on sales of a business or other assets

Other items, net

Changes in assets and liabilities that

provided (required) cash, net of acquisitions:

Trade receivables, net

Inventory, net

Deferred revenues

Accounts payable and other accrued liabilities

Restructuring cash payments

Pension contributions

Net investment hedge settlement

Other items, net

Net Cash Provided by Operating Activities

Investing Activities:

Cash Flows Provided (Required) by Investing

Purchases of short-term investments

Maturities of short-term investments

Capital expenditures

Acquisition of businesses, net of cash acquired

Purchases of long-term debt and equity securities

Technology and other investments

Proceeds from divestiture of a business

Other investments and property disposal proceeds

Net Cash Required by Investing Activities

Financing Activities:

Cash Flows Provided (Required) by Financing

Net change in financing with less than 90-day maturities

Short-term debt proceeds

Short-term debt reductions

Long-term debt proceeds

Long-term debt reductions

Payments on other financing

Debt issuance costs

Treasury stock purchases

Stock option exercises

Excess tax benefits from stock-based compensation

Tax withholding on restricted stock and

restricted stock units

Dividend payments

Proceeds from noncontrolling interest

Dividend payments to noncontrolling interests

Net Cash Required by Financing Activities

Cash Assumed from Initial Consolidations

of Variable Interest Entities

Effect of Exchange Rate Changes on Cash and Cash Equivalents

Net Increase in Cash and Cash Equivalents

Cash and Cash Equivalents at Beginning of Period

Cash and Cash Equivalents at End of Period

2008

2009

2010

2011

2012

2013

$2,044

$2,133

$1,128

$1,659

$2,093

$2,525

573

57

(38)

90

(198)

47

548

49

602

58

613

3

622

3

615

27

102

(43)

10

210

(29)

104

(36)

124

1

(21)

128

(50)

263

(10)

(19)

100

(79)

176

25

116

(35)

264

361

(22)

163

(66)

(25)

(3)

65

(5)

18

(4)

2

(17)

(77)

(318)

(691)

492

889

526

(638)

(700)

(327)

(187)

35

51

2,246

(347)

181

85

586

(183)

(291)

170

(427)

(39)

439

(12)

(83)

222

(192)

50

(104)

(120)

(124)

(53)

2,837

(22)

213

(89)

(438)

(263)

(134)

(4)

35

1,398

323

2,814

(25)

3,051

(414)

2,740

(732)

430

(540)

(99)

(746)

746

(646)

(322)

(716)

764

(741)

(165)

(55)

(77)

(88)

50

(834)

21

(975)

11

(1,034)

169

(777)

(142)

75

(45)

48

75

(101)

(71)

(6)

(4)

(1)

(116)

30

(42)

499

(629)

104

22

(29)

32

(2)

(398)

39

35

(532)

56

43

69

84

(74)

299

(193)

(1)

(5)

(502)

65

36

(4)

(5)

(432)

117

50

(19)

(1,095)

257

79

(10)

(419)

(23)

(552)

(10)

(577)

(45)

(125)

(1,075)

(1,038)

(602)

69

(105)

(864)

77

(642)

101

(77)

(1,165)

(802)

133

(174)

(1,485)

77

747

866

$1,613

(105)

343

1,613

$1,956

3

(471)

1,956

$1,485

35

1,087

1,485

$2,572

(141)

711

2,572

$3,283

(93)

385

3,283

$3,668

(2)

164

(132)

59

(918)

(1,022)

(78)

(41)

90

(2,042)

92

(10)

546

(254)

(3)

(5)

(361)

114

198

132

(916)

(329)

(7)

(72)

300

169

(723)

(755)

(57)

(39)

(33)

(17)

(75)

5. Current

Hight Growth

Ratio Analysis

2009A

2010A

2011A

2012A

2013A

2014E

Sales growth

EBITDA growth

EPS growth

3.2%

10.8%

4.97%

-10.4%

-39.5%

-47.11%

12.6%

41.0%

47.26%

14.2%

21.0%

28.04%

10.0%

11.0%

21.37%

Gross margin

EBIT margin

EBITDA margin

Tax rate

Net margin

57.7%

26.5%

31.1%

28.5%

18.0%

48.4%

15.3%

21.0%

24.8%

10.6%

51.4%

21.2%

26.3%

30.2%

13.6%

52.2%

23.3%

27.9%

30.2%

15.1%

51.5%

24.0%

28.2%

26.7%

16.7%

5.9%

8.9%

20.00%

6.00%

52.2%

22.1%

26.9%

30.6%

15.3%

Return on equity (ROE)

20.8%

10.9%

13.7%

17.0%

19.5%

Payout Ratio

26.2%

52.0%

37.5%

31.4%

32.3%

Retention Ratio

73.8%

48.0%

62.5%

68.6%

67.7%

16.4%

17.0%

35.9%

35.9%

64.1%

64.1%

2015E

Stable Growth

2016E

2017E

2018E

2019E

6.5%

9.8%

9.3%

8.3%

6.9%

8.5% 18.1% 13.5% 12.0%

10.5%

19.00% 18.00% 17.00% 16.00% 14.00% Bullish

6.400% 6.800% 7.200% 7.600%

8.40% Bearish

51.2% 51.7% 51.8% 51.7%

51.7%

21.2% 22.3% 22.6% 22.4%

22.1%

26.1% 27.1% 27.2% 27.1%

26.9%

27.2% 31.1% 27.6% 31.6%

30.0%

15.4% 15.4% 16.3% 15.4%

15.5%

17.0%

16.2%

34.9%

34.9%

65.1%

65.1%

17.6%

15.3%

33.9%

33.9%

66.1%

66.1%

18.2%

14.5%

32.9%

32.9%

67.1%

67.1%

18.8%

13.7%

32.0%

32.0%

68.0%

68.0%

20.0%

12.0%

30%

30%

70.0%

70.0%

Bullish

Bearish

Bullish

Bearish

Bullish

Bearish

6. Beta

I calculated beta using regression for the period

01/2006 - 11/2013. Using the covariance formula

Estimating Risk Premium

E(Rm)=

17.61%

High Growth COE

E( R)=

Rf+ b(E(Rm) - Rf)

17.96%

Stable Growth COE

E( R)=

Rf+ b(E(Rm) - Rf)

17.61%

Gordon Growth

value of stock

expected dividend

expexted growth rate

104.88

1.900772

15.80%

Rf

b

E(Rm)

2.65%

1.023422

17.61%

Rf

b

E(Rm)

4.65%

1

17.61%

1.023422

7. Free Cash Flow to Equity

(Year Ending August 31)

2009A

Net Income

2010A

2011A

Current

2013A

2012A

High

Growth

2014E

2978.40

2630.92

3.00%

633.45

2.00%

755.82

2015E

3544.30

2799.30

652.45

770.94

2016E

4182.27

2989.65

672.03

786.36

2017E

4893.26

3204.91

692.19

802.08

2018E

5676.18

3448.48

712.95

818.12

Stable Growth

2019E

6470.84

bullish

3738.15 bearish

734.34

834.49

$2,109

$1,109

$1,607

$2,045

$2,482

548

916

602

755

613

540

622

646

615

741

2,934

7,883

1,956

676

79

145

307

7,654

2,739

7,122

1,485

752

66

151

83

7,324

2,591

8,809

2,572

839

117

161

94

7,617

2,839

9,658

3,283

794

75

200

14

8,131

2,947

10,077

3,668

995

91

228

12

8,030

102% 8150.45

8272.71

8396.80

8522.75

8650.59

8780.35

(330)

293

514

(101)

120.45

122.26

124.09

125.95

127.84

130.00

Add: Depreciation

Less:Capital Expenditures

Inventory, net

Total Current Assets

Cash and Cash Equivalents at End of Period

Accounts payable

Income taxes payable

Dividends payable

Customer payable

Non-Cash Working Capital

Less:Change in Non-Cash Working Capital

Short-term debt proceeds

75

75

84

30

22

Long-term debt proceeds

0

0

299

499

32

Short-term debt reductions

(45)

(101)

(74)

(42)

(29)

Long-term debt reductions

(71)

(4)

(193)

(629)

(2)

Plus: Net Cash Inflow from Borrowings

FCFE

($41)

$1,700

($30)

$1,256

$116

$1,503

($142)

$1,365

$23

$2,480

Growth Rate

Cost of Equity

Risk Free Rate

Beta

Risk Premium

Cost of Equity

Components of Value

Cash Flow - High Growth

Terminal Price

Total Value

Shares Outstanding

Total Value per Share

Target price

14.00%

8.40%

bullish

bearish

High Growth Stable Growth

2.65%

1.02

14.96%

17.96%

4.65%

1.00

12.96%

17.61%

Bullish

Bearish

Target(70%)

target(30%)

$ 11,837.04 $

8,433.32

$ 76,583.68 $ 16,848.67

$ 88,420.72 $ 25,282.00

539.70

539.70

$

163.83 $

128.74

46.84

Relative Multiple

Price

Forward Earnings

P/E

Target

$

128.74

$

5.33

24.2x

Actual

$

104.88

$

4.56

23.0x

Potential Appreciation

22.75%

Recommendation

Buy

bullish

bearish

$ 2,306 $ 2,363 $ 2,393 $ 2,398 $ 2,376 $ 76,584

$ 2,012 $ 1,828 $ 1,667 $ 1,526 $ 1,401 $ 16,849

Present Value

($15)

($15)

($15)

($15)

($15)

($15)

$2,721

$3,289

$3,929

$4,642

$5,428

$6,226

$ 2,373 $ 2,544 $ 2,736 $ 2,954 $ 3,200 $ 3,493

bullish

bearish