Embed presentation

Download to read offline

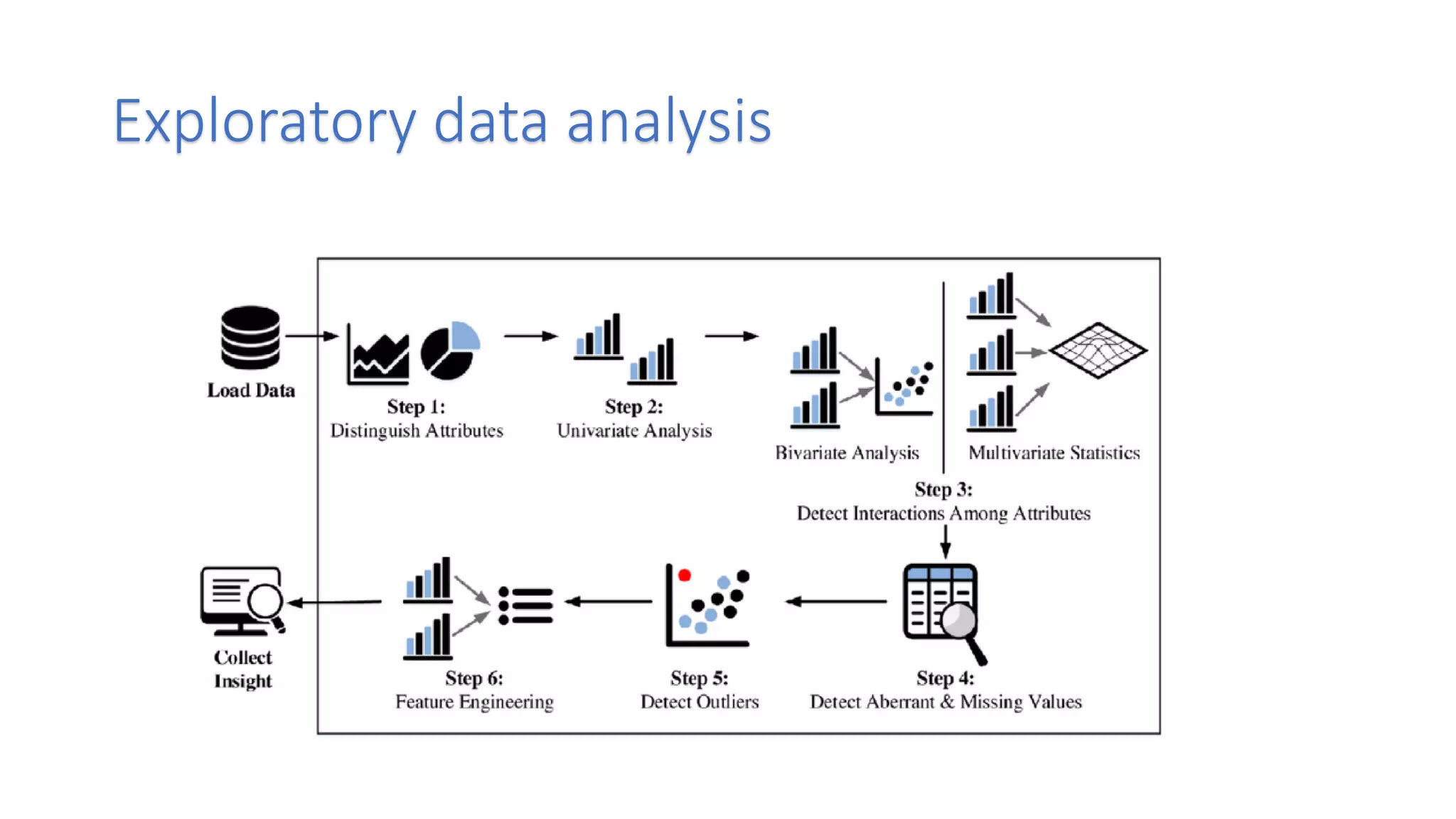

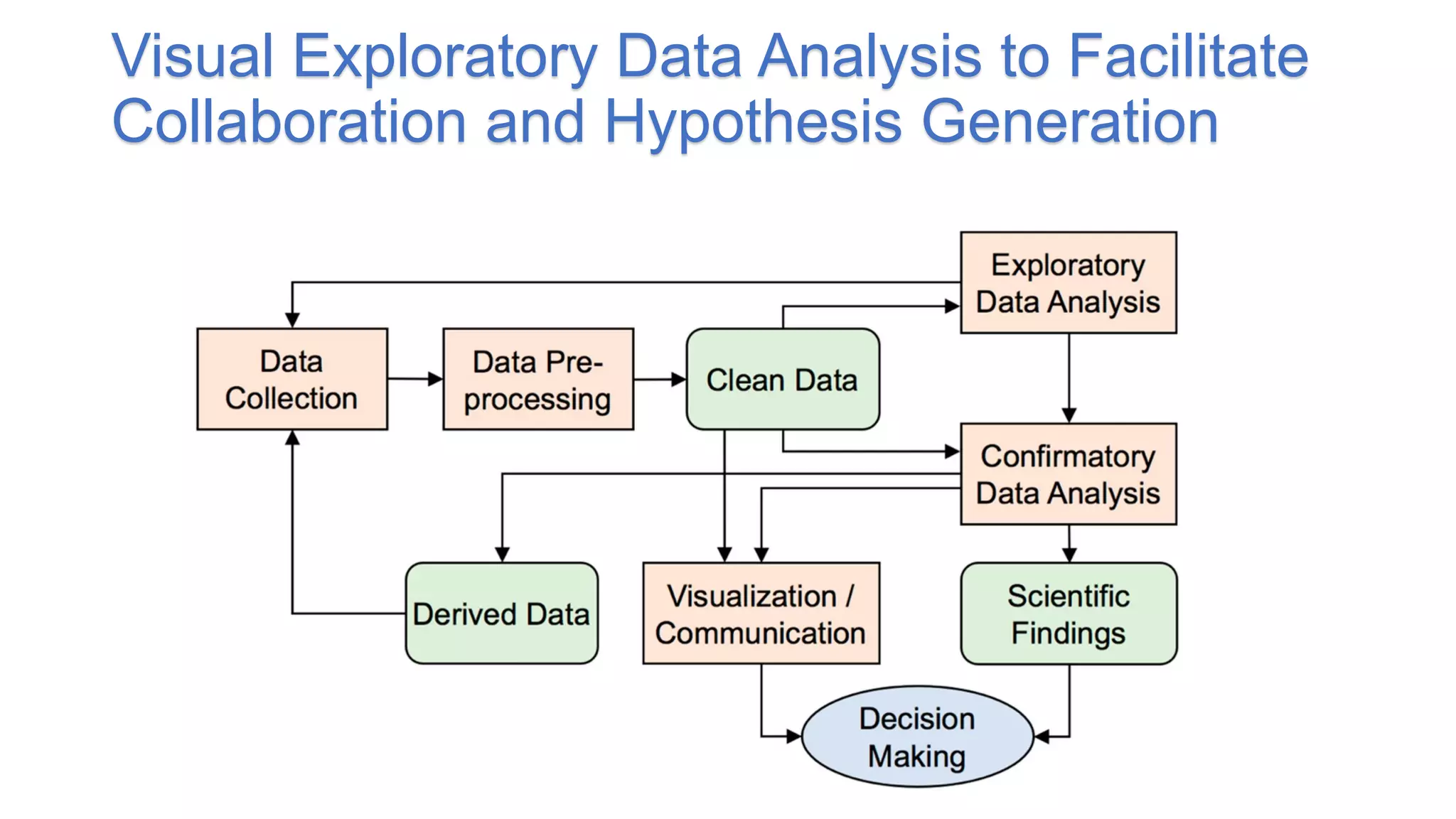

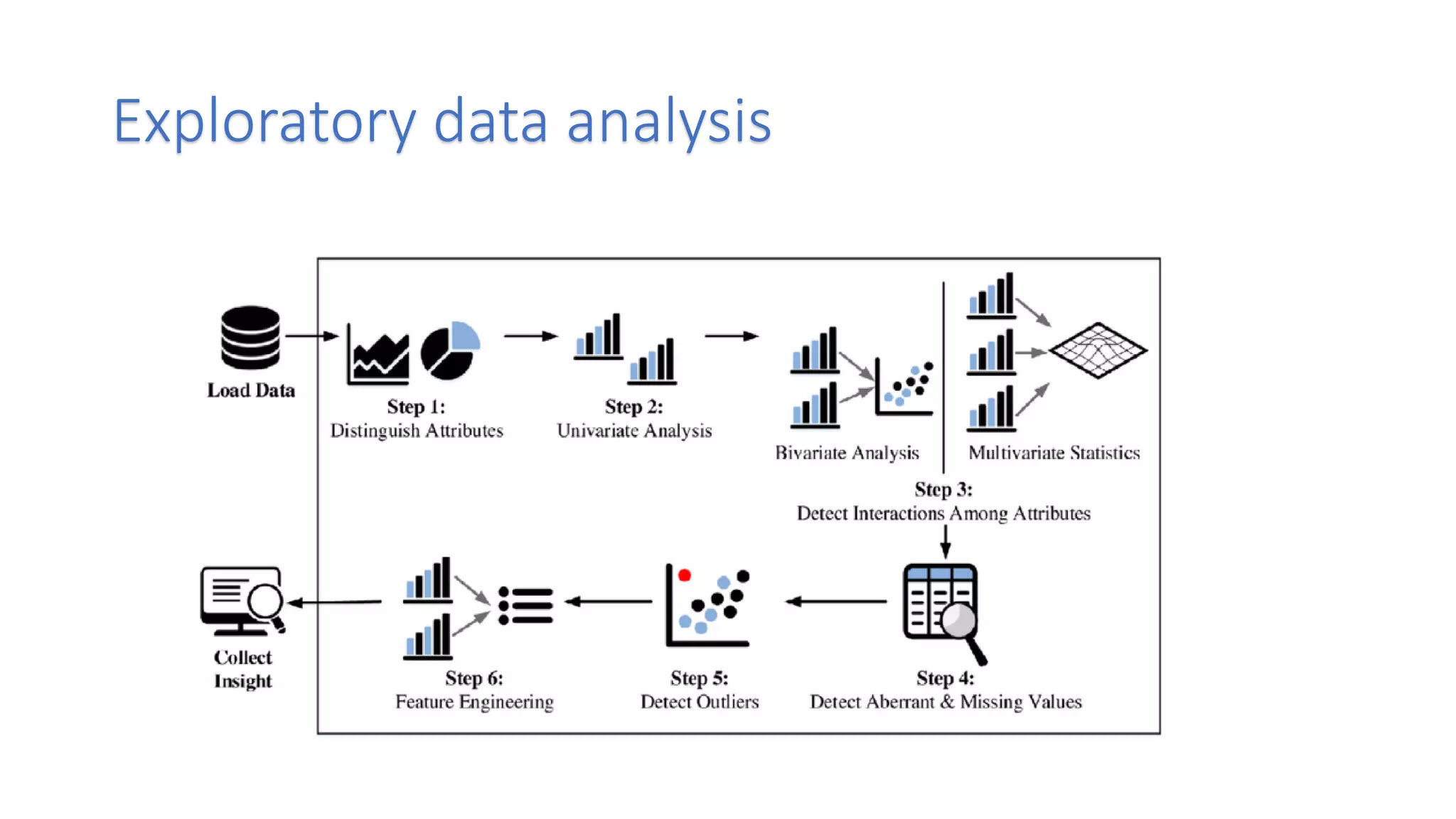

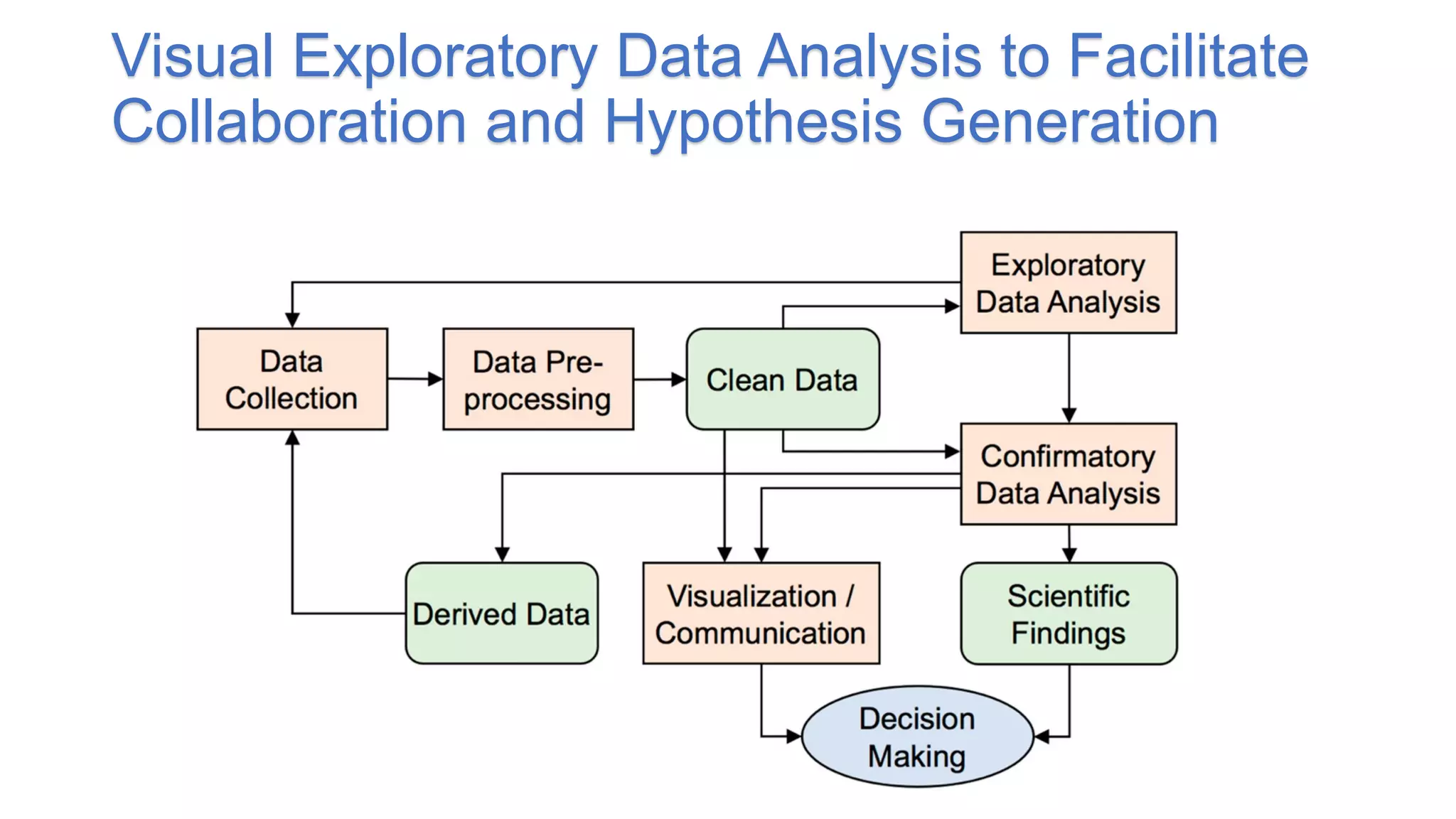

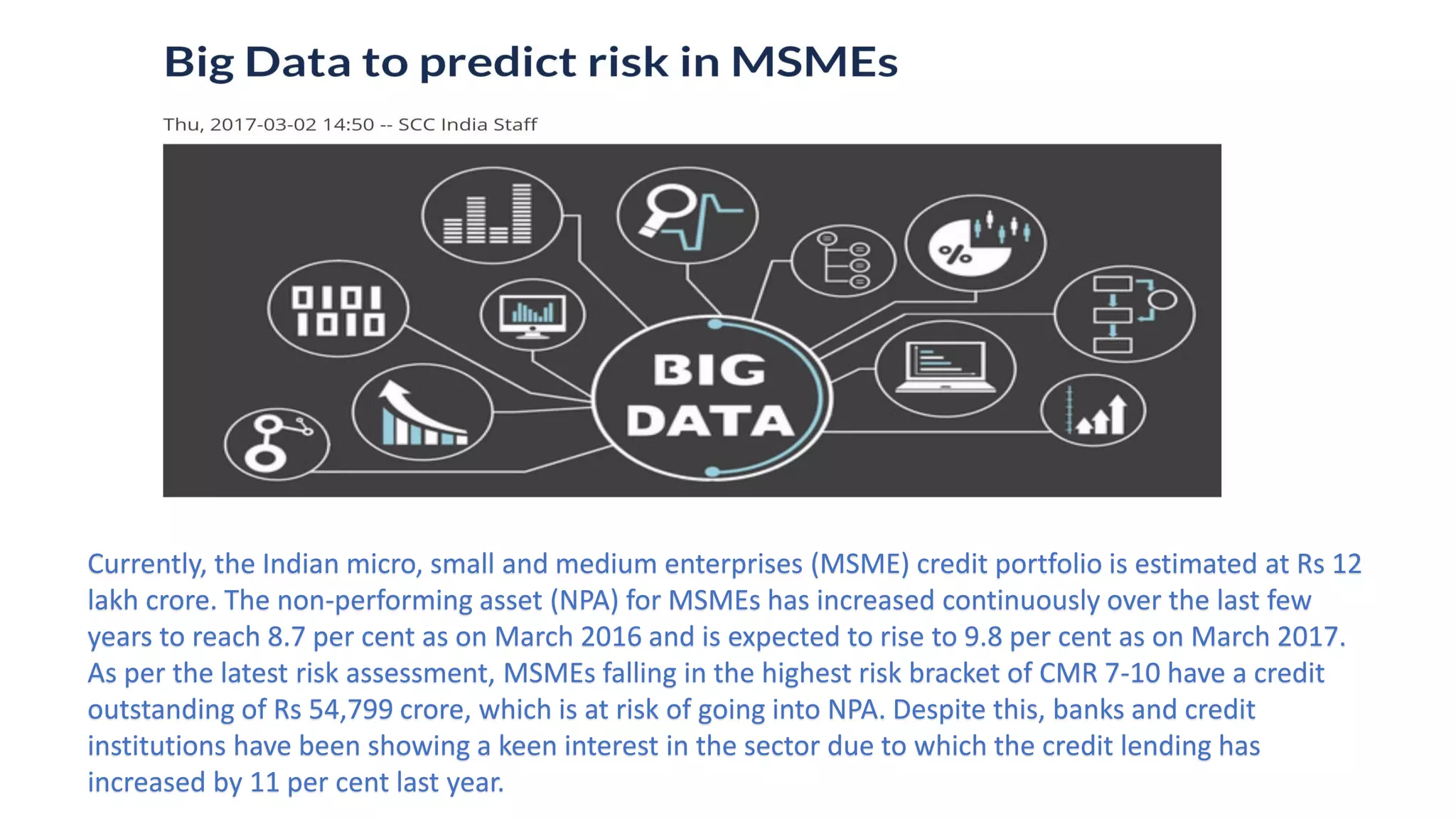

The document discusses exploratory data analysis and visual exploratory data analysis to facilitate collaboration and hypothesis generation. It then provides information about the Indian micro, small and medium enterprises (MSME) credit portfolio, noting that the non-performing asset (NPA) for MSMEs has been increasing in recent years and is projected to continue rising. It also states that MSMEs in the highest risk credit rating bracket have over $8 billion in credit outstanding that is at risk of becoming non-performing assets.