Tax and British business: Making the case

•Download as PPTX, PDF•

0 likes•444 views

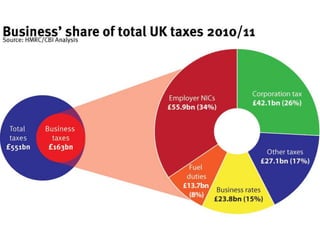

Taken from the CBI's report "Tax and British Business: Making the case". These graphics illustrate the contribution UK businesses make to the British economy

Report

Share

Report

Share

Recommended

Recommended

In a lecture at the London School of Economics, Carolyn Fairbairn, CBI Director-General, and Rain Newton-Smith, CBI Chief Economist, argue that uncertainty is biting on our economy and our firms. The complexities of 21st century trade and the prospect of serious disruption from a ‘no deal’ outcome means businesses are changing plans and slowing investment now. The lecture can be viewed here - https://www.youtube.com/watch?v=Zy6fz0tPcbgEyes Wide Open - The Importance of a Smooth Transition to a New EU Deal

Eyes Wide Open - The Importance of a Smooth Transition to a New EU DealConfederation of British Industry

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

More Related Content

More from Confederation of British Industry

In a lecture at the London School of Economics, Carolyn Fairbairn, CBI Director-General, and Rain Newton-Smith, CBI Chief Economist, argue that uncertainty is biting on our economy and our firms. The complexities of 21st century trade and the prospect of serious disruption from a ‘no deal’ outcome means businesses are changing plans and slowing investment now. The lecture can be viewed here - https://www.youtube.com/watch?v=Zy6fz0tPcbgEyes Wide Open - The Importance of a Smooth Transition to a New EU Deal

Eyes Wide Open - The Importance of a Smooth Transition to a New EU DealConfederation of British Industry

More from Confederation of British Industry (20)

Eyes Wide Open - The Importance of a Smooth Transition to a New EU Deal

Eyes Wide Open - The Importance of a Smooth Transition to a New EU Deal

Effective average and marginal tax rates in g20 countries

Effective average and marginal tax rates in g20 countries

Living with Minerals 4 - Shaping UK minerals policy - Part 1

Living with Minerals 4 - Shaping UK minerals policy - Part 1

Living with Minerals 4 - Shaping UK minerals policy - Part 7

Living with Minerals 4 - Shaping UK minerals policy - Part 7

Recently uploaded

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Recently uploaded (20)

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

UAE Bur Dubai Call Girls ☏ 0564401582 Call Girl in Bur Dubai

UAE Bur Dubai Call Girls ☏ 0564401582 Call Girl in Bur Dubai

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Escorts in Nungambakkam Phone 8250092165 Enjoy 24/7 Escort Service Enjoy Your...

Escorts in Nungambakkam Phone 8250092165 Enjoy 24/7 Escort Service Enjoy Your...

Falcon Invoice Discounting: Unlock Your Business Potential

Falcon Invoice Discounting: Unlock Your Business Potential

Berhampur Call Girl Just Call 8084732287 Top Class Call Girl Service Available

Berhampur Call Girl Just Call 8084732287 Top Class Call Girl Service Available

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

Berhampur CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Kalyan Call Girl 98350*37198 Call Girls in Escort service book now

Kalyan Call Girl 98350*37198 Call Girls in Escort service book now

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

JAJPUR CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN JAJPUR ESCORTS

JAJPUR CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN JAJPUR ESCORTS

HomeRoots Pitch Deck | Investor Insights | April 2024

HomeRoots Pitch Deck | Investor Insights | April 2024

Editor's Notes

- Out of business' total contribution in 2010/11, 26% (£42bn) was from corporation tax, the rest being paid through other taxes such as Employers National Insurance (£56bn), business rates (£42bn) and fuel duties, (£14bn)

- Two measures of a country's corporation tax rate - the effective average and effective martinal tax rates, show the UK regime is far from being the most competitive in the G20

- The headline statutory rate of corporation tax has been falling in major economies over the last 15 years - and how the UK's rate has had to fall in recent years to to remain competitive

- The effect of deductions and reliefs on the corporation tax bill of two aggregated business sectors, illustrating the extent of the impact they have on a company's taxable profit

- While businesses pay a large share of the overall tax take, the business tax burden does not fall uniformly across all businesses

- UK businesses pay more corporation tax than their counterparts in the US, France and Germany, both as a proportion of total taxes collected and as a proportion of GDP