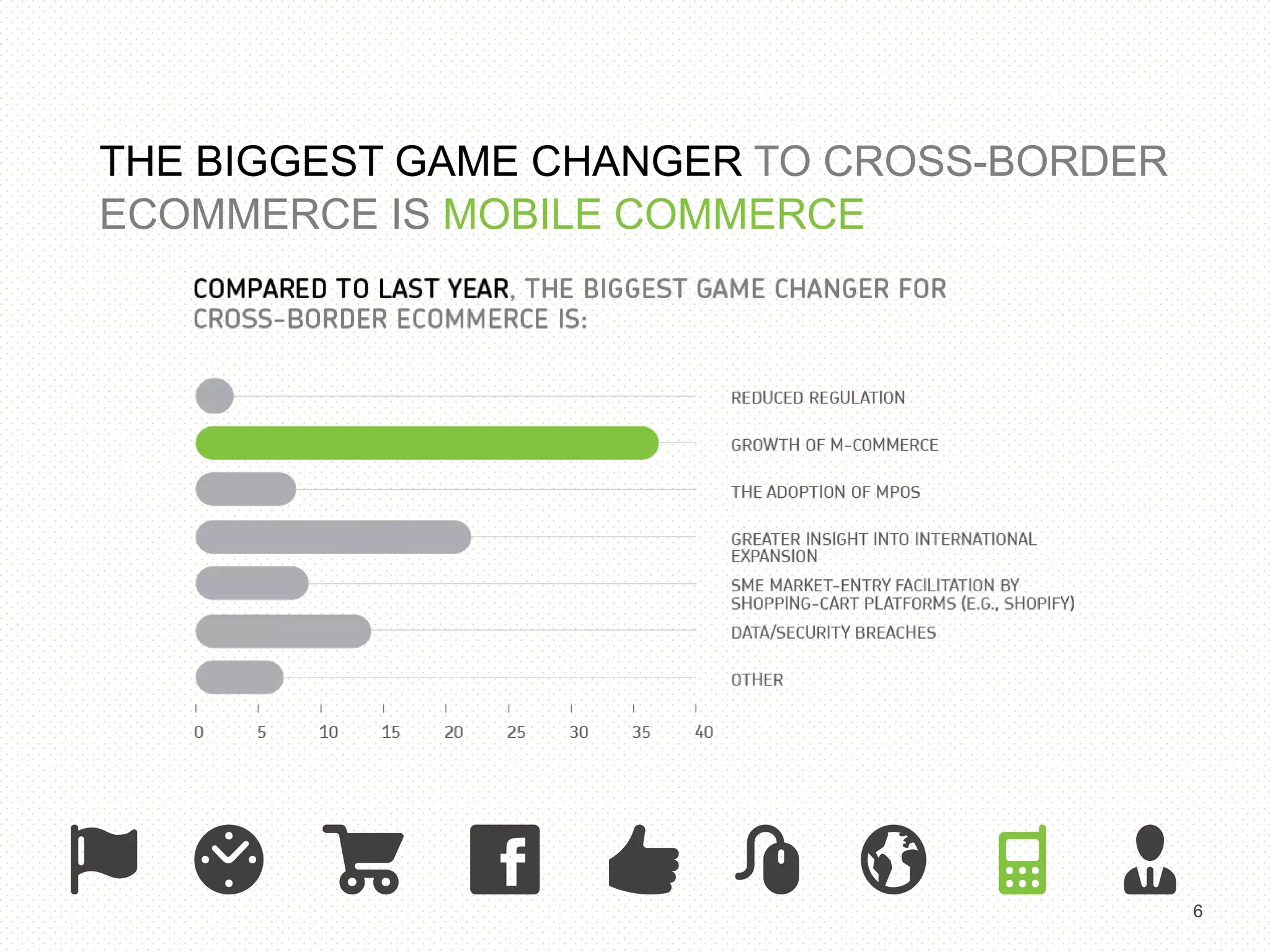

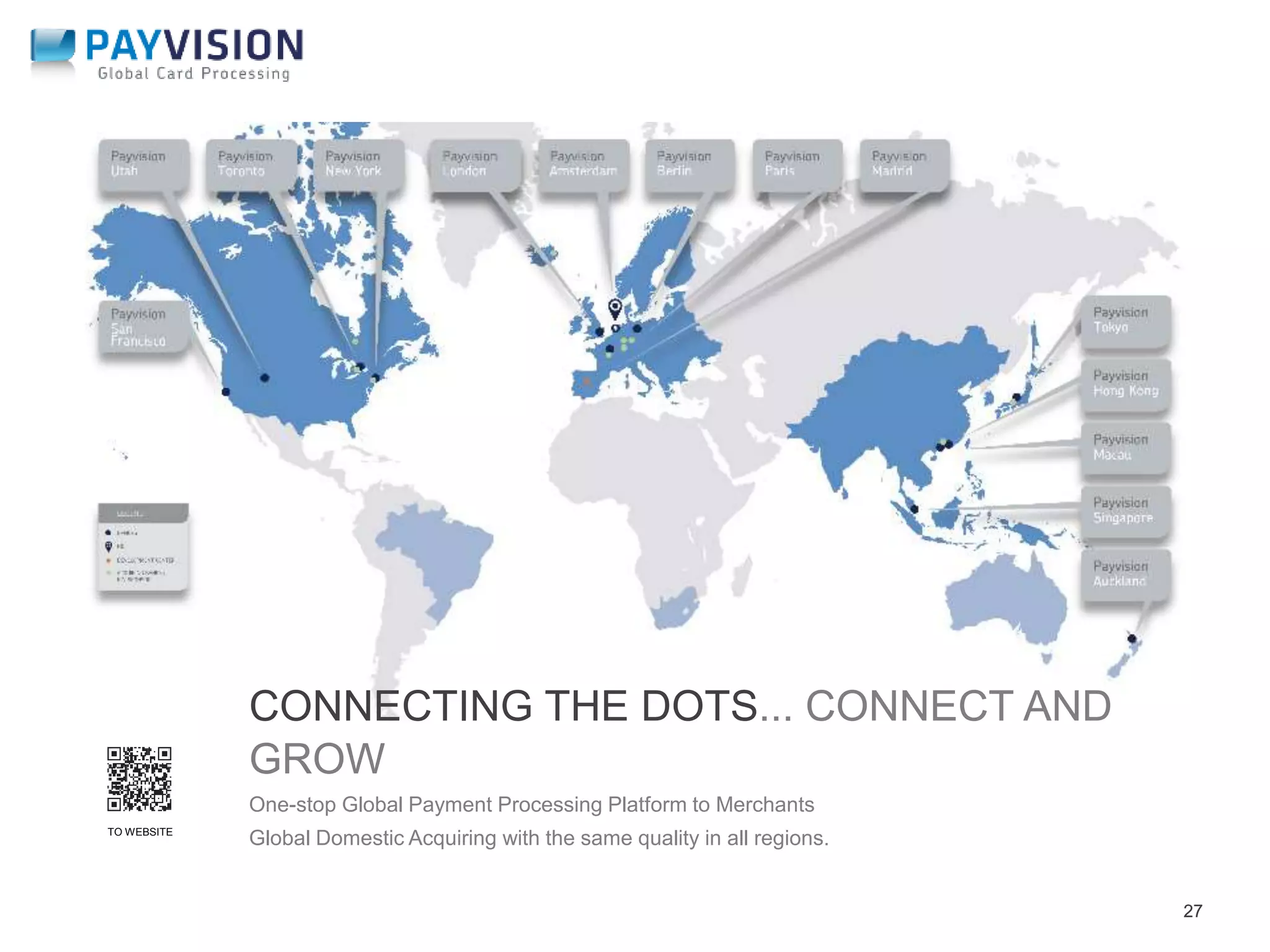

The document discusses the growth of cross-border ecommerce, highlighting that global ecommerce is expected to reach $1.5 trillion in 2014, with Asia Pacific taking the lead. It identifies key trends such as the rise of mobile commerce and the dominance of China as a significant player in the market, offering opportunities for merchants. The report also emphasizes the importance of emerging markets and the willingness of online consumers to engage in cross-border shopping.