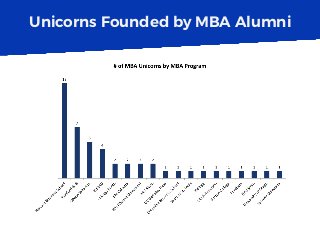

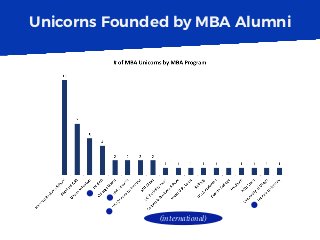

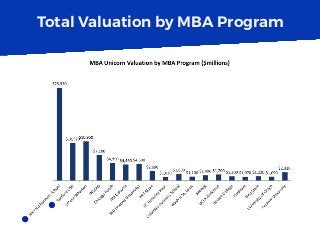

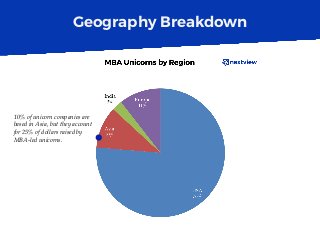

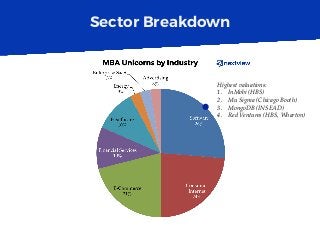

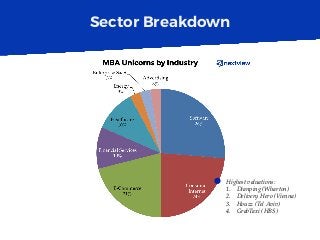

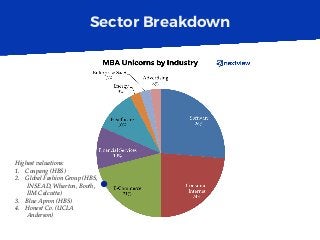

It's become somewhat trendy to criticize or doubt the hunger, drive, and entrepreneurial success of MBA students. So we did some research at NextView about various unicorn startups founded by these individuals, including schools like Harvard, Stanford, Wharton and more.