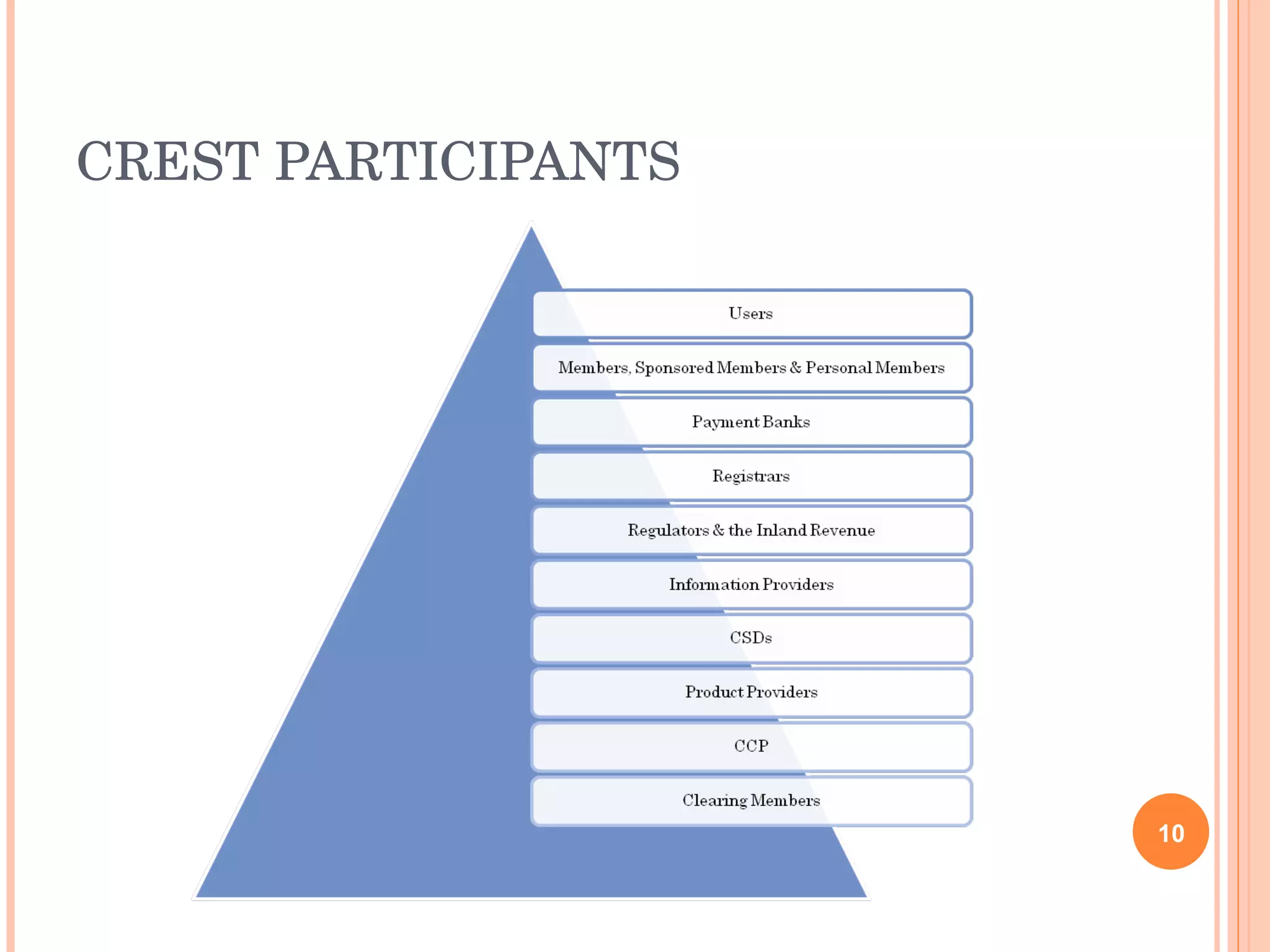

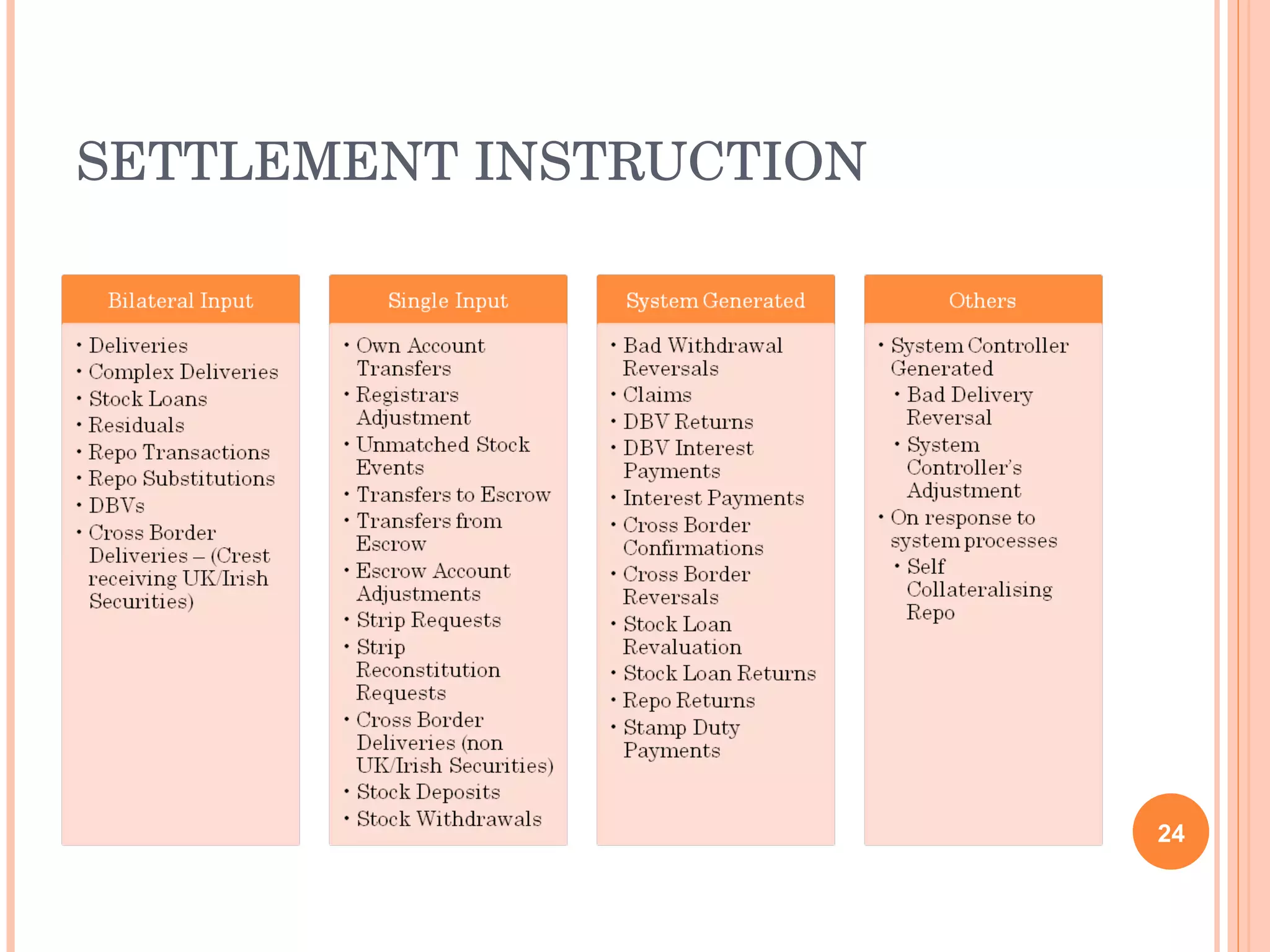

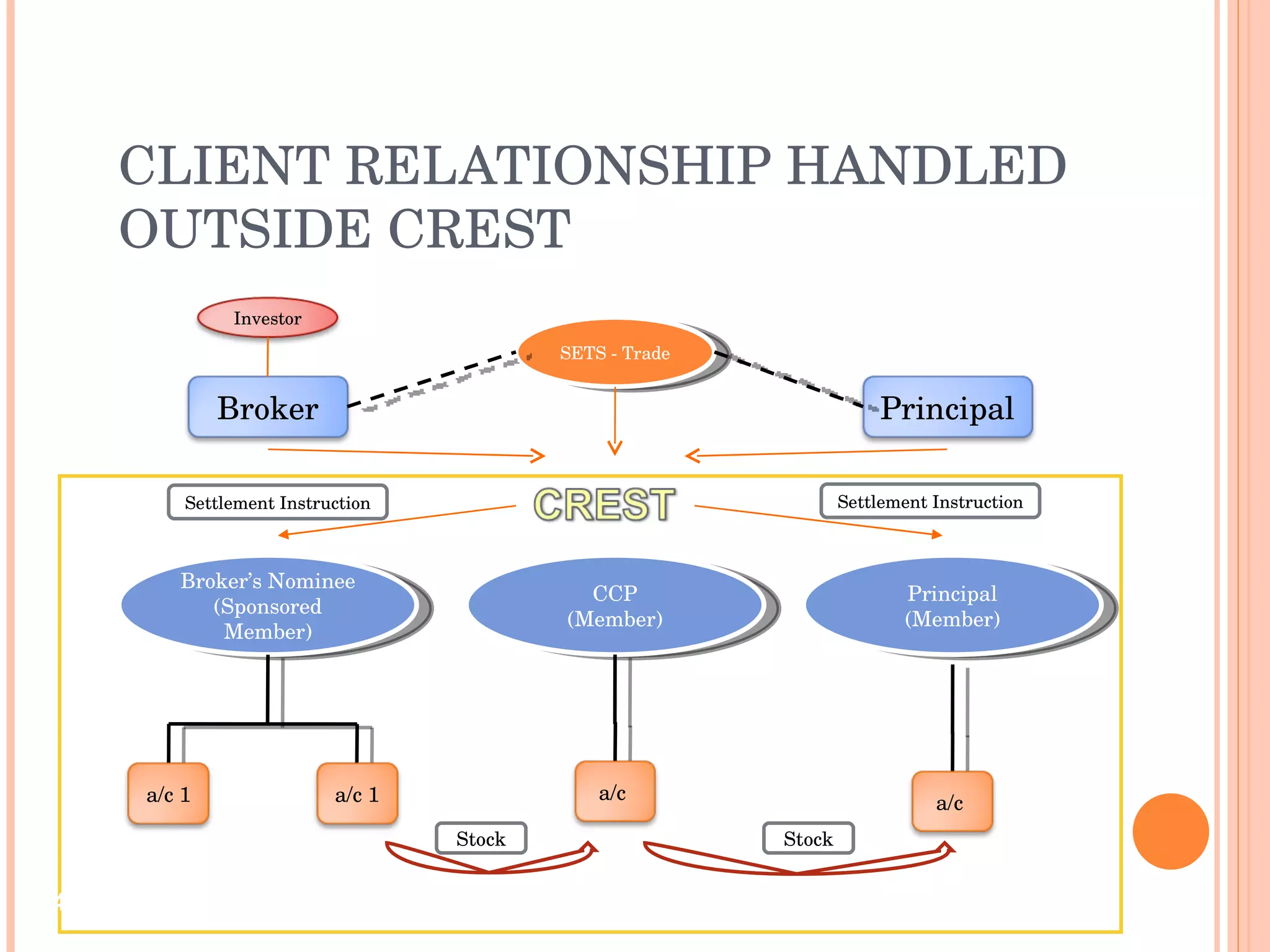

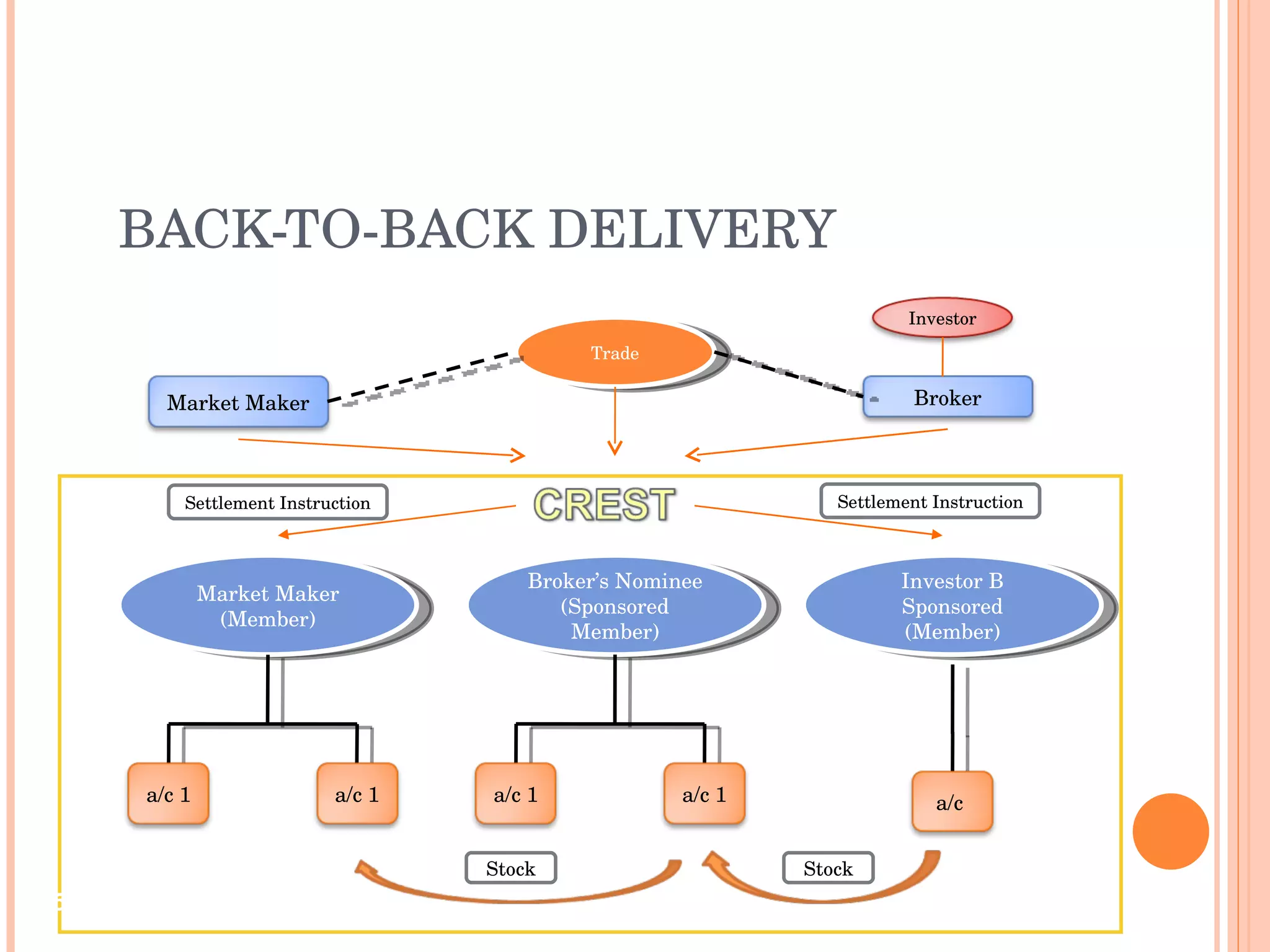

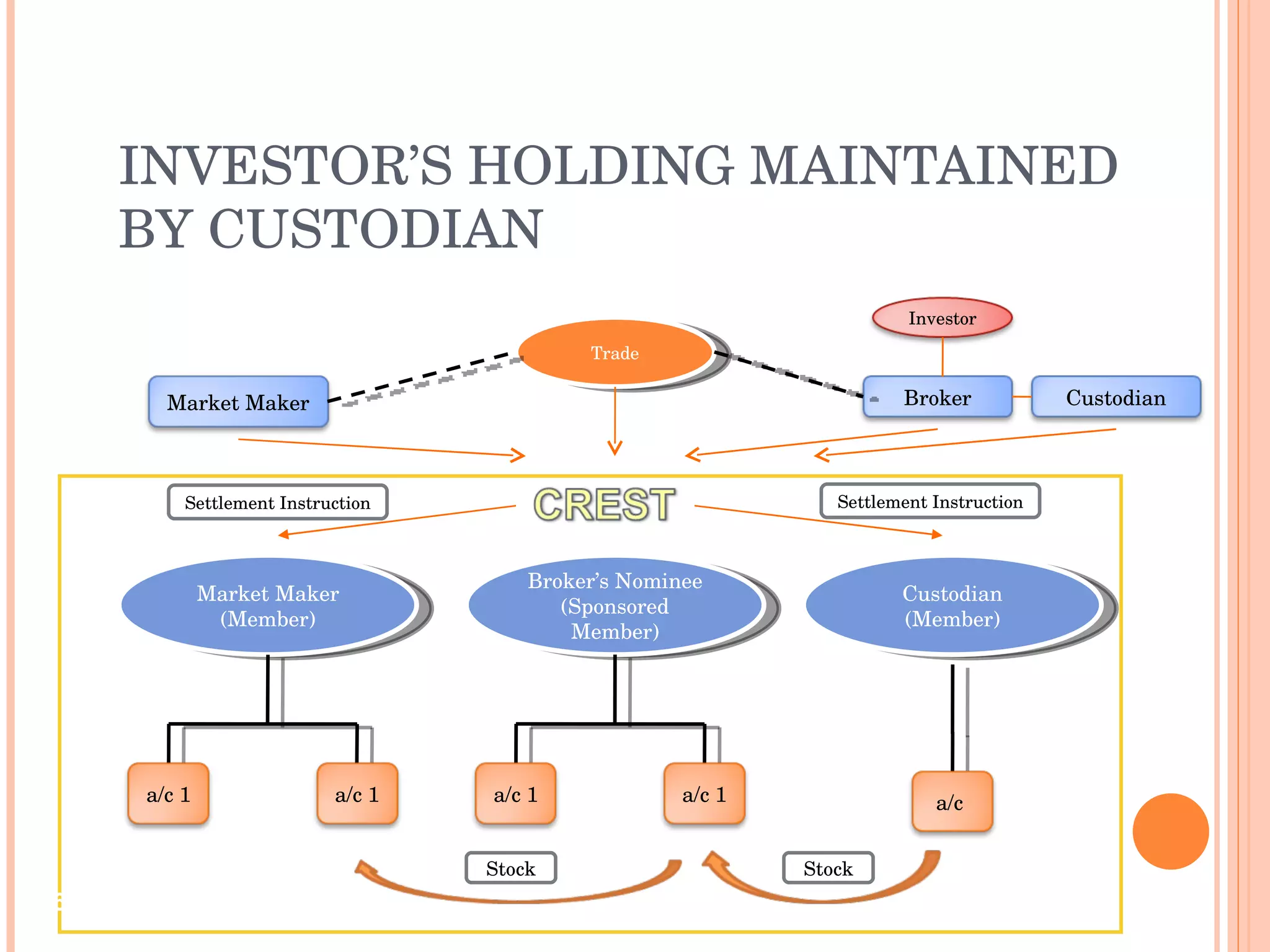

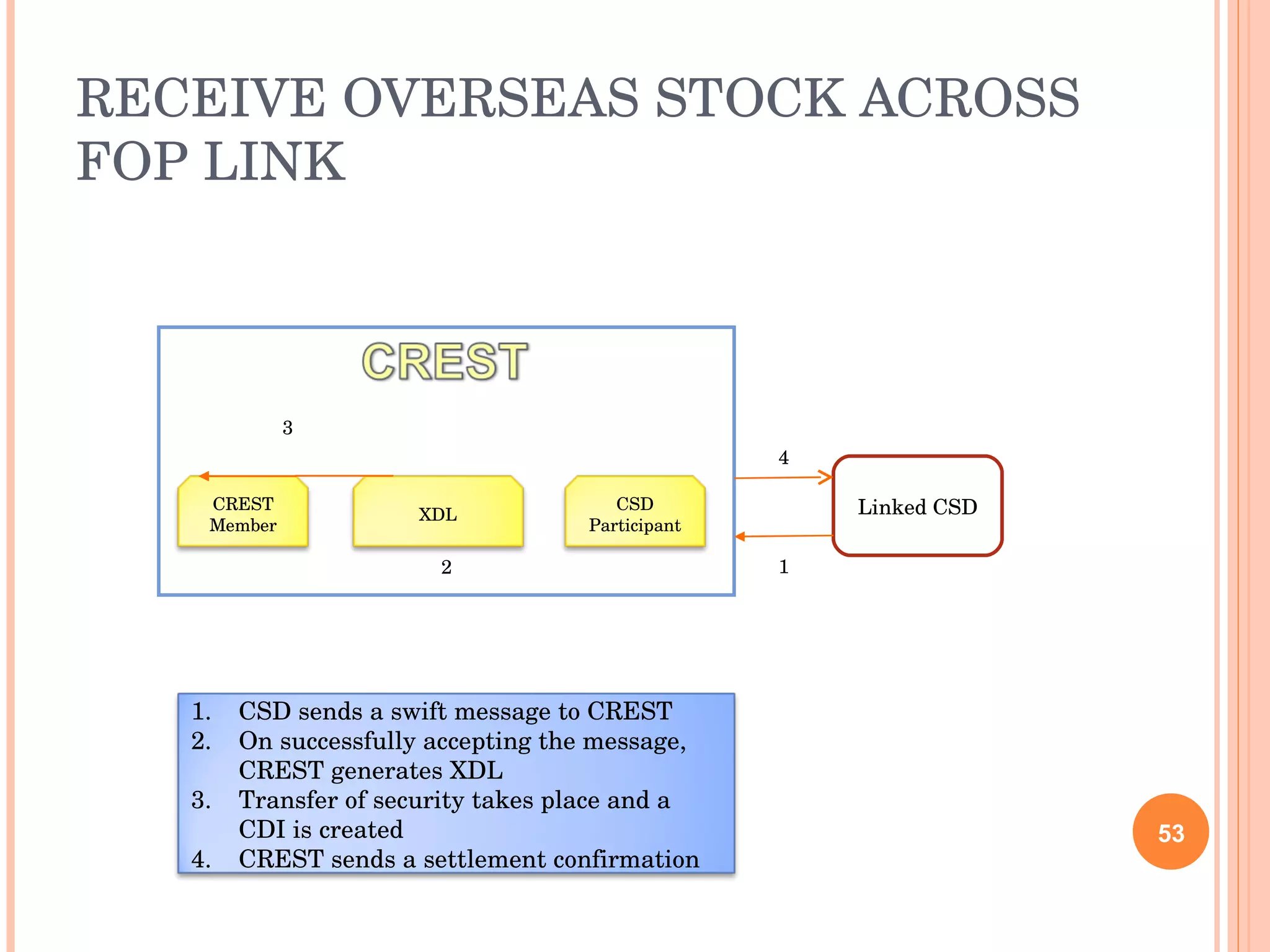

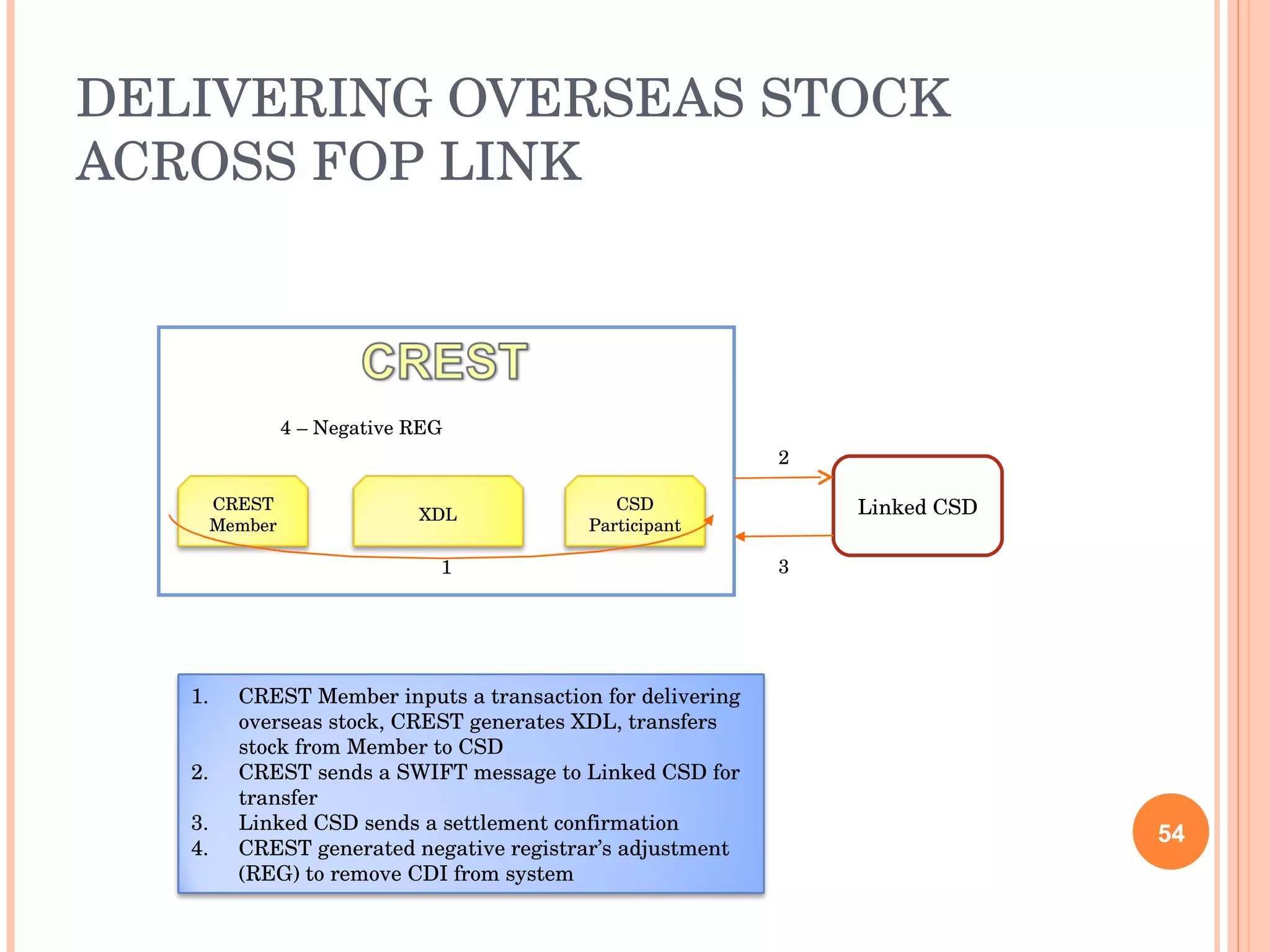

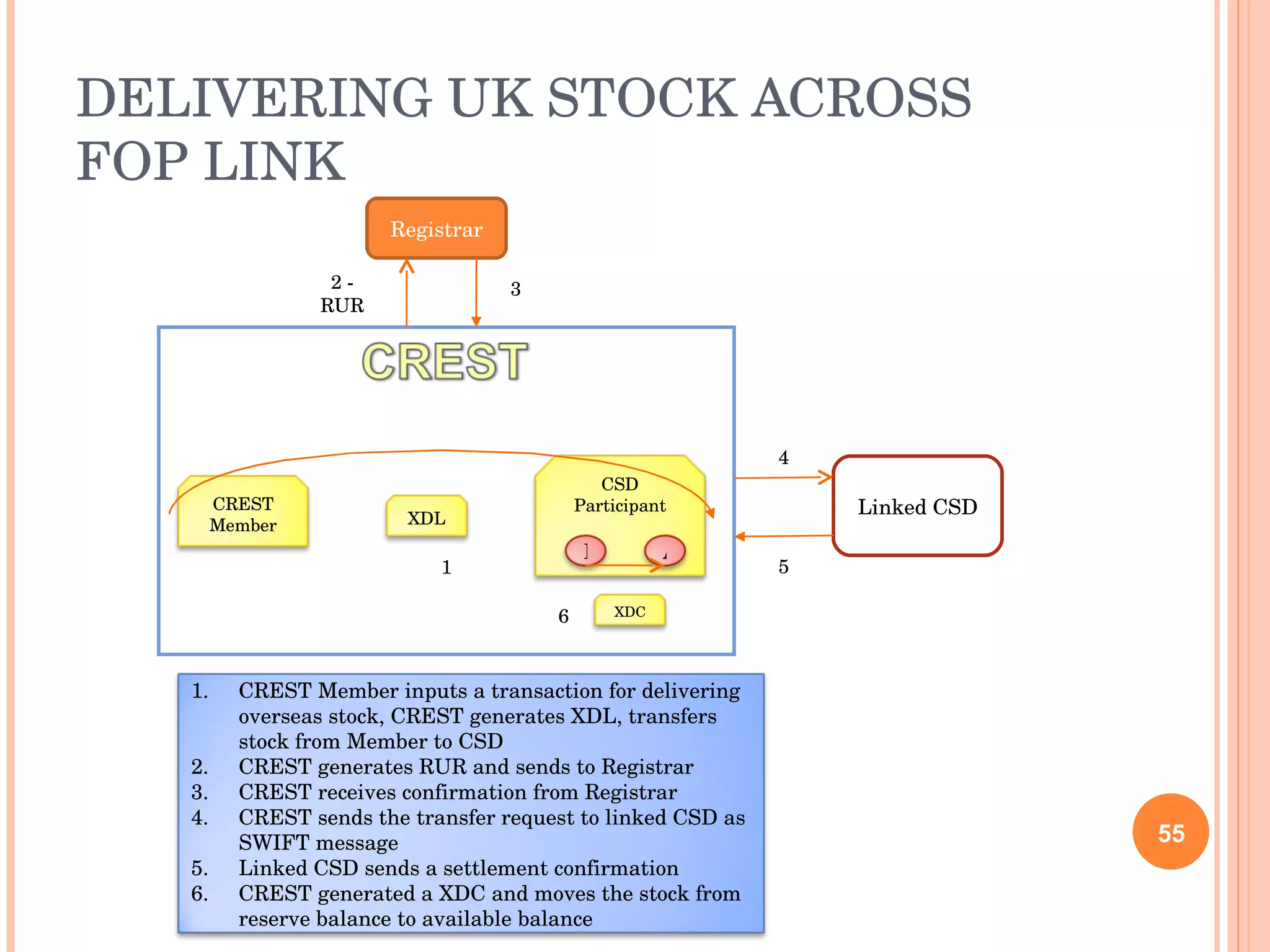

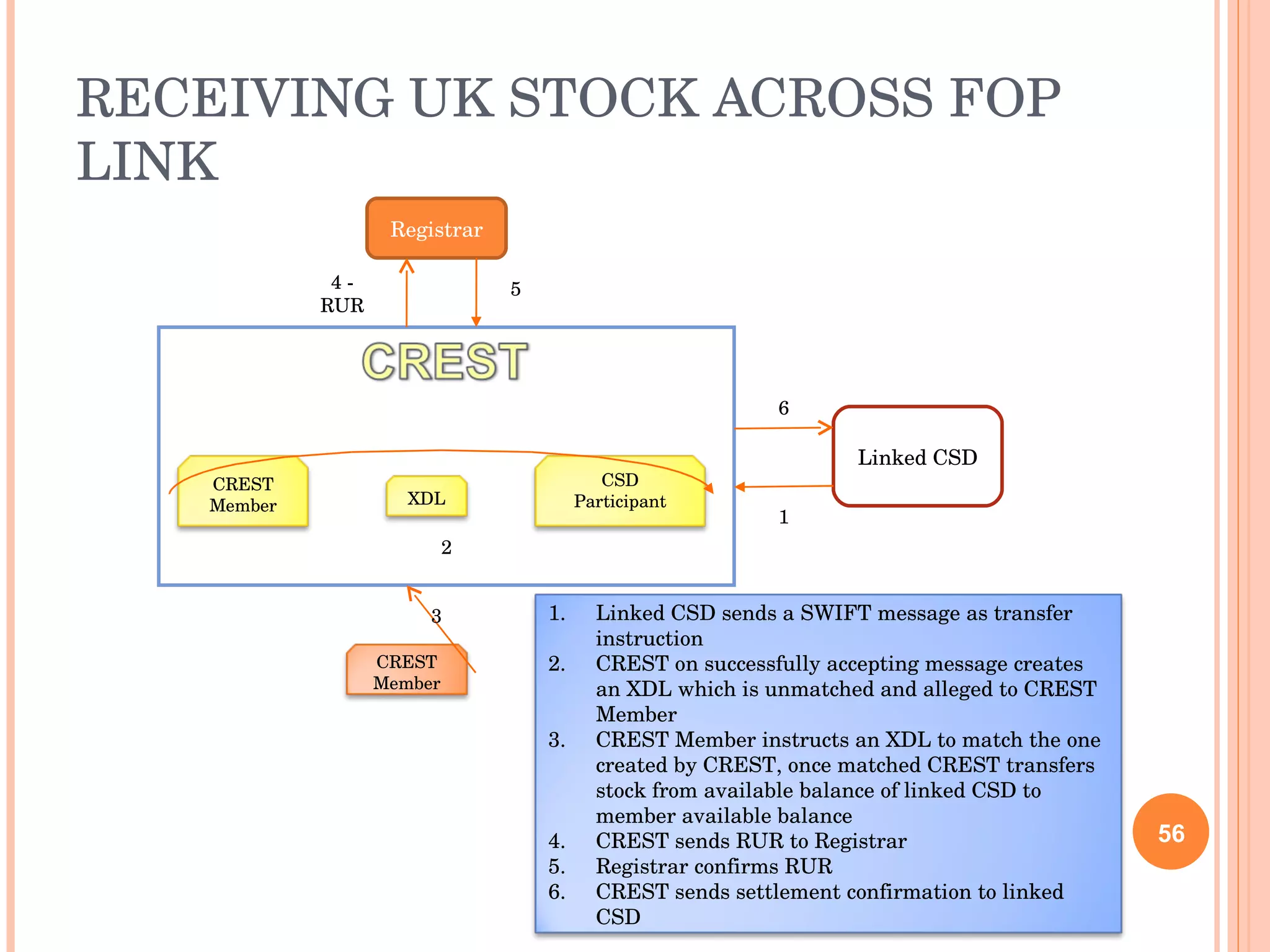

CREST is the central securities depository for the UK, Ireland, Isle of Man and Jersey. It maintains records of eligible securities and facilitates the electronic settlement of transactions. CREST distinguishes between users who can connect electronically and participants who have a formal relationship and hold stock accounts. Investors can hold securities through CREST directly as members or through nominee accounts. CREST also facilitates cross-border settlement through links with other central securities depositories.