Word of Mouth's Role in Driving Sales

•

8 likes•1,850 views

Presentation by Brad Fay of Keller Fay, Greg Pharo of AT&T and Matt Sato of Accenture at ARF AM 6.0

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Phases of Discovery: Let's Play The Marketing Game

Phases of Discovery: Let's Play The Marketing Game

Dallas retail Summit - Succeeding in the Infinite Marketing Future

Dallas retail Summit - Succeeding in the Infinite Marketing Future

Celebrity intelligence-age-of-social-influence-uk.original

Celebrity intelligence-age-of-social-influence-uk.original

Inside the Forbes "World’s Most Influential CMOs" List

Inside the Forbes "World’s Most Influential CMOs" List

Engaged Brands and the Rise of Trust-Based Marketing

Engaged Brands and the Rise of Trust-Based Marketing

Similar to Word of Mouth's Role in Driving Sales

Similar to Word of Mouth's Role in Driving Sales (20)

Measuring Customer-Experience ROI with social media

Measuring Customer-Experience ROI with social media

Salesforce research-fourth-annual-state-of-marketing

Salesforce research-fourth-annual-state-of-marketing

Social Media Case Study - Social Listening Report on E-retail Brands

Social Media Case Study - Social Listening Report on E-retail Brands

[Report] India's eCommerce Industry on Social Media![[Report] India's eCommerce Industry on Social Media](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![[Report] India's eCommerce Industry on Social Media](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

[Report] India's eCommerce Industry on Social Media

E commerce industry-in-india-a-social-media-case-study

E commerce industry-in-india-a-social-media-case-study

Turn Online Reviews into Data Driven Business Decisions-2

Turn Online Reviews into Data Driven Business Decisions-2

Social Media Intelligence: What can it tell us about consumer behavior?

Social Media Intelligence: What can it tell us about consumer behavior?

Measuring customer experience with social media.jan15

Measuring customer experience with social media.jan15

More from Keller Fay Group

More from Keller Fay Group (20)

Influence and impact across all channels - Keller Fay Group

Influence and impact across all channels - Keller Fay Group

The Social Brand: Dynamics & Realities of the Social Haze

The Social Brand: Dynamics & Realities of the Social Haze

Talking Social TV 2 with Ed Keller and Beth Rockwood

Talking Social TV 2 with Ed Keller and Beth Rockwood

Facebook & Keller Fay: Where Social TV Meets Word-of-Mouth, ARF RE:THINK 2014

Facebook & Keller Fay: Where Social TV Meets Word-of-Mouth, ARF RE:THINK 2014

The Power of Out of Home Audiences in the Digital Age

The Power of Out of Home Audiences in the Digital Age

Social TV Viewing, Word of Mouth, and Ad Effectiveness

Social TV Viewing, Word of Mouth, and Ad Effectiveness

Supercharging the Path to Purchase: Using Word of Mouth to Drive More Consume...

Supercharging the Path to Purchase: Using Word of Mouth to Drive More Consume...

The Most Talked about Sports Teams in America from 2010

The Most Talked about Sports Teams in America from 2010

Integrating Word of Mouth into Consumer-Centric Measurement

Integrating Word of Mouth into Consumer-Centric Measurement

Recently uploaded

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS Live

Booking Contact Details :-

WhatsApp Chat :- [+91-9999965857 ]

The Best Call Girls Delhi At Your Service

Russian Call Girls Delhi Doing anything intimate with can be a wonderful way to unwind from life's stresses, while having some fun. These girls specialize in providing sexual pleasure that will satisfy your fetishes; from tease and seduce their clients to keeping it all confidential - these services are also available both install and outcall, making them great additions for parties or business events alike. Their expert sex skills include deep penetration, oral sex, cum eating and cum eating - always respecting your wishes as part of the experience

(07-May-2024(PSS)VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Recently uploaded (20)

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

Call Girls From Pari Chowk Greater Noida ❤️8448577510 ⊹Best Escorts Service I...

Call Girls From Pari Chowk Greater Noida ❤️8448577510 ⊹Best Escorts Service I...

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon's Invoice Discounting: Your Path to Prosperity

Insurers' journeys to build a mastery in the IoT usage

Insurers' journeys to build a mastery in the IoT usage

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Call Girls In Panjim North Goa 9971646499 Genuine Service

Call Girls In Panjim North Goa 9971646499 Genuine Service

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Word of Mouth's Role in Driving Sales

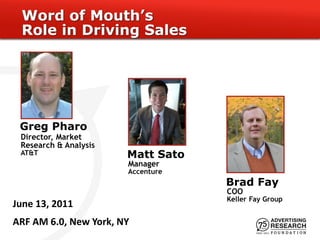

- 1. Word of Mouth’s Role in Driving Sales Greg Pharo Director, Market Research & Analysis AT&T Matt Sato Manager Accenture Brad Fay COO Keller Fay Group June 13, 2011 ARF AM 6.0, New York, NY

- 2. Spending on WOM Rising Fast “Word of Mouth Marketing” and “Social Media” Are Among the Most Exciting New Tools in the Arsenal of Marketers Today $3,043 $2,572 $2,204 $1,918 $1,701 $1,543 $1,351 $981 $722 $487 $313 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 WOM Marketing Spending WOM Marketing Forecast Source: PQ Media

- 3. Does Word of Mouth Drive Sales? Questions Remain on Word of Mouth’s Role in Generating Sales Does word of mouth directly influence sales volume, and to what extent? Where does word of mouth fit into the “owned- earned-paid” media model? Is it really a metric of interest to companies? #ARFAM6

- 4. Background - AT&T Marketing ROI AT&T is one of the nation’s largest advertisers Well-developed Marketing ROI program Uses Market Mix Modeling to optimize DMA- deployment of media – Partnered with Accenture and Mediaedge to develop advanced analytics capabilities for market mix optimization AT&T also tracks weekly and monthly brand awareness, attitudes, and usage with a multitude of market research studies #ARFAM6

- 5. Problem - “Metrics Clutter” AT&T’s tracking studies collect a constellation of market metrics: – Brand perceptions – Usage – Customer satisfaction – Literally hundreds of data series Management wanted to know which metrics – in addition to media - are most impactful on Mobility sales (i.e., “Gross Adds”) and on disconnects (i.e., “churn”) #ARFAM6

- 6. Methods - Create a Purchase Funnel Model AT&T and Accenture created both a Purchase Funnel model which identifies which metrics are the most significant influencer Gross Adds The model also shows what other upstream metrics drive these key metrics #ARFAM6

- 7. Methods - Using a Two-step Process to Identify Key Metrics Analytical techniques are used to winnow the myriad of earned media metrics – Highly-related metrics were grouped together using a cluster analysis – A short-list of metrics that are most correlated with their group are selected These representative metrics are then input into a separate model – Reduces the burden of incorporating potentially hundreds of metrics – Ensures the earned media impact is not “diluted” by having related metrics in the same model #ARFAM6

- 8. Methods - SEM Modeling Traditional regressions The SEM structure, used here, assume no interactions allows for interaction among among sales drivers sales drivers Brand Health Brand Health Gross Gross Paid Media Paid Media Adds Adds Word of Mouth Word of Mouth #ARFAM6

- 9. Methods - Measuring ALL Word of Mouth Keller Fay Group’s TalkTrack®, a national syndicated program measuring WOM in all forms Mode of Conversations – Over 3 in 4 conversations occur face-to-face Across All Categories The study involves 36,000 online consumers surveyed annually, Other – 100 every day 2% Face- – Yielding about 1,000 weekly mentions of to-Face brands; 350,000 per year 77% Online Respondents are representative of the 6% US population aged 13 to 69 Phone – use a diary to keep track of their brand 15% conversations, then complete an online survey to gather detailed information about these conversations – Quotas/weights by age, gender, education, race, etc. #ARFAM6

- 10. Finding - WOM Is a Major Driver of Sales The number of positive WOM “mentions” in TalkTrack® proved to be one of the more powerful metrics directly influencing “Gross Adds” (sales) Unaided Advertising Awareness, a top-of-funnel metric, was also a strong driver of Gross Adds In turn, the Structural Equation Model identified which metrics influence Word of Mouth and Unaided Advertising Awareness Paid media drivers are also included, as they directly impact Gross Adds, Word of Mouth and brand health metrics #ARFAM6

- 11. Unaided Ad Awareness and WOM Are Two Strong Direct Influencers of Gross Adds Unaided Ad Awareness Word of Mouth- Positive Mentions Device Gross Adds perception #1 (non-customers) Strength of Network Relationship perception #1 (non-customers) Strong Moderate Weak Provider Consideration #ARFAM6

- 12. The Model Also Identified Attitudinal Metrics Which Influenced Word of Mouth Customer Service Perception #1 Network Network Willingness to perception #2 Perception #3 Recommend Word of Mouth- Positive Mentions Strength of Relationship Strong Moderate Weak Gross Adds #ARFAM6

- 13. Word of Mouth Data Was “Clean” Enough to Model, in Contrast to Online “Buzz” Data Word of Mouth variables were easily incorporated into the model In contrast, online “buzz” data proved difficult to incorporate into models – Computer-scored online buzz sentiment data did not prove to be as accurate as hoped – Online buzz may not always include all relevant online sites – WOM captures a broader spectrum of discussions; fewer than 10% of conversations are online #ARFAM6

- 14. Next, Word of Mouth Was Trialed in Traditional Market Mix Models AT&T next introduced Word of Mouth variables into traditional Market Mix Models – AT&T constructed market mix models for itself and key competitors – Each model uses Gross Adds as dependent variable – Media, pricing, product innovation, messaging performance, competitive, other relevant marketing/environmental factors incorporated as independent variables – Modeling Approach: Multiple regression analysis Word of Mouth proved to be a powerful and statistically significant sales driver in Mix Models – Word of Mouth explained 10%+ of sales volume – Paid Media remains #1 sales driver, driving ~30% of sales – but WOM is one of the top influencers of Gross Adds #ARFAM6

- 15. AT&T Conclusions Word of Mouth is an impactful, relevant variable for influencing sales in the Wireless category WOM metrics belong on a CMO dashboard as a key performance indicator #ARFAM6

- 16. AT&T Next Steps Leverage Word of Mouth data in other analytics projects, including tactical campaign analysis Deeper learning on paid media/WOM interaction Making it actionable: influencing conversations Work with research vendors to improve quality of online buzz data #ARFAM6

- 17. Keller Fay Observations AT&T analysis provides strong evidence that “conversation” should be a marketing objective – Today, about half of WOM is influenced by marketing, including 20% by paid advertising – These numbers ought to grow as marketers adopt word of mouth as an objective Ways to Stimulate WOM – Messages should be “talkworthy” and easy to share Think about providing “triggers” – Targeting: Aim for consumers with larger social networks Seek out “influencers” – Channels: Favor those that facilitate conversations Not just “social media”, but any media that reaches people in a social context Pay-off: Conversation, advocacy, SALES #ARFAM6