ameriprise april_Invested_Asset_FINALpm1

•

0 likes•174 views

Report

Share

Report

Share

Download to read offline

Recommended

Our High Noon Knowledge Series - A Debt Market “Jungle Guide”: Strategies for PE Portfolio Companies and Public Issuers. A Debt Market “Jungle Guide”: Strategies for PE Portfolio Companies and Publi...

A Debt Market “Jungle Guide”: Strategies for PE Portfolio Companies and Publi...Michael J. Blankenship

More Related Content

What's hot

Our High Noon Knowledge Series - A Debt Market “Jungle Guide”: Strategies for PE Portfolio Companies and Public Issuers. A Debt Market “Jungle Guide”: Strategies for PE Portfolio Companies and Publi...

A Debt Market “Jungle Guide”: Strategies for PE Portfolio Companies and Publi...Michael J. Blankenship

What's hot (20)

A Debt Market “Jungle Guide”: Strategies for PE Portfolio Companies and Publi...

A Debt Market “Jungle Guide”: Strategies for PE Portfolio Companies and Publi...

Financial crises presentation causes , consequences and remedies

Financial crises presentation causes , consequences and remedies

Similar to ameriprise april_Invested_Asset_FINALpm1

Bank of America Corporation acquires Merrill Lynch & Co., Inc. Presentation

Bank of America Corporation acquires Merrill Lynch & Co., Inc. PresentationQuarterlyEarningsReports3

Similar to ameriprise april_Invested_Asset_FINALpm1 (20)

JPMorgan Chase Third Quarter 2008 Financial Results Conference Call Earnings ...

JPMorgan Chase Third Quarter 2008 Financial Results Conference Call Earnings ...

Bank of America Corporation acquires Merrill Lynch & Co., Inc. Presentation

Bank of America Corporation acquires Merrill Lynch & Co., Inc. Presentation

Q1 2009 Earning Report of New York Community Bancorp

Q1 2009 Earning Report of New York Community Bancorp

Q1 2009 Earning Report of Susquehanna Bancshares, Inc.

Q1 2009 Earning Report of Susquehanna Bancshares, Inc.

Q1 2009 Earning Report of Travelers Companies Inc.

Q1 2009 Earning Report of Travelers Companies Inc.

More from finance43

More from finance43 (20)

nordstrom 4AF8C938-BCC4-4A47-BC67-CACBB3E4E66F_JWN200810-K

nordstrom 4AF8C938-BCC4-4A47-BC67-CACBB3E4E66F_JWN200810-K

nordstrom 4AF8C938-BCC4-4A47-BC67-CACBB3E4E66F_JWN200810-K

nordstrom 4AF8C938-BCC4-4A47-BC67-CACBB3E4E66F_JWN200810-K

nordstrom 4AF8C938-BCC4-4A47-BC67-CACBB3E4E66F_JWN200810-K

nordstrom 4AF8C938-BCC4-4A47-BC67-CACBB3E4E66F_JWN200810-K

Recently uploaded

Recently uploaded (20)

Famous No1 Amil Baba Love marriage Astrologer Specialist Expert In Pakistan a...

Famous No1 Amil Baba Love marriage Astrologer Specialist Expert In Pakistan a...

Black magic specialist in Canada (Kala ilam specialist in UK) Bangali Amil ba...

Black magic specialist in Canada (Kala ilam specialist in UK) Bangali Amil ba...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Call Girls Howrah ( 8250092165 ) Cheap rates call girls | Get low budget

Call Girls Howrah ( 8250092165 ) Cheap rates call girls | Get low budget

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

Law of Demand.pptxnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnn

Law of Demand.pptxnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnnn

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

Famous Kala Jadu, Kala ilam specialist in USA and Bangali Amil baba in Saudi ...

Famous Kala Jadu, Kala ilam specialist in USA and Bangali Amil baba in Saudi ...

Avoidable Errors in Payroll Compliance for Payroll Services Providers - Globu...

Avoidable Errors in Payroll Compliance for Payroll Services Providers - Globu...

abortion pills in Jeddah Saudi Arabia (+919707899604)cytotec pills in Riyadh

abortion pills in Jeddah Saudi Arabia (+919707899604)cytotec pills in Riyadh

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

ameriprise april_Invested_Asset_FINALpm1

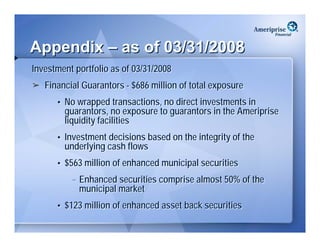

- 1. Appendix – as of 03/31/2008 Investment portfolio as of 03/31/2008 Financial Guarantors - $686 million of total exposure • No wrapped transactions, no direct investments in guarantors, no exposure to guarantors in the Ameriprise liquidity facilities • Investment decisions based on the integrity of the underlying cash flows • $563 million of enhanced municipal securities – Enhanced securities comprise almost 50% of the municipal market • $123 million of enhanced asset back securities

- 2. Appendix – as of 03/31/2008 Structured asset portfolio - $10.1 billion • $6.2 billion RMBS, $2.9 billion CMBS, $1.0 billion ABS Residential mortgage backed securities portfolio of $6.2 billion is 97% AAA-rated • Agency mortgage exposure totals $4,544 million – Stable prepayment profile with less negative convexity and interest rate sensitivity than the MBS index – Portfolio has a higher coupon bias which should perform well in a rising interest rate environment • Prime mortgage exposure totals $516 million – $421 million is AAA-rated and $95 million is AA- rated

- 3. Appendix – as of 03/31/2008 Residential mortgage backed securities (cont’d) • Alt A exposure is $1,095 million – $984 million is AAA-rated, $104 million AA-rated and $7 million A-rated – Majority of Alt-A holdings are “super senior” bonds » Greater credit enhancement than required to get a AAA rating – Market value of 81% of book as of 03/31/2008

- 4. Appendix – as of 03/31/2008 Commercial mortgage backed securities portfolio - $2.9 billion exposure • Entirely AAA-rated • Seasoned collateral, predominantly 2005 or earlier vintages – Lower delinquency rates than the overall CMBS market • Market value of 99% of book as of 3/31/2008 Asset backed securities portfolio - $1.0 billion exposure • 94% AAA-rated • $437 million are securitized small business loans backed by the full faith and credit of the US government. • $347 million - primarily credit cards, automobile loans, and student loans, 89% AAA-rated.

- 5. Appendix – as of 03/31/2008 Asset backed securities portfolio (cont’d) • $247 million of securities back by subprime residential mortgages, less than 1% of the Ameriprise portfolio – $221 million are senior AAA-rated tranches, $16 million are AA-rated, and $10 million are BBB-rated – High quality exposure - short duration, with limited negative convexity – Market value of 90% of book as of 3/31/2008 Commercial real estate - $3.1 billion exposure • Average loan to value ratio of 54% • Solid weighted average debt service coverage ratio of 1.82x • No delinquencies over the past year

- 6. Appendix – as of 03/31/2008 Corporate credit - $13.5 billion exposure • Investment grade portfolio is highly diversified and well positioned with a preference toward non-cyclicals and a bias toward regulated industries and asset rich-companies • High yield portfolio includes $1.5 billion in below investment grade bonds and $0.3 billion in bank loans, comprising 5% of the investment portfolio – Highly diversified with a focus on credits that can generate free cash flow through economic cycles • Homebuilders - $168 million exposure – As of 03/31/2008, unrealized losses on homebuilders were $30 million