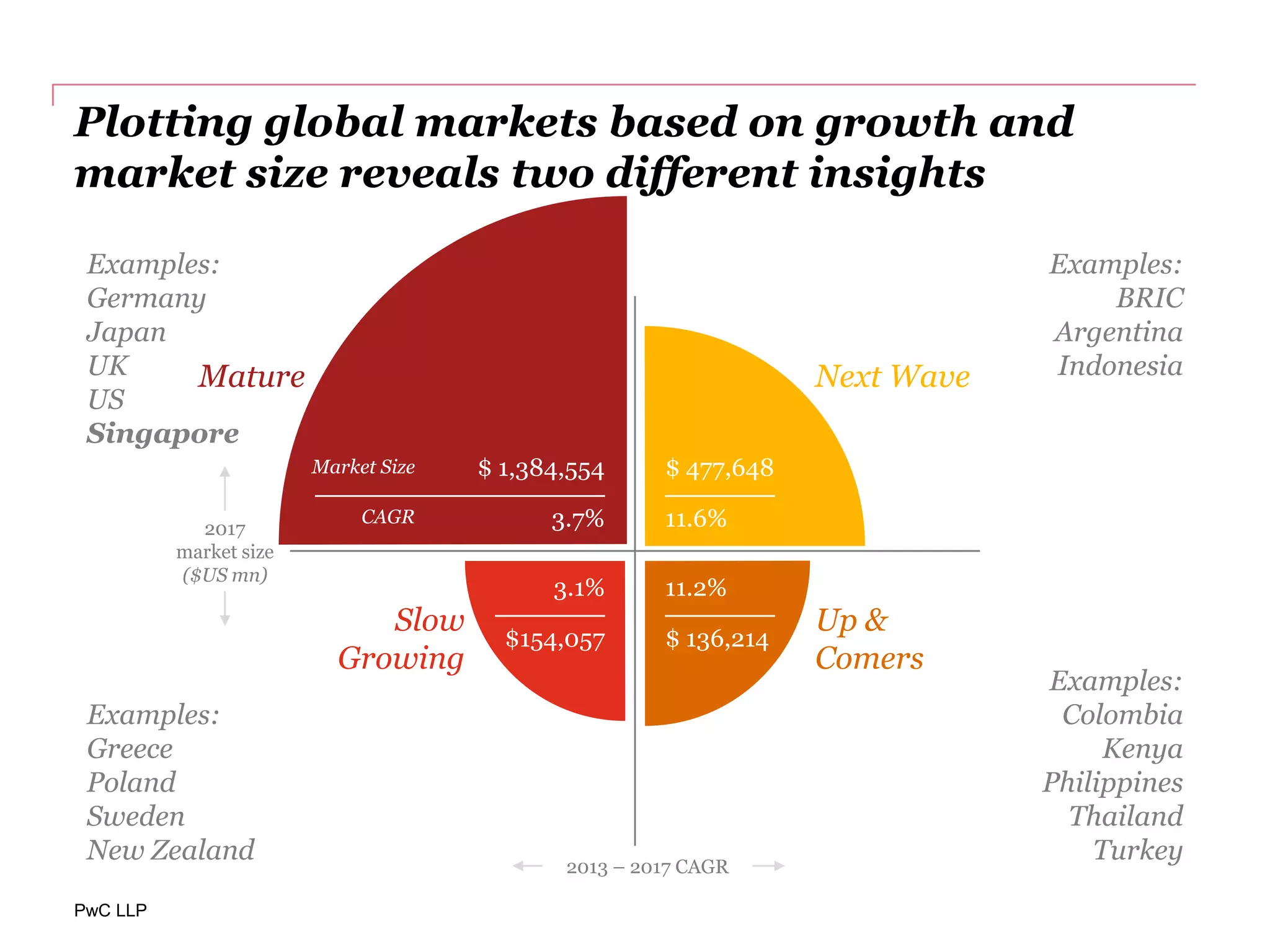

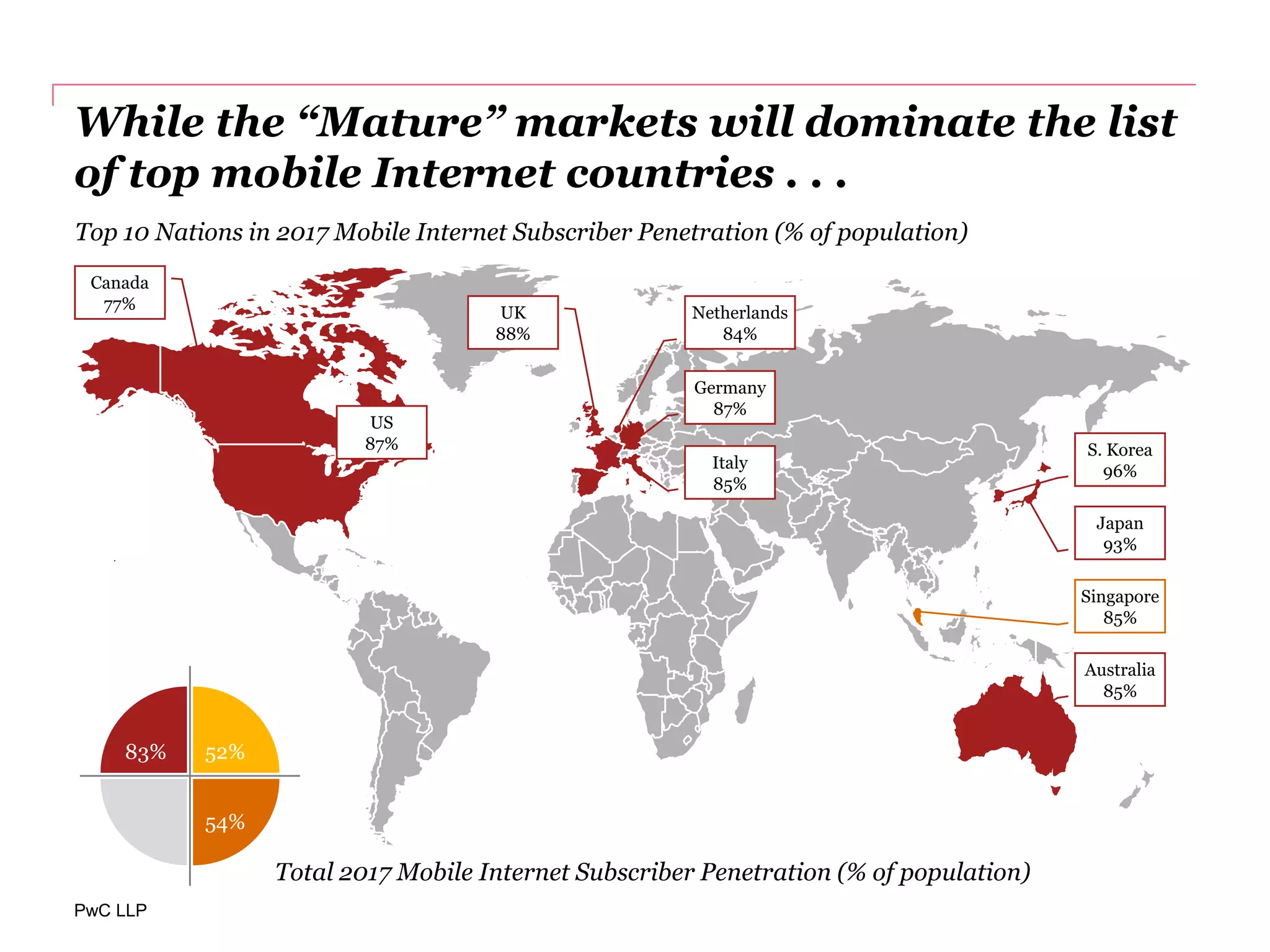

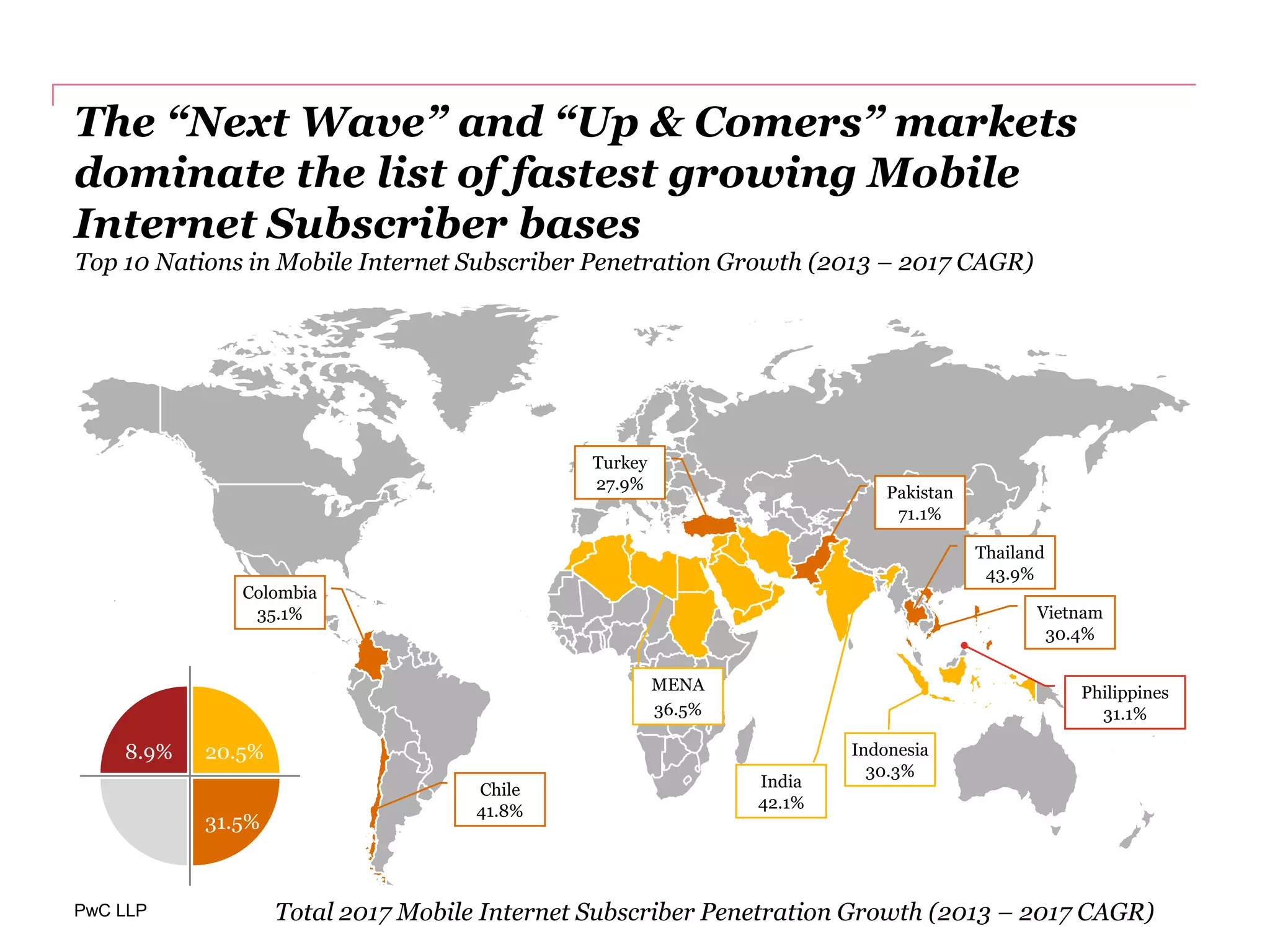

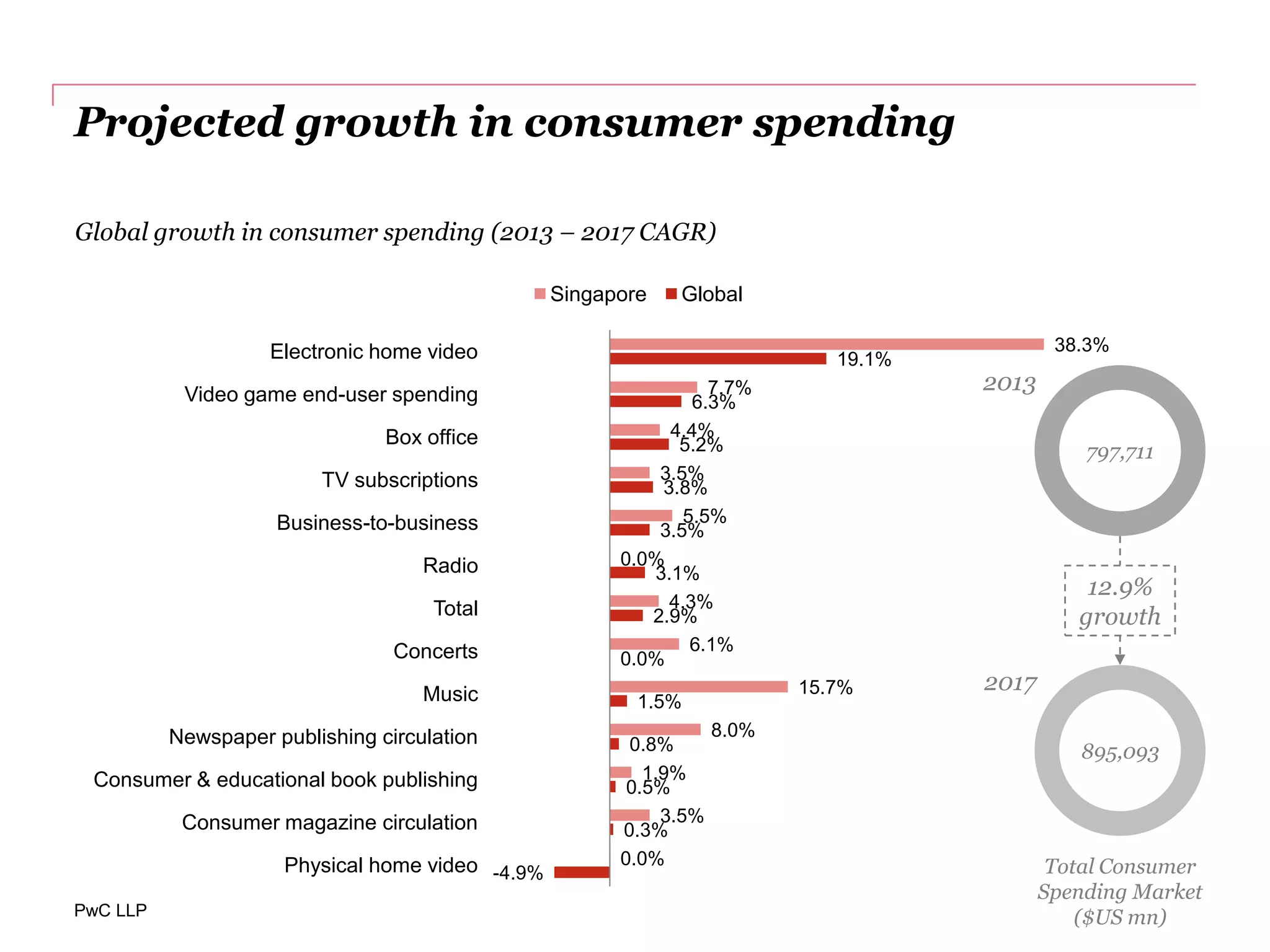

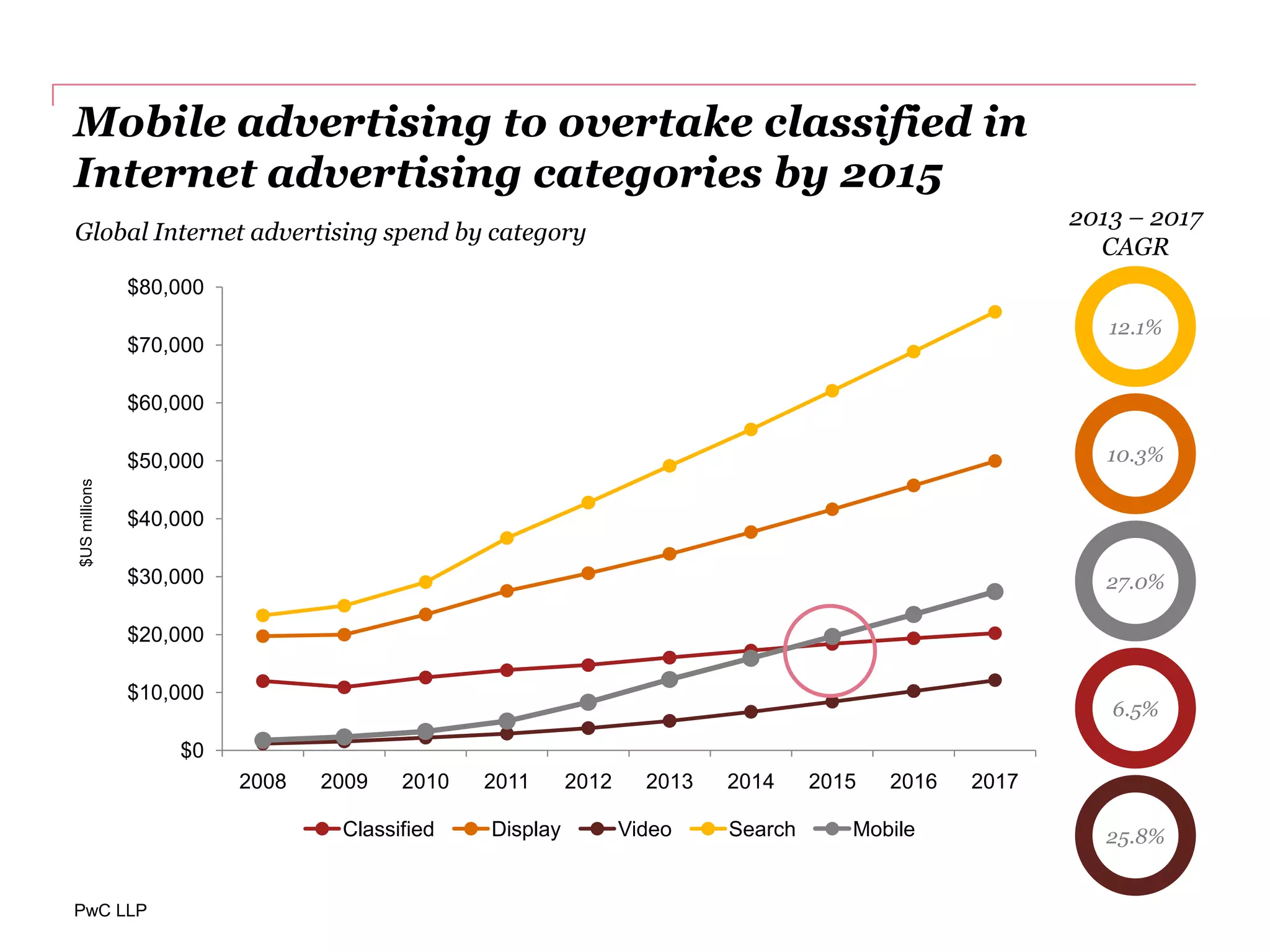

The 'Global Entertainment and Media Outlook 2013-2017' report from PwC analyzes growth trends and consumer behavior across various sectors, including internet access, advertising, and entertainment. It forecasts significant growth in mobile internet subscribers and highlights the increasing importance of consumer insights and digital innovation in shaping market dynamics. The report emphasizes the divergence in spending and growth rates between mature markets and emerging economies, pointing out the shift towards digital advertising and consumer-driven experiences.