zar monthly covered call report (march) draft

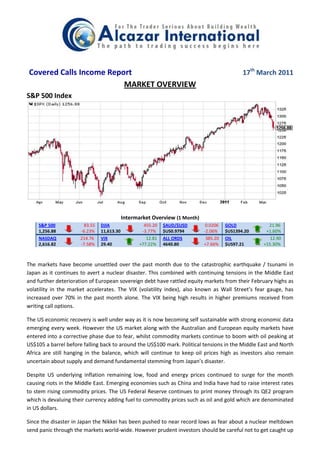

- 1. Covered Calls Income Report 17th March 2011 MARKET OVERVIEW S&P 500 Index Intermarket Overview (1 Month) S&P 500 83.55 DJIA 455.20 $AUD/$USD 0.0206 GOLD 21.96 1,256.88 -6.23% 11,613.30 -3.77% $US0.9794 -2.06% $US1394.20 +1.60% NASDAQ 214.76 VIX 12.81 ALL ORDS 385.20 OIL 12.90 2,616.82 -7.58% 29.40 +77.22% 4640.80 +7.66% $US97.21 +15.30% The markets have become unsettled over the past month due to the catastrophic earthquake / tsunami in Japan as it continues to avert a nuclear disaster. This combined with continuing tensions in the Middle East and further deterioration of European sovereign debt have rattled equity markets from their February highs as volatility in the market accelerates. The VIX (volatility index), also known as Wall Street’s fear gauge, has increased over 70% in the past month alone. The VIX being high results in higher premiums received from writing call options. The US economic recovery is well under way as it is now becoming self sustainable with strong economic data emerging every week. However the US market along with the Australian and European equity markets have entered into a corrective phase due to fear, whilst commodity markets continue to boom with oil peaking at US$105 a barrel before falling back to around the US$100 mark. Political tensions in the Middle East and North Africa are still hanging in the balance, which will continue to keep oil prices high as investors also remain uncertain about supply and demand fundamental stemming from Japan’s disaster. Despite US underlying inflation remaining low, food and energy prices continued to surge for the month causing riots in the Middle East. Emerging economies such as China and India have had to raise interest rates to stem rising commodity prices. The US Federal Reserve continues to print money through its QE2 program which is devaluing their currency adding fuel to commodity prices such as oil and gold which are denominated in US dollars. Since the disaster in Japan the Nikkei has been pushed to near record lows as fear about a nuclear meltdown send panic through the markets world-wide. However prudent investors should be careful not to get caught up

- 2. in the media hype and instead look for clear trading opportunities. You only have to look at the Eurozone debt crisis of mid 2010 or the BP oil spill to see how investors react to constant negative media and the subsequent rebound in prices once the issue is no longer top story. “Be fearful when others are greedy and greedy when others are fearful” - Warren Buffet This report has chosen to recommend only eight covered calls for the April expiry with the majority of call’s being written one or two strike prices In The Money (ITM) to offer greater downside protection against the current volatile market while still returning on average just over 3% for the month. Trade Well Daniel Rooney MARCH Covered Call Recommendations Code Stock Current Strike Premium Option Call Break Yield If Stop Price (Time Type Yield Even Exercised Loss Value) BHP BHP Billiton Ltd. $84.88 85.00 $3.50 OTM 4.12% 81.38 4.26% 77.31 (NYSE) CELG Celgene Corporation $52.88 52.50 $1.76 ITM 3.33% 50.74 3.33% 48.20 CTRP Ctrip.com $37.01 36.00 $1.39 ITM 3.76% 34.61 3.76% 32.88 International Ltd. MSFT Microsoft Corp. $24.79 24.00 $0.53 ITM 2.14% 23.47 2.14% 22.30 ORCL Oracle Corp $30.20 29.00 $0.83 ITM 2.75% 28.17 2.75% 26.76 TBT ProShares UltraShort $36.10 36.00 1.24 ITM 3.43% 34.76 3.43% 33.02 20+ Year Treasury USO Unites States Oil $39.68 38.00 1.03 ITM 2.60% 36.97 2.60% 35.12 Fund V Visa Inc. $70.96 70.00 $2.03 ITM 2.86% 67.97 2.86% 64.57 *N.B Please read the ‘Strategy Disclaimer’ found on the last page of this report before trading. Prices can change from the release date of this report to when trades are placed on entry resulting in different yields to the above stated. It is ideal that orders are placed whilst the market is open to ensure orders are filled as close as possible to the desired price. PLACE YOUR BUY AND SELL TRADES THROUGH Alcazar International Pty Ltd Call Our Dealing Desk – Daniel Rooney Phone: 1300 433 000 or Email: coveredcalls@alcazarsec.com.au That’s right, we offer clients our one stop shop, full service broking facility, providing you with full execution services to trade Stocks, CFD’s, Options strategies, Futures and Forex.

- 3. BHP Billiton Ltd. ADR (NYSE) Code Current Strike Premium Option Yield Break Yield If Stop Price (TV) Type Even Exercised Loss BHP $84.88 85.00 $3.50 OTM 4.12% 81.38 4.26% 77.31 COMPANY OVERVIEW: BHP Billiton is a diversified miner that supplies aluminium, coal, copper, iron ore, mineral sands, oil, gas, nickel, diamonds, uranium, and silver. BHP Billiton is a global leader in the resources industry. FUNDAMENTALS: Market Capitalisation $236.15 Billion Sales Growth past 5 Years 14.59% EPS (past 12 months) 6.13 Return on Equity 34.21% EPS Growth next 5 Years 14.75% Net Profit Margin 28.03% TRADE PROFILE: The US recovery from recession combined with China’s strong growth and demand for resources have helped BHP share price recover from its post GFC low of $25 as it continues to benefit from soaring commodity prices. BHP enjoys a healthy net profit margin of approximately 28% with sales growth over the past 5 years annually averaging just under 15%. An Out of The money Call Option yielding 4.12% would place the break even of $81.38 well under the past 3 months support level. ORDER Example: (N.B 1 US option contract = 100 shares) - Buy 100 BHP (NYSE) Shares @ $84.88 - Sell 1 BHP 85.00 April Call @ $3.50 Celgene Corporation (NASDAQ)

- 4. Code Current Strike Premium Option Yield Break Yield If Stop Price (TV) Type Even Exercised Loss CELG $52.88 52.50 $1.76 ITM 3.33% 50.74 3.33% 48.20 COMPANY OVERVIEW: Celgene is a biopharmaceutical firm that discovers, develops, and markets therapeutics for the treatment of cancer and immunological diseases. Acquisitions have brought MDS drug Vidaza, T-cell lymphoma drug Istodax, and breast cancer drug Abraxane. FUNDAMENTALS: Market Capitalisation $24.58 Billion Sales Growth past 5 Years 46.52% EPS (past 12 months) 1.88 Return on Equity 16.97% EPS Growth next 5 Years 24.54% Net Profit Margin 24.28% TRADE PROFILE: Celgene is in the midst of a global expansion led by its continued organic growth of existing drug and recent acquisitions adding strength to its portfolio. The company has ample cash reserves with a current ratio of 4.06 which could be used for additional acquisitions in the near future keeping sales moving higher. Celgene being a health care stock offers a higher degree of safety in volatile markets as an In The Money (ITM) call option offers greater downside protection with a break even lying on strong support just above the $50 price. ORDER Example: (N.B 1 US option contract = 100 shares) - Buy 100 CELG Shares @ $52.88 - Sell 1 CELG 52.50 April Call @ $2.14 Ctrip.com International Ltd. (NASDAQ)

- 5. Code Current Strike Premium Option Yield Break Yield If Stop Price (TV) Type Even Exercised Loss CTRP $37.01 36.00 $1.39 ITM 3.76% 34.61 3.76% 32.88 COMPANY OVERVIEW: Ctrip.com is the dominant provider of travel services for hotel accommodations, airline tickets, and packaged tours in China. Nearly a third of its current sales come through the online channel, while the other 70% is from call centres. FUNDAMENTALS: Market Capitalisation $5.47 Billion Sales Growth past 5 Years 40.61% EPS (past 12 months) 1.06 Return on Equity 23.22% EPS Growth next 5 Years 28.54% Net Profit Margin 34.22% TRADE PROFILE: With China’s online market expected to top RMB 5.4 billion in 2010 and triple to RMB 15.91 billion by 2013, makes Ctrip.com a very attractive company as over a third of its business comes from online transactions. Earnings per share have grown by 31.62% over the past 5 years as similar projections are anticipated over the coming 5 years. Writing an ITM call at the 36.00 strike will offer a 6.48% buffer to our breakeven price whilst yielding a 3.76% return. ORDER Example: (N.B 1 US option contract = 100 shares) - Buy 100 CTRP Shares @ $37.01 - Sell 1 CTRP 36.00 April Call @ $2.40 Microsoft Corp. (NASDAQ)

- 6. Code Current Strike Premium Option Yield Break Yield If Stop Price (TV) Type Even Exercised Loss MSFT $24.79 24.00 $0.53 ITM 2.14% 23.47 2.14% 22.30 COMPANY OVERVIEW: Microsoft develops the Windows operating system and the Office suite of productivity software. Windows and Office account for roughly 56% of Microsoft's revenue, with another 24% coming from software for enterprise servers. FUNDAMENTALS: Market Capitalisation $208.30 Billion Sales Growth past 5 Years 9.45% EPS (past 12 months) 2.36 Return on Equity 44.34% EPS Growth next 5 Years 10.55% Net Profit Margin 30.84% TRADE PROFILE: Microsoft is one of the largest tech giants which is piling up cash at a furious rate. It has also engaged in aggressive share repurchasing since 2006 buying back just under 1.5 billion shares. Fundamentally the company is sound but has had a major pull back in share price over the past 3 months which has created an opportunity to write the 24.00 covered call putting the break-even close to the 52 week low. ORDER Example: (N.B 1 US option contract = 100 shares) - Buy 100 MSFT Shares @ $24.79 - Sell 1 MSFT 24.00 April Call @ $1.32 Oracle Corp. (NASDAQ)

- 7. Code Current Strike Premium Option Yield Break Yield If Stop Price (TV) Type Even Exercised Loss ORCL $30.20 29.00 $0.83 ITM 2.75% 28.17 2.75% 26.76 COMPANY OVERVIEW: Oracle sells a wide range of enterprise IT solutions, including databases, middleware, applications, and hardware. Software license updates and product support, the most profitable segment of its operations, account for almost than 50% of total revenue. FUNDAMENTALS: Market Capitalisation $152.58 Billion Sales Growth past 5 Years 17.85% EPS (past 12 months) 1.33 Return on Equity 21.87% EPS Growth next 5 Years 14.02% Net Profit Margin 21.18% TRADE PROFILE: Oracle has an active acquisition program that is a fundamental component of the company's overall strategy, spending more than $34 billion in acquisitions since fiscal 2005. The recent correction in Oracle’s price is seen as a buying opportunity as the company is fundamentally sound and relatively stable. An ITM call has been written to lower the break-even level whilst still returning a healthy 2.75% for the month. ORDER Example: (N.B 1 US option contract = 100 shares) - Buy 100 ORCL Shares @ $30.20 - Sell 1 ORCL 29.00 April Call @ $2.03 ProShares UltraShort 20+ Year Treasury. (NYSE)

- 8. Code Current Strike Premium Option Yield Break Yield If Stop Price (TV) Type Even Exercised Loss TBT $36.10 36.00 $1.24 ITM 3.43% 34.76 3.43% 33.02 COMPANY OVERVIEW: ProShares UltraShort Lehman 20+ Treasury TBT is primarily an ETF holding for investors with a high-conviction belief that long-dated US Treasury bonds will drop in value as Treasury yields rise. TECHNICAL: 52 Week Low $29.77 Average Trading Range 0.89 52 Week High $50.68 Volatility (week) 2.39% Average Volume 15.38 Million Volatility (month) 1.91% TRADE PROFILE: Investors interested in this fund essentially think the unprecedented moves by the Federal Reserve’s quantitative easing program will cause an increase in inflation making fixed investments such as long-dated bonds undesirable causing TBT to increase. With commodity prices continuing to push to new heights and the US printing more money than it has ever done in history are all indicating that inflation is imminent. An ITM Covered Call at the 36.00 strike offers an impressive yield of 3.43% with good downside protection. ORDER Example: (N.B 1 US option contract = 100 shares) - Buy 100 TBT Shares @ $36.10 - Sell 1 TBT 36.00 April Call @ $1.34 United States Oil Fund. (NYSE)

- 9. Code Current Strike Premium Option Yield Break Yield If Stop Price (TV) Type Even Exercised Loss USO $39.68 38.00 $1.03 ITM 2.60% 36.97 2.60% 35.12 COMPANY OVERVIEW: United States Oil (USO) is an ETF that is designed to track the price movements of light, sweet crude oil. TECHNICAL: 52 Week Low $30.93 Average Trading Range 1.03 52 Week High $42.83 Volatility (week) 2.32% Average Volume 14.57 Million Volatility (month) 2.38% TRADE PROFILE: With unrest in the Middle East combined with the improving economy of the US has caused investors looking to hedge against inflation buying oil. Speculators have also recently flooded the oil market with the price of oil now over US$100 per barrel. The Federal Reserve continues to print money through its Quantitative Easing program, devaluing the US dollar, which is placing upwards pressure on the price of oil as it is denominated in US dollars. With oil prices likely to remain high a 38.00 covered call will be written ITM to offset any short term price volatility. ORDER Example: (N.B 1 US option contract = 100 shares) - Buy 100 USO Shares @ $39.68 - Sell 1 USO 38.00 April Call @ $2.71 Visa Inc. (NYSE)

- 10. Code Current Strike Premium Option Yield Break Yield If Stop Price (TV) Type Even Exercised Loss V $70.96 70.00 $2.03 ITM 2.86% 67.97 2.86% 64.57 COMPANY OVERVIEW: Visa manages a group of global payment card brands, which it licenses to financial institutions that issue cards to their customers. The firm acts as the payment processor by facilitating the authorization, clearing, and settlement of transactions on its proprietary networks. Visa maintains the largest card scheme in the world. FUNDAMENTALS: Market Capitalisation $50.57 Billion Sales Growth past 5 Years 24.79% EPS (past 12 months) 3.69 Return on Equity 12.60% EPS Growth next 5 Years 18.42% Net Profit Margin 36.98% TRADE PROFILE: Visa is a company with strong fundamentals with earnings growth over the past ranging between 15% to 20% and a net profit margin of 36.98%. In addition Visa is a good buy from a technical perspective as it trades 10% above its 52 week low. The recent fears about limits on debit card fees are overblown as the regulatory action will impact banks much more than Visa. The ITM 70.00 strike offers just under a 3% yield with a break even sitting on strong support. ORDER Example: (N.B 1 US option contract = 100 shares) - Buy 100 V Shares @ $70.96 - Sell 1 V 70.00 April Call @ $2.99

- 11. The subscription fee is only $200 per month, which includes auto trading the strategies on your own account, no contracts, cancel anytime. 100% Money Back Guarantee! We are so sure that you will love the Alcazar Covered Calls Income Report that we are offering an unconditional 100% money-back guarantee. If you are not completely satisfied with your purchase, simply notify us within 30 days and we will refund your subscription fee, in full, with absolutely no questions asked! That’s 30 days to put us to the test. I don’t think I can be any fairer than that. Tax Deduction: Your subscription fee to Alcazar Covered Calls Income Report is fully tax deductable, if you use the services offered to assist you to derive income or capital gain. Call now to join, trade smart not often, mirror trade and never miss a trade! Please contact our Dealing Desk to: 1. Become a Subscriber 2. Open your online trading account 3. Place your trading order 4. Auto trade your alerts – (Never miss a trade) 5. Receive regular market reports Phone Allen Liao: 1300.433.000 Warning Information contained in this newsletter is intended to be general advice only, and you are warned that: 1. The advice has been prepared without taking into account your objectives, financial situation or particular needs; and 2. Because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs; and 3. If the advice relates to the acquisition, or possible acquisition, of a particular financial product – you should obtain a Product Disclosure Statement relating to the product and consider the Statement before making any decision about whether to acquire the product. General Disclaimer Trading in financial products involves significant risk and/or loss and may not be suitable for you. You should never trade using money you cannot afford to lose. Past performance is no guarantee or reliable indication of future results. The contents of this document is in the nature of general information only and must not in any way be construed or relied upon as legal, financial or professional advice. The decision to invest or trade and the method selected is a personal decision and involves an inherent level of risk, and you must undertake your own investigations and obtain your own advice regarding the suitability of this product for your circumstances. Please ensure you obtain and read the current offer documentation from the relevant entity or your adviser, prior to acquiring the products contained herein, so you are informed regarding the key risks and costs associated with these products. ALCAZAR INTERNATIONAL PTY LTD (ACN 149 881 238) is a corporate authorised representative (ASIC # 401892) of Romad Financial Services Pty Ltd AFSL 238032, and is authorised to provide dealing services in Deposit products, Securities, Derivatives and Futures products and FOREX products. There is risk of LOSS trading Futures, Forex, Securities, Derivatives and Options. Past performance is not indicative of future results. You should seek advice before undertaking any trading or investments. © 2011 all rights reserved.