Embed presentation

Download as PDF, PPTX

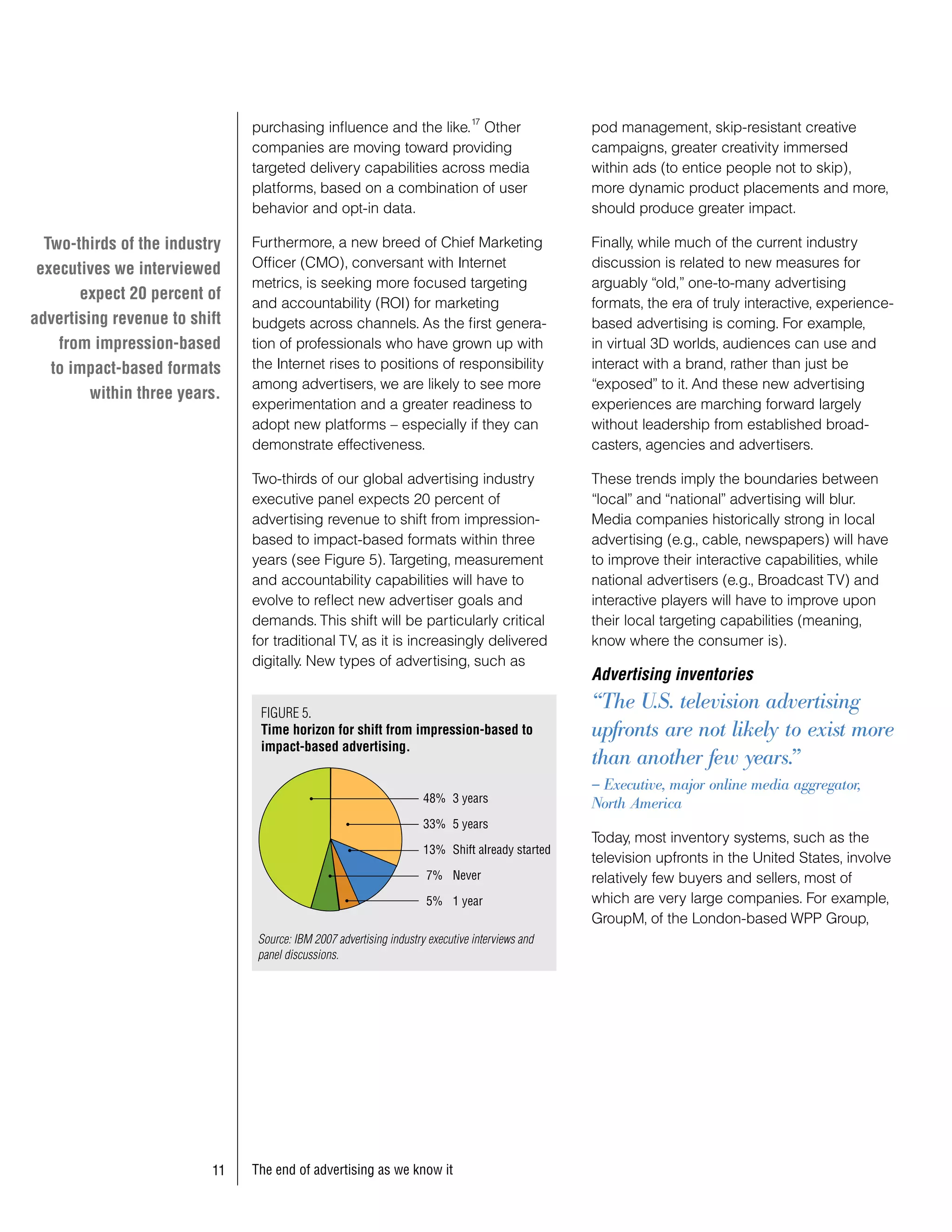

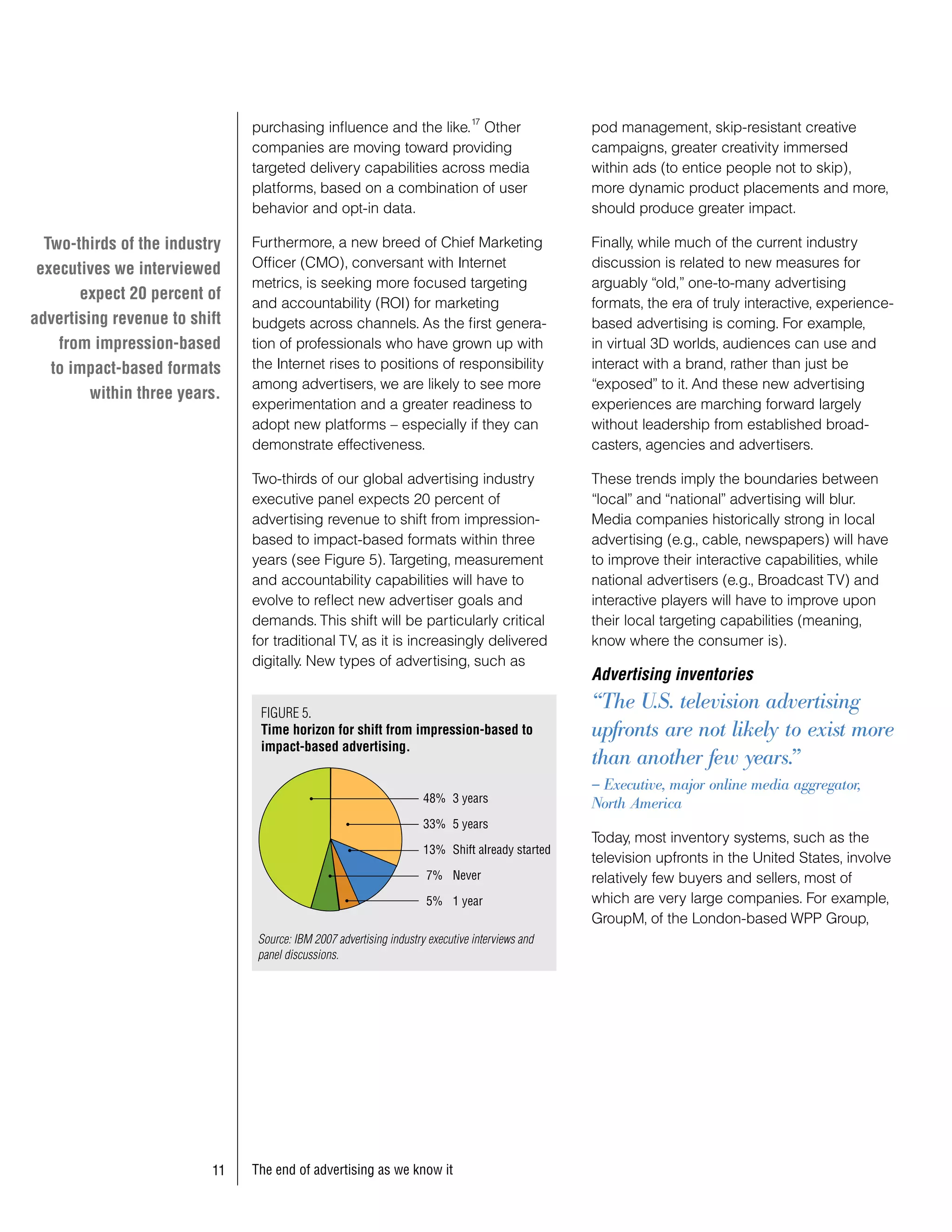

This document discusses the future of advertising based on research by IBM. It finds that over the next 5 years, more change is expected than the previous 50 years due to empowered consumers, evolving technologies, and new business models. Four scenarios for 2012 are presented based on the openness of advertising inventories and consumer control over marketing. Traditional players may be disrupted if they do not innovate their business models, designs, and offer more personalized advertising.