Report

Share

Recommended

Recommended

Entrepreneurship Development(ED)- Financial Institutions Supporting Entrepreneurship- MBAEntrepreneurship Development(ED)- Financial Institutions Supporting Entrepren...

Entrepreneurship Development(ED)- Financial Institutions Supporting Entrepren...Chandra Shekar Immani

More Related Content

What's hot

Entrepreneurship Development(ED)- Financial Institutions Supporting Entrepreneurship- MBAEntrepreneurship Development(ED)- Financial Institutions Supporting Entrepren...

Entrepreneurship Development(ED)- Financial Institutions Supporting Entrepren...Chandra Shekar Immani

What's hot (20)

Role of financial institutions for funding enterprise

Role of financial institutions for funding enterprise

Entrepreneurship Development(ED)- Financial Institutions Supporting Entrepren...

Entrepreneurship Development(ED)- Financial Institutions Supporting Entrepren...

Institutional Support to Micro, Small and Medium Enterprises

Institutional Support to Micro, Small and Medium Enterprises

National institute for entrepreneurship and small business development

National institute for entrepreneurship and small business development

agencies for policy formulation and implementation for promoting entrepreneur...

agencies for policy formulation and implementation for promoting entrepreneur...

Viewers also liked

Viewers also liked (20)

National Bank for Agriculture and Rural Development (NABARD)

National Bank for Agriculture and Rural Development (NABARD)

Similar to Sidbi

Similar to Sidbi (20)

Role of specilized institution in development of ssi

Role of specilized institution in development of ssi

Role of supoort Institutions & Management of Small Business UNIT IV

Role of supoort Institutions & Management of Small Business UNIT IV

entrepreneurship and small business management unit iv

entrepreneurship and small business management unit iv

government institutions for entrepreneurship development

government institutions for entrepreneurship development

The 10 most trusted non banking financial companies to watch in 2019 compressed

The 10 most trusted non banking financial companies to watch in 2019 compressed

Recently uploaded

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974 🔝✔️✔️

Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes.

We provide both in-call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease.

We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us.

Our services feature various packages at competitive rates:

One shot: ₹2000/in-call, ₹5000/out-call

Two shots with one girl: ₹3500/in-call, ₹6000/out-call

Body to body massage with sex: ₹3000/in-call

Full night for one person: ₹7000/in-call, ₹10000/out-call

Full night for more than 1 person: Contact us at 🔝 9953056974 🔝. for details

Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations.

For premium call girl services in Delhi 🔝 9953056974 🔝. Thank you for considering us!Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-992072VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Call Girls

Booking Now open +91- 9352852248

Why you Choose Us- +91- 9352852248

HOT⇄ 8005736733

Mr ashu ji

Call Mr ashu Ji +91- 9352852248

𝐇𝐨𝐭𝐞𝐥 𝐑𝐨𝐨𝐦𝐬 𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐑𝐚𝐭𝐞 𝐒𝐡𝐨𝐭𝐬/𝐇𝐨𝐮𝐫𝐲🆓 .█▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓

Hello Guys ! High Profiles young Beauties and Good Looking standard Profiles Available , Enquire Now if you are interested in Hifi Service and want to get connect with someone who can understand your needs.

Service offers you the most beautiful High Profile sexy independent female Escorts in genuine ✔✔✔ To enjoy with hot and sexy girls ✔✔✔$s07

★providing:-

• Models

• vip Models

• Russian Models

• Foreigner Models

• TV Actress and Celebrities

• Receptionist

• Air Hostess

• Call Center Working Girls/Women

• Hi-Tech Co. Girls/Women

• HousewifeCall Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...roshnidevijkn ( Why You Choose Us? ) Escorts

Low Rate Call Girls Pune Vedika Call Now: 8250077686 Pune Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974 🔝✔️✔️

Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes.

We provide both in-call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease.

We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us.

Our services feature various packages at competitive rates:

One shot: ₹2000/in-call, ₹5000/out-call

Two shots with one girl: ₹3500/in-call, ₹6000/out-call

Body to body massage with sex: ₹3000/in-call

Full night for one person: ₹7000/in-call, ₹10000/out-call

Full night for more than 1 person: Contact us at 🔝 9953056974 🔝. for details

Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations.

For premium call girl services in Delhi 🔝 9953056974 🔝. Thank you for considering us!call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️9953056974 Low Rate Call Girls In Saket, Delhi NCR

Call Girl Srinagar Indira Call Now: 8617697112 Srinagar Escorts Booking Contact Details WhatsApp Chat: +91-8617697112 Srinagar Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable. Independent Escorts Srinagar understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7Call Girls in Nagpur High Profile Call Girls

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...dipikadinghjn ( Why You Choose Us? ) Escorts

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Girls Waiting For You To Fuck

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...Call Girls in Nagpur High Profile

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call Girls All India Service 🔥

Looking for Enjoy all Day(Akanksha) : ☎️ +91-7737669865

Today call girl service available 24X7*▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 CALL 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓 SERVICE ✅

⭐➡️HOT & SEXY MODELS // COLLEGE GIRLS

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

★ SAFE AND SECURE HIGH CLASS SERVICE AFFORDABLE RATE

★ 100% SATISFACTION,UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL 24x7 :: 3 * 5 *7 *Star Hotel Service .In Call & Out call SeRvIcEs :

★ A-Level (5 star escort) S040524N

★ Strip-tease

★ BBBJ (Bareback Blowjob)Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

100% SAFE AND SECURE 24 HOURS SERVICE AVAILABLE HOME AND HOTEL SERVICES

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-7737669865 👈

Our Best Areas:-

( Rohtak, Korba, Berhampur, Muzaffarpur, Mathura, Kollam, Avadi, Kadapa, Kamarhati, Sambalpur, Bilaspur, Shahjahanpur, Bijapur, Rampur, Shivamogga, Thrissur, Bardhaman, Kulti, Nizamabad, Tumkur, Khammam, Ozhukarai, Bihar Sharif, Panipat, Darbhanga, Bally, Karnal, Kirari Suleman Nagar, Barasat, Purnia, Satna, Mau, Sonipat, Farrukhabad, Sagar, Durg, Ratlam, Hapur, Arrah, Etawah, North Dumdum, Begusarai, Gandhidham, Baranagar, Tiruvottiyur, Puducherry, Thoothukudi, Rewa, Mirzapur, Raichur, Ramagundam, Katihar, Thanjavur, Bulandshahr, Uluberia, Murwara, Sambhal, Singrauli, Nadiad, Secunderabad, Naihati, Yamunanagar, Bidhan Nagar, Pallavaram, Munger, Panchkula, Burhanpur, Kharagpur, Dindigul, Hospet, Malda, Ongole, Deoghar, Chhapra, Haldia, Nandyal, Morena, Amroha, Madhyamgram, Bhiwani, Baharampur, Ambala, Morvi, Fatehpur, kutch, machilipatnam, mahisagar, malwa, manali, mansa, margao, mehsana, mizoram, modasa, moga, mohali, morbi, Mount Abu, muktsar, nainital, narmada, narsinghpur, Navsari, nawanshahr, neemuch, ooty, palanpur, panna, patan, pathankot, porbandar, prakasam, pushkar, raisen, rajpura, rishikesh, roorkee, sabarkantha, sangrur, sehore, seoni, shahdol, shajapur, sheopur, shivpuri, surendranagar, valsad, vapi, veraval, vidisha, Edappally, Ernakulam, Kottayam, Alappuzha, Chalakudy, Changanassery, Cherthala, Chittur Thathamangalam, Guruvayoor, Kanhangad, Kannur, Kasaragod, Kodungallur, Koyilandy, Malappuram, Nedumangad, Neyyattinkara, Palakkad, Paravur, Pathanamthitta, Peringathur, Perumbavoor, Taliparamba, Thiruvalla, Vaikom, Varkala, Chengannur, Munnar, Guruvayur, Kovalam, Thalassery, Ponnani, Punalur, Angamaly, Shornur, Ottapalam, Kalpetta, Kumarakom, Irinjalakuda, Muvattupuzha, Thekkady, Wayanad, Erattupetta, Kottakkal, Mananthavady, Ma( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALLVIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Shikrapur ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Shikrapur ⟟ 6297143586 ⟟ Call Me For Genuine Sex S...

Top Rated Pune Call Girls Shikrapur ⟟ 6297143586 ⟟ Call Me For Genuine Sex S...Call Girls in Nagpur High Profile

Call Girl Mumbai Indira Call Now: 8250077686 Mumbai Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Mumbai Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Mumbai understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...Call Girls in Nagpur High Profile

Recently uploaded (20)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

Bandra High Profile Sexy Call Girls,9833754194-Khar Road Speciality Call Girl...

Bandra High Profile Sexy Call Girls,9833754194-Khar Road Speciality Call Girl...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

Top Rated Pune Call Girls Shikrapur ⟟ 6297143586 ⟟ Call Me For Genuine Sex S...

Top Rated Pune Call Girls Shikrapur ⟟ 6297143586 ⟟ Call Me For Genuine Sex S...

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

Call Girls Rajgurunagar Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Rajgurunagar Call Me 7737669865 Budget Friendly No Advance Booking

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Sidbi

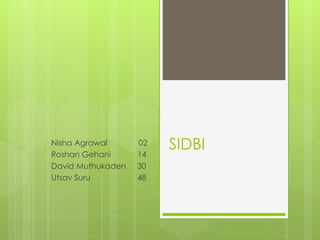

- 1. Nisha Agrawal Roshan Gehani 02 14 SIDBI David Muthukaden 30 Utsav Suru 48

- 2. What is SIDBI SIDBI stands for Small Industries Development Bank of India An independent financial institution aimed to aid the growth and development of micro, small and medium scale enterprises in India Set up in 1990 through an act of parliament, it was incorporated initially as a wholly owned subsidiary of Industrial Development Bank of India

- 3. SIDBIretained its position in the top 30 Development Banks of the World in the latest ranking of The Banker, London. As per the May 2001 issue of The Banker, London, SIDBI ranked 25th both in terms of Capital and Assets .

- 4. Objectives Small Industries Development Bank of India is an independent financial institution aimed to aid the growth and development of micro, small and medium-scale enterprises in India.

- 5. Mission: To empower the Micro, Small and Medium Enterprises (MSME) sector with a view to contributing to the process of economic growth, employment generation and balanced regional development. Vision: To emerge as a single window for meeting the financial and developmental needs of the small scale sector to make it strong, vibrant and globally competitive, to position SIDBI Brand as the preferred and customer - friendly institution and for enhancement of share - holder wealth and highest corporate values through modern technology platform.

- 6. Shareholding The entire issued capital of Rs.450 Crore has been divided into 45 Crore shares of Rs.10 each. Of the total Rs.450 Crore subscribed by IDBI, while setting up of SIDBI, 19.21% has been retained by it and balance 80.79% has been transferred / divested in favour of banks / institutions / insurance companies owned and controlled by the Central Government.

- 7. Aim Of SIDBI Expansion of small scale sector and increase its share in industrial output. ‡Development of rural areas where more than 70% of the population resides. ‡Increase the efficiency of SSIs. ‡Increase the contribution of SSIs in export. ‡More employment generation in rural areas of rural India

- 8. The business domain of SIDBI The business domain of SIDBI consists of small scale industrial units, which contribute significantly to the national economy in terms of production, employment and exports. Small scale industries are the industrial units in which the investment in plant and machinery does not exceed Rs.10 million . About 3.1 million such units, employing 17.2 million persons account for a share of 36 per cent of India's exports and 40 per cent of industrial manufacture. SIDBI's assistance flows to the transport, health care and tourism sectors and also to the professional and self-employed persons setting up small-sized professional ventures.

- 9. Conclusion we can say that the SIDBI, by the mode of refinancing, discounting and rediscounting as well as financial assistance through indirect functions regarding lending to Primary institutions, through its direct assistance to small units and through its various developmental and supporting services, encouraging small scale sector in Rural India.