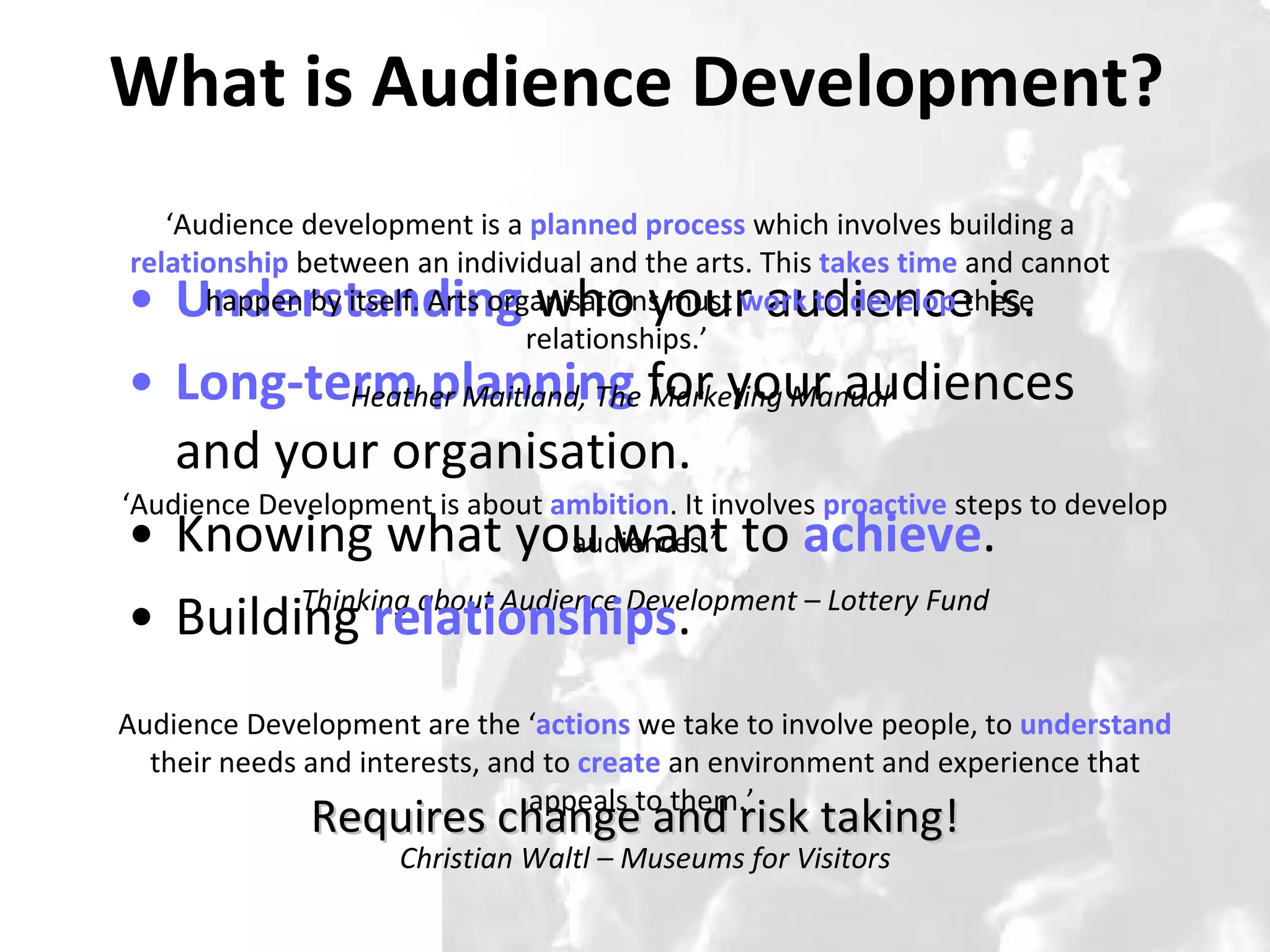

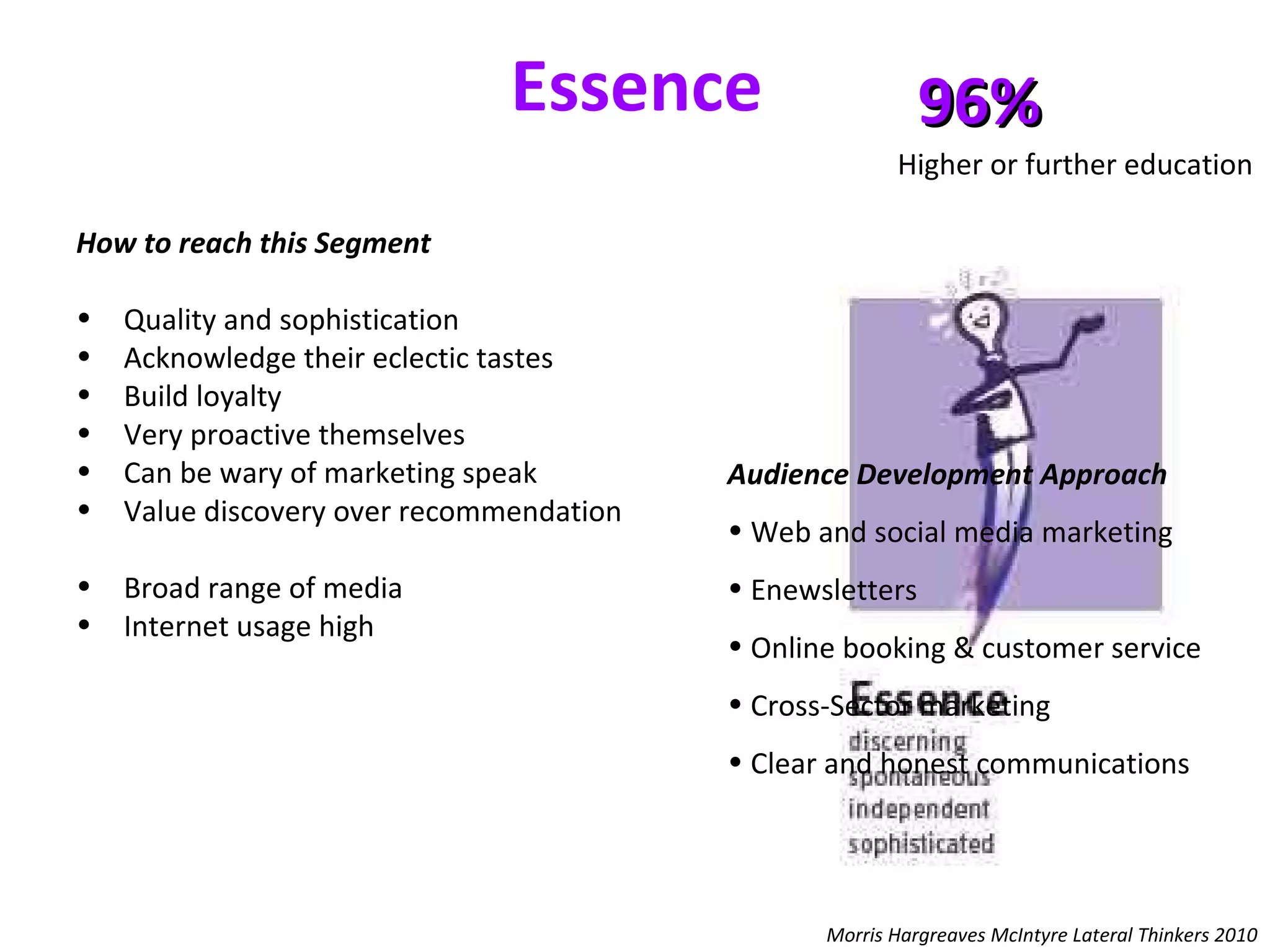

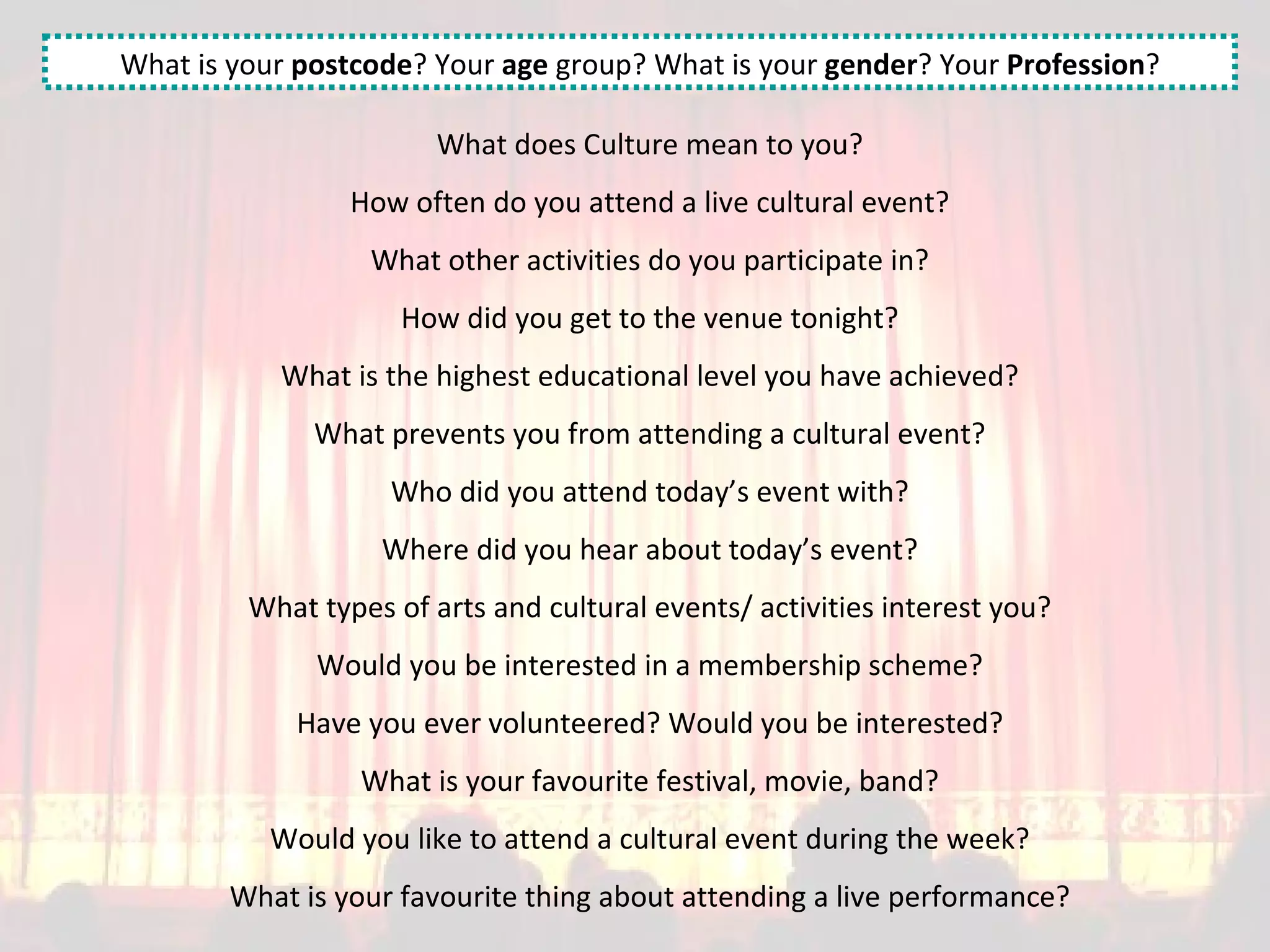

Audience development involves understanding current audiences, attracting new audiences, and creating enriching experiences for all. It is a planned process of building long-term relationships between arts organizations and individuals. Audience research can help organizations identify opportunities, overcome obstacles, and improve in various areas to better serve audiences and increase attendance numbers.

![Sian Jamieson HI-Arts Audience Development Manager Marketing Advice and Support Audience Development Research Audience Development Planning Customer Relationship Management Marketing Health Checks Workshops and training [email_address]](https://image.slidesharecdn.com/scottishborderspresentation-110905080135-phpapp01/75/Audience-Development-2-2048.jpg)

![[email_address] 01463 720 889 www.hi-arts.co.uk Twitter @HiArtsAudiences www.facebook.com/HIArtsAudienceDevelopment http://audiences.northings.com/](https://image.slidesharecdn.com/scottishborderspresentation-110905080135-phpapp01/75/Audience-Development-74-2048.jpg)