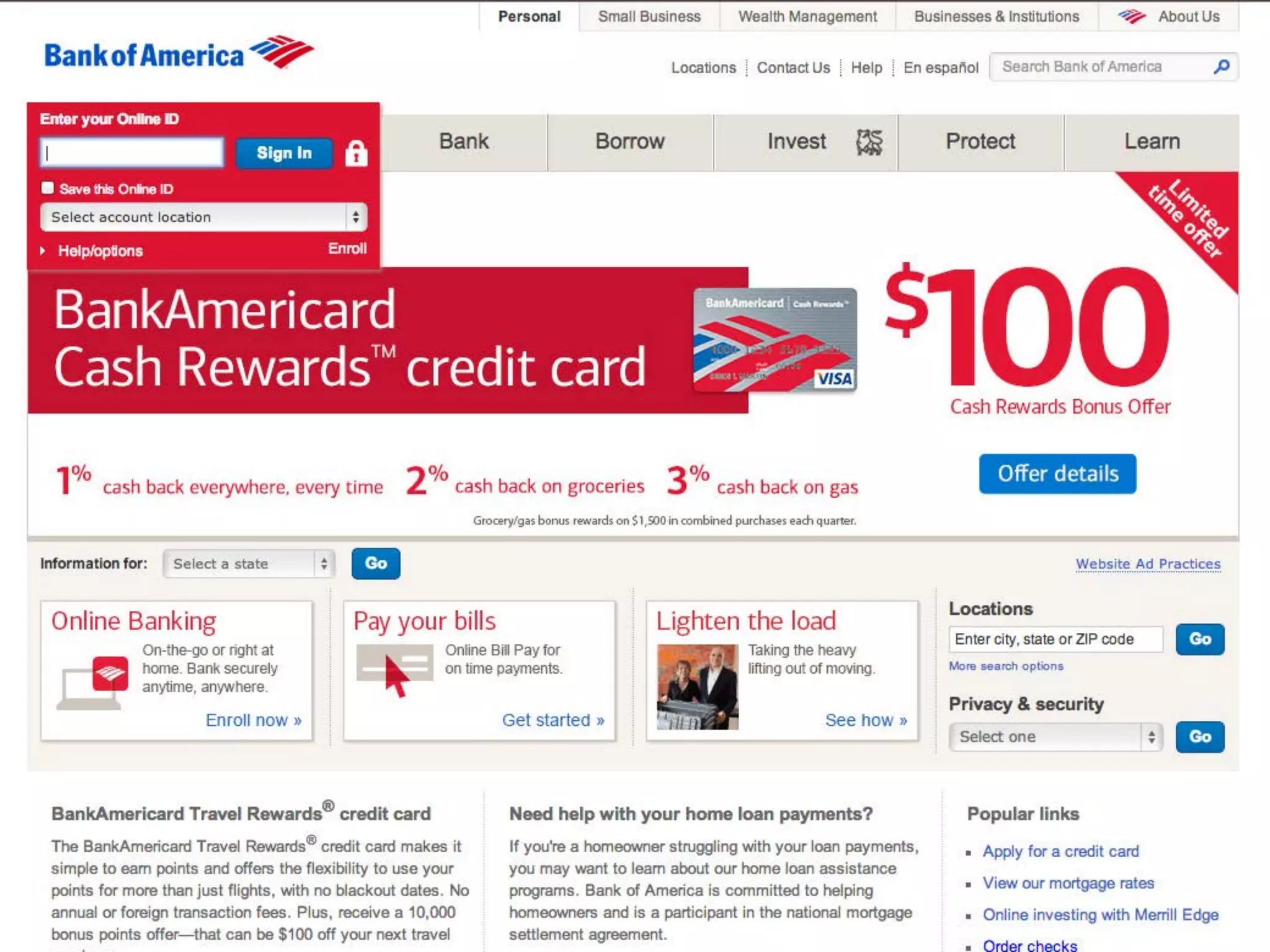

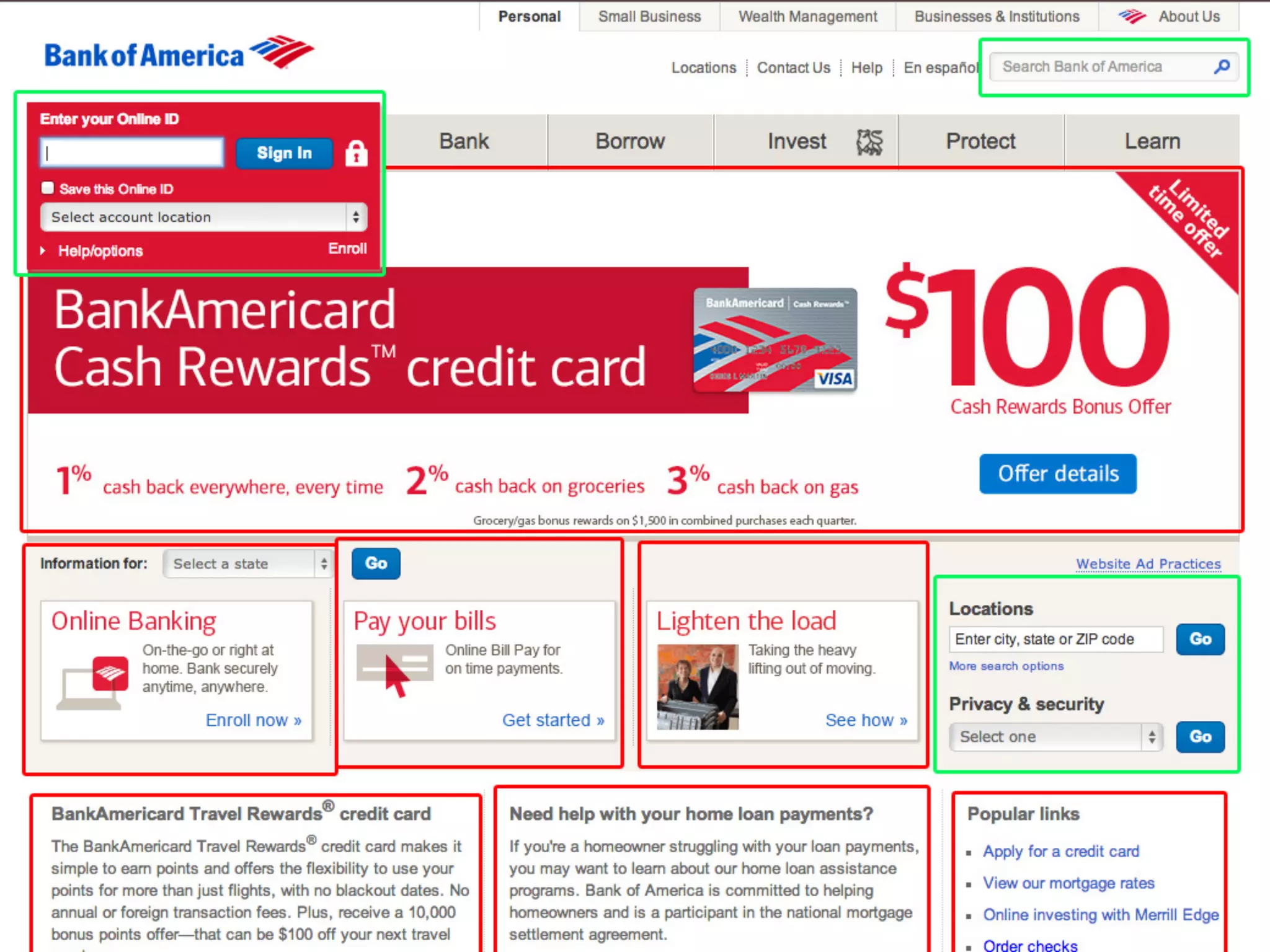

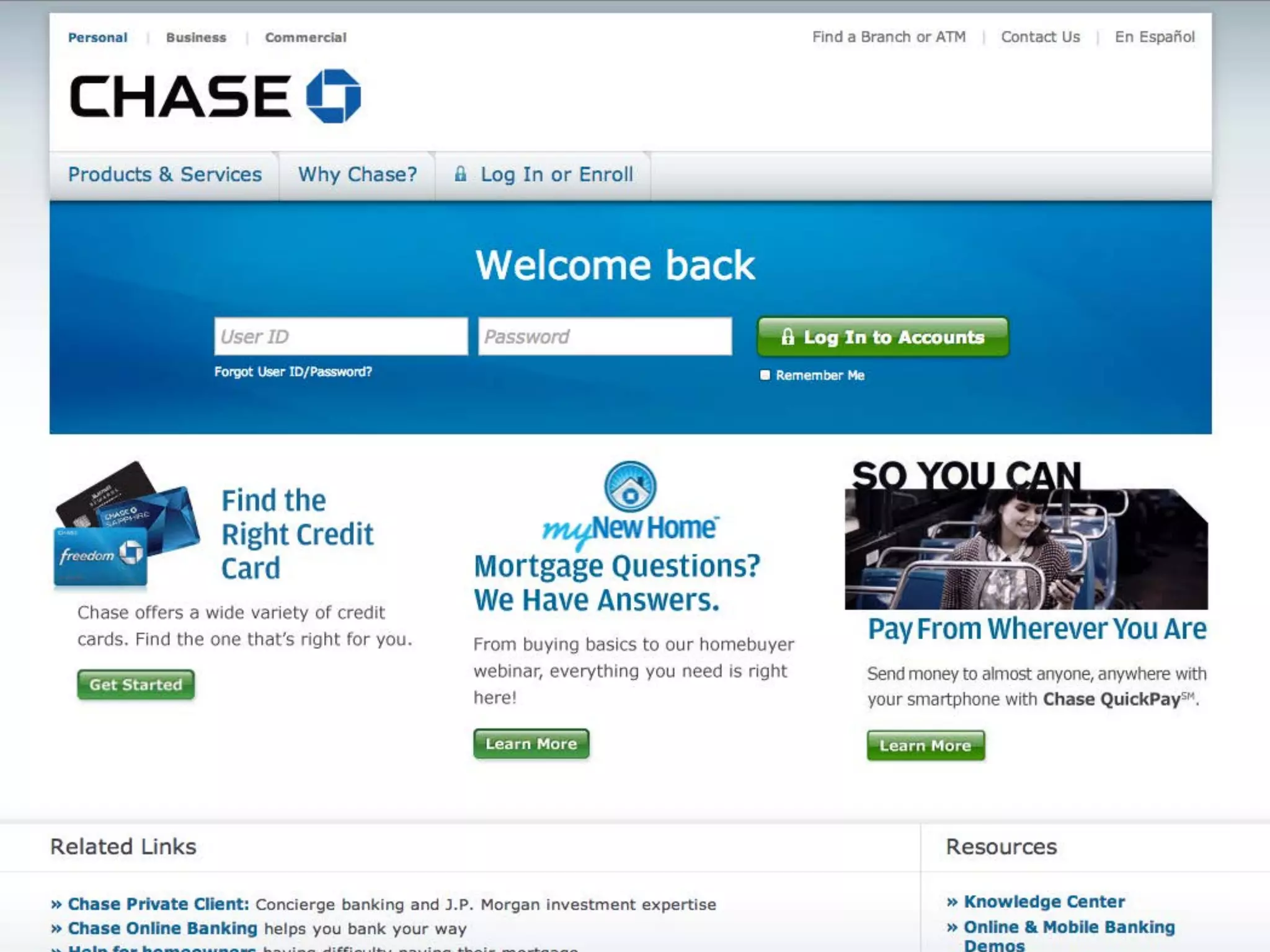

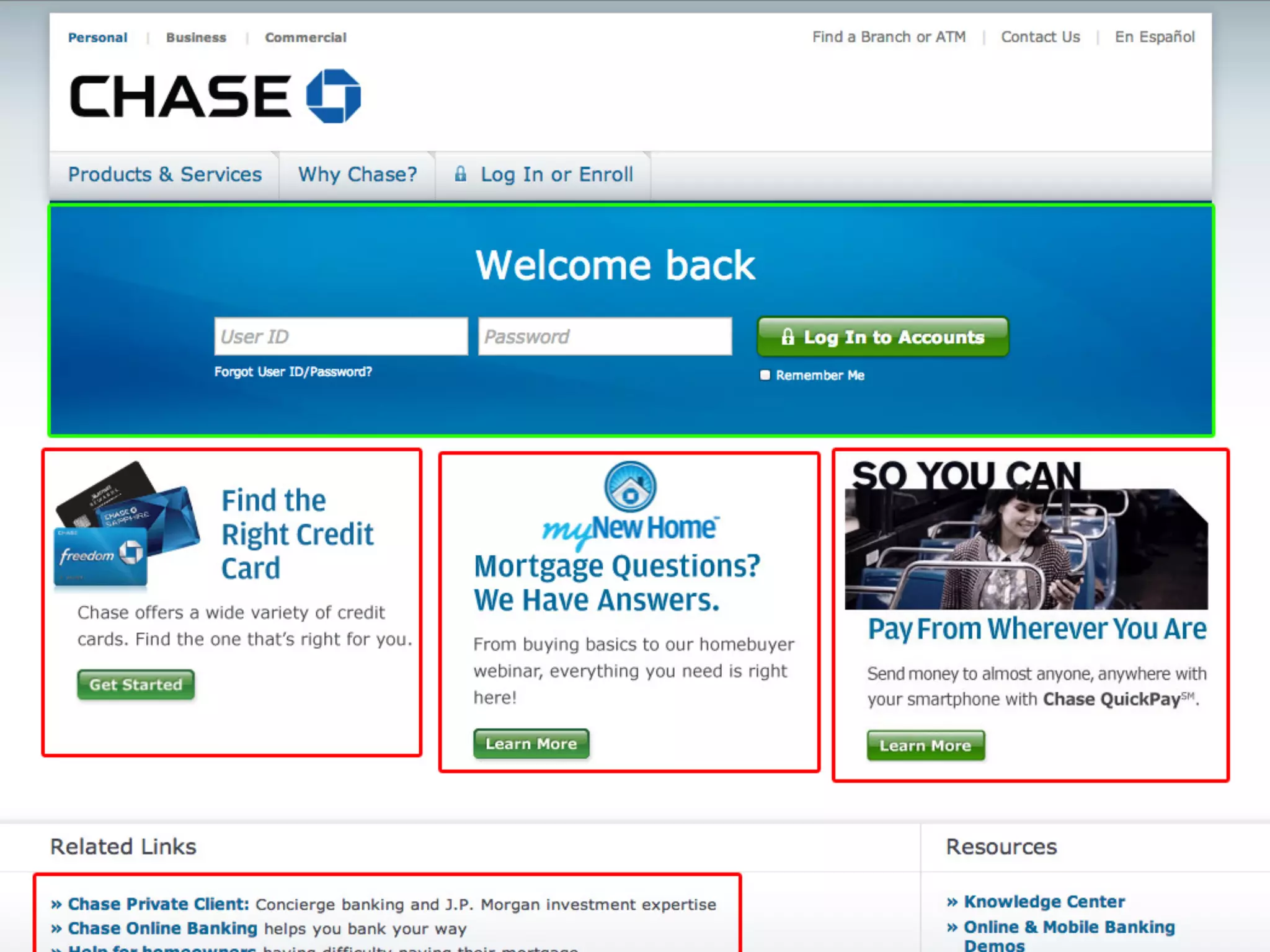

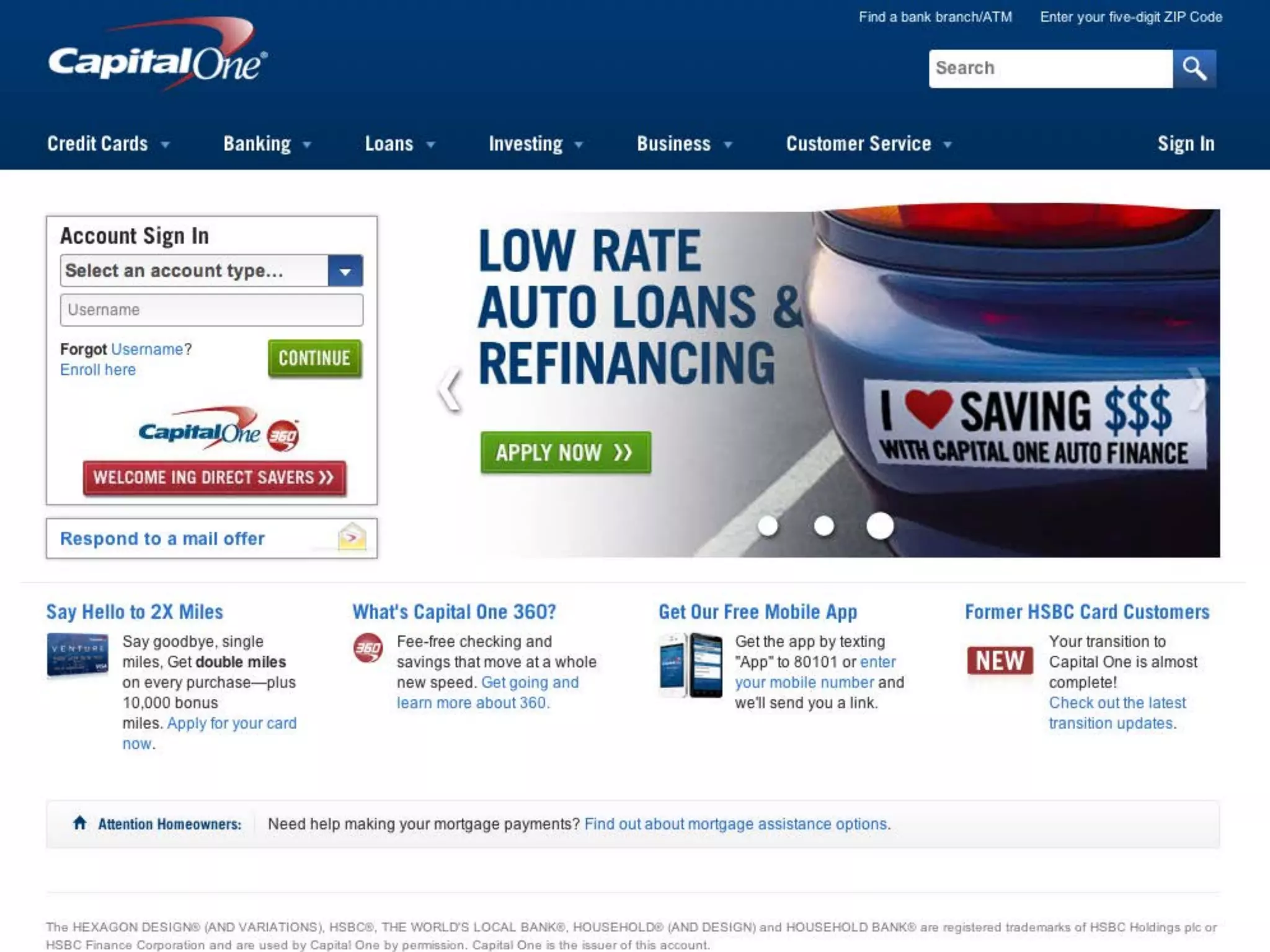

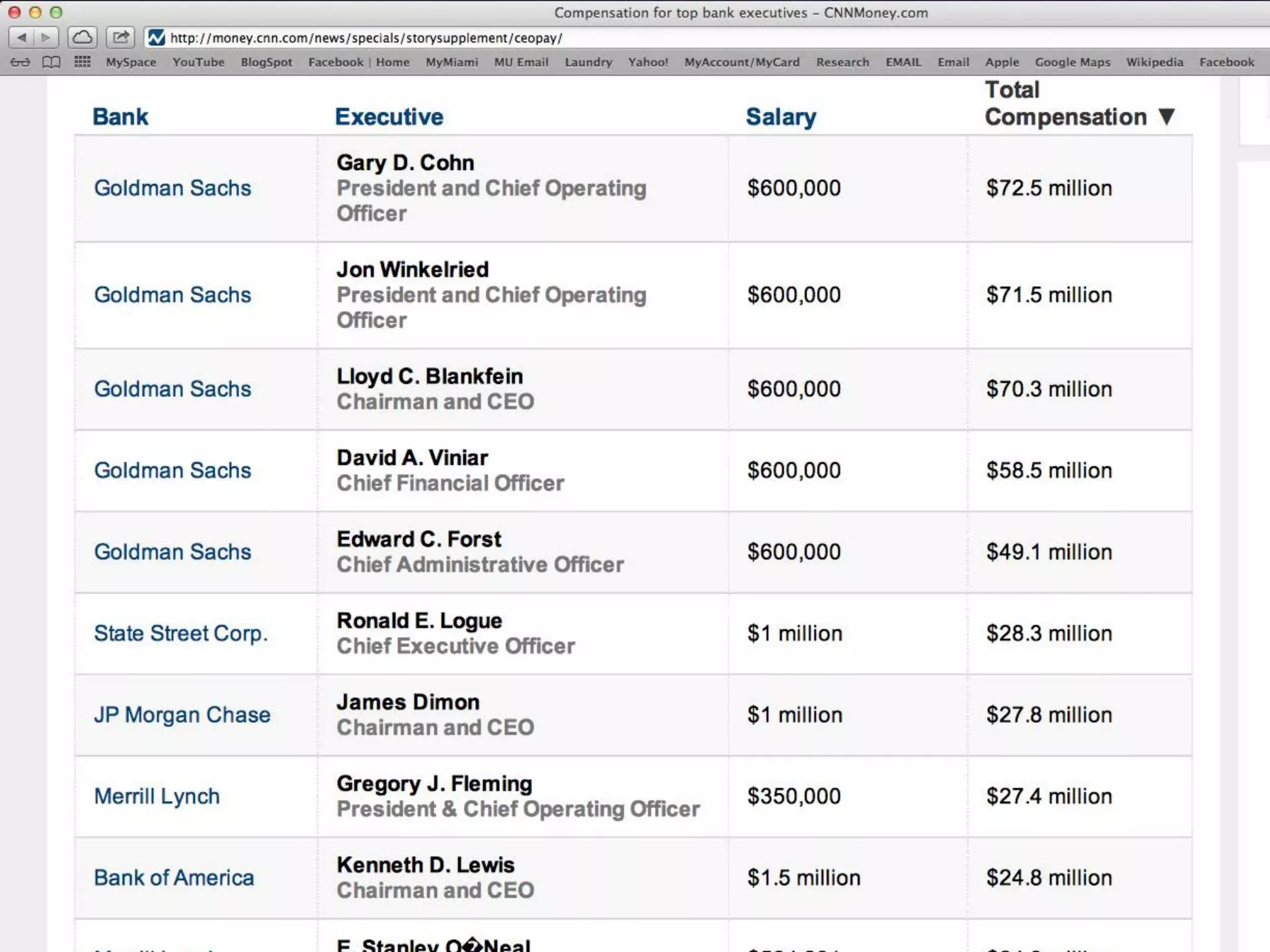

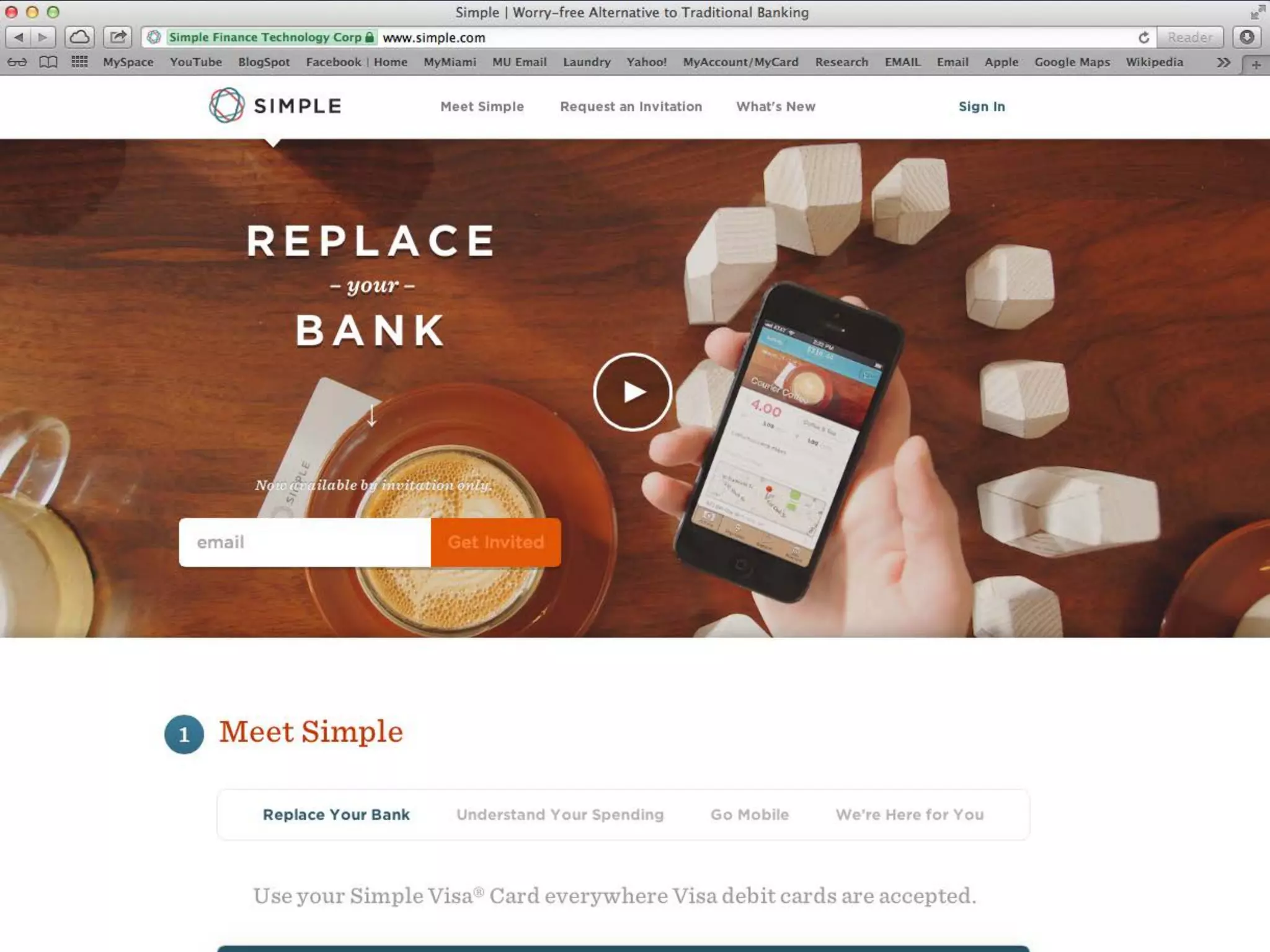

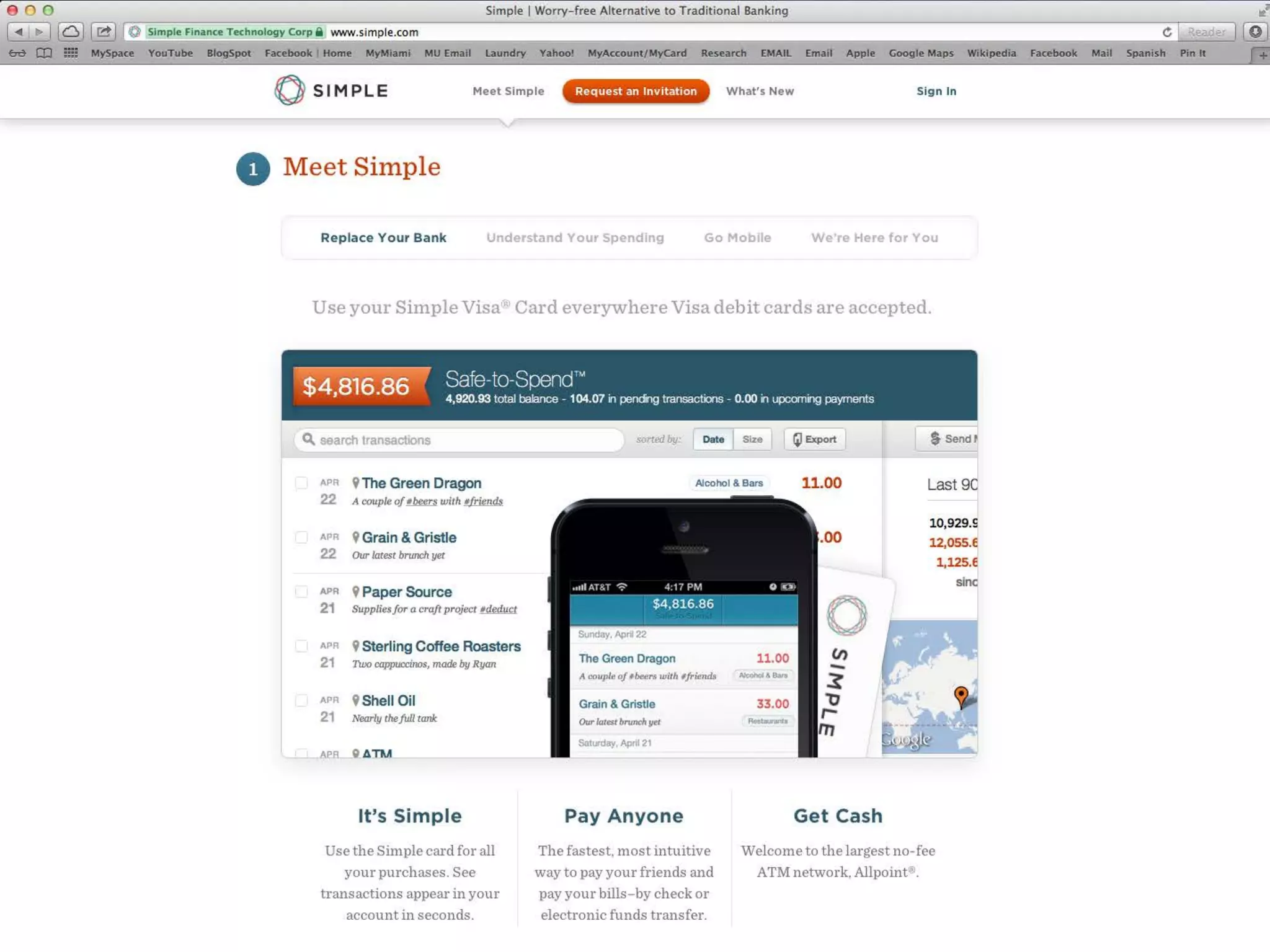

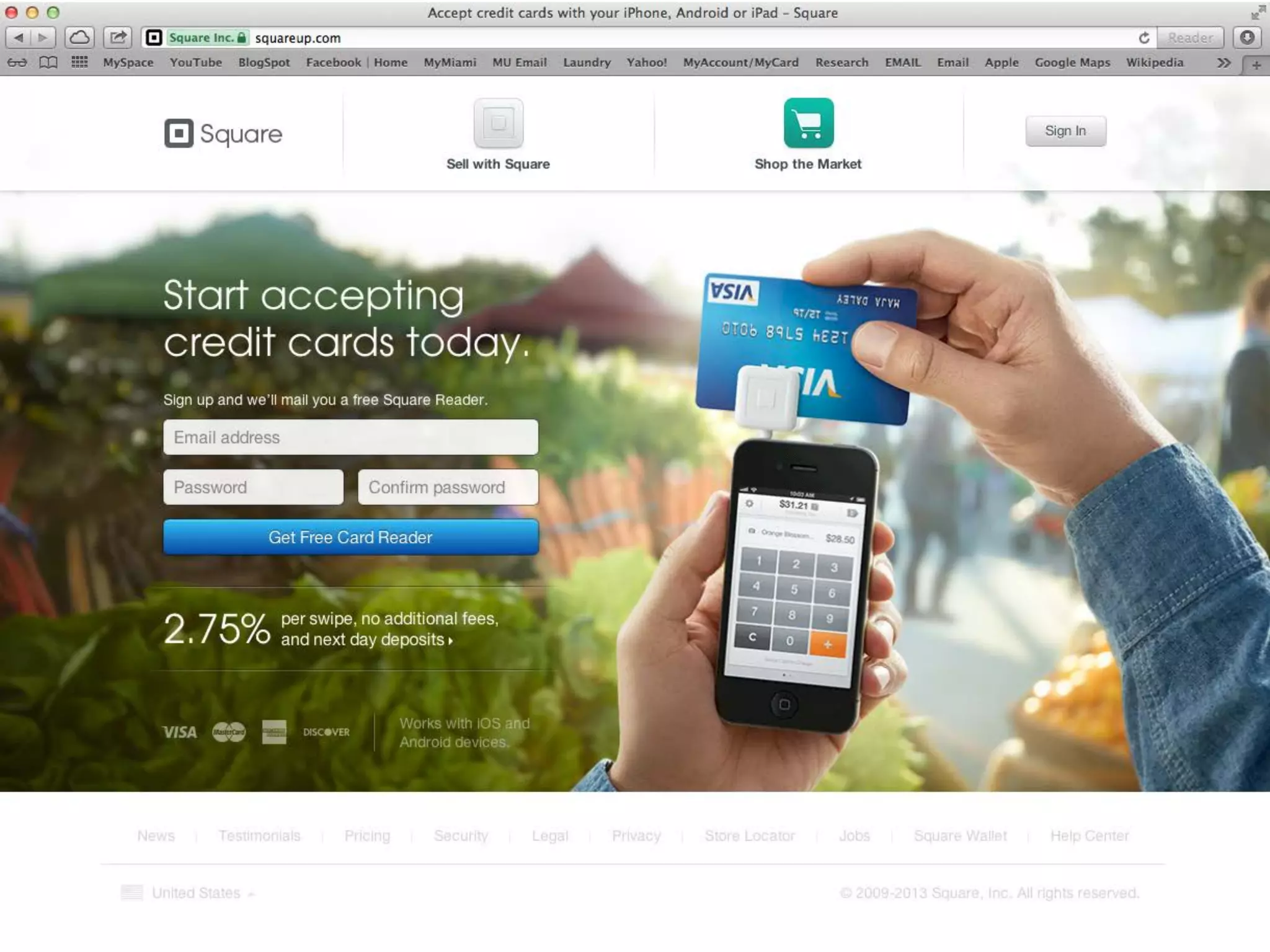

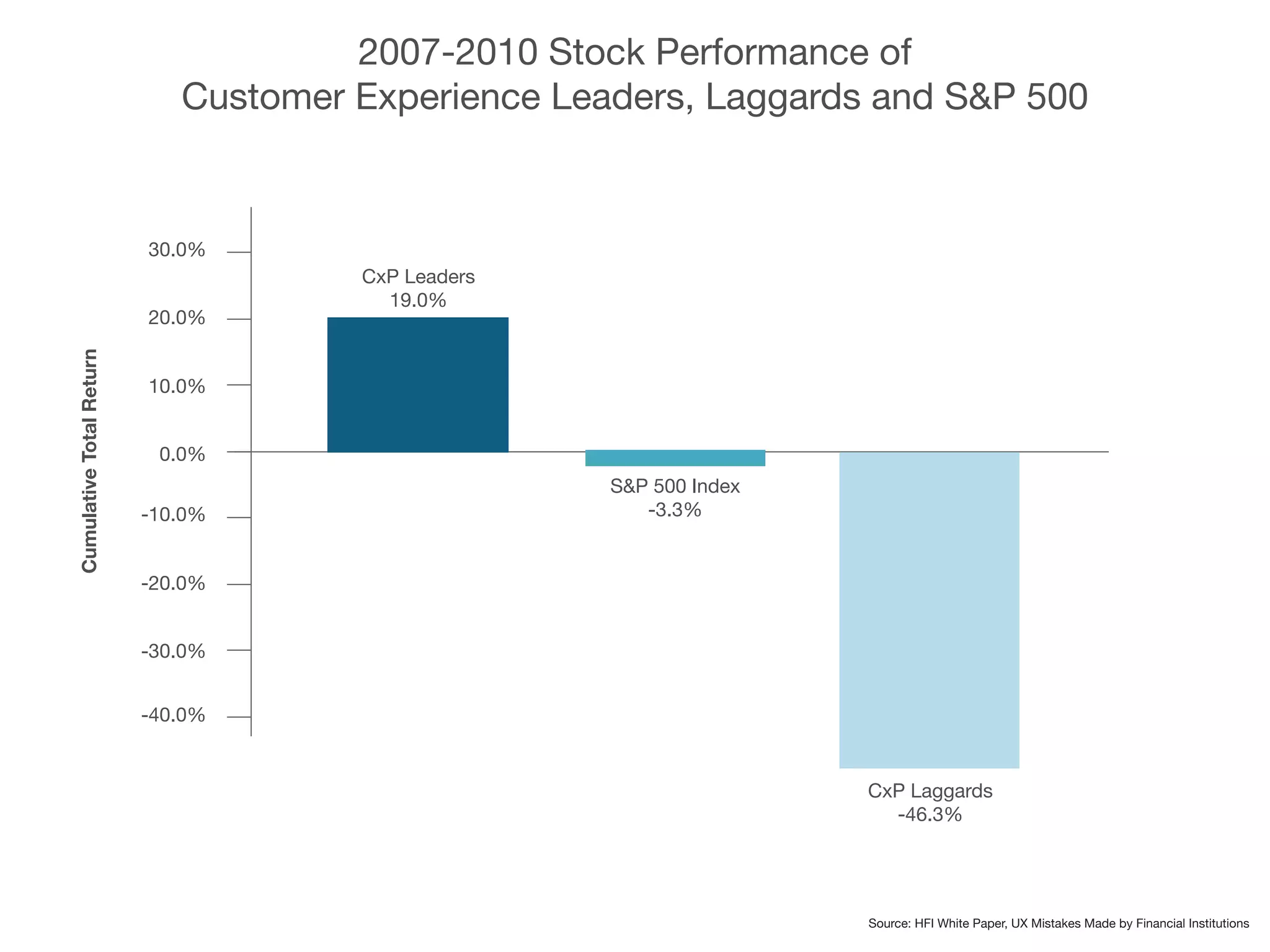

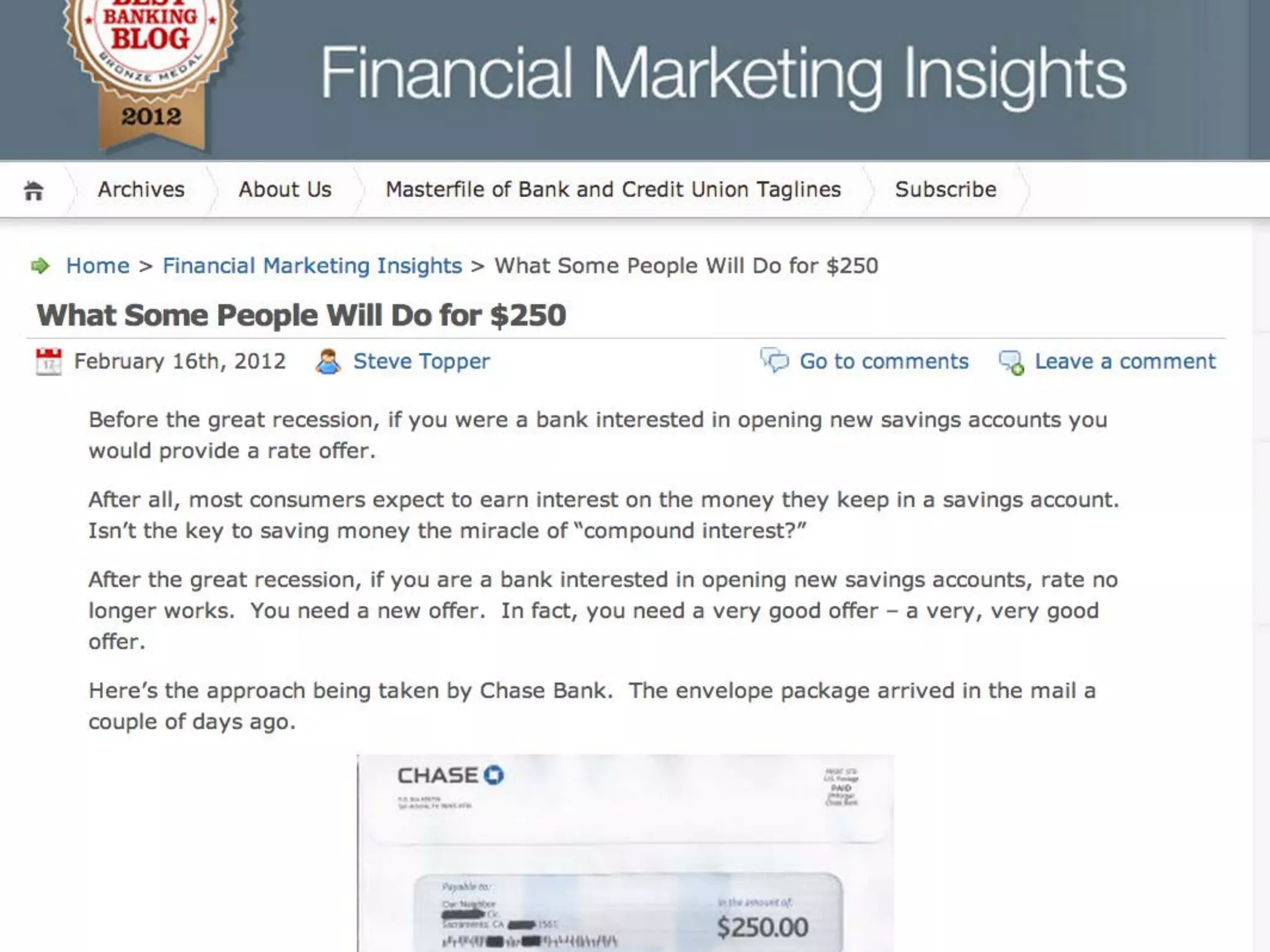

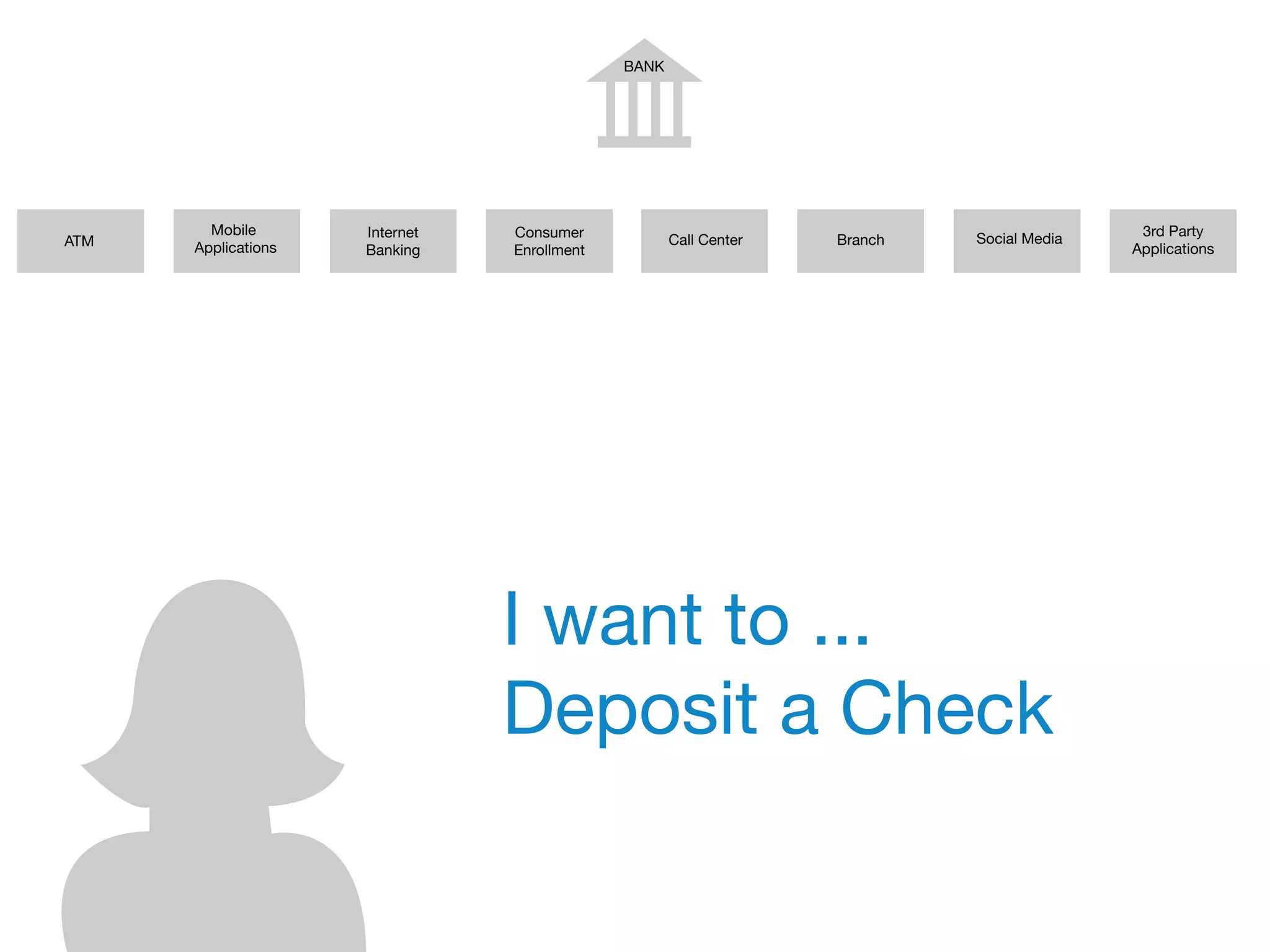

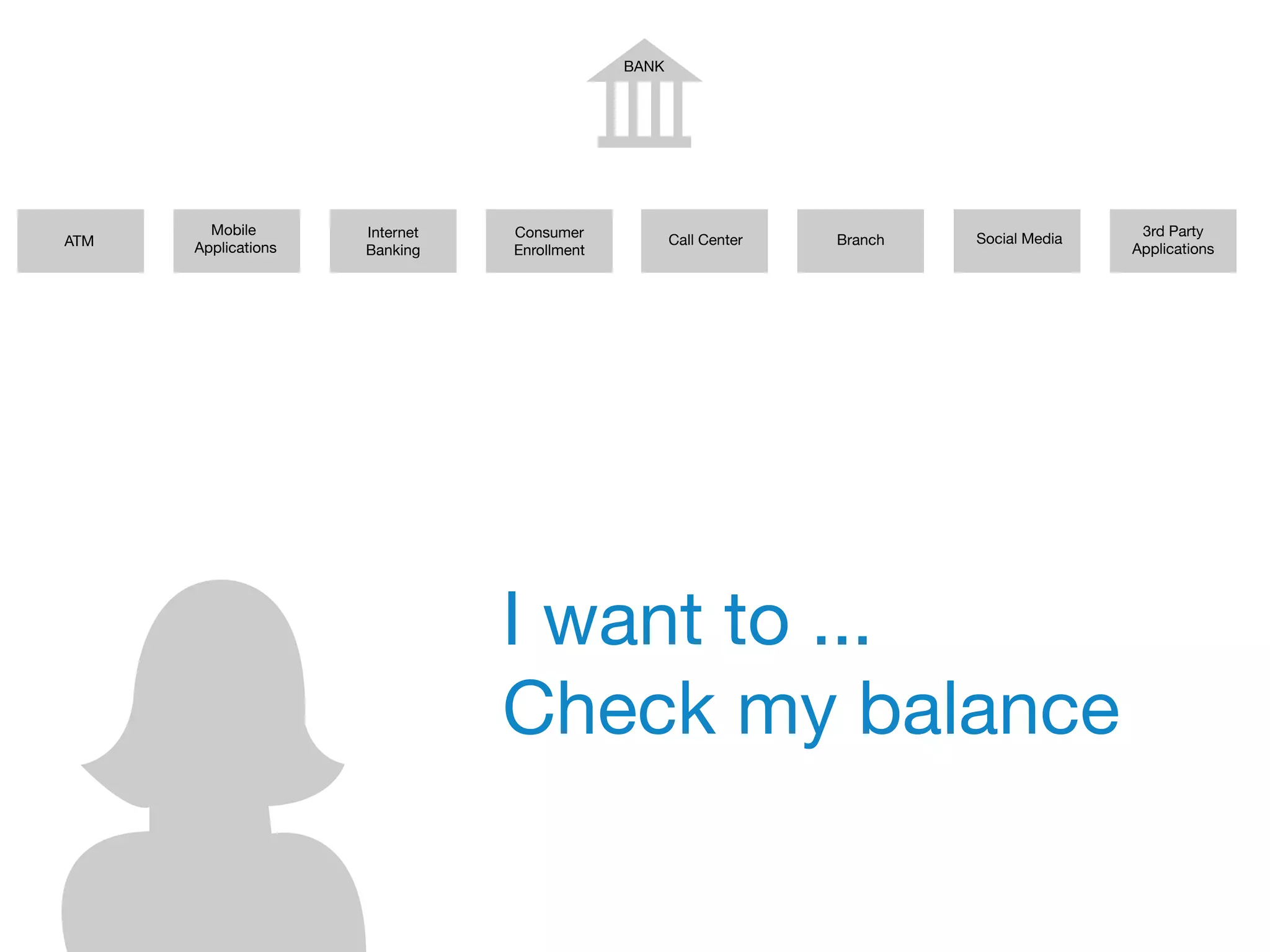

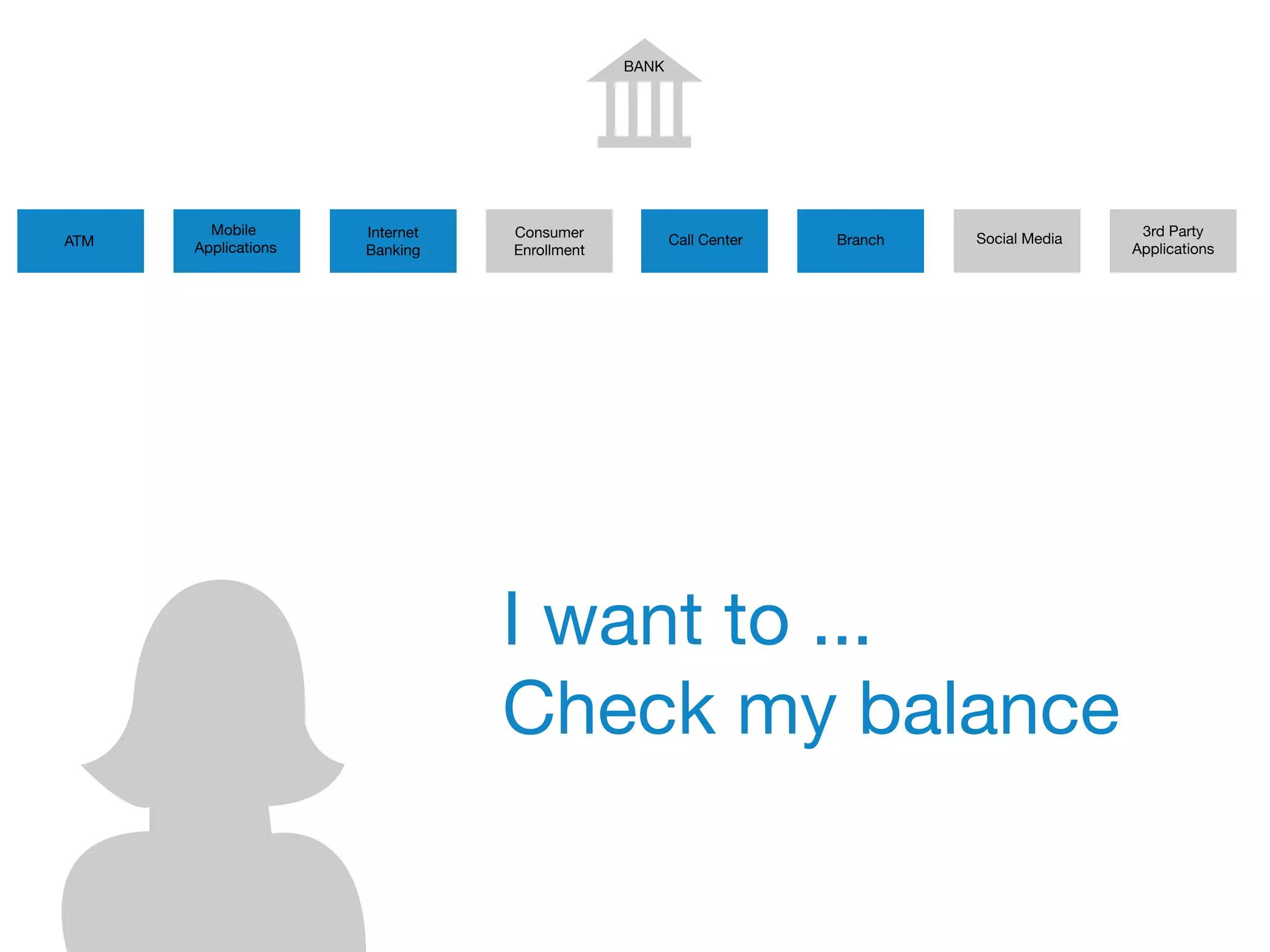

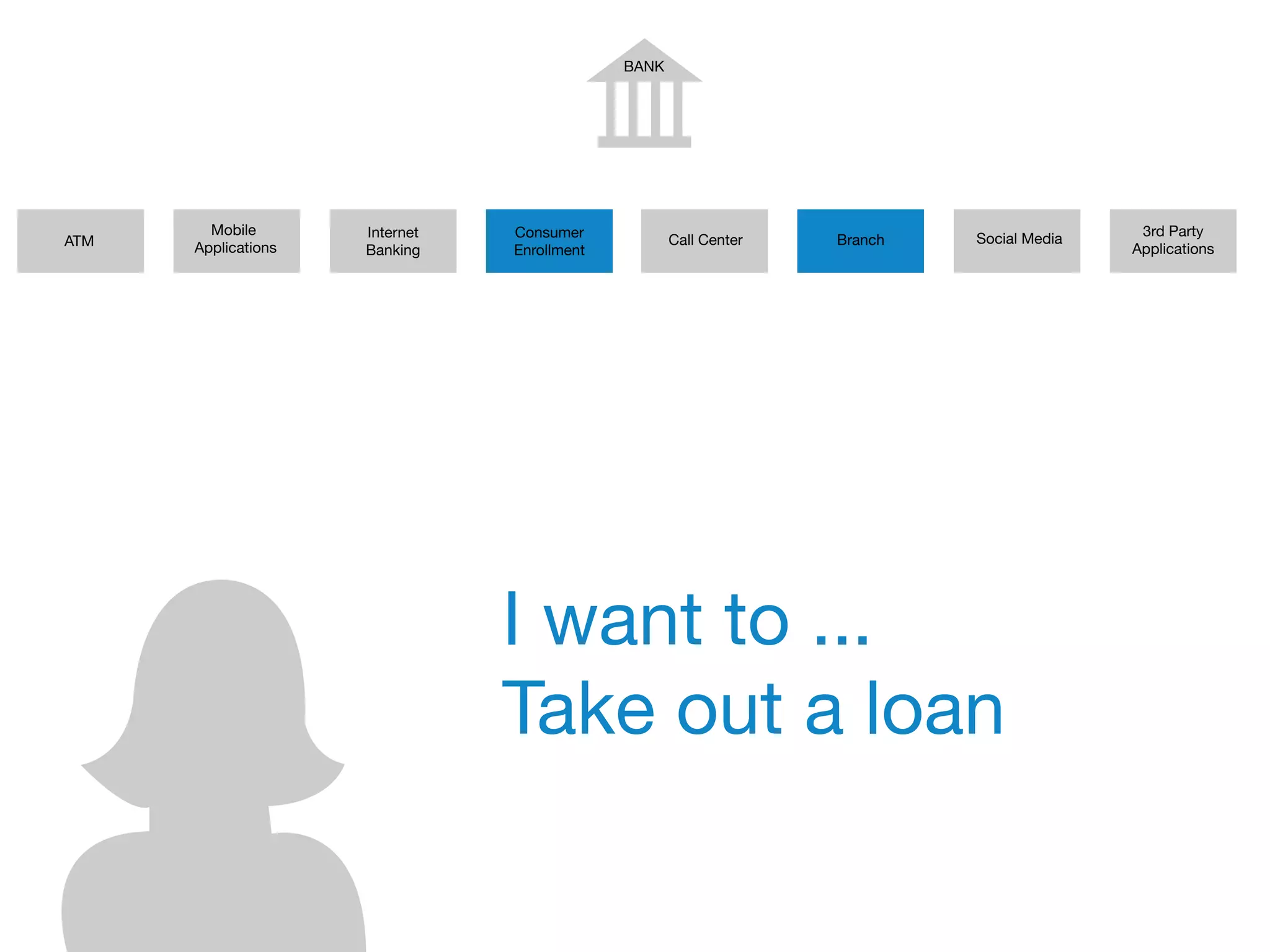

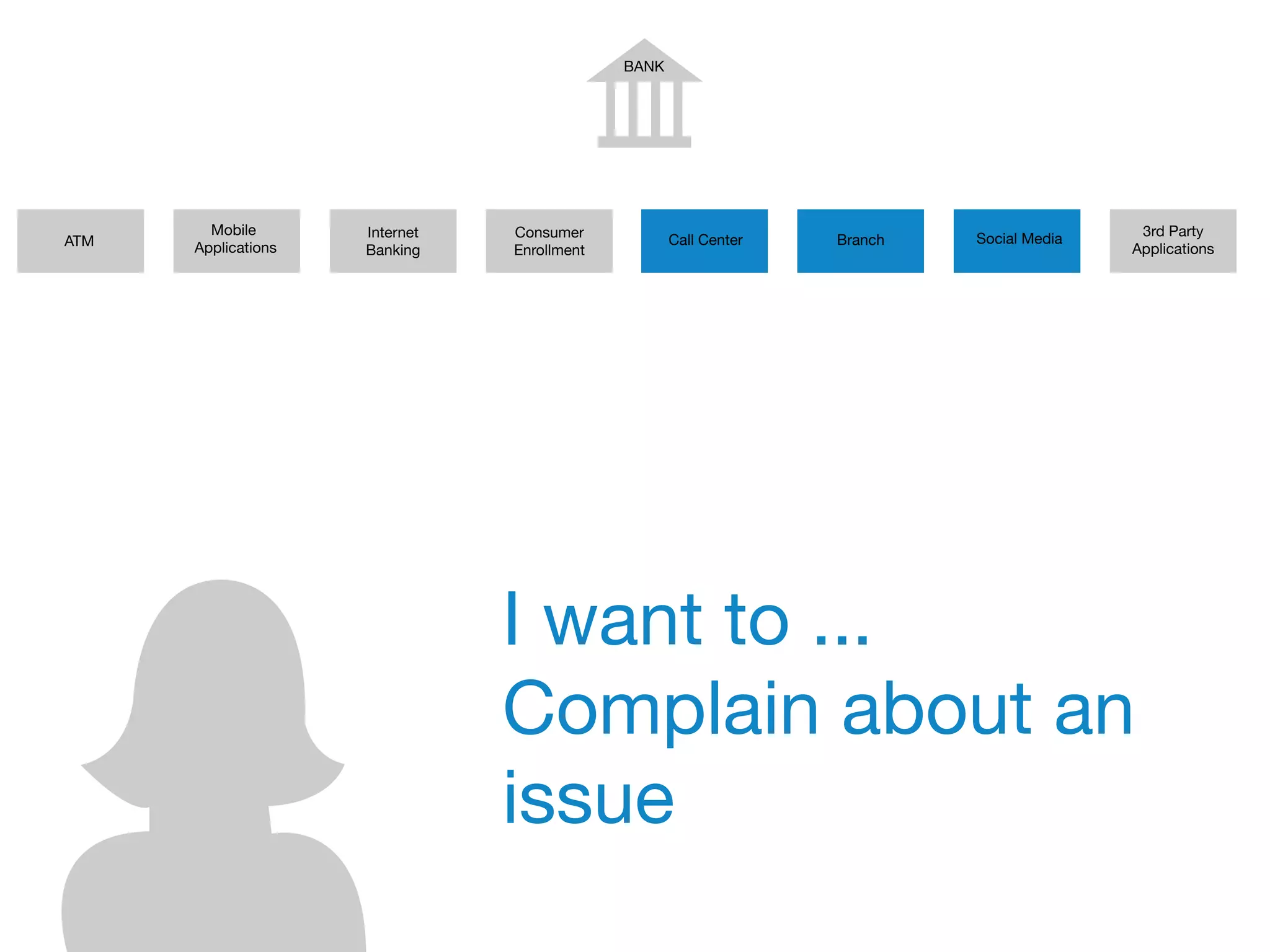

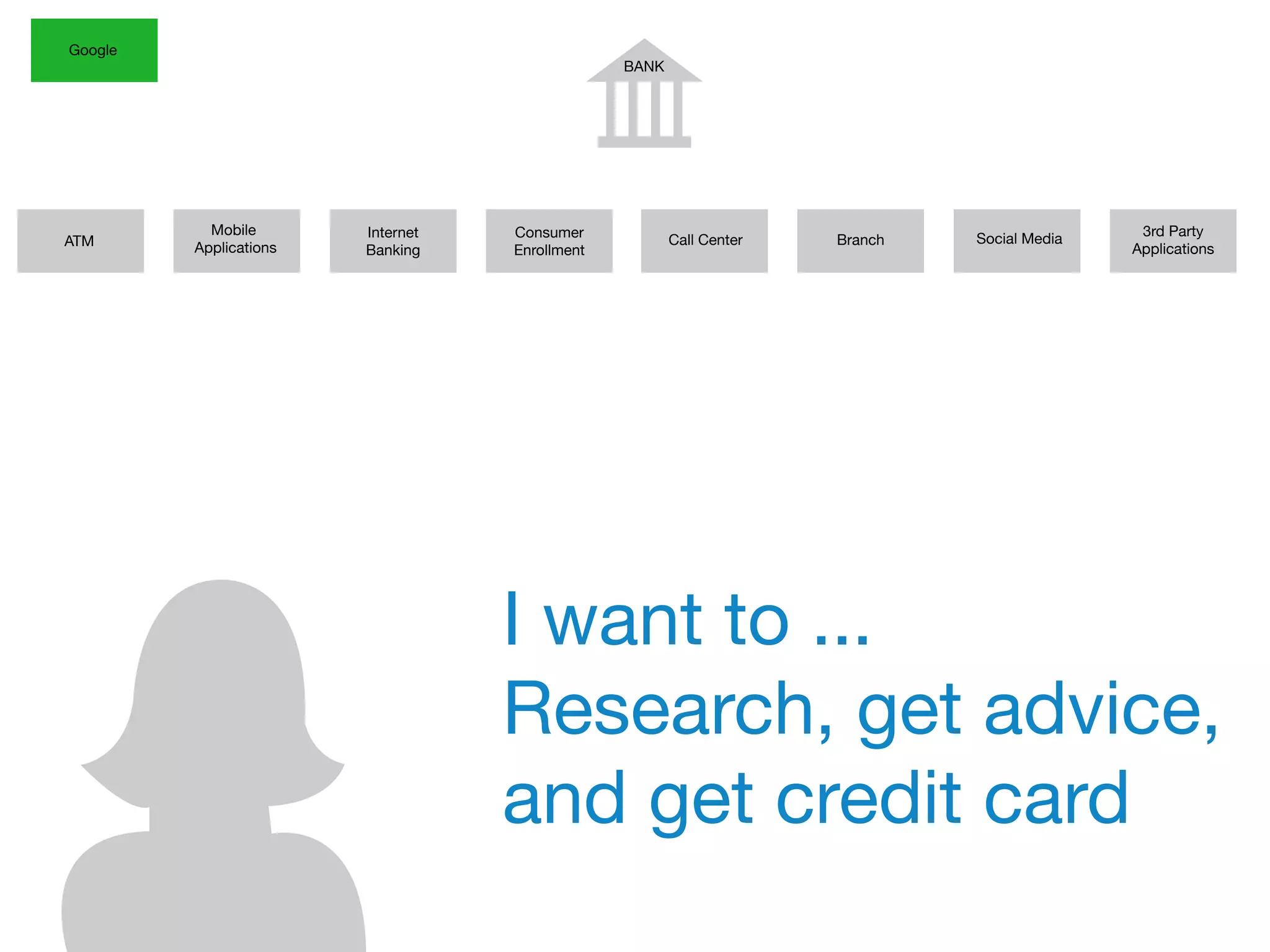

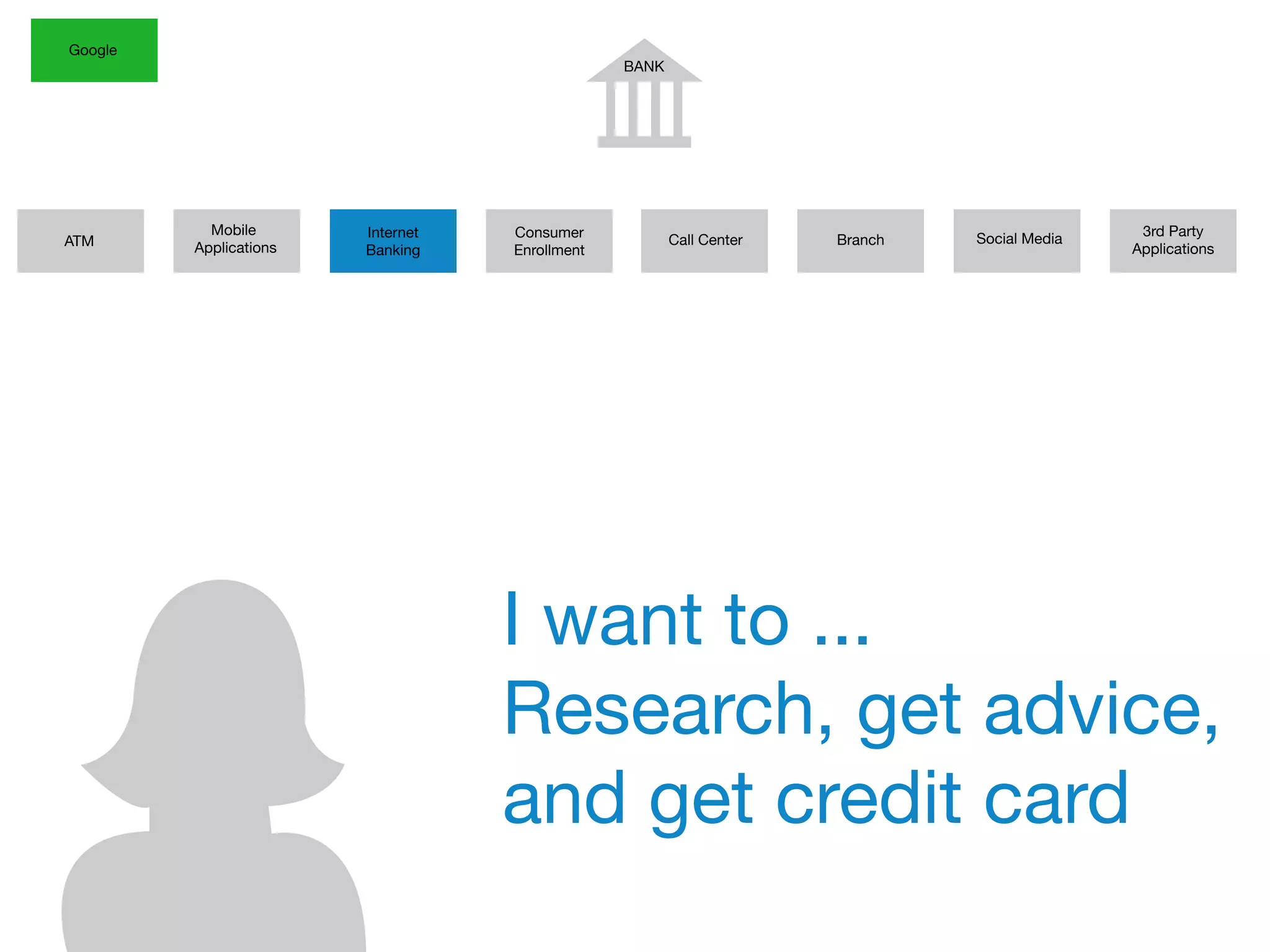

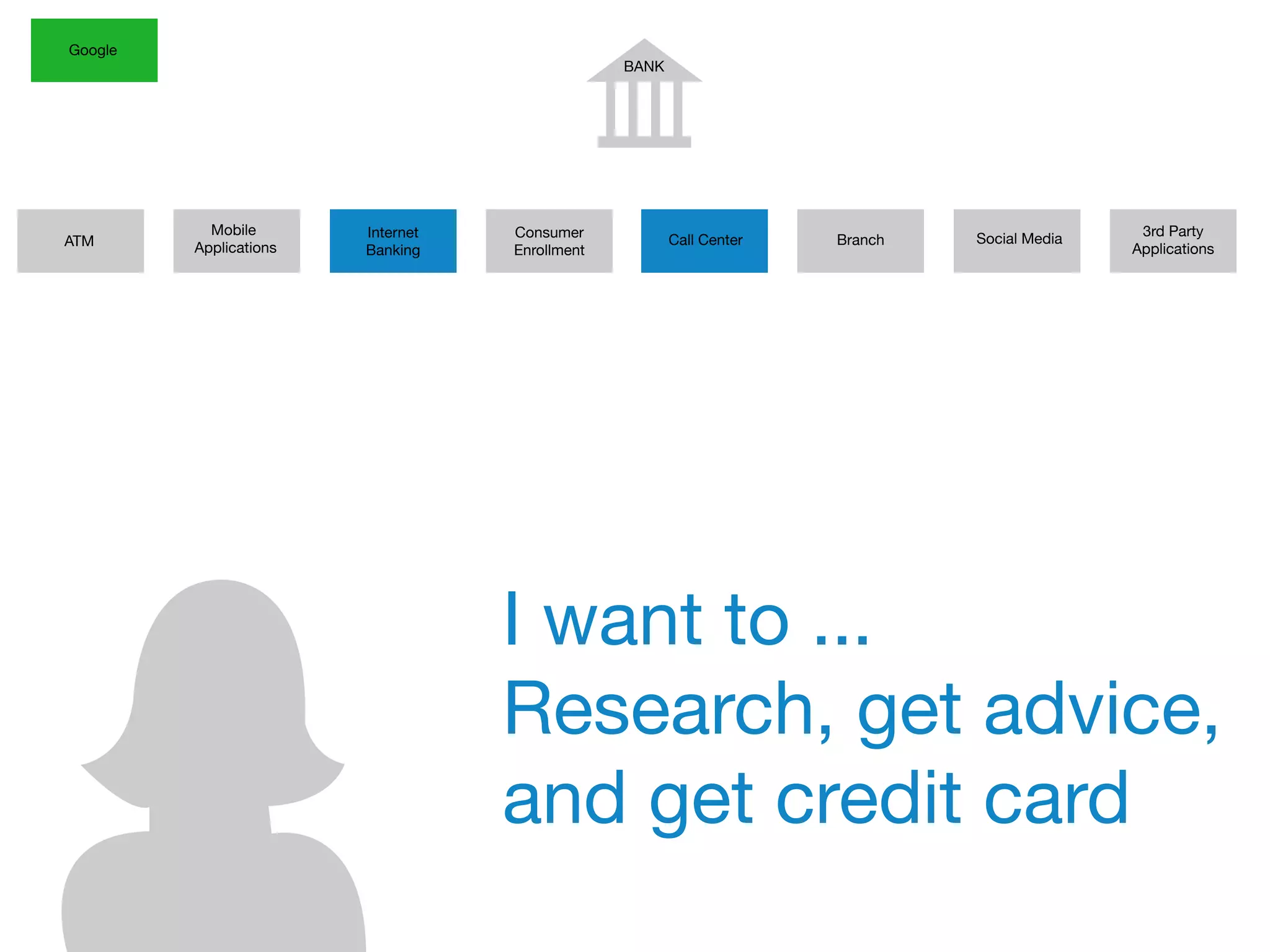

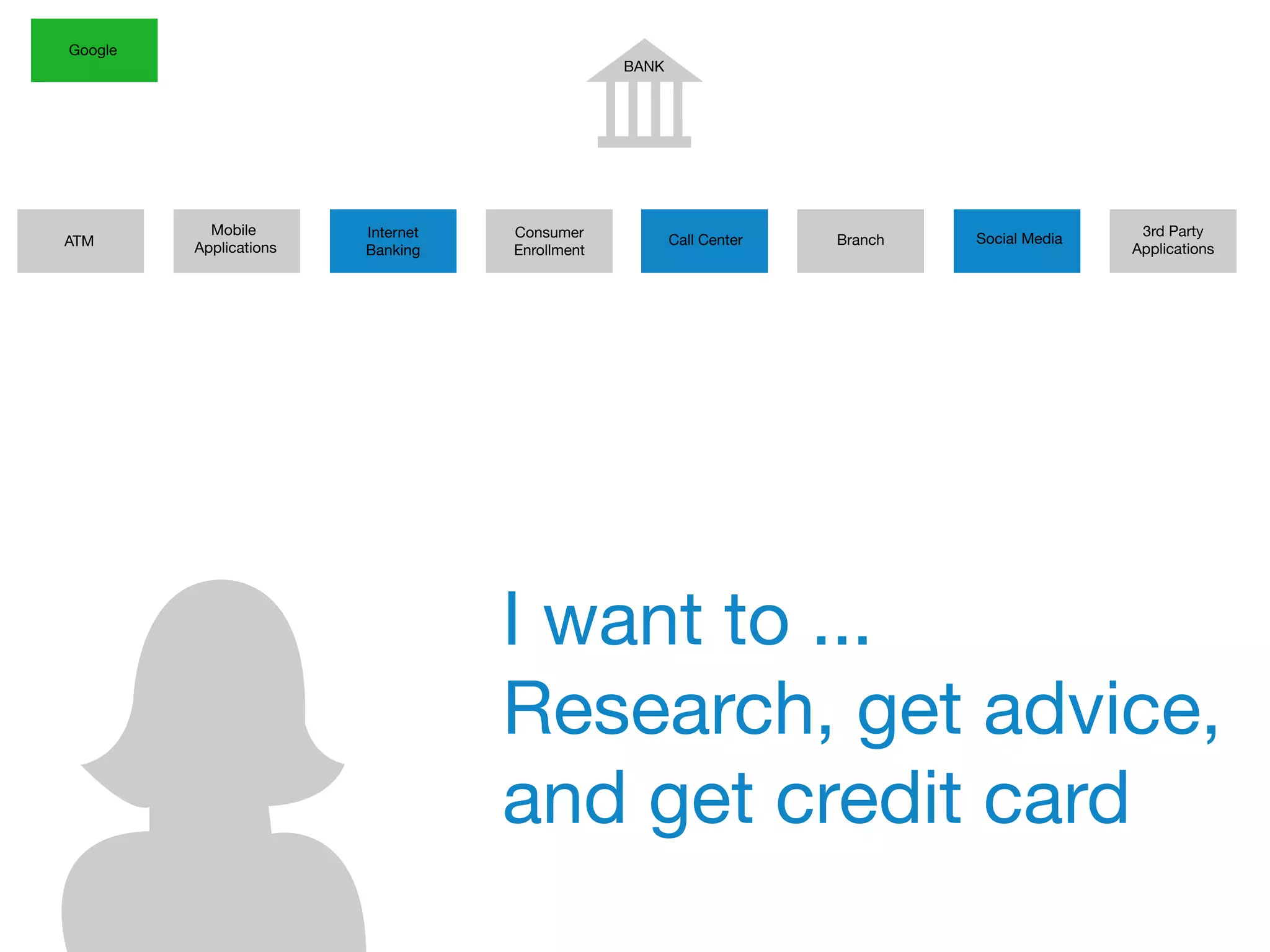

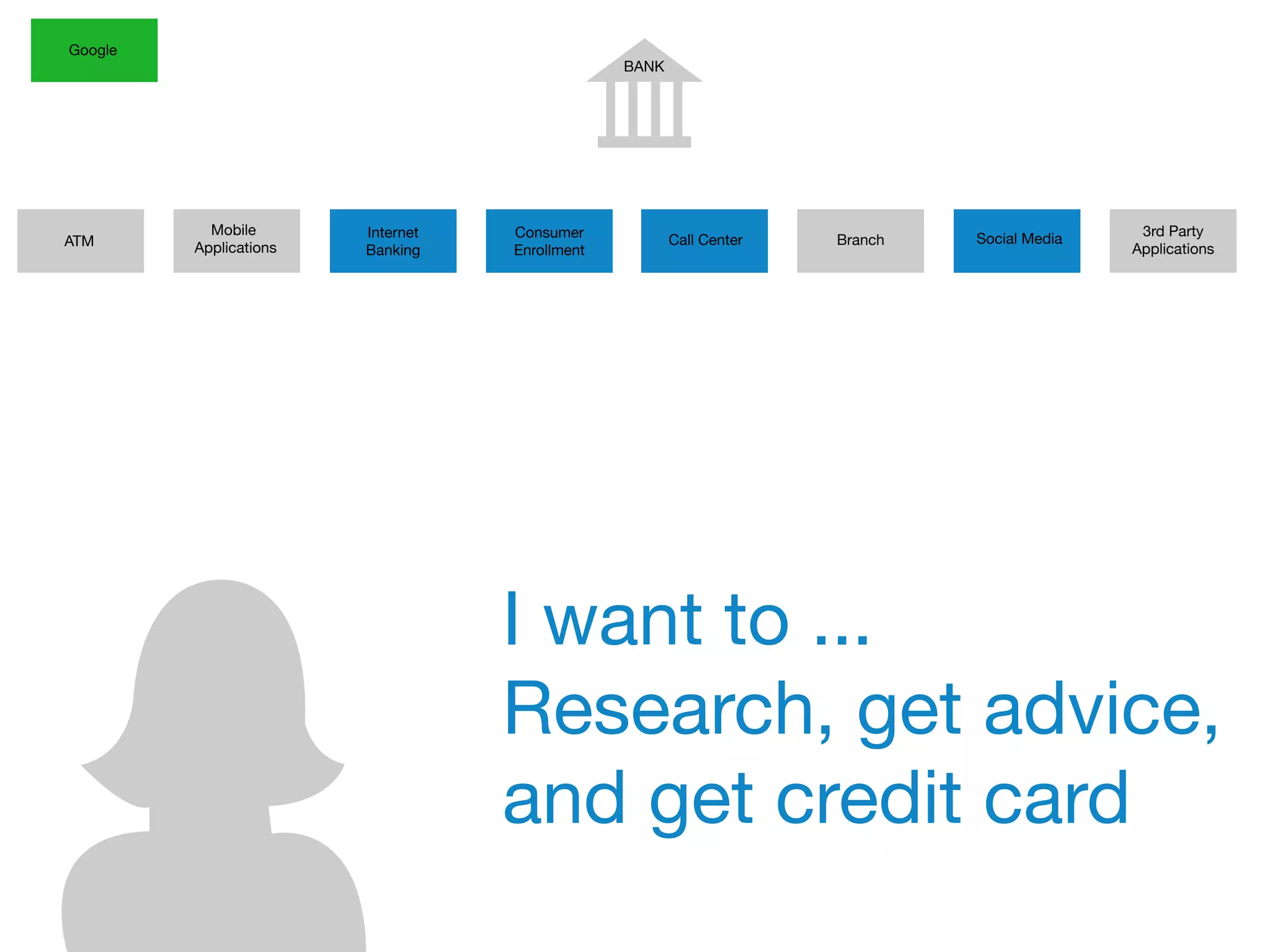

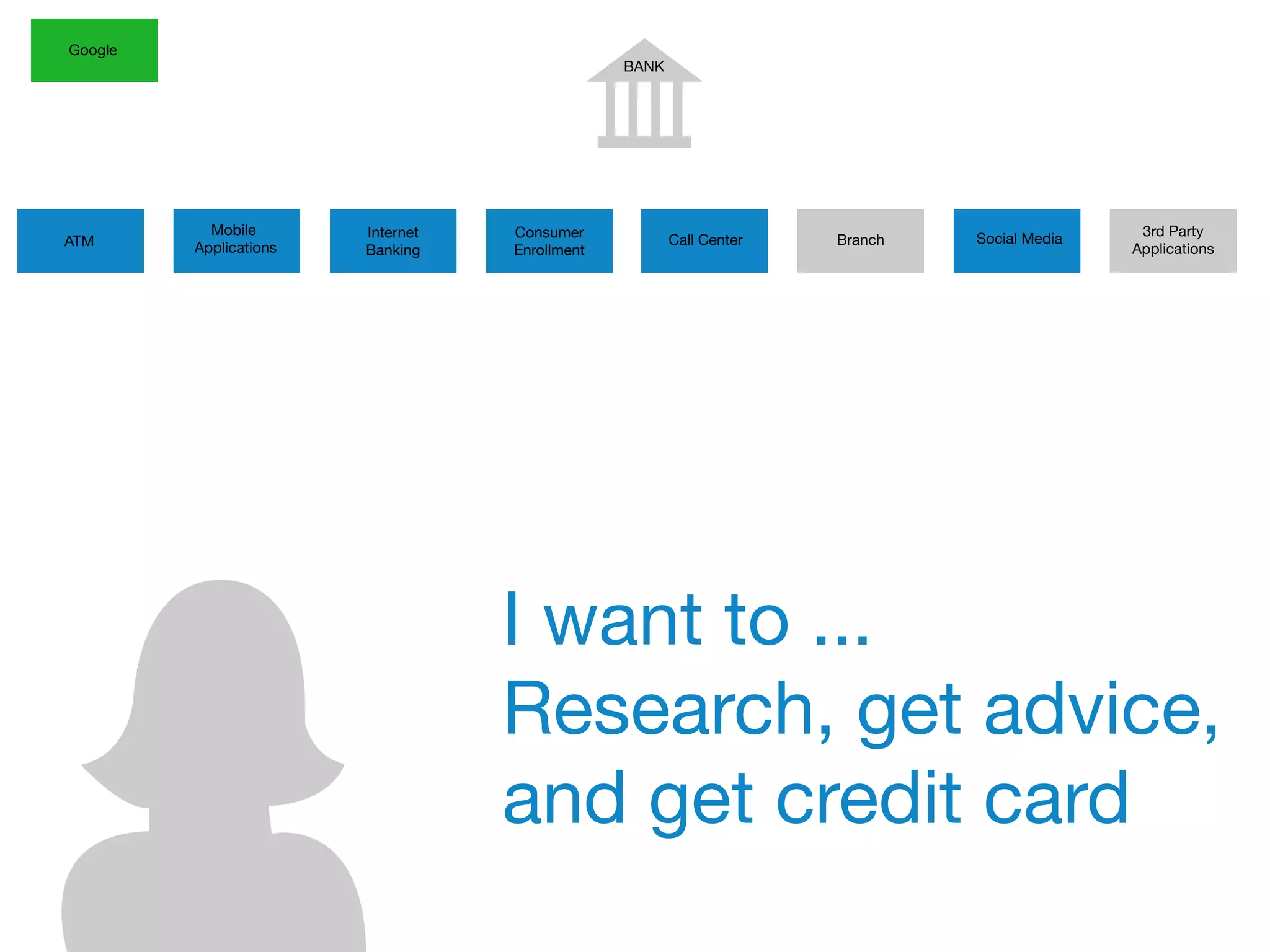

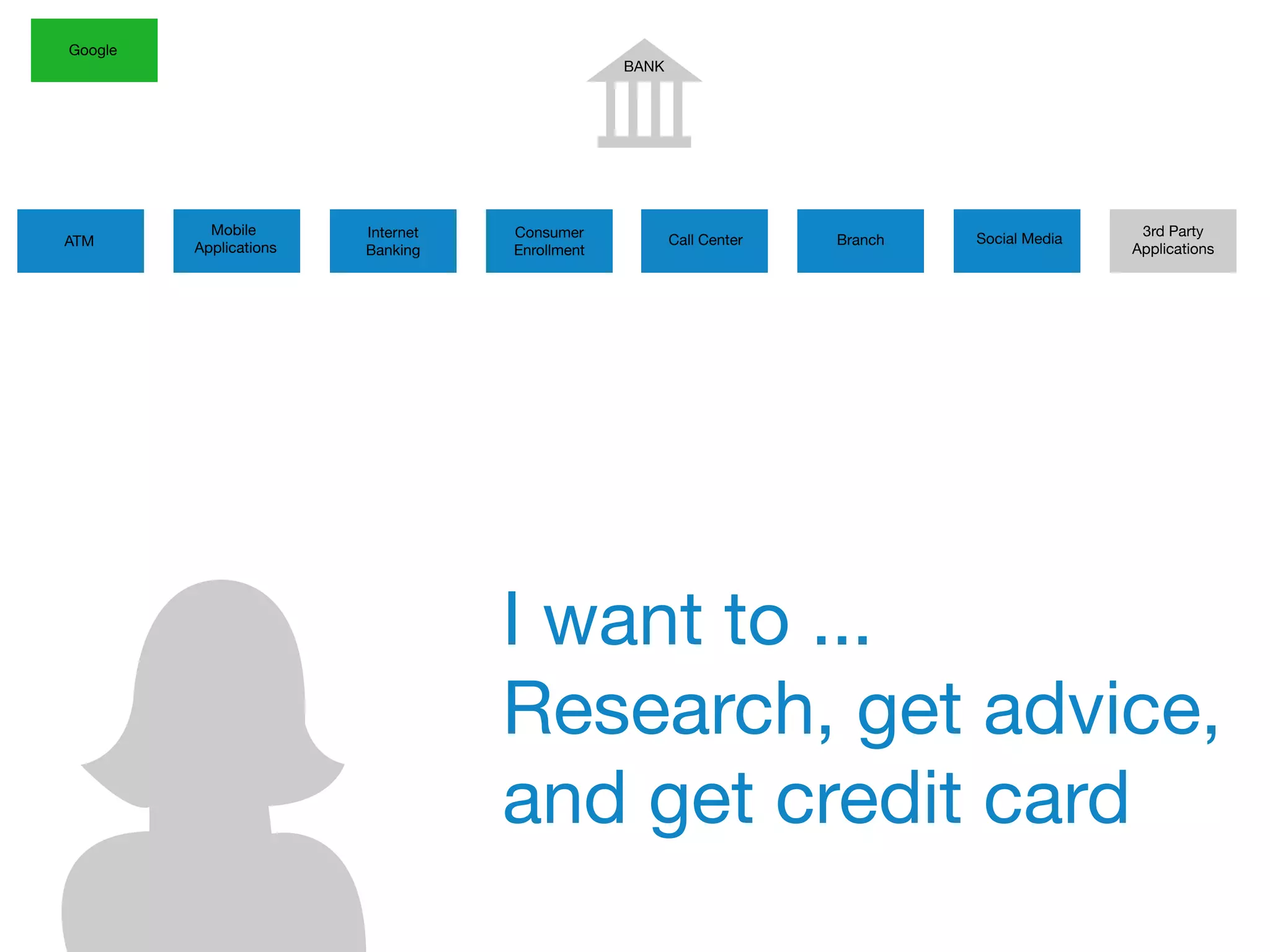

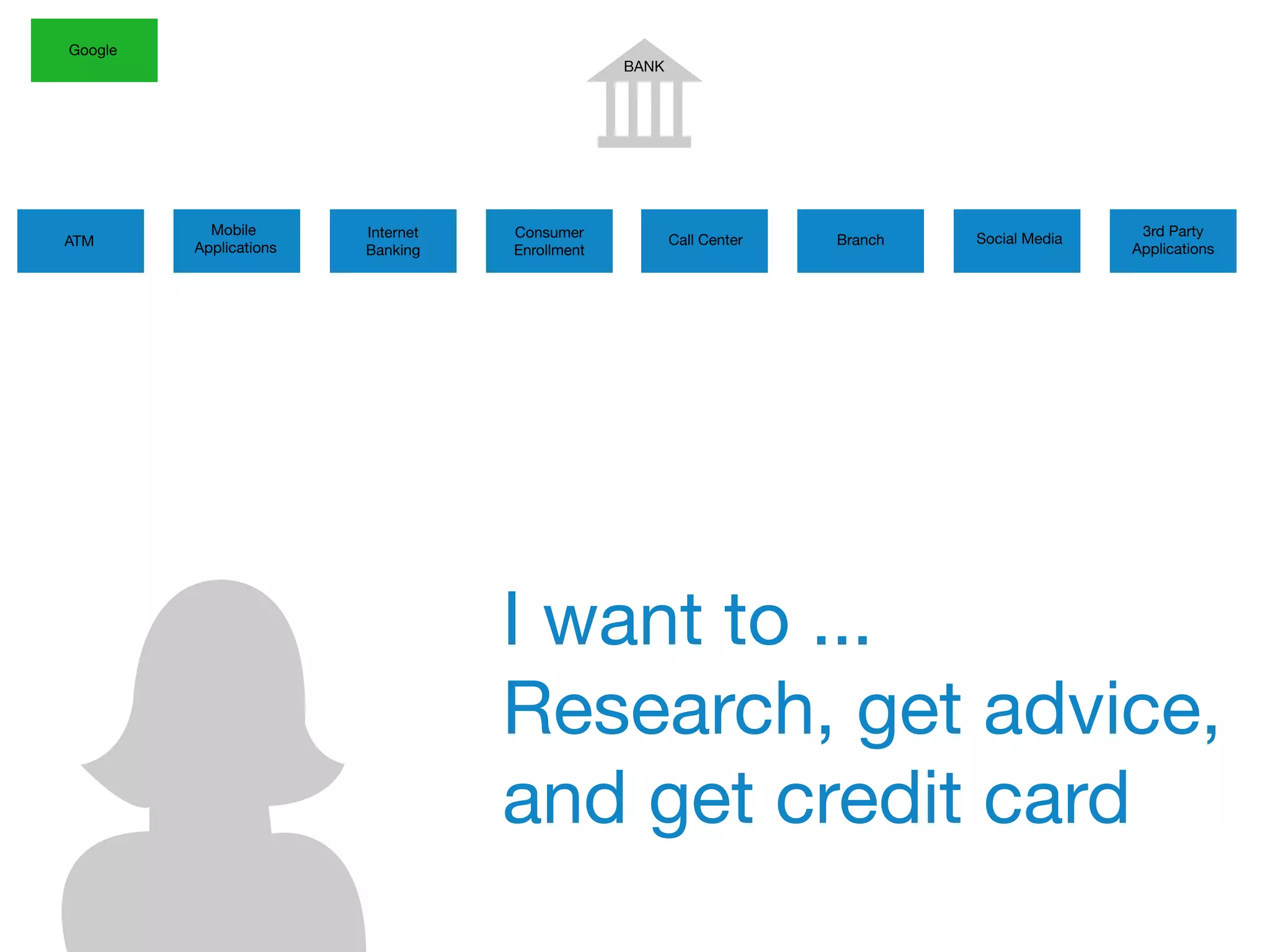

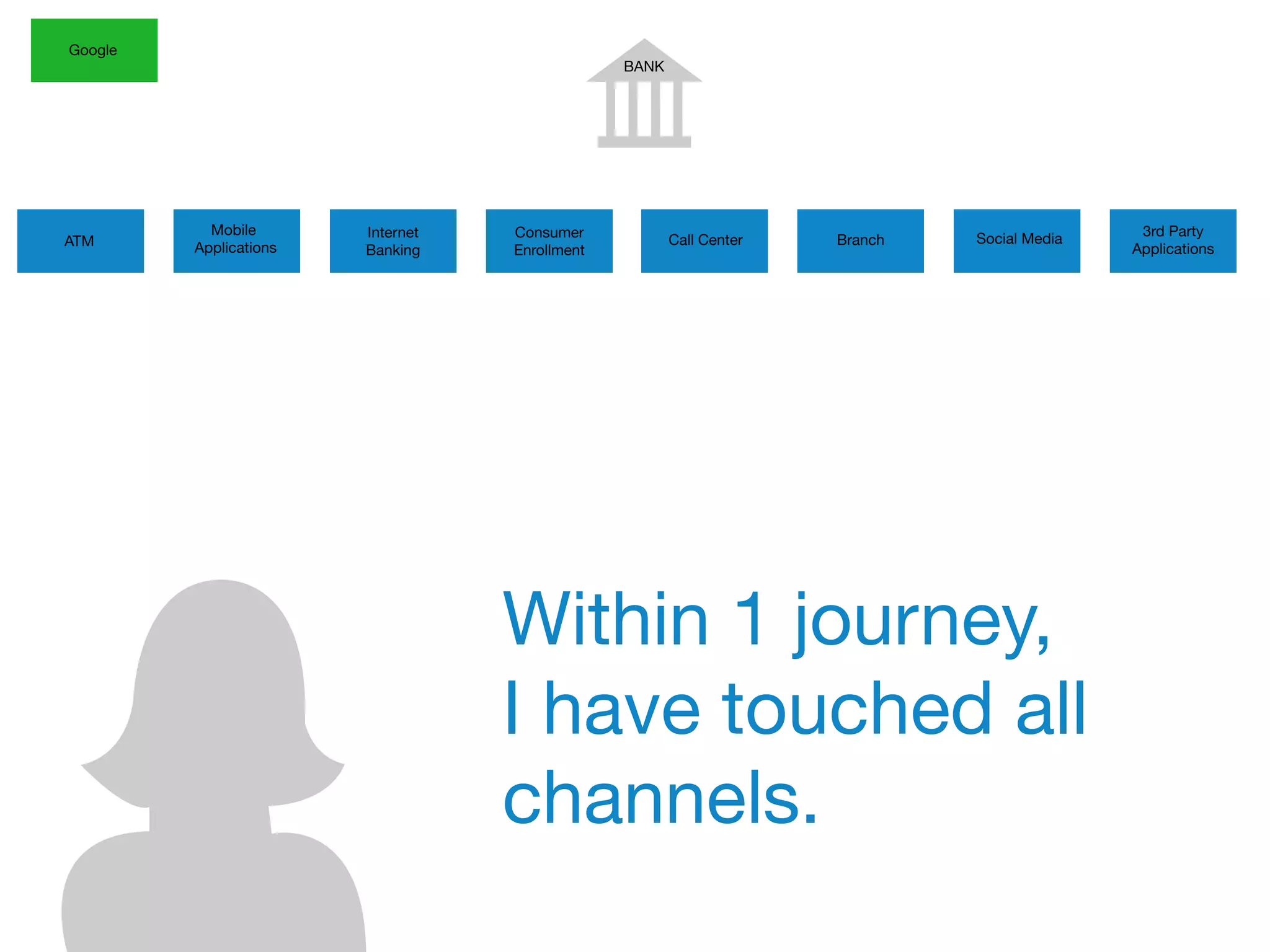

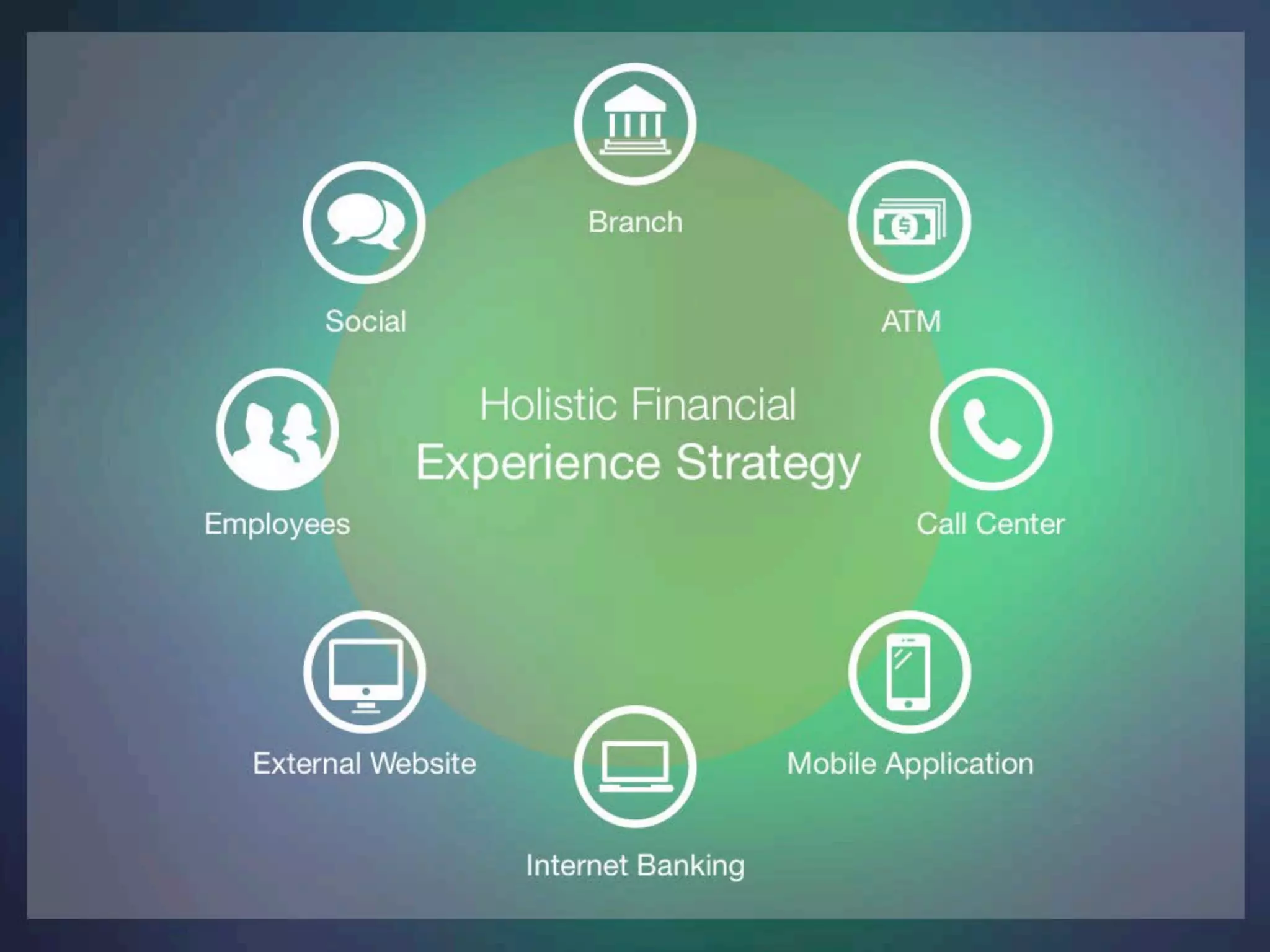

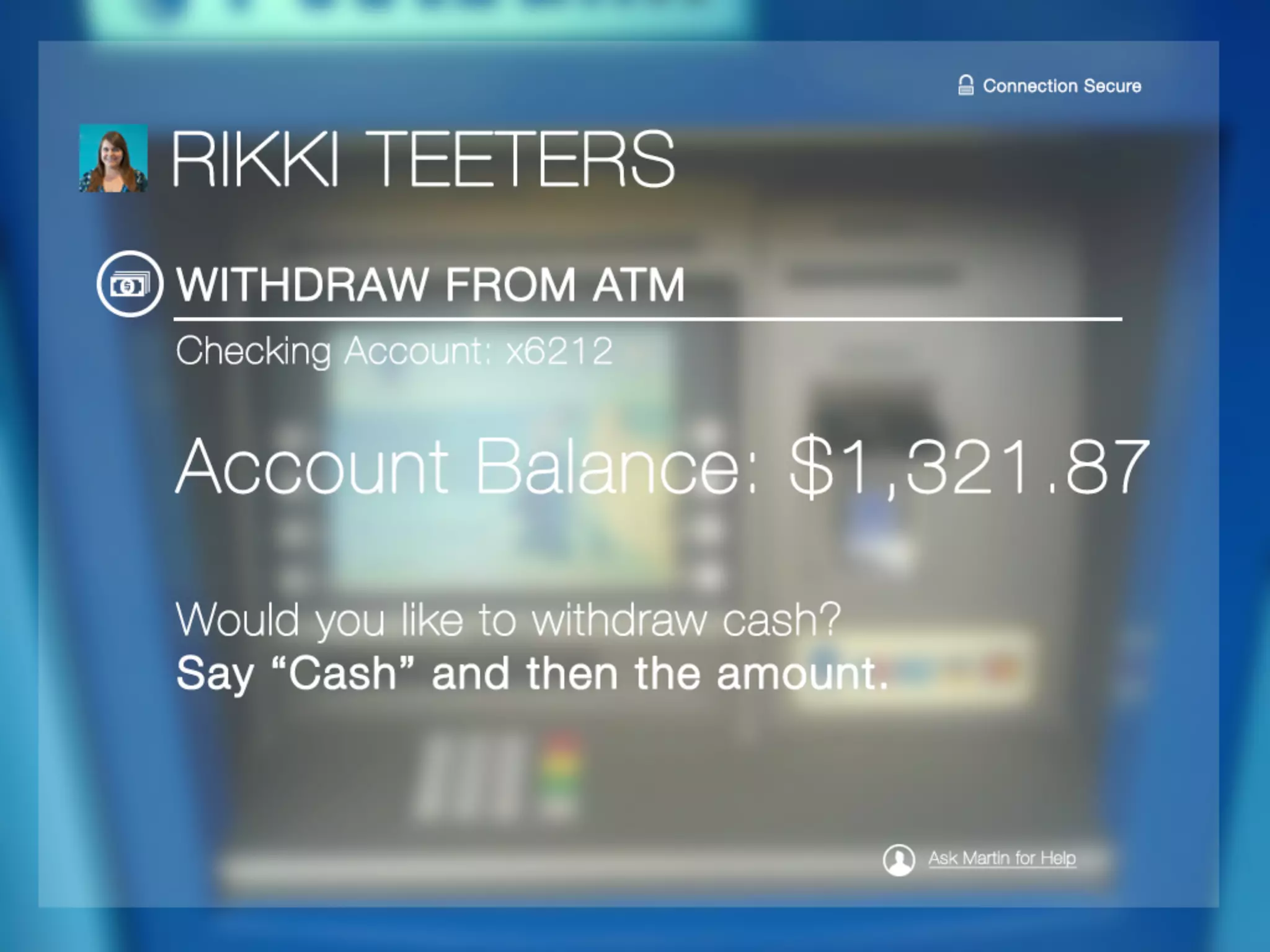

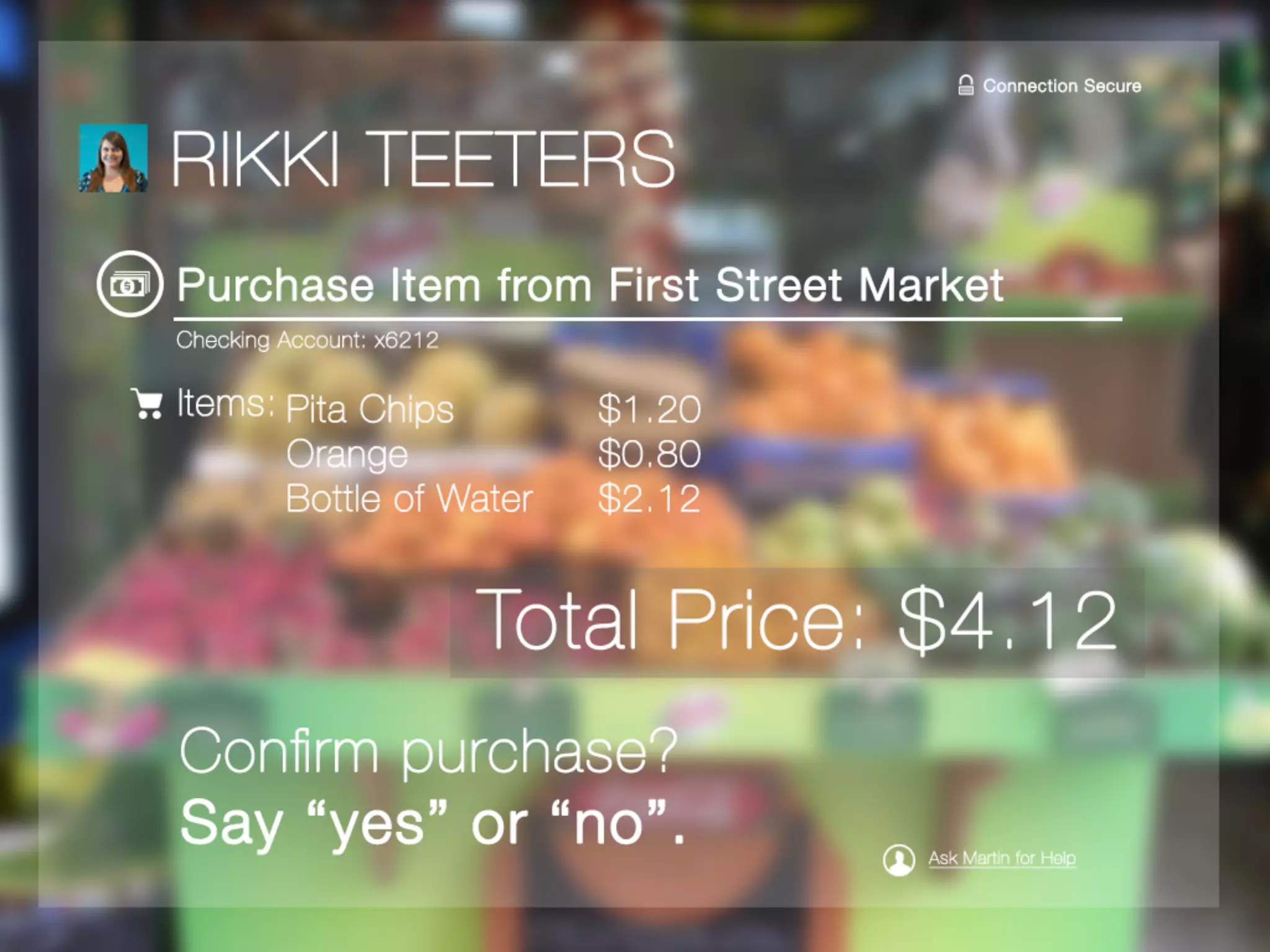

The document discusses the necessity of creating a holistic financial experience strategy that addresses the needs and emotions of all stakeholders involved with banks, emphasizing the importance of aligning technology and human relationships. It identifies key problems in the current banking experience, including outdated technology, lack of trust, and a failure to view customers as individuals. The proposed solution involves a strategically designed experience plan that integrates research, executive support, and consistency across all touchpoints to enhance customer relationships and trust.