July 2014 Housing Sales Statistics

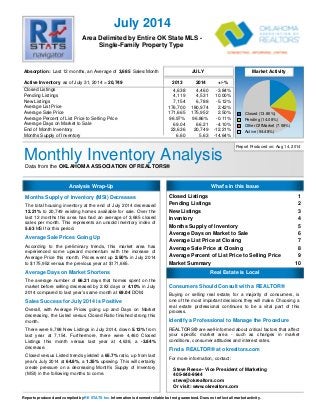

- 1. July 2014 Area Delimited by Entire OK State MLS - Single-Family Property Type 4,638 4,460 -3.84% 4,119 4,531 10.00% 7,154 6,788 -5.12% 176,700 180,974 2.42% 171,665 175,952 2.50% 96.97% 96.86% -0.11% 69.04 66.21 -4.10% 23,636 20,749 -12.21% 6.60 5.63 -14.64% Monthly Inventory Analysis D a t a f r o m t h e OKLAHOMA ASSOCIATION OF REALTORS® Closed (13.86%) Pending (14.08%) Other OffMarket (7.58%) Active (64.48%) Report Produced on: Aug 14, 2014 Absorption: Active Inventory 3,685 20,749 JULY Market Activity 2013 2014 +/-% Last 12 months, an Average of Sales/Month as of July 31, 2014 = Closed Listings Pending Listings New Listings Average List Price Average Sale Price Average Percent of List Price to Selling Price Average Days on Market to Sale End of Month Inventory Months Supply of Inventory Analysis Wrap-Up What's in this Issue Closed Listings 1 Pending Listings 2 New Listings 3 Inventory 4 Months Supply of Inventory 5 Average Days on Market to Sale 6 Average List Price at Closing 7 Average Sale Price at Closing 8 Average Percent of List Price to Selling Price 9 Market Summary 10 Real Estate is Local Months Supply of Inventory (MSI) Decreases The total housing inventory at the end of July 2014 decreased 12.21% to 20,749 existing homes available for sale. Over the last 12 months this area has had an average of 3,685 closed sales per month. This represents an unsold inventory index of 5.63 MSI for this period. Average Sale Prices Going Up According to the preliminary trends, this market area has experienced some upward momentum with the increase of Average Price this month. Prices went up 2.50% in July 2014 to $175,952 versus the previous year at $171,665. Average Days on Market Shortens The average number of 66.21 days that homes spent on the market before selling decreased by 2.83 days or 4.10% in July 2014 compared to last year’s same month at 69.04 DOM. Sales Success for July 2014 is Positive Overall, with Average Prices going up and Days on Market decreasing, the Listed versus Closed Ratio finished strong this month. There were 6,788 New Listings in July 2014, down 5.12% from last year at 7,154. Furthermore, there were 4,460 Closed Listings this month versus last year at 4,638, a -3.84% decrease. Closed versus Listed trends yielded a 65.7% ratio, up from last year’s July 2014 at 64.8%, a 1.35% upswing. This will certainly create pressure on a decreasing Month’s Supply of Inventory (MSI) in the following months to come. Consumers Should Consult with a REALTOR® Buying or selling real estate, for a majority of consumers, is one of the most important decisions they will make. Choosing a real estate professional continues to be a vital part of this process. Identify a Professional to Manage the Procedure REALTORS® are well-informed about critical factors that affect your specific market area - such as changes in market conditions, consumer attitudes and interest rates. Find a REALTOR® at okrealtors.com For more information, contact: Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com Or visit: www.okrealtors.com Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity.

- 2. Monthly Inventory Analysis OKLAHOMA ASSOCIATION OF REALTORS® July 2014 Closed Sales as of Aug 08, 2014 Closed Listings Closed Listings Ready to Buy or Sell Real Estate? Contact an experienced REALTOR® Data from the Area Delimited by Entire OK State MLS - Single-Family Property Type Report Produced on: Aug 14, 2014 JULY YEAR TO DATE (YTD) -3.84% +1.37% 5 YEAR MARKET ACTIVITY TRENDS 5yr JUL AVG = 3,835 3 MONTHS High Jul 2013 = 4,638 Low Jan 2010 = 1,722 Closed Listings this month at 4,460, above the 5 yr JUL average of 3,835 Jun 2010 Dec 2010 Jun 2011 Dec 2011 Jun 2012 Dec 2012 Jun 2013 Dec 2013 Jun 2014 CLOSED LISTINGS & BEDROOMS DISTRIBUTION BY PRICE MAY J UN J UL 5,000 4,000 3,000 2,000 1,000 0 Distribution of Closed Listings by Price Range % AVDOM 2 Beds 3 Beds 4 Beds 5 Beds+ 2010 2,738 2011 3,372 2012 3,967 2013 4,638 2014 4,460 1 Year 2 Year +12.43% 2010 21,650 2011 20,307 2012 23,880 2013 25,898 2014 26,252 1 Year 2 Year +9.93% 4,492 4,583 2.03% 4,460 -2.68% $50,000 416 9.33% 78.0 199 184 31 2 and less $50,001 318 7.13% 91.3 124 172 22 0 $75,000 $75,001 945 21.19% 62.4 206 648 82 9 $125,000 $125,001 1,101 24.69% 53.7 160 733 191 17 $175,000 $175,001 668 14.98% 69.5 94 337 227 10 $225,000 $225,001 522 11.70% 62.8 63 180 253 26 $300,000 $300,001 490 10.99% 74.7 47 125 240 78 and up Total Closed Units: Total Closed Volume: Average Closed Price: 4,460 784,747,535 $175,952 66.2 893 112.95M $126,480 2379 358.35M $150,629 1046 259.77M $248,351 142 53.68M $378,033 Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity. pp. 1 Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com

- 3. Monthly Inventory Analysis OKLAHOMA ASSOCIATION OF REALTORS® July 2014 Pending Listings as of Aug 08, 2014 Pending Listings Pending Listings Ready to Buy or Sell Real Estate? Contact an experienced REALTOR® Data from the Area Delimited by Entire OK State MLS - Single-Family Property Type Report Produced on: Aug 14, 2014 JULY YEAR TO DATE (YTD) +10.00% +4.65% 5 YEAR MARKET ACTIVITY TRENDS 5yr JUL AVG = 3,769 3 MONTHS High Apr 2010 = 4,943 Low Dec 2010 = 2,049 Pending Listings this month at 4,531, above the 5 yr JUL average of 3,769 Jun 2010 Dec 2010 Jun 2011 Dec 2011 Jun 2012 Dec 2012 Jun 2013 Dec 2013 Jun 2014 PENDING LISTINGS & BEDROOMS DISTRIBUTION BY PRICE MAY J UN J UL 5,000 4,000 3,000 2,000 1,000 0 Distribution of Pending Listings by Price Range % AVDOM 2 Beds 3 Beds 4 Beds 5 Beds+ 2010 2,913 2011 3,325 2012 3,959 2013 4,119 2014 4,531 1 Year 2 Year +14.45% 2010 22,544 2011 21,764 2012 26,018 2013 27,887 2014 29,184 1 Year 2 Year +12.17% 4,581 4,474 -2.34% 4,531 1.27% $50,000 429 9.47% 67.1 193 201 32 3 and less $50,001 367 8.10% 72.1 112 231 19 5 $75,000 $75,001 484 10.68% 63.0 133 307 40 4 $100,000 $100,001 1,143 25.23% 51.5 189 808 136 10 $150,000 $150,001 889 19.62% 61.6 125 534 213 17 $200,000 $200,001 762 16.82% 68.0 82 312 330 38 $300,000 $300,001 457 10.09% 77.7 43 108 248 58 and up Total Pending Units: Total Pending Volume: Average Listing Price: 4,531 823,944,087 $167,066 65.1 877 109.10M $124,407 2501 366.02M $146,348 1018 299.99M $294,688 135 48.83M $361,707 Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity. pp. 2 Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com

- 4. Monthly Inventory Analysis OKLAHOMA ASSOCIATION OF REALTORS® July 2014 New Listings New Listings Ready to Buy or Sell Real Estate? Contact an experienced REALTOR® Data from the New Listings as of Aug 08, 2014 Area Delimited by Entire OK State MLS - Single-Family Property Type Report Produced on: Aug 14, 2014 JULY YEAR TO DATE (YTD) -5.12% -1.01% 5 YEAR MARKET ACTIVITY TRENDS 5yr JUL AVG = 6,605 3 MONTHS High Apr 2010 = 7,797 Low Dec 2013 = 3,478 New Listings this month at 6,788, above the 5 yr JUL average of Jun 2010 Dec 2010 Jun 2011 Dec 2011 Jun 2012 Dec 2012 Jun 2013 Dec 2013 Jun 2014 NEW LISTINGS & BEDROOMS DISTRIBUTION BY PRICE 6,605 MAY J UN J UL 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 Distribution of New Listings by Price Range % 2 Beds 3 Beds 4 Beds 5 Beds+ 2010 6,238 2011 6,415 2012 6,430 2013 7,154 2014 6,788 1 Year 2 Year +5.57% 2010 43,404 2011 42,711 2012 44,874 2013 45,871 2014 45,407 1 Year 2 Year +1.19% 6,930 6,618 -4.50% 6,788 2.57% $50,000 511 7.53% 246 242 16 7 and less $50,001 550 8.10% 217 297 31 5 $75,000 $75,001 1,459 21.49% 314 979 156 10 $125,000 $125,001 1,523 22.44% 239 1,009 249 26 $175,000 $175,001 937 13.80% 132 496 292 17 $225,000 $225,001 999 14.72% 112 371 461 55 $325,000 $325,001 809 11.92% 84 183 410 132 and up Total New Listed Units: Total New Listed Volume: Average New Listed Listing Price: 6,788 1,370,193,392 $193,134 1344 185.29M $137,861 3577 565.72M $158,155 1615 501.28M $310,388 252 117.91M $467,893 Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity. pp. 3 Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com

- 5. Monthly Inventory Analysis OKLAHOMA ASSOCIATION OF REALTORS® July 2014 Active Inventory as of Aug 08, 2014 Active Inventory Active Inventory Ready to Buy or Sell Real Estate? Contact an experienced REALTOR® Data from the Area Delimited by Entire OK State MLS - Single-Family Property Type Report Produced on: Aug 14, 2014 END OF JULY ACTIVE DURING JULY -12.13% -7.40% 5 YEAR MARKET ACTIVITY TRENDS 5yr JUL AVG = 24,170 3 MONTHS High Jul 2011 = 26,786 Low Jan 2010 = 19,955 Inventory this month at below the 5 yr JUL average of Jun 2010 Dec 2010Jun 2011 Dec 2011Jun 2012 Dec 2012Jun 2013 Dec 2013Jun 2014 INVENTORY & BEDROOMS DISTRIBUTION BY PRICE 20,749, 24,170 MAY J UN J UL 30,000 20,000 10,000 0 Distribution of Inventory by Price Range % AVDOM 2 Beds 3 Beds 4 Beds 5 Beds+ 2010 25,218 2011 26,786 2012 24,483 2013 23,613 2014 20,749 1 Year 2 Year -15.25% 2010 30,528 2011 32,730 2012 30,959 2013 29,938 2014 27,723 1 Year 2 Year -10.45% 20,808 20,952 0.69% 20,749 -0.97% $50,000 1,745 8.41% 128.2 907 739 88 11 and less $50,001 2,095 10.10% 118.2 829 1,121 129 16 $75,000 $75,001 2,377 11.46% 110.0 655 1,464 233 25 $100,000 $100,001 5,689 27.42% 95.0 1,077 3,592 916 104 $175,000 $175,001 3,661 17.64% 97.5 605 1,766 1,193 97 $250,000 $250,001 2,755 13.28% 105.6 367 865 1,295 228 $375,000 $375,001 2,427 11.70% 117.9 276 488 1,187 476 and up Total Active Inventory by Units: Total Active Inventory by Volume: Average Active Inventory Listing Price: 20,749 4,493,893,153 $216,584 106.4 4,716 751.29M $159,307 10,035 1.66B $164,967 5,041 1.57B $310,568 957 521.58M $545,017 Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity. pp. 4 Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com

- 6. Monthly Inventory Analysis OKLAHOMA ASSOCIATION OF REALTORS® July 2014 Active Inventory as of Aug 08, 2014 Months Supply of Inventory Months Supply Ready to Buy or Sell Real Estate? Contact an experienced REALTOR® Data from the Area Delimited by Entire OK State MLS - Single-Family Property Type Report Produced on: Aug 14, 2014 MSI FOR JULY INDICATORS FOR JULY 2014 -14.56% 5 YEAR MARKET ACTIVITY TRENDS 5yr JUL AVG = 7.5 3 MONTHS High Jun 2011 = 9.7 Low Feb 2014 = 5.5 Months Supply this month at 5.6, below the 5 yr JUL average of 7.5 Jun 2010 Dec 2010 Jun 2011 Dec 2011 Jun 2012 Dec 2012 Jun 2013 Dec 2013 Jun 2014 MONTHS SUPPLY & BEDROOMS DISTRIBUTION BY PRICE MAY J UN J UL 10 9 8 7 6 5 4 3 2 1 0 Distribution of Active Inventory by Price Range and MSI % MSI 2 Beds 3 Beds 4 Beds 5 Beds+ 2010 7.9 2011 9.6 2012 7.6 2013 6.6 2014 5.6 1 Year 2 Year -25.43% Inventory 20,749 End of Month Active Inventory Closed 44,220 Closed Last 12 Months Absorption 3,685 Average Closed per Month over 12 Months MSI 5.6 Months Supply of Inventory MSI % 17.760% Percent Months Supply of Inventory 5.7 5.7 -0.39% 5.6 -0.57% $50,000 1,745 8.41% 4.1 4.9 3.6 3.1 2.7 and less $50,001 2,095 10.10% 6.5 7.9 5.8 5.6 8.3 $75,000 $75,001 2,377 11.46% 5.9 7.0 5.5 6.7 7.0 $100,000 $100,001 5,689 27.42% 4.3 5.2 4.0 4.5 7.4 $175,000 $175,001 3,661 17.64% 5.6 7.1 5.6 5.0 5.7 $250,000 $250,001 2,755 13.28% 7.1 9.8 7.2 6.4 8.1 $375,000 $375,001 2,427 11.70% 13.4 20.7 13.7 12.3 13.3 and up MSI: Total Active Inventory: 20,749 5.6 6.5 4,716 4.9 10,035 6.1 5,041 9.1 957 Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity. pp. 5 Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com

- 7. Monthly Inventory Analysis OKLAHOMA ASSOCIATION OF REALTORS® July 2014 Closed Sales as of Aug 08, 2014 Average Days on Market to Sale Average Days on Market Ready to Buy or Sell Real Estate? Contact an experienced REALTOR® Data from the Area Delimited by Entire OK State MLS - Single-Family Property Type Report Produced on: Aug 14, 2014 JULY YEAR TO DATE (YTD) -4.10% -3.56% 5 YEAR MARKET ACTIVITY TRENDS 5yr JUL AVG = 75 3 MONTHS High Mar 2011 = 98 Low Jun 2014 = 66 Average DOM this month at 66, below the 5 yr JUL average of 75 MAY J UN J UL Jun 2010 Dec 2010 Jun 2011 Dec 2011 Jun 2012 Dec 2012 Jun 2013 Dec 2013 Jun 2014 AVERAGE DOM OF CLOSED SALES & BEDROOMS DISTRIBUTION BY PRICE 100 90 80 70 60 50 40 30 20 10 0 Distribution of Average Days on Market to Sale by Price Range % AVDOM 2 Beds 3 Beds 4 Beds 5 Beds+ 2010 79 2011 85 2012 77 2013 69 2014 66 1 Year 2 Year -14.12% 2010 78 2011 91 2012 84 2013 76 2014 73 1 Year 2 Year -13.00% 66 66 -0.92% 66 0.64% $50,000 416 9.33% 78.0 81.4 73.1 84.3 85.5 and less $50,001 318 7.13% 91.3 98.8 77.1 159.7 0.0 $75,000 $75,001 945 21.19% 62.4 66.8 61.8 54.8 78.6 $125,000 $125,001 1,101 24.69% 53.7 57.1 54.3 47.0 67.5 $175,000 $175,001 668 14.98% 69.5 87.5 67.9 63.0 99.4 $225,000 $225,001 522 11.70% 62.8 90.7 49.8 63.0 82.9 $300,000 $300,001 490 10.99% 74.7 98.4 71.8 62.5 102.2 and up Average Closed DOM: Total Closed Units: Total Closed Volume: 66.2 4,460 784,747,535 78.3 893 112.95M 62.0 2379 358.35M 62.0 1046 259.77M 92.6 142 53.68M Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity. pp. 6 Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com

- 8. Monthly Inventory Analysis OKLAHOMA ASSOCIATION OF REALTORS® July 2014 Closed Sales as of Aug 08, 2014 Average List Price at Closing Average List Price Ready to Buy or Sell Real Estate? Contact an experienced REALTOR® Data from the Area Delimited by Entire OK State MLS - Single-Family Property Type Report Produced on: Aug 14, 2014 JULY YEAR TO DATE (YTD) +2.42% +1.36% 5 YEAR MARKET ACTIVITY TRENDS 5yr JUL AVG = 170K 3 MONTHS High Jun 2014 = 181,871 Low Jan 2010 = 138,948 Average LPrice this month at 180,974, above the 5 yr JUL average of 169,561 MAY J UN J UL Jun 2010 Dec 2010Jun 2011 Dec 2011Jun 2012 Dec 2012Jun 2013 Dec 2013Jun 2014 AVERAGE LIST PRICE OF CLOSED SALES & BEDROOMS DISTRIBUTION BY PRICE 200,000 100,000 0 Distribution of Average List Price at Closing by Price Range % AVL$ 2 Beds 3 Beds 4 Beds 5 Beds+ 2010 161,867 2011 163,644 2012 164,619 2013 176,700 2014 180,974 1 Year 2 Year +9.94% 2010 150,568 2011 155,315 2012 157,991 2013 168,407 2014 170,696 1 Year 2 Year +8.04% 173,111 181,871 5.06% 180,974 -0.49% $50,000 377 8.45% 32,468 33,771 35,423 40,803 59,750 and less $50,001 315 7.06% 64,255 66,200 67,217 69,977 0 $75,000 $75,001 921 20.65% 102,355 103,622 106,073 107,197 108,344 $125,000 $125,001 1,104 24.75% 150,713 154,975 151,577 159,810 160,155 $175,000 $175,001 685 15.36% 198,827 200,058 201,688 204,207 210,435 $225,000 $225,001 549 12.31% 259,737 267,167 261,679 265,754 265,107 $300,000 $300,001 509 11.41% 462,113 431,280 438,720 462,650 548,395 and up Average List Price: Total Closed Units: Total List Volume: $180,974 4,460 807,144,409 $130,995 893 116.98M $154,616 2379 367.83M $255,014 1046 266.74M $391,473 142 55.59M Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity. pp. 7 Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com

- 9. Monthly Inventory Analysis OKLAHOMA ASSOCIATION OF REALTORS® July 2014 Closed Sales as of Aug 08, 2014 Average Sold Price at Closing Average Sold Price Ready to Buy or Sell Real Estate? Contact an experienced REALTOR® Data from the Area Delimited by Entire OK State MLS - Single-Family Property Type Report Produced on: Aug 14, 2014 JULY YEAR TO DATE (YTD) +2.50% +1.58% 5 YEAR MARKET ACTIVITY TRENDS 5yr JUL AVG = 164K 3 MONTHS High Jun 2014 = 176,850 Low Jan 2010 = 133,317 Average SPrice this month at 175,952, above the 5 yr JUL average of 163,927 MAY J UN J UL Jun 2010 Dec 2010Jun 2011 Dec 2011Jun 2012 Dec 2012Jun 2013 Dec 2013Jun 2014 AVERAGE SOLD PRICE OF CLOSED SALES & BEDROOMS DISTRIBUTION BY PRICE 200,000 100,000 0 Distribution of Average Sold Price at Closing by Price Range % AVS$ 2 Beds 3 Beds 4 Beds 5 Beds+ 2010 155,665 2011 157,560 2012 158,793 2013 171,665 2014 175,952 1 Year 2 Year +10.81% 2010 145,212 2011 149,156 2012 152,375 2013 163,165 2014 165,743 1 Year 2 Year +8.77% 168,712 176,850 4.82% 175,952 -0.51% $50,000 416 9.33% 31,148 29,693 31,727 35,842 50,000 and less $50,001 318 7.13% 63,583 62,779 64,089 64,163 0 $75,000 $75,001 945 21.19% 101,926 99,303 102,591 102,918 105,046 $125,000 $125,001 1,101 24.69% 150,426 150,937 148,638 156,375 155,894 $175,000 $175,001 668 14.98% 198,889 196,992 198,261 200,359 204,490 $225,000 $225,001 522 11.70% 259,174 259,175 256,953 260,678 259,921 $300,000 $300,001 490 10.99% 452,010 421,310 423,910 447,969 527,977 and up Average Closed Price: Total Closed Units: Total Closed Volume: $175,952 4,460 784,747,535 $126,480 893 112.95M $150,629 2379 358.35M $248,351 1046 259.77M $378,033 142 53.68M Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity. pp. 8 Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com

- 10. Monthly Inventory Analysis OKLAHOMA ASSOCIATION OF REALTORS® July 2014 Closed Sales as of Aug 08, 2014 Average Percent of List Price to Selling Price Average List/Sell Price Ready to Buy or Sell Real Estate? Contact an experienced REALTOR® Data from the Area Delimited by Entire OK State MLS - Single-Family Property Type Report Produced on: Aug 14, 2014 JULY YEAR TO DATE (YTD) -0.11% +0.13% 5 YEAR MARKET ACTIVITY TRENDS 5yr JUL AVG=96.53% 3 MONTHS High May 2014 = 97.41% Low Jan 2011 = 95.22% Average List/Sell this month at 96.86%, above the 5 yr JUL average of 96.53% MAY J UN J UL Jun 2010 Dec 2010 Jun 2011 Dec 2011 Jun 2012 Dec 2012 Jun 2013 Dec 2013 Jun 2014 AVERAGE L/S% OF CLOSED SALES & BEDROOMS DISTRIBUTION BY PRICE Distribution of Average L/S % by Price Range % AVL/S% 2 Beds 3 Beds 4 Beds 5 Beds+ 2010 95.89% 2011 96.17% 2012 96.76% 2013 96.97% 2014 96.86% 1 Year 2 Year +0.11% 2010 96.35% 2011 95.77% 2012 96.26% 2013 96.69% 2014 96.81% 1 Year 2 Year +0.58% 97.41% 97.19% -0.23% 96.86% -0.34% 98 97 96 95 $50,000 416 9.33% 89.95% 89.68% 90.39% 89.26% 85.97% and less $50,001 318 7.13% 95.33% 95.18% 95.82% 92.38% 0.00% $75,000 $75,001 945 21.19% 96.80% 96.23% 96.87% 97.40% 99.79% $125,000 $125,001 1,101 24.69% 98.02% 97.51% 98.16% 97.98% 97.47% $175,000 $175,001 668 14.98% 98.72% 101.09% 98.42% 98.24% 97.14% $225,000 $225,001 522 11.70% 98.15% 97.31% 98.31% 98.24% 98.17% $300,000 $300,001 490 10.99% 97.33% 97.94% 97.00% 97.37% 97.37% and up Average List/Sell Ratio: Total Closed Units: Total Closed Volume: 96.90% 4,460 784,747,535 95.53% 893 112.95M 97.02% 2379 358.35M 97.54% 1046 259.77M 97.51% 142 53.68M Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity. pp. 9 Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com

- 11. Monthly Inventory Analysis OKLAHOMA ASSOCIATION OF REALTORS® July 2014 Inventory as of Aug 08, 2014 Market Summary Data from the Area Delimited by Entire OK State MLS - Single-Family Property Type Report Produced on: Aug 14, 2014 Inventory Inventory Market Activity Market Activity New Listings Closed Sales Pending Sales Other Off Market Active Inventory 6,788 = 24.46% Start Inventory 20,958 Total Inventory Units 27,746 Volume $5,843,903,030 4,460 = 13.86% 4,531 = 14.08% 2,439 = 7.58% 20,749 = 64.48% Absorption: Active Inventory 3,685 20,749 JULY Year To Date 2013 2014 +/-% 2013 2014 +/-% Last 12 months, an Average of Sales/Month as of July 31, 2014 = Closed Sales Pending Sales New Listings Average List Price Average Sale Price Average Percent of List Price to Selling Price Average Days on Market to Sale Monthly Inventory Months Supply of Inventory 4,638 4,460 -3.84% 4,119 4,531 10.00% 7,154 6,788 -5.12% 176,700 180,974 2.42% 171,665 175,952 2.50% 96.97% 96.86% -0.11% 69.04 66.21 -4.10% 23,636 20,749 -12.21% 6.60 5.63 -14.64% 25,898 26,252 1.37% 27,887 29,184 4.65% 45,871 45,407 -1.01% 168,407 170,696 1.36% 163,165 165,743 1.58% 96.69% 96.81% 0.13% 76.01 73.31 -3.56% 23,636 20,749 -12.21% 6.60 5.63 -14.64% 2013 2014 JULY MARKET AVERAGE PRICES New Listings Pending Listings List Price Sale Price 2013 2014 4,531 +10.00% 2013 2014 175,952 +2.50% 2013 2014 4,119 176,700 171,665 180,974 +2.42% INVENTORY AVERAGE L/S% & DOM 7,154 6,788 -5.12% Active Inventory Monthly Supply of Inventory % of List to Sale Price Days on Market to Sale 23,636 6.60 20,749 -12.21% 5.63 -14.64% 96.97% 69.04 96.86% -0.11% 66.21 -4.10% Reports produced and compiled by R E S T A T S I n c . Information is deemed reliable but not guaranteed. Does not reflect all market activity. pp. 10 Steve Reese - Vice President of Marketing 405-848-9944 steve@okrealtors.com