Daily market derivatives trading report by epic research on 22 july 2014

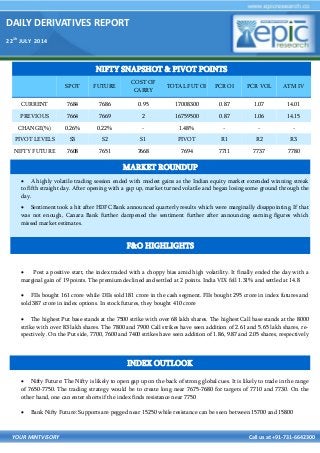

- 1. DAILY DERIVATIVES REPORT 221h JULY 2014 YOUR MINTVISORY Call us at +91-731-6642300 Post a positive start, the index traded with a choppy bias amid high volatility. It finally ended the day with a marginal gain of 19 points. The premium declined and settled at 2 points. India VIX fell 1.31% and settled at 14.8 FIIs bought 161 crore while DIIs sold 181 crore in the cash segment. FIIs bought 295 crore in index futures and sold 387 crore in index options. In stock futures, they bought 410 crore The highest Put base stands at the 7500 strike with over 68 lakh shares. The highest Call base stands at the 8000 strike with over 83 lakh shares. The 7800 and 7900 Call strikes have seen addition of 2.61 and 5.65 lakh shares, re- spectively. On the Put side, 7700, 7600 and 7400 strikes have seen addition of 1.86, 9.87 and 2.05 shares, respectively Nifty Future: The Nifty is likely to open gap up on the back of strong global cues. It is likely to trade in the range of 7650-7750. The trading strategy would be to create long near 7675-7680 for targets of 7710 and 7730. On the other hand, one can enter shorts if the index finds resistance near 7750 Bank Nifty Future: Supports are pegged near 15250 while resistance can be seen between 15700 and 15800 NIFTY SNAPSHOT & PIVOT POINTS SPOT FUTURE COST OF CARRY TOTAL FUT OI PCR OI PCR VOL ATM IV CURRENT 7684 7686 0.95 17008300 0.87 1.07 14.01 PREVIOUS 7664 7669 2 16759500 0.87 1.06 14.15 CHANGE(%) 0.26% 0.22% - 1.48% - - - PIVOT LEVELS S3 S2 S1 PIVOT R1 R2 R3 NIFTY FUTURE 7608 7651 7668 7694 7711 7737 7780 F&O HIGHLIGHTS INDEX OUTLOOK A highly volatile trading session ended with modest gains as the Indian equity market extended winning streak to fifth straight day. After opening with a gap up, market turned volatile and began losing some ground through the day. Sentiment took a hit after HDFC Bank announced quarterly results which were marginally disappointing. If that was not enough, Canara Bank further dampened the sentiment further after announcing earning figures which missed market estimates. MARKET ROUNDUP

- 2. DAILY DERIVATIVES REPORT 221h JULY 2014 YOUR MINTVISORY Call us at +91-731-6642300 INTRADAY STRATEGY i) ) HOUSING DEVELOPMNT FINANCE CORPORA- TION LTD (HDFC) ii) CANARA BANK(CAN BANK) Buy HDFC July fut in range of 1015-1020 Sell CANBANK July fut in range of 400-399 View : Bullish View :Bearish Strategy : Buy Future Strategy : Sell Future Target1 :1030 Target 2 : 1040 Target 1 : 396.50 Target 2 : 394 Stop loss : 1010 Stop loss : 402.50 Market Lot : 250 CMP : 1009.50 Market Lot : 1000 CMP : 401.55 STOCK ANALYSIS OPEN INTEREST ACTIVITY LONG BUILD UP SHORT BUILD UP SYMBOL OI (LOTS) % CHNG PRICE %CHNG SYMBOL OI (LOTS) %CHNG PRICE %CHNG CENTURY TEXTILE 6039000 26.0 642.70 10.7 HDIL 29384000 9.3 93.55 4.5 HDFC 611000 8.9 1008.00 2.6 CANARA BANK 9102000 7.2 400.05 3.1 INDUSIND BANK 5872000 6.4 562.25 3.3 INFOSYS 3104000 7.0 3216.00 1.4 BHARTIARTL 12378000 4.1 338.35 0.4 AUROPHARMA 9221000 2.1 722.70 2.1 ITC 24800000 4.1 350.75 1.8 HDFC BANK 33570000 1.4 829.15 0.7 OI addition : We saw long build-up in Century textile,Bata india,Hdfc, Indusind bank and Idea while short build up was seen in Hdil, Canara bank,Infosys,Hdfc bank and Pnb OI Shedding : We saw short covering in Lic housing fin,Reliance,Sunpharma,Tatacomm and Ktk bank while long closure was seen in Hindalco, Idfc, Dlf, Exid ind and Pfc

- 3. DAILY DERIVATIVES REPORT 221h JULY 2014 YOUR MINTVISORY Call us at +91-731-6642300 F&O TURNOVER INSTRUMENT NO. OF CONTRACTS TURNOVER(CR) PERCENTAGE CHANGE INDEX FUTURES 280142 10810.19 - STOCK FUTURES 646871 25402.33 - INDEX OPTIONS 3212285 123455.68 1.05 STOCK OPTIONS 311654 12019.29 0.47 F&O TOTAL 4450960 171688.15 0.98 NIFTY OPTION OI DISTRIBUTION 0 1000000 2000000 3000000 4000000 5000000 6000000 7000000 8000000 7900 7800 7700 7600 7500 7400 7300 7200 7100 7000 6900 OpenInterest Strike Price OI Concentration Chart Call OI (APR) PutOI (APR)

- 4. DAILY DERIVATIVES REPORT 221h JULY 2014 YOUR MINTVISORY Call us at +91-731-6642300 Instrument Type Symbol Expiry Date Option Type Strike Price LTP Traded Volume (Contracts) Traded Value (Lakhs) OPTSTK RELIANCE 31JUL2014 CE 1,000 15.40 9,832 25,049.48 OPTSTK SBIN 31JUL2014 CE 2,600 22.50 8,367 27,563.62 OPTSTK TCS 31JUL2014 CE 2,500 14.80 3,331 10,463.92 OPTSTK ICICIBANK 31JUL2014 CE 1,500 22.50 3,020 11,528.93 OPTSTK INFOSYS 31JUL2014 CE 3,300 22.00 2,952 12,275.71 MOST ACTIVE CALLS MOST ACTIVE PUTS Instrument Type Symbol Expiry Date Option Type Strike Price LTP Traded Volume (Contracts) Traded Value (Lakhs) OPTSTK RELIANCE 31JUL2014 PE 1,000 17.00 3,518 8,924.81 OPTSTK SBIN 31JUL2014 PE 2,500 34.50 2,954 9,333.53 OPTSTK TCS 31JUL2014 PE 2,300 6.00 1,866 5,383.41 OPTSTK RELIANCE 31JUL2014 PE 940 1.60 1,612 3,793.24 OPTSTK AXISBANK 31JUL2014 PE 2,000 34.25 1,358 6,910.42 DERIVATIVE PRODUCT BUY SELL OPEN INTEREST AT THE END OF THE DATE NO.OF CON- TRACTS AMOUNT IN CRORES NO.OF COTRACTS AMOUNT IN CRORES NO. OF CONTRACTS AMOUNT IN CRORES INDEX FUTURE 36992 1413.95 46745 1789.11 340571 13069 INDEX OPTION 347004 13183.31 333793 12702.06 1744356 66862 STOCK FUTURE 76795 2830.56 66619 2512.63 1549590 56280 STOCK OPTION 78569 2960.44 77707 2933.04 118998 4441

- 5. DAILY DERIVATIVES REPORT 221h JULY 2014 YOUR MINTVISORY Call us at +91-731-6642300 DISCLAIMER The information and views in this report, our website & all the service we provide are believed to be reli- able, but we do not accept any responsibility (or liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most. Sincere efforts have been made to present the right investment perspective. The information contained herein is based on analysis and up on sources that we consider reliable. This material is for personal information and based upon it & takes no responsibility. The information given herein should be treated as only factor, while making investment decision. The report does not provide individually tailor-made investment advice. Epic research recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial adviser. Epic research shall not be responsible for any transaction conducted based on the information given in this report, which is in violation of rules and regulations of NSE and BSE. The share price projections shown are not necessarily indicative of fu- ture price performance. The information herein, together with all estimates and forecasts, can change without notice. Analyst or any person related to epic research might be holding positions in the stocks recommended. It is under- stood that anyone who is browsing through the site has done so at his free will and does not read any views expressed as a recommendation for which either the site or its owners or anyone can be held re- sponsible for . Any surfing and reading of the information is the acceptance of this disclaimer. All Rights Reserved. In- vestment in equity & bullion market has its own risks. We, however, do not vouch for the accuracy or the completeness thereof. We are not responsible for any loss incurred whatsoever for any financial profits or loss which may arise from the recommendations above epic research does not purport to be an invitation or an offer to buy or sell any financial instrument. Our Clients (Paid or Unpaid), any third party or anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.