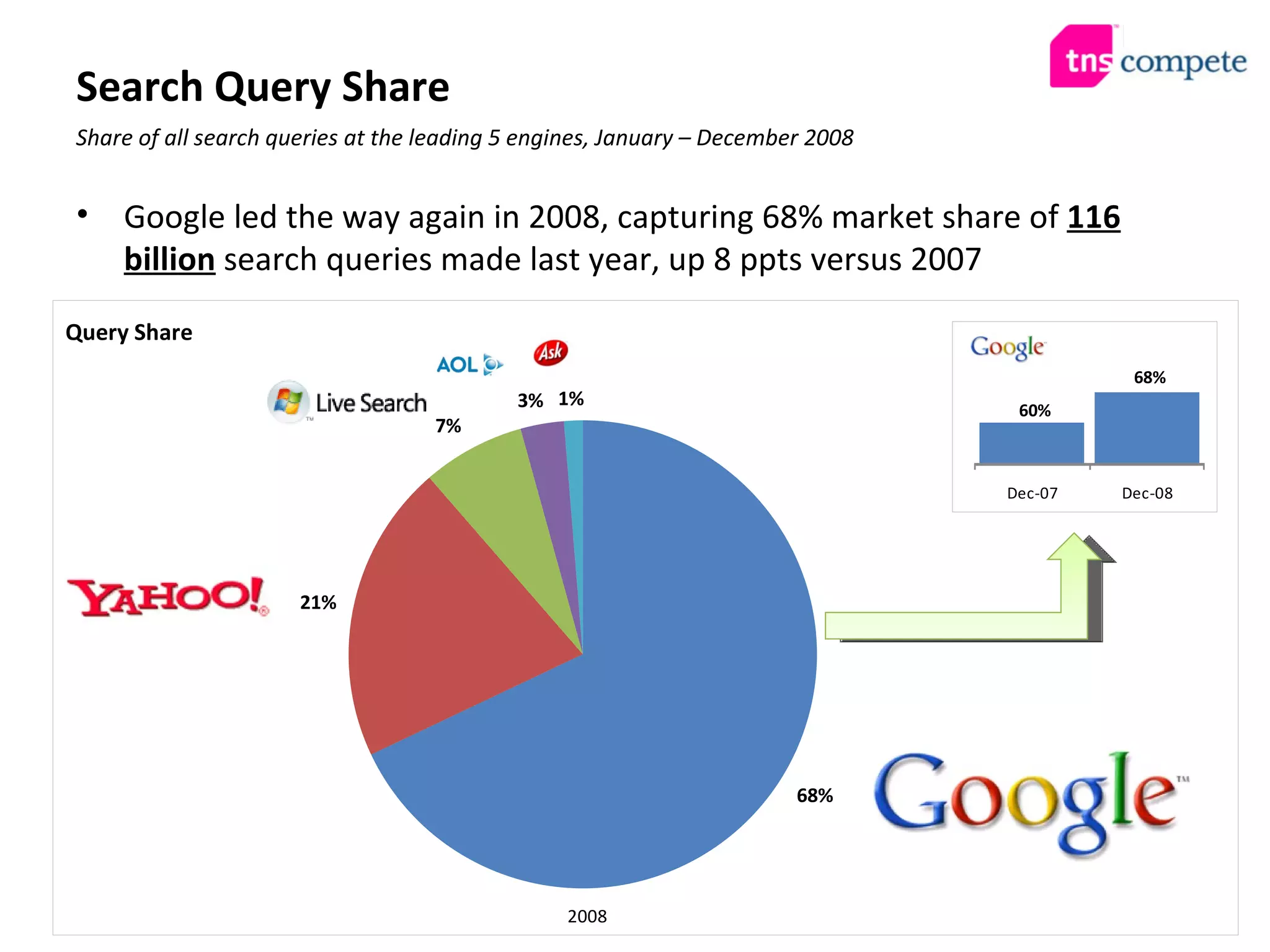

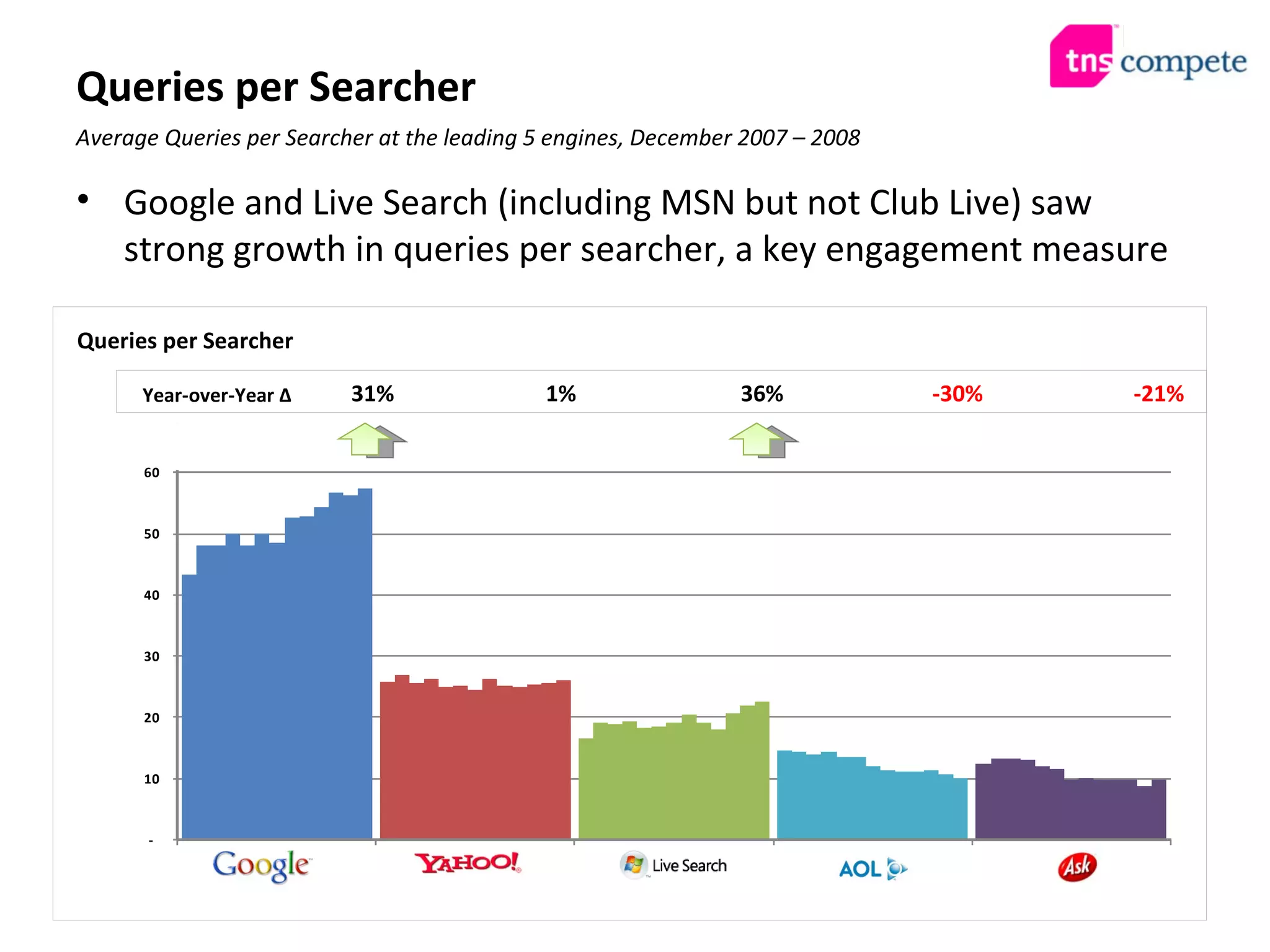

The document examines major trends in online media and search for 2008, highlighting Google's significant market share and query volume growth. It notes patterns in search engine loyalty and the increasing dominance of social media in terms of page views and user engagement. Predictions for 2009 include ongoing growth for Google, potential competition from Microsoft, and a need for publishers to integrate social media functionalities.

![Thank you Media inquiries, please contact: Alex Patriquin Senior Associate Online Media & Search Compete, a TNS Media Company p: 617-933-5724 e: [email_address]](https://image.slidesharecdn.com/oms4-1233264376599958-1/75/Online-Media-2008-15-2048.jpg)