Wassim Zhani Kroger Value.pdf

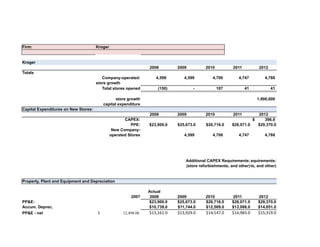

- 1. Firm: Kroger Kroger 2008 2009 2010 2011 2012 Totals Company-operated: 4,599 4,599 4,706 4,747 4,788 store growth Total stores opened (150) - 107 41 41 store growth 1,900,000 capital expenditure Capital Expenditures on New Stores: 2008 2009 2010 2011 2012 CAPEX: $ 396.8 PPE: $23,900.0 $25,673.0 $26,716.0 $28,071.0 $29,370.0 New Company- operated Stores 4,599 4,706 4,747 4,788 Additional CAPEX Requirements: equirements: (store refurbishments, and other)ts, and other) Property, Plant and Equipment and Depreciation Actual 2007 2008 2009 2010 2011 2012 PP&E: $23,900.0 $25,673.0 $26,716.0 $28,071.0 $29,370.0 Accum. Deprec. $10,739.0 $11,744.0 $12,569.0 $13,088.0 $14,051.0 PP&E - net $ 12,498.00 $13,161.0 $13,929.0 $14,147.0 $14,983.0 $15,319.0

- 2. CAPEX Forecasts from above: Depreciation Expense: $ 1,355.00 $ 1,443.00 $ 1,525.00 $ 1,600.00 $ 1,638.00 $ 1,652.00 PP&E in place at end of 2012: $ 15,319.0 Remaining balance to be depreciated. PP&E Purchases: Capex 2012 455.7 Capex 2013 515.2 Capex 2014 572.3 Capex 2015 624.5 Capex 2016 681.4 Capex 2017 743.6 Capex 2018 811.5 Capex 2019 885.6 Capex 2020 966.6 Capex 2021 1055.1 Capex 2022 0.0 Total Depreciation Expense 2008 2009 2010 2011 2012 Depreciation methods: Gross PPE $ 23,900 $ 25,673 $ 26,716 $ 28,071 $ 29,370 Depreciable PPE $ 5,365 $ 25,496 $ 26,484 $ 27,899 $ 29,060 Average Depreciable PPE $ 15,430 $ 25,990 $ 27,192 $ 28,479 Depreciation Expense $1,525.0 $1,600.0 $1,638.0 $1,652.0 Implied Average Useful Life in Years 10.1 16.2 16.6 17.2

- 3. Forecasts: Numbers of Stores 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 4,828 4,868 4,908 4,948 4,988 5,028 5,068 5,108 5,148 5,188 0.84% 0.83% 0.82% 0.81% 0.81% 0.80% 0.80% 0.79% 0.78% 0.78% 40 40 40 40 40 40 40 40 40 40 0.84% 0.83% 0.82% 0.81% 0.81% 0.80% 0.80% 0.79% 0.78% 0.78% 2,200,000 2,508,000 2,808,960 3,089,856 3,398,842 3,738,726 4,112,598 4,523,858 4,976,244 5,473,868 16% 14% 12% 10% 10% 10% 10% 10% 10% 10% CAPEX Forecasts: 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 $455.7 $515.2 $572.3 $624.5 $681.4 $743.6 $811.5 $885.6 $966.6 $1,055.1 4,828 4,868 4,908 4,948 4,988 5,028 5,068 5,108 5,148 5,188 CAPEX Inflation Forecast: 3% 3% 3% 3% 3% 3% 3% 3% 3% 3% *assume they refurbish each store every __ years and it costs 25% of original build-out Property, Plant and Equipment and Depreciation Forecasts: Forecast: 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 29825.7 30340.9 30913.2 31537.7 32219.1 32962.6 33774.1 34659.8 35626.4 36681.5 37782.0 12320.9 10560.9 8767.7 6938.3 -1731.3 -1939.7 -2195.1 -2502.0 -2864.9 -3289.0 -3387.7 42146.6 40901.8 39680.9 38476.0 30487.8 31023.0 31579.0 32157.8 32761.5 33392.5 0.0

- 4. 455.7 515.2 572.3 624.5 681.4 743.6 811.5 885.6 966.6 1055.1 0.0 1703.7 1703.7 1703.7 1703.7 8504.3 0.0 0.0 0.0 0.0 0.0 0.0 13615.3 11911.7 10208.0 8504.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 26.4 26.4 26.4 26.4 26.4 26.4 26.4 26.4 26.4 26.4 26.4 29.9 29.9 29.9 29.9 29.9 29.9 29.9 29.9 29.9 29.9 33.2 33.2 33.2 33.2 33.2 33.2 33.2 33.2 33.2 36.2 36.2 36.2 36.2 36.2 36.2 36.2 36.2 39.5 39.5 39.5 39.5 39.5 39.5 39.5 43.1 43.1 43.1 43.1 43.1 43.1 47.1 47.1 47.1 47.1 47.1 51.4 51.4 51.4 51.4 56.1 56.1 56.1 61.2 61.2 0.0 1730.1 1760.0 1793.2 1829.4 8669.6 208.4 255.5 306.8 362.9 424.1 98.7 98.7 3% (remove land and work in progress)

- 6. 15319.0 290.8 17.6 316.5 33.2 19.6 351.6 36.2 36.2 21.4 383.6 39.5 39.5 39.5 23.3 418.6 43.1 43.1 43.1 43.1 25.4 456.8 47.1 47.1 47.1 47.1 47.1 27.7 498.5 51.4 51.4 51.4 51.4 51.4 51.4 30.3 544.0 56.1 56.1 56.1 56.1 56.1 56.1 56.1 33.1 593.8 61.2 61.2 61.2 61.2 61.2 61.2 61.2 61.2 36.1 648.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 assumption for long run growth rate

- 7. Firm: Kroger Kroger: Income Statement Forecasts Actual Forecasts (Thousands) 2012 2013 2014 2015 2016 2017 Total net revenues $ 96,751.00 $100,621.0 $104,645.9 $108,831.7 $112,096.7 $116,580.5 2011 Total net revenues $ 90,374.00 4% 4% 4.0% 3% 4% implied growth 7.1% Marchandise costs $ 76,858 79893 83193 86521 89117 92682 79.4% 79.4% 79.5% 79.5% 79.5% 79.5% Gross Profit $19,893 $20,728 $21,452 $22,311 $22,980 $23,899 implied margins 20.6% 20.6% 20.5% 20.5% 20.5% 20.5% Operating, General and Administrative $ 14,849 $ 15,395 $ 16,011 $ 16,651 $ 16,815 $ 17,487 15.3% 15.3% 15.3% 15.3% 15.0% 15.0% Rent $ 628 $ 805 $ 837 $ 871 $ 897 $ 933 0.6% 0.8% 0.8% 0.8% 0.8% 0.8% Depreciation and amortization expenses $ 1,652 $ 1,765 $ 1,784 $ 1,630 $ 1,653 $ 1,692 12% 12% 12% 12% 12% Operating income $2,764.0 $2,762.6 $2,820.1 $3,158.5 $3,615.8 $3,786.9 implied margins 2.9% 2.7% 2.7% 2.9% 3.2% 3.2% Interest expense ($462) ($521) ($525) ($524) ($519) ($548) interest rate on financial liabilities 7.0% 7.0% 7.5% 7.5% 7.5% Earnings before income taxes $2,302 $2,242 $2,295 $2,634 $3,097 $3,239 Income taxes $ 794 $ 785 $ 803 $ 922 $ 1,084 $ 1,134 effective tax rate assumption (10-K, p.26 mgt. provided) 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% Net earnings including noncontrolling interes $1,508 $1,457 $1,492 $1,712 $2,013 $2,105 Net earnings attributable to noncontrolling in $11 $11 $11 $11 $11 $11

- 8. Net earnings attributable to Kroger $1,497 $1,446 $1,481 $1,701 $2,002 $2,094

- 9. Kroger: Balance Sheet Forecasts (Thousands) Actual Forecasts ASSETS 2012 2013 2014 2015 2016 2017 Current assets: Cash and temporary cash investments $238.0 0.0 0.0 0.0 165.5 0.0 days sales in cash 1.7 1.7 1.7 1.7 1.7 Deposits in-transit 955.00 974.7 1032.2 1055.0 1033.4 1074.7 percentage of total assets 3.50 3.50 3.50 3.40 3.30 Receivables $1,051.0 1071.7 1135.9 1070.5 1140.7 1159.0 percentage of total assets 3.85 3.85 3.70 3.60 3.60 FIFO inventory $6,244.0 6437.0 6464.5 6654.9 6858.1 6876.0 turnover assumption (in days) 23.0 22.5 22.0 22.0 21.5 LIFO reserve ($1,098.0) -1029.9 -1099.0 -1197.9 -1234.5 -1237.7 turnover assumption (in days) 0.18 0.16 0.17 0.18 0.18 0.18 Prefunded employee benefits $0.0 0.0 0.0 0.0 0.0 0.0 percentage of total assets Prepaid expenses and other current assets $569.0 539.4 520.4 518.7 550.9 564.1 percentage of total assets 2.2% 2.1% 2.1% 2.2% 2.2% Total current assets $7,959.0 $7,992.9 $8,054.1 $8,101.2 $8,514.2 $8,436.1 Property, plant and equipment, net $14,875.0 14710.85 14869.07 14819.33 15024.98 15384.98 60.0% 60.0% 60.0% 60.0% 60.0% Other assets $584.0 588.4 594.8 568.1 500.8 538.5 percentage of total assets 2.4% 2.4% 2.3% 2.0% 2.1% Goodwill $1,234.0 1225.9 1263.9 1210.2 1001.7 1282.1 percentage of total assets 5.0% 5.1% 4.9% 4.0% 5.0% TOTAL ASSETS $24,652.0 $24,518.1 $24,781.8 $24,698.9 $25,041.6 $25,641.6 LIABILITIES AND SHAREHOLDERS EQUITY Current liabilities:

- 10. $2,734.0 $1,109.1 $986.9 $275.4 $0.0 $181.8 % of total debt 16.00% 16.00% 16.00% 16.00% 16.00% Trade accounts payable $4,524.0 4607.7 4560.1 4751.3 4894.3 4825.4 Turnover assumption (in days) 21.00 20.00 20.00 20.00 19.00 Accrued salaries and wages $977.0 1003.4 1030.5 1057.3 1083.7 1109.7 % of total assets 2.70% 2.70% 2.6% 2.5% 2.4% Deferred income taxes $284.0 291.1 295.5 298.4 299.9 301.4 grow with sales 2.5% 1.5% 1.0% 0.5% 0.5% Other current liabilities $2,538.0 $2,558.3 $2,578.8 $2,599.4 $2,620.2 $2,641.2 grow with company stores 0.80% 0.80% 0.80% 0.80% 0.80% Total current liabilities $11,057.0 $9,569.6 $9,451.7 $8,981.8 $8,898.1 $9,059.5 $6,141.0 6325 6515 6710 6912 7119 % of total equity 10961.3 11157.2 11427.1 11704.6 12014.1 $4.0 $4.0 $4.0 $4.0 $4.0 $4.0 Long-term debt including obligations under c $6,145.0 $6,329.2 $6,519.0 $6,714.4 $6,915.7 $7,123.1 Deferred income taxes $800.0 $832.0 $865.3 $899.9 $926.9 $964.0 grow with Sale 4.00% 4.00% 4.00% 3.00% 4.00% Pension and postretirement benefit obligatio $1,291.0 $1,337.8 $1,392.5 $1,409.7 $1,464.5 $1,499.6 %of accrual salaries 75% 74% 75% 74% 74% Other long-term liabilities $1,145.0 $1,154.2 $1,163.4 $1,172.7 $1,182.1 $1,191.5 % of store growth 0.80% 0.80% 0.80% 0.80% 0.80% TOTAL LIABILITIES $20,438.0 $19,222.8 $19,391.8 $19,178.5 $19,387.2 $19,837.7 Preferred shares, $100 par per share, 5 share $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $959.0 959.0 959.0 959.0 959.0 959.0 Current portion of long-term debt including obligations under capital leases and financing obligations Face-value of long-term debt including obligations under capital leases and financing obligations Adjustment related to fair-value of interest rate hedges Common shares, $1 par per share, 1,000 shares authorized; 959 shares issued in 2011 and 2010

- 11. Additional paid-in capital $3,451.0 3485.5 3485.5 3485.5 3485.5 3485.5 Accumulated other comprehensive loss ($753.0) ($783.1) ($814.4) ($847.0) ($880.9) ($916.1) Accumulated earnings $9,787.0 10963.3 11182.5 11439.7 11702.9 11983.7 Common stock in treasury, at cost, 398 shares ($9,237.0) -9329.4 -9422.7 -9516.9 -9612.1 -9708.2 Total Shareowners’ Equity $4,207.0 5295.3 5389.9 5520.3 5654.4 5803.9 Noncontrolling interests $7.0 $7.0 $7.0 $7.0 $7.0 $7.0 Total equity $4,214.0 $5,295.3 $5,389.9 $5,520.3 $5,654.4 $5,803.9 TOTAL LIABILITIES AND SHAREHOLDERS EQUI $24,652.0 $24,518.1 $24,781.8 $24,698.9 $25,041.6 $25,641.6 implied debt/equity ratios 1.405 1.393 1.266 1.223 1.259 check: balance sheet balance? 0.0 0.0 0.0 0.0 0.0 Normal dividend payout forecast: 267.0 267.0 267.0 267.0 267.0 Plug: -10.0 -1001.3 -1184.1 -1479.0 -1553.5 Total implied dividends: 277.0 1268.3 1451.1 1746.0 1820.5

- 12. kroger: Implied Statement of Cash Flows Forecasts Forecasts Implied Cash Flows: 2012 2013 2014 2015 2016 2017 Operations: Net earnings including noncontrolling interest 1508.00 1457.28 1491.57 1712.25 2013.12 2105.40 Depreciation and amortization 1652.00 1765.30 1784.29 1630.13 1652.75 1692.35 Goodwill impairment charge 0.00 0.00 0.00 0.00 0.00 0.00 Asset impairment charge 18.00 20.00 18.00 19.00 18.00 18.00 LIFO charge 55.00 111.85 116.47 121.13 124.76 129.75 Stock-based employee compensation 82.00 80.00 80.00 80.00 80.00 80.00 Expense for Company-sponsored pension pla 89.00 93.00 97.00 101.00 105.00 109.00 Deferred income taxes 176.00 -7.10 -4.37 -2.95 -1.49 -1.50 Other 17.00 23.17 29.34 35.51 41.68 47.85 Store deposits in-transit -169.00 -112.17 -177.17 -120.34 -185.34 -128.51 average 56.83 -65.00 56.83 -65.00 56.83 Inventories -78.00 -193.01 -27.53 -190.36 -203.22 -17.90 Receivables -126.00 -20.69 -64.22 65.36 -70.13 -18.31 Prepaid expenses -257.00 29.60 18.98 1.74 -32.24 -13.20 Trade accounts payable 58.00 -83.69 47.64 -191.26 -142.93 68.80 Accrued expenses 76.00 -26.38 -27.09 -26.79 -26.43 -26.01 Income taxes receivable and payable 164.00 -39.10 -37.65 -37.57 -28.49 -38.58 Contribution to Company-sponsored pension -71.00 -90.40 -109.80 -129.20 -148.60 -168.00 average -19.40 -19.40 -19.40 -19.40 -19.40 Other -361.00 -402.17 -443.34 -484.51 -525.68 -566.85 average -41.17 -41.17 -41.17 -41.17 -41.17 Adjustments to reconcile net earnings to net cash provided by Operating activities: Changes in operating assets and liabilities net of effects from acquisitions of businesses:

- 13. Net cash provided by operating activities 2833.00 2662.32 2727.12 2639.96 2605.76 3329.12

- 14. Terminal Growth Factor 1.02 Terminal 2018 2019 2020 2021 2022 2023 $114,248.9 $117,676.4 $116,499.6 $119,994.6 $118,794.7 $121,170.6 -2% 3% -1% 3% -1% 2% 90828 94141 93200 95996 95036 96936 79.5% 80.0% 80.0% 80.0% 80.0% 79.0% $23,421 $23,535 $23,300 $23,999 $23,759 $24,234 20.5% 20.0% 20.0% 20.0% 20.0% 20.0% $ 17,023 $ 17,298 $ 17,358 $ 17,639 $ 17,463 $ 17,812 14.9% 14.7% 14.9% 14.7% 14.7% $ 914 $ 941 $ 932 960.0 950.4 969.4 0.8% 0.8% 0.8% 0.8% 0.8% $ 1,703 $ 1,652 $ 1,652 $ 1,652 $ 1,652 $ 1,685 12% 12% 12% 12% 12% $3,780.7 $3,643.4 $3,357.5 $3,747.8 $3,693.8 $3,767.6 3.3% 3.1% 2.9% 3.1% 3.1% 3.1% ($550) ($567) ($584) ($601) ($619) ($632) 7.5% 7.5% 7.5% 7.5% 7.5% $3,230 $3,077 $2,774 $3,147 $3,074 $3,136 $ 1,163 $ 1,108 $ 971 $ 1,133 $ 1,107 $ 1,129 36.0% 36.0% 35.0% 36.0% 36.0% $2,068 $1,969 $1,803 $2,014 $1,968 $2,007 $11 $11 $11 $11 $11 $11

- 15. $2,057 $1,958 $1,792 $2,003 $1,957 $1,996

- 16. Terminal Growth Factor 1.02 Terminal 2018 2019 2020 2021 2022 2023 340.2 263.0 629.1 629.3 827.6 844.1 1.7 1.7 1.7 1.7 1.7 1053.8 1138.5 1031.9 1072.1 1076.0 1097.5 3.40 3.40 3.40 3.20 3.30 1157.3 1228.5 1133.4 1299.3 1174.2 1197.7 3.70 3.70 3.70 3.70 3.80 6896.5 6966.8 7077.0 7059.4 7065.8 7207.1 22.0 21.5 22.0 21.5 21.7 -1241.4 -1254.0 -1273.9 -1270.7 -1271.8 -1297.3 0.18 0.18 0.18 0.18 0.18 0.0 0.0 0.0 0.0 0.0 0.0 567.7 577.2 585.6 598.7 604.3 616.3 2.2% 2.2% 2.2% 2.2% 2.2% $8,774.1 $8,919.9 $9,183.1 $9,388.1 $9,476.0 $9,665.5 15483.69 15740.99 15970.63 16327.07 16479.93 16809.53 60.0% 60.0% 60.0% 60.0% 60.0% 516.1 524.7 532.4 544.2 549.3 560.3 2.0% 2.0% 2.0% 2.0% 2.0% 1032.2 1049.4 931.6 952.4 961.3 980.6 4.0% 4.0% 3.5% 3.5% 3.5% $25,806.1 $26,235.0 $26,617.7 $27,211.8 $27,466.5 $28,015.9

- 17. $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 16.00% 16.00% 16.00% 16.00% 16.00% 4729.1 4646.0 4601.6 4733.2 4687.0 4780.8 19.00 18.00 18.00 18.00 18.00 1136.3 1163.6 1191.5 1214.2 1236.0 1260.7 2.4% 2.4% 2.4% 1.9% 1.8% 302.6 303.5 304.1 304.4 304.7 310.8 0.4% 0.3% 0.2% 0.1% 0.1% $2,662.3 $2,683.6 $2,705.1 $2,726.7 $2,748.5 2803.5 0.80% 0.80% 0.80% 0.80% 0.80% $8,830.3 $8,796.8 $8,802.3 $8,978.5 $8,976.3 $9,155.8 7333 7553 7779 8013 8253 8418.1 12332.6 12635.0 12867.7 13105.4 13077.9 $4.0 $4.0 $4.0 $4.0 $4.0 $4.08 $7,336.7 $7,556.7 $7,783.2 $8,016.6 $8,257.0 $8,422.1 $944.7 $973.0 $963.3 $992.2 $982.3 $1,001.9 -2.00% 3.00% -1.00% 3.00% -1.00% $1,535.6 $1,594.0 $1,632.2 $1,663.3 $1,693.2 $1,727.1 74% 73% 73% 73% 73% $1,201.1 $1,210.7 $1,220.4 $1,230.1 $1,240.0 $1,264.8 0.80% 0.80% 0.80% 0.80% 0.80% $19,848.4 $20,131.1 $20,401.4 $20,880.7 $21,148.7 $21,571.7 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 959.0 959.0 959.0 959.0 959.0 978.2

- 18. 3485.5 3485.5 3485.5 3485.5 3485.510 3555.220 ($952.8) ($990.9) ($1,030.5) ($1,071.8) ($1,114.6) -1136.9 12271.3 12553.6 12804.6 13060.7 13191.3 13455.2 -9805.3 -9903.3 -10002.3 -10102.4 -10203.4 -10407.462 5957.8 6103.9 6216.3 6331.1 6317.8 6444.2 $7.0 $7.0 $7.0 $7.0 $7.0 $7.0 $5,957.8 $6,103.9 $6,216.3 $6,331.1 $6,317.8 $6,444.2 $25,806.1 $26,235.0 $26,617.7 $27,211.8 $27,466.5 $28,015.9 1.231 1.238 1.252 1.266 1.307 1.307 0.0 0.0 0.0 0.0 0.0 0.0 267.0 267.0 267.0 267.0 267.0 267.0 -1508.9 -1415.8 -1280.9 -1486.7 -1566.1 -1472.2 1775.9 1682.8 1547.9 1753.7 1833.1 1739.2

- 19. Terminal 1.02 1.02 2018 2019 2020 2021 2022 2023 2067.51 1969.08 1802.93 2013.77 1967.67 2007.02 1703.21 1652.00 1652.00 1652.00 1652.00 1685.04 0.00 0.00 0.00 0.00 0.00 0.00 18.00 18.00 18.00 18.00 18.00 18.36 127.16 131.80 130.48 134.39 133.05 135.71 80.00 80.00 80.00 80.00 80.00 80.00 113.00 117.00 121.00 125.00 129.00 131.58 -1.21 -0.91 -0.61 -0.30 -0.30 -6.09 54.02 60.19 66.36 72.53 78.70 84.87 -193.51 -136.68 -201.68 -144.85 -209.85 -214.05 -65.00 56.83 -65.00 56.83 -65.00 -20.43 -70.35 -110.20 17.64 -6.46 -141.32 1.71 -71.19 95.05 -165.91 125.14 -23.48 -3.62 -9.43 -8.42 -13.07 -5.60 -12.09 96.36 83.05 44.46 -131.58 46.15 -93.74 -26.63 -27.27 -27.93 -22.64 -21.86 -24.72 18.07 -29.25 9.12 -29.20 9.62 -25.74 -187.40 -206.80 -226.20 -245.60 -265.00 -270.30 -19.40 -19.40 -19.40 -19.40 -19.40 -608.02 -649.19 -690.36 -731.53 -772.70 -788.15 -41.17 -41.17 -41.17 -41.17 -41.17

- 20. 3173.22 2966.87 2689.01 2685.47 2892.56 2542.90

- 21. 371377193.xlsx Professor Matt Wieland Valuation Models **Go to Tools, Options, Calculations tab, and click on "Iteration" to allow changes to flow through. 3/21/2013 Firm: Starbucks Analyst: A517 (insert forecast assumptions in blue font cells.) Valuation Parameter Assumptions: WACC Computations: Forecasts: 2013 2014 2015 2016 Equity: Risk-free rate 2.2% 0.73 finance.yahoo.com Beta 0.65 0.6 value line Market risk premium 4% 0.38 google Equity cost of capital 4.93% 0.37 S&P 0.52 Shares Outstanding: 537.00 537.00 537.00 537.00 537.00 Market (Intrinsic) Value ps 23.46 24.62 25.83 27.10 28.44 Market Value total 12598.0 13219.1 13870.8 14554.6 15272.2 Debt: 35% 35% 35% 35% 35% Total debt capital 8879.0 7438.3 7505.9 6989.9 6915.7 cost of debt 6.1% 6.1% 6.1% 6.1% 6.1% 1-Tax rate 65.0% 65.0% 65.0% 65.0% 65.0% Cost of equity 4.93% 4.93% 4.93% 4.93% 4.93% Total capital (d+e) 21477.0 20036.3 20103.9 19587.9 19513.8 Equity Weight 0.59 0.63 0.63 0.64 0.65 Debt Weight: 0.41 0.37 0.37 0.36 0.35 WACC 4.53% 4.57% 4.57% 4.59% 4.59% WACC Discount Factors

- 22. 371377193.xlsx Terminal Value Growth Assumption: 2.0%

- 23. 371377193.xlsx Valuation: Residual Income 1 2 3 4 2013 2014 2015 2016 Net Earnings 1446.3 1480.6 1701.2 2002.1 Lagged Book Value Equity 4214.0 5295.3 5389.9 5520.3 Normal Earnings (Re * BVt-1) 207.8 261.1 265.7 272.2 Abnormal Earnings 1238.5 1219.5 1435.5 1730.0 Present Value Factors 0.953 0.908 0.866 0.825 PV Abnormal Earnings 1180.3 1107.6 1242.5 1427.1 Sum PV Abnormal Earnings thru Year +10 12,030.6 Sensitivity to growth PV of Continuing Abnormal Earnings 35,532.1 98.80 Add: Beginning Book Value of Equity 4,214.0 0% PV of Equity 51,776.7 1% 2% Adjust to midyear 1.02 3% Total PV Abnormal Earnings 53,053.01 4% Shares Outstanding 537.00 Estimated Value per Share 99 Valuation: Dividends 1 2 3 4 2013 2014 2015 2016 Dividends 277.0 1268.3 1451.1 1746.0 (1+Re) 1.049 1.101 1.155 1.212 V0 264.0 1151.9 1256.0 1440.3 Sum of V0 11398.8 D t+1 1390.9 1404.3 1627.5 1931.8 Earnings 1446 1481 1701 2002 (1+g) 1.020 1.020 1.020 1.020 Earnings*(1+g) 1475.2 1510.2 1735.3 2042.2

- 24. 371377193.xlsx BV t 4214.0 5295.3 5389.9 5520.3 BV t * (1+g) 4298.3 5401.2 5497.7 5630.7 (Re-g) 2.93% 2.93% 2.93% 2.93% Vt PV of Vt 40,278.69 V 51677.5 Sensitivity to growth Midterm year 1.02 98 V 52711.06 0% 1% #REF! Shares outstanding 537.00 2% #REF! Value Per Share 98 3% #REF!

- 25. 371377193.xlsx 4% #REF! Valuation: Free Cash Flow for Common Equity Ending Invested capital 14237.48 ROIC beyond horizon 15.80% cost of equity 4.93% growth 2.0% Horizon value 67057.07 Present value of horizon 41442.68 PV of FCF 17580.63 Total PV 59023.31 Midterm Year 1.02 Value of operation 60203.78 Add non operating assets Cash and temporary cash investments 238.00 Deposits in-transit 955.00 Value of enterprise 61396.78 Deduct debt 2734 6145 Noncontrolling interests 7 Total deduction 8886 Value of Common equity 52510.78 Shares outstanding 537.00 Current portion of long-term debt including obligations under capital leases and financing obligations Long-term debt including obligations under capital leases and financing

- 26. 371377193.xlsx Estimated Value per Share 98

- 27. 371377193.xlsx 2017 2018 2019 2020 2021 2022 finance.yahoo.com 537.00 537.00 537.00 537.00 537.00 537.00 29.84 31.31 32.86 34.48 36.18 37.96 Cost of Capital - Heinz 2,012 16025.1 16815.1 17644.1 18514.0 19426.7 20384.5 Share price at January 28, 2012 $23.46 Shares outstanding, January 2012 537.00 Market value of equity, in thousands 12,598 35% 35% 35% 35% 35% 35% 7304.9 7336.7 7556.7 7783.2 8016.6 8257.0 Portion of long-term debt due within one year 2,734 6.1% 6.1% 6.1% 6.1% 6.1% 6.1% long term debt 6,145 65.0% 65.0% 65.0% 65.0% 65.0% 65.0% Market value of debt 8,879 4.93% 4.93% 4.93% 4.93% 4.93% 4.93% 19902.9 19934.7 20154.7 20381.3 20614.6 20855.0 0.63 0.63 0.63 0.62 0.61 0.60 Total market value 21,477 0.37 0.37 0.37 0.38 0.39 0.40 Weight of equity 0.59 Weight of debt 0.41 4.58% 4.57% 4.57% 4.56% 4.55% 4.55% Risk-free rate (recent 10-yr Treasury rate) 2.20%

- 28. 371377193.xlsx Market risk premium (given) 3.0%

- 29. 371377193.xlsx 5 6 7 8 9 10 11 2017 2018 2019 2020 2021 2022 2023 2094.4 2056.5 1958.1 1791.9 2002.8 1956.7 1996.0 5654.4 5803.9 5957.8 6103.9 6216.3 6331.1 6317.8 278.8 286.1 293.7 300.9 306.5 312.1 311.5 1815.6 1770.4 1664.4 1491.0 1696.3 1644.5 1684.6 0.786 0.749 0.714 0.680 0.648 0.618 0.029 (Re - g) 1427.3 1326.4 1188.4 1014.6 1100.0 1016.4 57,493.3 Sensitivity to discount rate 0.618 98.80 35,532.1 3% 4% 5% 6% 7% 8% 5 6 7 8 9 10 11 2017 2018 2019 2020 2021 2022 2023 1820.5 1775.9 1682.8 1547.9 1753.7 1833.1 1739.2 1.272 1.335 1.401 1.470 1.542 1.618 1431.2 1330.5 1201.6 1053.3 1137.2 1132.9 2023.2 1981.6 1878.1 1705.7 1918.5 1869.2 1909.6 2094 2057 1958 1792 2003 1957 1996 1.020 1.020 1.020 1.020 1.020 1.020 1.020 2136.3 2097.6 1997.2 1827.8 2042.8 1995.8 2035.9

- 30. 371377193.xlsx 5654.4 5803.9 5957.8 6103.9 6216.3 6331.1 6317.8 5767.5 5920.0 6077.0 6225.9 6340.6 6457.7 6444.2 2.93% 2.93% 2.93% 2.93% 2.93% 2.93% 2.93% 65174 Sensitivity to discount rate 98 3.0% 4.0% #REF! 5.0% #REF! 6.0% #REF!

- 32. 371377193.xlsx 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 $23.46 $23.46 $23.46 $23.46 $23.46 $23.46 $23.46 $23.46 $23.46 $23.46 537.00 537.00 537.00 537.00 537.00 537.00 537.00 537.00 537.00 537.00 12,598 12,598 12,598 12,598 12,598 12,598 12,598 12,598 12,598 12,598 1,109 987 275 0 182 0 0 0 0 0 6,329 6,519 6,714 6,916 7,123 7,337 7,557 7,783 8,017 8,257 7,438 7,506 6,990 6,916 7,305 7,337 7,557 7,783 8,017 8,257 20,036 20,104 19,588 19,514 19,903 19,935 20,155 20,381 20,615 20,855 0.63 0.63 0.64 0.65 0.63 0.63 0.63 0.62 0.61 0.60 0.37 0.37 0.36 0.35 0.37 0.37 0.37 0.38 0.39 0.40

- 33. Firm: kroger kroger: Income Statement Forecasts Actual Forecasts (Thousands) 2012 2013 2014 2015 2016 Total net revenues $ 96,751.00 $100,621.0 $104,645.9 $108,831.7 $112,096.7 2011 Total net revenues $ 90,374.00 4% 4% 4.0% 3% implied growth 7.1% Marchandise costs $ 76,858.00 79893.1 83193.5 86521.2 89116.9 79.4% 79.4% 79.5% 79.5% 79.5% Gross Profit $19,893.0 $20,727.9 $21,452.4 $22,310.5 $22,979.8 implied margins 20.6% 20.6% 20.5% 20.5% 20.5% Operating, General and Administrative $ 14,849.00 15395.0 16010.8 16651.3 16814.5 15.3% 15.3% 15.3% 15.3% 15.0% Rent $ 628.00 805.0 837.2 870.7 896.8 0.6% 0.8% 0.8% 0.8% 0.8% Depreciation and amortization expenses $ 1,652.00 $ 1,765.30 $ 1,784.29 $ 1,630.13 $ 1,652.75 12% 12% 12% 12% Operating income $2,764.0 $2,762.6 $2,820.1 $3,158.5 $3,615.8 implied margins 2.9% 2.7% 2.7% 2.9% 3.2% Interest expense ($462.0) ($520.7) ($525.4) ($524.2) ($518.7) interest rate on financial liabilities 7.0% 7.0% 7.5% 7.5% Earnings before income taxes $2,302.0 $2,242.0 $2,294.7 $2,634.2 $3,097.1 Income taxes 794.00 784.7 803.2 922.0 1084.0 effective tax rate assumption (10-K, p.26 mgt. provided) 35.0% 35.0% 35.0% 35.0% 35.0% Net earnings including noncontrolling interests $1,508.0 $1,457.3 $1,491.6 $1,712.2 $2,013.1 Net earnings attributable to noncontrolling interests $11.0 $11.0 $11.0 $11.0 $11.0

- 34. Net earnings attributable to Kroger $1,497.0 $1,446.3 $1,480.6 $1,701.2 $2,002.1

- 35. Kroger: Balance Sheet Forecasts (Thousands) Actual Forecasts ASSETS 2012 2013 2014 2015 2016 Current assets: Cash and temporary cash investments $238.0 0.0 0.0 0.0 165.5 days sales in cash 1.7 1.7 1.7 1.7 Deposits in-transit 955.00 974.7 1032.2 1055.0 1033.4 percentage of total assets 3.50 3.50 3.50 3.40 Receivables $1,051.0 1071.7 1135.9 1070.5 1140.7 percentage of total assets 3.85 3.85 3.70 3.60 FIFO inventory $6,244.0 6437.0 6464.5 6654.9 6858.1 turnover assumption (in days) 23.0 22.5 22.0 22.0 LIFO reserve ($1,098.0) -1029.9 -1099.0 -1197.9 -1234.5 turnover assumption (in days) 0.18 0.16 0.17 0.18 0.18 Prefunded employee benefits $0.0 0.0 0.0 0.0 0.0 percentage of total assets Prepaid expenses and other current assets $569.0 539.4 520.4 518.7 550.9 percentage of total assets 2.2% 2.1% 2.1% 2.2% Total current assets $7,959.0 $7,992.9 $8,054.1 $8,101.2 $8,514.2 Property, plant and equipment, net $14,875.0 14710.85 14869.07 14819.33 15024.98 60.0% 60.0% 60.0% 60.0% Other assets $584.0 588.4 594.8 568.1 500.8 percentage of total assets 2.4% 2.4% 2.3% 2.0% Goodwill $1,234.0 1225.9 1263.9 1210.2 1001.7 percentage of total assets 5.0% 5.1% 4.9% 4.0% TOTAL ASSETS $24,652.0 $24,518.1 $24,781.8 $24,698.9 $25,041.6 LIABILITIES AND SHAREHOLDERS EQUITY Current liabilities:

- 36. $2,734.0 $1,109.1 $986.9 $275.4 $0.0 % of total debt 16.00% 16.00% 16.00% 16.00% Trade accounts payable $4,524.0 4607.7 4560.1 4751.3 4894.3 Turnover assumption (in days) 21.00 20.00 20.00 20.00 Accrued salaries and wages $977.0 1003.4 1030.5 1057.3 1083.7 % of total assets 2.70% 2.70% 2.6% 2.5% Deferred income taxes $284.0 291.1 295.5 298.4 299.9 grow with sales 2.5% 1.5% 1.0% 0.5% Other current liabilities $2,538.0 $2,558.3 $2,578.8 $2,599.4 $2,620.2 grow with company stores 0.80% 0.80% 0.80% 0.80% Total current liabilities $11,057.0 $9,569.6 $9,451.7 $8,981.8 $8,898.1 $6,141.0 6325 6515 6710 6912 % of total equity 10961.3 11157.2 11427.1 11704.6 Adjustment related to fair-value of interest rate hedges $4.0 $4.0 $4.0 $4.0 $4.0 Long-term debt including obligations under capital leas $6,145.0 $6,329.2 $6,519.0 $6,714.4 $6,915.7 Deferred income taxes $800.0 $832.0 $865.3 $899.9 $926.9 grow with Sale 4.00% 4.00% 4.00% 3.00% Pension and postretirement benefit obligations $1,291.0 $1,337.8 $1,392.5 $1,409.7 $1,464.5 %of accrual salaries 75% 74% 75% 74% Other long-term liabilities $1,145.0 $1,154.2 $1,163.4 $1,172.7 $1,182.1 % of store growth 0.80% 0.80% 0.80% 0.80% TOTAL LIABILITIES $20,438.0 $19,222.8 $19,391.8 $19,178.5 $19,387.2 Preferred shares, $100 par per share, 5 shares authorize $0.0 $0.0 $0.0 $0.0 $0.0 $959.0 959.0 959.0 959.0 959.0 Additional paid-in capital $3,451.0 3485.5 3485.5 3485.5 3485.5 Current portion of long-term debt including obligations under capital leases and financing obligations Face-value of long-term debt including obligations under capital leases and financing obligations Common shares, $1 par per share, 1,000 shares authorized; 959 shares issued in 2011 and 2010

- 37. Accumulated other comprehensive loss ($753.0) ($783.1) ($814.4) ($847.0) ($880.9) Accumulated earnings $9,787.0 10963.3 11182.5 11439.7 11702.9 Common stock in treasury, at cost, 398 shares in 2011 an ($9,237.0) -9329.4 -9422.7 -9516.9 -9612.1 Total Shareowners’ Equity $4,207.0 5295.3 5389.9 5520.3 5654.4 Noncontrolling interests $7.0 $7.0 $7.0 $7.0 $7.0 Total equity $4,214.0 $5,295.3 $5,389.9 $5,520.3 $5,654.4 TOTAL LIABILITIES AND SHAREHOLDERS EQUITY $24,652.0 $24,518.1 $24,781.8 $24,698.9 $25,041.6 implied debt/equity ratios 1.405 1.393 1.266 1.223 check: balance sheet balance? 0.0 0.0 0.0 0.0 Invested Capital (operating) 2012 2013 2014 2015 2016 Receivables 1051.0 1071.7 1135.9 1070.5 1140.7 FIFO inventory 6244.0 6437.0 6464.5 6654.9 6858.1 LIFO reserve -1098.0 -1029.9 -1099.0 -1197.9 -1234.5 Prefunded employee benefits 0.0 0.0 0.0 0.0 0.0

- 38. Prepaid expenses and other current assets 569.0 539.4 520.4 518.7 550.9 Property, plant and equipment, net 14875.0 14710.8 14869.1 14819.3 15025.0 Other assets 584.0 588.4 594.8 568.1 500.8 Goodwill 1234.0 1225.9 1263.9 1210.2 1001.7 Trade accounts payable -4524.0 -4607.7 -4560.1 -4751.3 -4894.3 Accrued salaries and wages -977.0 -1003.4 -1030.5 -1057.3 -1083.7 Other current liabilities -2538.0 -2558.3 -2578.8 -2599.4 -2620.2 Pension and postretirement benefit obligations -1291.0 -1337.8 -1392.5 -1409.7 -1464.5 Other long-term liabilities -1145.0 -1154.2 -1163.4 -1172.7 -1182.1 Total Invested Capital (operating) 12984 12882 13024 12654 12598 Invested Capital (financing) 2012 2013 2014 2015 2016 Cash and temporary cash investments -238.0 0.0 0.0 0.0 -165.5 Deposits in-transit -955.0 -974.7 -1032.2 -1055.0 -1033.4 2734.0 1109.1 986.9 275.4 0.0 Deferred income taxes 284.0 291.1 295.5 298.4 299.9 6145.0 6329.2 6519.0 6714.4 6915.7 Deferred income taxes 800.0 832.0 865.3 899.9 926.9 Total equity 4214.0 5295.3 5389.9 5520.3 5654.4 Total Invested Capital (financing) 12984.0 12882.0 13024.4 12653.5 12598.1 NOPAT (operating) 2012 2013 2014 2015 2016 Operating income 2764.0 2762.6 2820.1 3158.5 3615.8 Income tax provision -794.00 -784.69 -803.15 -921.98 -1083.99 Reverse non-operating tax effect Interest expense tax affect -184.80 -208.27 -210.16 -209.70 -207.47 Change in deffered income tax liabilities 1 7.10 4.37 2.95 1.49 Liabilities 2 $32.0 $33.3 $34.6 $27.0 Current portion of long-term debt including obligations under capital leases and financing obligations Long-term debt including obligations under capital leases and financing

- 39. NOPAT (Operating) 1808.8 1844.5 2064.4 2352.8 NOPAT (financing) 2012 2013 2014 2015 2016 Net income $1,497.0 $1,446.3 $1,480.6 $1,701.2 $2,002.1 Reverse nonoperating ithems Interest expense $277.20 $312.41 $315.25 $314.54 $311.21 Net earnings attributable to noncontrolling interests $11.00 $11.00 $11.00 $11.00 $11.00 Change in deferred income tax liabilities 1 7.10 4.37 2.95 1.49 Liabilities 2 32.00 33.28 34.61 27.00 NOPAT (Financing) $1,808.8 $1,844.5 $2,064.4 $2,352.8 ROIC 13.93% 14.32% 15.85% 18.59% FCF 1911 1702 2435 2408

- 40. Terminal Growth Factor 1.02 Terminal 2017 2018 2019 2020 2021 2022 2023 $116,580.5 $114,248.9 $117,676.4 $116,499.6 $119,994.6 $118,794.7 $121,170.6 4% -2% 3% -1% 3% -1% 2% 92681.5 90827.9 94141.1 93199.7 95995.7 95035.7 96936.5 79.5% 79.5% 80.0% 80.0% 80.0% 80.0% 79.0% $23,899.0 $23,421.0 $23,535.3 $23,299.9 $23,998.9 $23,758.9 $24,234.1 20.5% 20.5% 20.0% 20.0% 20.0% 20.0% 20.0% 17487.1 17023.1 17298.4 17358.4 17639.2 17462.8 17812.1 15.0% 14.9% 14.7% 14.9% 14.7% 14.7% 932.6 914.0 941.4 932.0 960.0 950.4 969.4 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% $ 1,692.35 $ 1,703.21 $ 1,652.00 $ 1,652.00 $ 1,652.00 $ 1,652.00 1685.0 12% 12% 12% 12% 12% 12% $3,786.9 $3,780.7 $3,643.4 $3,357.5 $3,747.8 $3,693.8 $3,767.6 3.2% 3.3% 3.1% 2.9% 3.1% 3.1% 3.1% ($547.9) ($550.3) ($566.7) ($583.7) ($601.2) ($619.3) -631.7 7.5% 7.5% 7.5% 7.5% 7.5% 7.5% $3,239.1 $3,230.5 $3,076.7 $2,773.7 $3,146.5 $3,074.5 $3,136.0 1133.7 1163.0 1107.6 970.8 1132.7 1106.8 1129.0 35.0% 36.0% 36.0% 35.0% 36.0% 36.0% $2,105.4 $2,067.5 $1,969.1 $1,802.9 $2,013.8 $1,967.7 $2,007.0 $11.0 $11.0 $11.0 $11.0 $11.0 $11.0 $11.0

- 41. $2,094.4 $2,056.5 $1,958.1 $1,791.9 $2,002.8 $1,956.7 $1,996.0

- 42. Terminal Growth Factor 1.02 Terminal 2017 2018 2019 2020 2021 2022 2023 0.0 340.2 263.0 629.1 629.3 827.6 844.1 1.7 1.7 1.7 1.7 1.7 1.7 1074.7 1053.8 1138.5 1031.9 1072.1 1076.0 1097.5 3.30 3.40 3.40 3.40 3.20 3.30 1159.0 1157.3 1228.5 1133.4 1299.3 1174.2 1197.7 3.60 3.70 3.70 3.70 3.70 3.80 6876.0 6896.5 6966.8 7077.0 7059.4 7065.8 7207.1 21.5 22.0 21.5 22.0 21.5 21.7 -1237.7 -1241.4 -1254.0 -1273.9 -1270.7 -1271.8 -1297.3 0.18 0.18 0.18 0.18 0.18 0.18 0.0 0.0 0.0 0.0 0.0 0.0 0.0 564.1 567.7 577.2 585.6 598.7 604.3 616.3 2.2% 2.2% 2.2% 2.2% 2.2% 2.2% $8,436.1 $8,774.1 $8,919.9 $9,183.1 $9,388.1 $9,476.0 $9,665.5 15384.98 15483.69 15740.99 15970.63 16327.07 16479.93 16809.53 60.0% 60.0% 60.0% 60.0% 60.0% 60.0% 538.5 516.1 524.7 532.4 544.2 549.3 560.3 2.1% 2.0% 2.0% 2.0% 2.0% 2.0% 1282.1 1032.2 1049.4 931.6 952.4 961.3 980.6 5.0% 4.0% 4.0% 3.5% 3.5% 3.5% $25,641.6 $25,806.1 $26,235.0 $26,617.7 $27,211.8 $27,466.5 $28,015.9

- 43. $181.8 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 16.00% 16.00% 16.00% 16.00% 16.00% 16.00% 4825.4 4729.1 4646.0 4601.6 4733.2 4687.0 4780.8 19.00 19.00 18.00 18.00 18.00 18.00 1109.7 1136.3 1163.6 1191.5 1214.2 1236.0 1260.7 2.4% 2.4% 2.4% 2.4% 1.9% 1.8% 301.4 302.6 303.5 304.1 304.4 304.7 310.8 0.5% 0.4% 0.3% 0.2% 0.1% 0.1% $2,641.2 $2,662.3 $2,683.6 $2,705.1 $2,726.7 $2,748.5 2803.5 0.80% 0.80% 0.80% 0.80% 0.80% 0.80% $9,059.5 $8,830.3 $8,796.8 $8,802.3 $8,978.5 $8,976.3 $9,155.8 7119 7333 7553 7779 8013 8253 8418.1 12014.1 12332.6 12635.0 12867.7 13105.4 13077.9 $4.0 $4.0 $4.0 $4.0 $4.0 $4.0 $4.08 $7,123.1 $7,336.7 $7,556.7 $7,783.2 $8,016.6 $8,257.0 $8,422.1 $964.0 $944.7 $973.0 $963.3 $992.2 $982.3 $1,001.9 4.00% -2.00% 3.00% -1.00% 3.00% -1.00% $1,499.6 $1,535.6 $1,594.0 $1,632.2 $1,663.3 $1,693.2 $1,727.1 74% 74% 73% 73% 73% 73% $1,191.5 $1,201.1 $1,210.7 $1,220.4 $1,230.1 $1,240.0 $1,264.8 0.80% 0.80% 0.80% 0.80% 0.80% 0.80% $19,837.7 $19,848.4 $20,131.1 $20,401.4 $20,880.7 $21,148.7 $21,571.7 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 959.0 959.0 959.0 959.0 959.0 959.0 978.2 3485.5 3485.5 3485.5 3485.5 3485.5 3485.510 3555.220

- 44. ($916.1) ($952.8) ($990.9) ($1,030.5) ($1,071.8) ($1,114.6) -1136.9 11983.7 12271.3 12553.6 12804.6 13060.7 13191.3 13455.2 -9708.2 -9805.3 -9903.3 -10002.3 -10102.4 -10203.4 -10407.462 5803.9 5957.8 6103.9 6216.3 6331.1 6317.8 6444.2 $7.0 $7.0 $7.0 $7.0 $7.0 $7.0 $7.0 $5,803.9 $5,957.8 $6,103.9 $6,216.3 $6,331.1 $6,317.8 $6,444.2 $25,641.6 $25,806.1 $26,235.0 $26,617.7 $27,211.8 $27,466.5 $28,015.9 1.259 1.231 1.238 1.252 1.266 1.307 1.307 0.0 0.0 0.0 0.0 0.0 0.0 0.0 2017 2018 2019 2020 2021 2022 2023 1159.0 1157.3 1228.5 1133.4 1299.3 1174.2 1197.7 6876.0 6896.5 6966.8 7077.0 7059.4 7065.8 7207.1 -1237.7 -1241.4 -1254.0 -1273.9 -1270.7 -1271.8 -1297.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0

- 45. 564.1 567.7 577.2 585.6 598.7 604.3 616.3 15385.0 15483.7 15741.0 15970.6 16327.1 16479.9 16809.5 538.5 516.1 524.7 532.4 544.2 549.3 560.3 1282.1 1032.2 1049.4 931.6 952.4 961.3 980.6 -4825.4 -4729.1 -4646.0 -4601.6 -4733.2 -4687.0 -4780.8 -1 -1109.7 -1136.3 -1163.6 -1191.5 -1214.2 -1236.0 -1260.7 -1 -2641.2 -2662.3 -2683.6 -2705.1 -2726.7 -2748.5 -2803.5 -1499.6 -1535.6 -1594.0 -1632.2 -1663.3 -1693.2 -1727.1 -1191.5 -1201.1 -1210.7 -1220.4 -1230.1 -1240.0 -1264.8 13300 13148 13536 13606 13943 13958 14237 2017 2018 2019 2020 2021 2022 2023 0.0 -340.2 -263.0 -629.1 -629.3 -827.6 -844.1 -1074.7 -1053.8 -1138.5 -1031.9 -1072.1 -1076.0 -1097.5 -1 181.8 0.0 0.0 0.0 0.0 0.0 0.0 -1 301.4 302.6 303.5 304.1 304.4 304.7 310.8 7123.1 7336.7 7556.7 7783.2 8016.6 8257.0 8422.1 964.0 944.7 973.0 963.3 992.2 982.3 1001.9 5803.9 5957.8 6103.9 6216.3 6331.1 6317.8 6444.2 13299.5 13147.8 13535.6 13606.0 13943.0 13958.3 14237.5 2017 2018 2019 2020 2021 2022 2023 3786.9 3780.7 3643.4 3357.5 3747.8 3693.8 3767.6 -1133.67 -1162.98 -1107.61 -970.81 -1132.74 -1106.81 -1128.95 -1 -219.15 -220.10 -226.70 -233.50 -240.50 -247.71 -252.66 1.50 1.21 0.91 0.61 0.30 0.30 6.09 $37.1 ($19.3) $28.3 ($9.7) $28.9 ($9.9) $19.6

- 46. 2472.7 2379.6 2338.4 2144.1 2403.7 2329.6 2411.8 2017 2018 2019 2020 2021 2022 2023 $2,094.4 $2,056.5 $1,958.1 $1,791.9 $2,002.8 $1,956.7 $1,996.0 $328.72 $330.15 $340.05 $350.25 $360.75 $371.56 $379.00 $11.00 $11.00 $11.00 $11.00 $11.00 $11.00 $11.00 1.50 1.21 0.91 0.61 0.30 0.30 6.09 37.08 -19.28 28.34 -9.73 28.90 -9.92 19.65 $2,472.7 $2,379.6 $2,338.4 $2,144.1 $2,403.7 $2,329.6 $2,411.8 19.63% 17.89% 17.79% 15.84% 17.67% 16.71% 17.28% 1771 2531 1951 2074 2067 2314 2133