Consolidated accounts or Group Acccounts

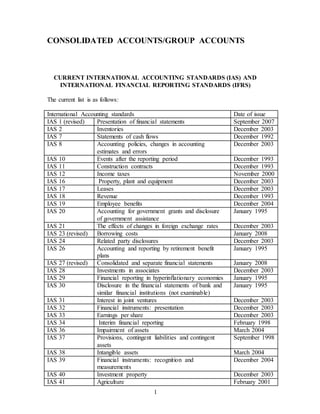

- 1. 1 CONSOLIDATED ACCOUNTS/GROUP ACCOUNTS CURRENT INTERNATIONAL ACCOUNTING STANDARDS (IAS) AND INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS) The current list is as follows: International Accounting standards Date of issue IAS 1 (revised) Presentation of financial statements September 2007 IAS 2 Inventories December 2003 IAS 7 Statements of cash flows December 1992 IAS 8 Accounting policies, changes in accounting estimates and errors December 2003 IAS 10 Events after the reporting period December 1993 IAS 11 Construction contracts December 1993 IAS 12 Income taxes November 2000 IAS 16 Property, plant and equipment December 2003 IAS 17 Leases December 2003 IAS 18 Revenue December 1993 IAS 19 Employee benefits December 2004 IAS 20 Accounting for government grants and disclosure of government assistance January 1995 IAS 21 The effects of changes in foreign exchange rates December 2003 IAS 23 (revised) Borrowing costs January 2008 IAS 24 Related party disclosures December 2003 IAS 26 Accounting and reporting by retirement benefit plans January 1995 IAS 27 (revised) Consolidated and separate financial statements January 2008 IAS 28 Investments in associates December 2003 IAS 29 Financial reporting in hyperinflationary economies January 1995 IAS 30 Disclosure in the financial statements of bank and similar financial institutions (not examinable) January 1995 IAS 31 Interest in joint ventures December 2003 IAS 32 Financial instruments: presentation December 2003 IAS 33 Earnings per share December 2003 IAS 34 Interim financial reporting February 1998 IAS 36 Impairment of assets March 2004 IAS 37 Provisions, contingent liabilities and contingent assets September 1998 IAS 38 Intangible assets March 2004 IAS 39 Financial instruments: recognition and measurements December 2004 IAS 40 Investment property December 2003 IAS 41 Agriculture February 2001

- 2. 2 IFRS 1 First time adoption of International Financial Reporting Standards June 2003 IFRS 2 Share-based payment February 2004 IFRS 3 (revised) Business combinations January 2008 IFRS 4 Insurance contracts March 2004 IFRS 5 Non-current assets held for sale and discontinued operations March 2004 IFRS 6 Exploration for and evaluation of mineral resources December 2004 IFRS 7 Financial instruments: disclosures August 2005 IFRS 8 Operating segments November 2006 IAS and Company Act CAP 486 requires that where a company has controlling interest in another then the holding company should prepare the following: (i) Consolidate balance sheet (ii) Consolidated profit and loss (iii) Consolidated cash flow statement (iv) Statement of changes in equity (v) Statement of changes in retained earnings (vi) Notes to the accounts Parent An entity that has one or more subsidiary. Subsidiary An entity that is controlled by another entity. Group A parent and all its subsidiaries Multi-Company structure/Nature of Control:- They are 3 types of multi-company structure. 1. Horizontal structure/Direct structure Co. B Co. C Holding Co. D Company Co. E company B, C, D, E are called subsidiaries

- 3. 3 Holding company Company A Co. B Co. C Subsidiaries 2. Vertical/indirect structures This is where the holding company (parent) owns indirect controlling interest in the subsidiary. However, in vertical group, direct relationship will first occur before the indirect relationship. Co. A Holding/parent company Co.B Subsidiary Indirect Co.C Sub- subsidiary relationship Co. D Sub-sub-subsidiary 3. Mixed Groups 5 This is where a parent company owns control interest in at least one subsidiary. Co.A – Holding company Co, B - Subsidiary Co. C - Subsidiary FORMS OF INTEREST IN A COMPANY % of Holding Nature of interest Results Relevant IAS/IFRS 1% to 19% 20% to 49% 50% 51% to 100% Growing interest Significant influence Joint control Control Investment Associate Joint venture Subsidiary - 28 31 IFRS 3

- 4. 4 Control Power of one company to influence decision of another. Power to govern financial and operating policies of an enterprise so as to obtain benefits from these activities. Also defined as a means that the holding company governs and directs its activities and formulation of policies of another company. IAS 27 states that control can ussually be assumed TO EXIST WHEN A PARENT OWNS MORE THAN 50% OF THE VOTING POWERS . However control can exist even when the parent owns only 50% of the voting power or less in the following circumstances: a) Agreement with other investors where total holding is more than 50% b) Parent has powers to govern financial and operating policies of an entity by a statute or agreement c) Parent has powers to appoint or remove majority memebres of BOD d) Parent has majority votes at the meetings of BOD Significant influence This means that a company does not control the operating and financial policies of the other, but participates in formulation of policies. NB: Each individual company in the group is a separate legal entity and should prepare its accounts and submit them to its shareholders. The holding company however must prepare in addition to its account the consolidated accounts. Consolidated Balance sheet (C.B.S) Computation of % of holding Percentage of Holding = shares purchased by the holding company x 100 Total shares of the subsidiary Illustration One Achievers limited purchased 500,000 shares of KCB on 1 January 2006. The total shares in KCB as at that date were 800,000. Required: (i) Percentage of holding (ii) Define the results Illustration Two Uchumi Limited purchased 200,000 shares of Kenya Airways Limited on 1 January 2004 cum-div. KA has a share capital of Ksh.1.5 million each share at a par value of sh.5 and market price is sh.10. Required: Calculate the percentage of holding. MINORITY INTEREST This is the part of the company’s equity/net assets which is not owned directly or indirectly by the holding company. Illustration Three NBK Limited has invested in Kenya Limited and the total investment amounts to Ksh.6 million. The share capital of Kenya Limited is made up of 400,000 ordinary shares of sh.20 each. There are no calls in arrears.

- 5. 5 Required: (i) Percentage of holding and define the result. (ii) Minority interest if any Illustration Four Tausi Limited has investment in Uchumi Limited amounting to sh.600,000. the share capital of Tausi Limited is made of 100,000 ordinary shares of sh.20 each and that of Uchumi Limited is made up of 40,000 ordinary shares of sh.20 each. Required; (i) Percentage of holding (ii) Minority interest. Illustration Five Majani Mingi limited purchased 100,000 shares of K.K limited on 1 January 2005. the capital base of K.K Limited is made up of 100,000 ordinary shares of sh.20 each. Majani Mingi limited has a capital base of 150,000 ordinary shares of sh.50 each. Required: (i) Percentage of holding (ii) Minority interest Illustration Six The following Balance Sheet extracts are provided: Balance sheet extract Assets Co.H Co.S Investment in Co.S 100,000 -- (30,000 ordinary shares) Capital Co. H Co. S Ordinary shares 1,000,000 800,000 The ordinary shares of both companies are of sh.20 each. Required: (i) Percentage of holding (ii) Minority interest. r BEFORE PREPARING CBS, THE FOLLOWING LEDGER ACCOUNTS MUST BE OPENED AS PART OF THE WORKINGS. 1. Cost of Control account(COC) This is prepared to determine positive or negative goodwill. The cost of investment in the subsidiary is compared with the book value of assets acquired and the difference between the two sides is the goodwill. Positive goodwill: This arises when the consideration paid is more than the book value of the assets acquired. Provision of IFRS 3 regarding positive goodwill The positive goodwill should be shown in full in the balance sheet without any amortization. However, if the management feels there is loss of value of goodwill (impairment) the following journal entry should be passed Dr: Group profit and loss xxx Cr: Cost of control account xxx – with the impairment loss Negative goodwill – Arises when the assets acquired a higher than the consideration paid.

- 6. 6 Provision of IFRS 3 regarding negative goodwill Negative goodwill should be recognised as an income immediately. In this are: Dr: Cost of control xxx Cr: Group profit and loss xxx – with full amount of negative goodwill NB: No goodwill will appear in the CBS. Cost of control account Cost of investment/purchase consideration: Ordinary shares xxx Preference shares xxx Debentures xxx Negative goodwill xxx xxx value of assets acquired Percentage holding x ordinary share capital xxx Percentage holding x preference share capital xxx Percentage holding x pre-acquisition profit xxx Percentage holding x Debentures xxx Percentage holding x pre acqui capital reserves xxx Positive goodwill xxx xxx xxx Pre-Acquisition profits These are profits which were in existence at the time of acquiring the subsidiary. Post-Acquisition profits These are profits earned after the date of acquisition. 2. MINORITY INTEREST The minority will share the financed by part of the balance sheet. Minority Interest Account CBS xxx (balancing figure) ___ xxx Percentage of ordinary share capital xxx Percentage of Reserves xxx Percentage share of preference share capital xxx xxx NB: Minority interest is based on current share of reserves whether pre or post. 3. GROUP PROFIT AND LOSS/GROUP RETAINED EARNINGS ACCOUNT This account aggregates the various balances of retained earnings from members of the group. Group profit and loss C.O.C xxx Minority interest (M.I) xxx Goodwill Amortised xxx Pre-acquisition dividends xxx C.B.S xxx xxx Balance brought down (profit): holding company xxx Subsidiary xxx ___ xxx CAPITAL RESERVES ACCOUNT C.O.C xxx M.I xxx CBS xxx xxx Balance brought down: holding company xxx subsidiary xxx ____ xxx

- 7. 7 Proposed dividend account (Subsidiary) Dividend receivable xxx (% holding x Proposed dividend of subsidiary) Due to minority xxx (% holding x proposed dividend of subsidiary) ___ xxx Balance brought down (subsidiary) xxx xxx NB: The share of dividends attributable to the minority should be shown as a current liability in the balance sheet. Proposed dividends of the holding company are shown in the C.B.S as a current liability. OTHER INTER-GROUP BALANCES Such balances are to be eliminated from the C.B.S but before elimination, the amount should be made equal. Illustration Seven The following balances of company A and B are presented as at 31 December 2005. Details: Land and building Share in B (400,000 ordinary shares at cost) Current assets Stock Debtors Dividend due (company B) Other receivables (company A) Cash Financed by: Ordinary shares of sh.10 each Capital reserves Revenue reserves Current liabilities Owed to company B Creditors Proposed dividends Company A (000) 10,000 6,000 600 3,200 800 ____ 400 21,000 9,000 2,400 6,000 1,600 2,000 _____ 21,000 Company B (000) 8,000 1,600 1,400 - 2,000 _____ 13,000 5,000 1,000 4,600 - 1,400 1,000 13,000 Additional information: 1. The shares in company B were acquired by company A on 1 January 2004 when the revenue reserves of company B were sh.1.2 million. The other balances were as they are now. 2. Goods invoiced in transit from company B to company A on 31 December 2005 amounted to sh.400, 000. Required: Consolidated balance sheet. INTER-GROUP/INTER-COMPANY SALE OF STOCK

- 8. 8 The holding company as part of its normal operations may sell inventory to a subsidiary at a profit or the subsidiary may sell to the holding company. If all the goods sold by either party are sold by the end of the year, no adjustment is made. However, if all or part of the stock remains unsold at the year end, an adjustment must be made to remove the unrealized profit. Holding company sells goods to the subsidiary Holding company sells goods to subsidiary First, determine the unrealized profit on closing stock with the unrealized profit Dr: Group profit and loss xxx Cr : Stock account xx – with the unrealized profit NB: unrealized profit is assessed on the seller (i.e. holding company in this case). Subsidiary company sells good to the holding company Holding company subsidiary company Dr: Group profit and loss (percentage share) xxx Dr: Minority Interest (percentage share) xxx Cr: Stock account (total unrealized profit) xxx Illustration Eight A holding company with 85% control in the subsidiary buys goods from the subsidiary amounting to sh.5 million with a 30% mark up. The holding company sold all the goods. Required: Show the journal entries to record the unrealized profit Illustration Nine Achievers limited own 75% of share capital of Tusker Limited during the year ended 31 December 2006. Achievers should stock to Tusker amounting to sh.2.5 million with a mark-up of 25%. Show the accounting for unrealized profit if 60% of the stock remained unsold. INTER-GROUP SALE OF FIXED ASSETS A company in a group may on occasion wish to transfer to a fixed asset and recognise that transfer as a sale between unrelated parties. On consolidation the usual group entity principle applies. The balance sheet must show assets at their cost and any depreciation charged based on that cost. The adjustments made are the reduction of unrealized profit made by the seller and depreciation overcharge made by the buyer. Accounting treatment 1. Holding company selling its assets to subsidiary a) Unrealized profit Dr: Group profit and loss Cr: Fixed asset account b) Depreciation overcharge Dr: Fixed asset account Cr: Group profit and loss Cr: Minority interest 2. Subsidiary selling its assets to holding company a. Unrealized profit

- 9. 9 Dr: Group profit and loss Dr: Minority interest Cr: Fixed asset account b. Depreciation overcharge Dr: Fixed assets Cr: Group profit and loss Illustration Ten ABC Limited controls 75% of the shares in XYZ Limited. ABC Limited sold a fixed asset to XYZ Limited for sh.21 million where the cost price of the fixed asset to ABC Limited was 16 million. The group policy is to depreciate fixed assets over 10 years on straight line basis. Show the accounting entries. Adjustment of Subsidiary assets to reflect their fair value (revaluation of assets) On acquisition of subsidiary the holding company may with to revalue subsidiary assets to reflect their fair value. The revalued amount may or may not be incorporated by the subsidiary company in its own books. Methods applicable 1) Bench-mark Approach This approach is applied where the subsidiary has incorporated the revaluation made by holding company. The total loss or profit is shown in the revaluation account with a transfer made to the C.O.C. (representing the share of profit/loss on revaluation) for the holding company and another transfer to the minority. 2) Alternative method/Approach/Treatment It is applied when revaluations are not incorporated in subsidiary book. The assets of subsidiary are adjusted onto to the extent of the holding company share of revaluation. With a corresponding entry in the revaluation reserve which is then closed with C.O.C. Illustration Eleven Unga Limited acquired 75% shares in Uchumi limited on 1 January 2006. Unga Limited decided to revalue the assets of Uchumi limited as follows: Assets book value fixed value Equipment 200,000 240,000 Inventory 140,000 130,000 Patents 60,000 90,000 Required: Adjust using the two methods. PIECEMEAL ACQUISITION OF SUBSIDIARY The holding company may acquire shares of a subsidiary which eventually leads to the control of the subsidiary. The issue that arises in piecemeal acquisition is determination of the amount of reserves to the capitalized i.e. taken to the C.O.C. are the reserves at the date of acquisition or are they subsequent reserves which are going to be capitalized at every stage of acquisition. There are two approaches which are applied 1. Capitalization of reserves at the date when control if acquired (conventions/basis)

- 10. 10 Under this approach reserves to be capitalized are those existing at the date when control was acquired. The reserves are capitalized using the holding percentage regardless of the date that makes up the holding percentage. 2. Step by step (capitalization approach) The reserves to be capitalized are those existing at each date of purchase ie for each purchase capitalization is done. Choice of approach Where the intention of the holding company is to acquire control of the subsidiary and hold the shares over a short period. The step by step approach is recommended. Illustration Twelve ABC Limited gained control of XYZ Limited in 2004. it acquired 60% of the share holding as follows: January 2002 25% January 2003 20% January 2004 15% 60% The profit/reserves of XYZ limited were as follows: 31 December 2001 300,000 31 December 2002 900,000 31 December 2003 1,200,000 31 December 2004 1,460,000 Required: a) Compute the minority interest, post-acquisition profit and pre-acquisition profit using the conventional method. b) Compute as per the above using step by step Approach. c) State in what situation the step by step approach is applicable. d) Outline any consideration that ABC limited would consider in deciding which approach to adopt. e) State factors that might influence ABC limited to acquire shares of XYZ Limited on a piecemeal basis. INTRODUCING NON-SUBSIDIARIES INTO CONSOLIDATED BANK STATEMENT Associates – IAS 28 (20 – 49%) Company A (holding company 80% 40% Company B Company C (associate) (Subsidiary) An associate is an enterprise in which the investor has significant influence which is neither a subsidiary not a joint-venture. The limit of holding is 20%-49%. There are two methods applied when accounting for the associate. (i) Equity method Investment in associate is first recorded at cost and thereafter adjusted to the post acquisition results of the associate. NB: An associate must be accounted for using the equity method in the consolidated accounts.

- 11. 11 (ii) Cost method Under this method the investment in associate is recorded at cost. This method is applied when: The investment is acquired and held exclusively with a view of its subsequent disposal in the near future. The associate operates under several long term restrictions that makes it difficult for the investor to expropriate profits. COMPUTATION OF PREMIUM Cost of investment xxx Assets acquired Percentage of ordinary share capital xxx Percentage of share premium xxx Percentage of pre-acquisition capital reserves xxx Percentage of share pre-acquisition revenue reserves (profits) xxx Percentage of pre-acquisition dividends xxx xxx Premium xxx Premium amortised: Dr: Group profit and loss xxx Cr: Investment in associate account xxx Investment in associate account Cost of investment xxx Post-acquisition profit (% share) xxx Post-acquisition reserve (% share) xxx Foreign exchange profit (% share) xxx ___ xxx Premium amortised xxx Pre-acquisition dividend (% share) xxx Unrealized profit xxx Consolidated bank statement xxx (balancing figure) xxx Illustration Thirteen Alfred Company bought a 25% shareholding on 31 December 2008 in Grimbald Company at a cost of sh.38, 000. During the year to 31 December 2009 Grimbald Company made a profit before tax of sh.82, 000 and the taxation charge on the year’s profits was sh.32, 000. a dividend of sh.20,000 was paid on 31 December out of these profits. Calculate the entries for the associate which would appear in the consolidated accounts of the Alfred group, in accordance with the requirements of IAS 28. NB: The only item posted to the consolidated bank statement in respect of the associate is the balancing figure of investment in associate account which is recorded as a non- current asset. Therefore, the assets, liabilities and capital of the associate must be ignored in the consolidated bank statement. Illustration Fourteen The statements of financial position of J Company and its investee companies, P Company and S company, at 31 December 2005 are shown below: Statements of financial position as at 31 December 2005 J company P company S company

- 12. 12 sh.’000’ Sh.’000’ Sh.’000’ Non-current assets Freehold property Plant and machinery Investments Current assets Inventory Trade receivables Cash Total assets Equity and liabilities Equity Share capital – sh.1 shares Retained earnings Non-current liabilities 12% loan stock Current liabilities Trade payables Bank overdraft Total equity and liabilities 1,950 795 1,500 4,245 575 330 50 955 5,200 2,000 1,460 3,460 500 680 560 1,240 5,200 1,250 375 - 1,625 300 290 120 710 2,335 1,000 885 1,885 100 350 - 350 2,335 500 285 - 785 265 370 20 655 1,440 750 390 1,140 300 ___- 300 1,440 Additional information: a) J Company acquired 600,000 ordinary shares in P Company on 1 January 2000 for sh.1, 000,000 when the retained earnings of P Company were sh.200, 000. b) At the date of acquisition of P Company, the fair value of its freehold property was considered to be sh.400, 000 greater than its value in P Company’s statement of financial position. P Company had acquired the property in January 2000 and the building element (comprising 50% of the total value) is depreciated on cost over 50 years. c) J Company acquired 225,000 ordinary shares in S company on 1 January 2004 for sh.500, 000 when the retained earnings of S company were sh.150, 000. d) P Company manufactures a component used by both J Company and S company. Transfers are made by P Company at cost plus 25%. J company held sh.100,000 inventory of these components at 31 December 2005 and S company held sh.80,000 at the same date. e) The goodwill in P Company is impaired and should be fully written off. An impairment loss of sh.92, 000 is to be recognized on the investment in S company. Required: Prepare, in a format suitable for inclusion in the annual report of the J Group, the consolidated statement of financial position at 31 December 2005. Illustration Fifteen A limited acquired the shares of B limited on 1 January 2000 when the reserves of B limited stood at sh.40, 000. B limited on the same day acquired the shares in C limited when the reserves of C limited stood at sh.50, 000. The following balance sheets are presented as at 31 December 2000:

- 13. 13 Details Company A Sh.’000’ Company B Sh.’000’ Company C Sh.’000’ Fixed assets Investment at cost (80,000 shares in company B) 60,000 shares in company C Current assets Ordinary share capital of sh.1 Retained earnings 105 120 - 50 275 80 195 275 125 - 110 35 270 100 170 270 180 - - 35 215 100 115 215 Required: Consolidated balance sheet 1) INVESTMENT Dividend receivable from investment is the only item included in the consolidated profit and loss account.

- 14. 14 CONSOLIDATED PROFIT AND LOSS In consolidated profit and loss, the subsidiary results are included from turnover to the profits after tax without distinguishing the share of the holding company with that of the minority interest. An adjustment is then made to deduct the minority interest share of the profit after tax. The following must be eliminated when preparing consolidated profit and loss: (i) Intergroup sales and purchases (ii) Unrealized profit on sales and purchase of fixed assets (iii) Unrealized profit on stock (iv) Intergroup interest received and paid (v) Intergroup dividend paid and received Computation of minority interest Percentage of preference dividend xxx Percentage share of profit after tax and preference dividend of the subsidiary xxx STATEMENT OF RETAINED EARNINGS Retained earnings brought down (holding company) xxx Profit for the year (holding company) xxx Percentage share of preference dividend xxx Percentage share of ordinary dividend xxx Percentage share of subsidiary profit after tax and dividends xxx (both preference and ordinary) ___ Retained profit carried down xxx Illustration Sixteen S. limited has 100,000 8% sh.100 preference shares and 100,000 sh.100 ordinary shares. On 1 July 2000, H. limited acquired 30,000 of the preference shares and 75,000 of the ordinary shares. The profit and loss of the two companies for the year ended 30 June 2007 is as follows: Details Company H Sh.’000’ Company S Sh.’000’ Turnover Cost of sales Administration expenses Net profit before tax Tax Net profit after tax Proposed dividend Preference Ordinary Retained earnings for the year Retained earning brought down 200,000 (90,000) 110,000 (35,000) 75,000 (23,000) 5,200 - (14,000) 38,000 79,000 117,000 98,000 (40,000) 58,000 (19,000) 39,000 (18,000) 21,000 (600) (2,000) 18,400 23,000 41,400 Required: Prepare consolidated profit and loss account.

- 15. 15 ACQUISITION OF A SUBSIDIARY AT MID-YEAR When the subsidiary is acquired at the middle of the year, it is necessary to apportion profits between pre and post acquisition period. There are two methods used when preparing profit and loss account: 1. Whole year approach Here, the turnover up to the profit after tax are added to that of the subsidiary. An adjustment is then made from the profit after tax to remove pre-acquisition profits. 2. Part year approach The entire profit and loss of the subsidiary is split between pre and post acquisition period. Only post acquisition results of the subsidiary are included in consolidated profit and loss account. NB: The latter approach is recommended. Illustration Seventeen Assuming the facts of the previous example, prepare consolidated profit and loss account if H. limited acquired the shares of S. limited on 1 January 2001 using both methods. INCORPORATING NON-SUBSIDIARY IN THE CONSOLIDATED PROFIT AND LOSS ACCOUNT 2) ASSOCIATE The associate is accounted for using the equity method recommended by IAS 28. There are only two items of the associate incorporated in the consolidated profit and loss account a) Percentage share of associate before tax b) Percentage share of associate tax NB: the sales cost of sales and expenses of the associate are not included in the consolidated profit and loss account. s BUSINESS COMBINATIONS This is the bringing together of two different enterprises into one company or entity. One enterprise obtaining control over the net assets of the other it can occur in two ways. 1. Acquisition 2. Uniting of interest 1. ACQUISITION This is a business combination where one of the companies (Acquires) obtains control over the net assets and operations of another company.(Acquiree) 2. UNITING OF INTEREST (MERGER) This is a business combination where the shareholders of combining enterprises Combine control of the net assets and operations to achieve mutual sharing of risks and benefits in respect of the lieu entity. There are two accounting approaches applied in business combinations:

- 16. 16 1. Merger/pooling of interest / Uniting of Interest Under this approach neither of the Companies can be identified as the acquirer or acquiree. Features 1. Shareholders of the enterprises must achieve a continuing mutual sharing 2. The basis of the transaction must be principles as exchange of shares 3. Net assets of the two companies are combined into one entity 4. The combination should result from an offer to the holder of voting shares which are not already held by the offeror company. 5. At least 90% of the consideration must be in shares issued by the offeror 6. The fair value of the net assets of the merging companies is almost equal i.e. no revaluation of assets is done 1. CONSOLIDATION PROCEDURE Merger A/C Cost of Investment xxx % Share of offeree shares xxx (Investment recorded at par value) Merger Reserve xxx Balance figure N/B The merger reserve is not amortized. 2. Group Reserves Account The account is prepared without distinguishing the pre- and post acquisition reserves. 3. Minority Interest The account is prepared in the same manner but M.I must be 10% or less. 4. Assets & Liabilities Individual assets and liabilities are added in the C.B S. 2. ACQUISITON This is the opposite of merger and has the following features. a) Revaluation of assets is done b) Transactions are recorded at their fair value c) C. O.C is prepared Cost of Control Account Cost of Investment xxx % share of acquiree shares xxx ( Investment recorded at market value) % share of pre-acquiree profits xxx Good will xxx Balance figure xxx d. Group Reserves Account The reserves must be distinguished as either post or pre Differences between Merger and Acquisition

- 17. 17 Merger Acquisition Larger consideration is in shares Consideration can be in shares No valuation of assets Valuation is done Shares issued to the offeree company are Shares are recorded at market value Recorded at par No acquirer no acquire There is acquirer and acquiree All reserves are considered post Reserves are either pre or post No goodwill is computed Goodwill is computed No share premium is recognized Share premium is recognized

- 18. 18 CONSOLIDATED CASHFLOW STATEMENT (C. C. S) Where a company has subsidiaries and associates a c.c.s should be prepared. The same procedure is followed just like that of individual companies. However the following information must be considered. 1. Minority Interest The amount paid to the minority inform of dividends is shown as a financing activity in the consolidated cash flow statement 2. Extra-ordinary Item These are items which occur on rare situations eg earthquake and expropriatiation of assets Expropriation- forceful takeover of company assets by the government Any cash flow arising from these items should be classified under operating activities 3. Investment in Associate Dividend receivable from associate should be classified under investing activities 4. Sale and Purchase of Subsidiary Sale proceeds as well as the purchase cost of the subsidiary should be recorded under investing activities. INDIRECT METHOD Shs. Shs. Shs. Net profit before Tax xxx Adjustments Depreciation Xxx Goodwill amortization Xxx Loss on sale of fixed assets Xxx Profit on sale of fixed assets Xxx Foreign exchange loss Xxx Foreign exchange grain Xxx Interest Exp Xxx Interest income Xxx xxx xxx Operating Activities Increase in current Assets xxx Decrease on current assets xxx Increase in current liabilities xxx Decrease in current liabilities xxx Less Taxation xxx Net cash inflows/ outflows from Operating activities xxx INVESTING ACTIVITIES Purchase of F/A and Investments Sale of F/A and investments xxx Dividends received from associates xxx

- 19. 19 Interest received xxx Other dividend received Xxx Net cash inflows/outflows from investing activities xxx FINANCIAL ACTIVITIES Increase in sales capital and sales premium Xxx Redemption of sales capital and loans Xxx Finance lease paid Xxx Dividend paid to group members Xxx Dividend paid to M.I Xxx Net cash inflow/ outflow from financing activities xxx xxx Add: Cash in cash equivalents at start of the year xxx Cash in cash equivalent at year end xxx Direct Method In this method the net profit before tax up to the operating activities is eliminated. Instead, the cash receipts from customers and cash paid to employers and employees is computed. Investing and financing activities part remains the same for both methods. N/B Indirect method is applicable in all questions while the direct method is only applied where the information on sales, purchases and expenses is given sh sh sh Sh Cash receipts from customers xxx Less cash paid to suppliers and employees xxx Extra-ordinary item net of tax xxx xxx Less tax paid xxx Net cash inflow/ outflow from operating activities xxx Investing activities- Remains the same Financing activities remains the same w-1 Cash receipts from customers w-2 Cash paid to

- 20. 20 suppliers & creditors Sales (credit) xxx Cost of sales xxx Debtors xxx Add –Admin exp xxx Cash receipts from customers xxx Selling & distribution expenses xxx Gain on sale of fixed assets and investments Closing stock xxx Creditors bal b/d xxx Less xxx Opening stock xxx Creditors bal b/d xxx Goodwill amortization xxx Depreciation xxx Cash paid to suppliers & employees