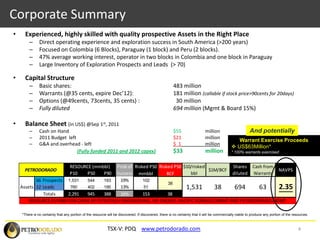

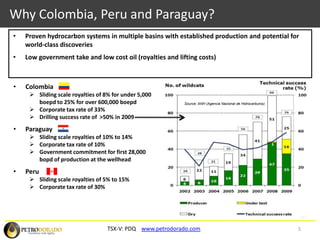

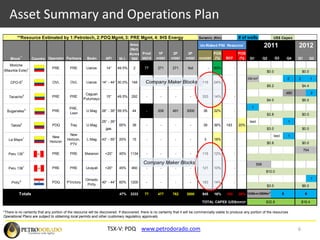

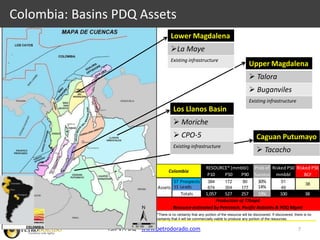

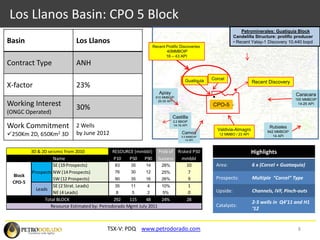

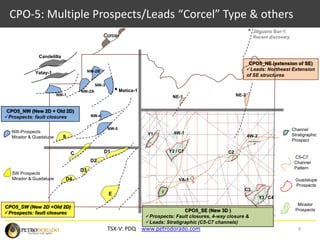

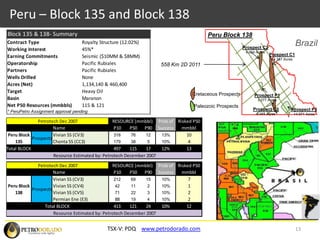

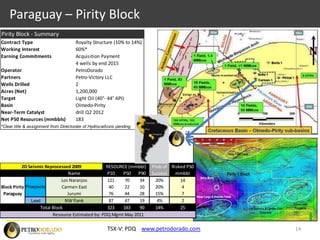

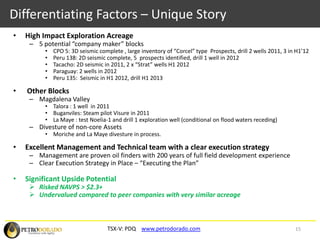

This corporate presentation by Petrodorado Ltd provides an overview of the company's assets and operations. Petrodorado has a portfolio of exploration licenses across Colombia, Peru and Paraguay, focusing on proven hydrocarbon basins. The presentation highlights several key blocks that have multi-well drilling plans for 2011-2012, including the CPO-5 block in Colombia's Llanos Basin which has identified multiple prospects from 3D seismic. Petrodorado is well funded with an experienced management team to execute its exploration and appraisal plans while seeking additional upside through prospective discoveries.