Speaker: Kees de Graaf

Date: 22-01-2016

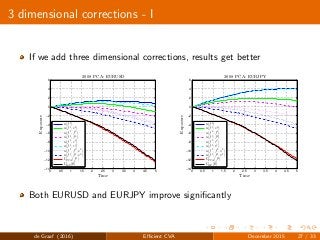

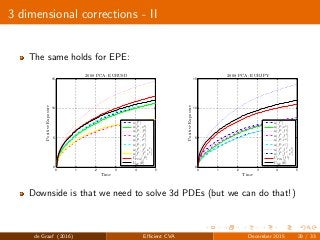

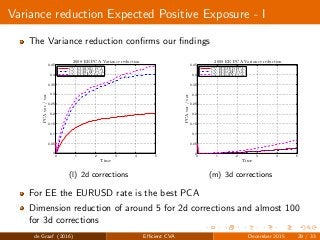

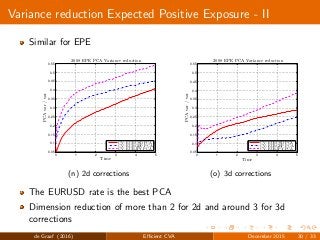

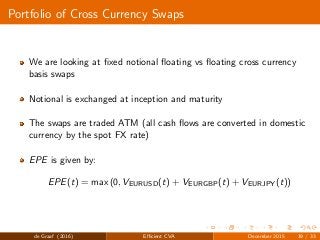

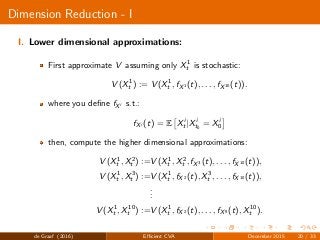

Abstract: We studied the applicability of Credit Valuation Adjustment (CVA) and ANOVA-based dimension reduction in the context of a portfolio of risk factors. Typically, to solve a PDE for multiple risk factors, one has to deal with the curse of dimensionality. Between these risk factors, the correlation is often high, and therefore PCA and ANOVA are promising techniques for dimension reduction and can enable us to compute the exposure profiles for higher dimensional portfolios. In our results, our method is able to compute Exposures (EE, EPE and ENE) and Quantiles for a 10 dimensional problem. That is, a portfolio of three Cross-Currency Swaps, where three different FX rates are modelled with stochastic volatility and stochastic foreign and domestic interest rates. The method is accurate when compared to a full-scale Monte Carlo solution.

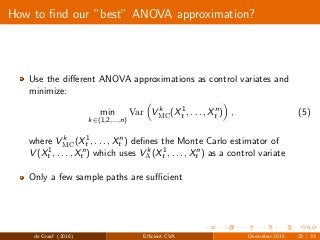

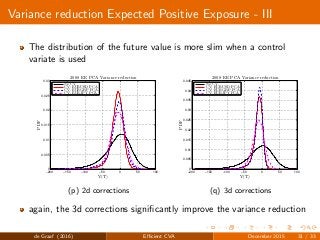

![CVA Formula

Mathematically:

CVA(t, T) = (1 − δ)

T

t

EQ

[PE(s)|τ = s] dPD(s) (1)

In practice:

CVA(t, T) ≈ (1 − δ)

N

k=1

q(tk−1, tk)EPE(tk) (2)

PE(t) = Positive Exposure

Q = Risk neutral measure

δ = recovery rate

τ = default time

EPE(t) = (discounted) Expected Positive Exposure

PD(t) = probability density of default before t

q(tk−1, tk) = default prob. in (tk−1, tk)

de Graaf (2016) Efficient CVA December 2015 7 / 33](https://image.slidesharecdn.com/20160121presentationcsl-160317105421/85/Efficient-CVA-computation-by-risk-factor-decomposition-7-320.jpg?cb=1458217560)

![Recovery Rate and default probability

Two important ingredients of CVA:

I. Recovery rate δ:

In practice can be deduced from CDS

Taken constant

II. Probability of default PD(t):

Needed at every time t ∈ [t0, T]

Can be modeled or also taken from CDS quotes

de Graaf (2016) Efficient CVA December 2015 8 / 33](https://image.slidesharecdn.com/20160121presentationcsl-160317105421/85/Efficient-CVA-computation-by-risk-factor-decomposition-8-320.jpg?cb=1458217560)

![Earlier related work

Computing Exposure:

[Ng and Peterson (2009)] and [Ng et al. (2010)]: Longstaff-Schwarz

technique compared to FD and nested MC

[de Graaf et al. (2015)]: FDMC for Exposure of portfolios and

sensitivities

[Simaitis et al. (2015)]: Impact of stochastic volatility and rates in CCR

Dimension reduction:

[Reisinger and Wissman (2015a)] and

[Reisinger and Wissman (2015b)]: Methodology and accuracy of lower

dimensional approximations of high-dimensional PDEs

de Graaf (2016) Efficient CVA December 2015 10 / 33](https://image.slidesharecdn.com/20160121presentationcsl-160317105421/85/Efficient-CVA-computation-by-risk-factor-decomposition-10-320.jpg?cb=1458217560)

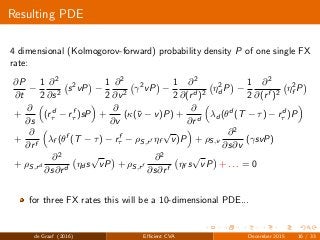

![Solving the Kolmogorov-Forward PDE

We discretize in every dimension

Partial space derivatives ⇒ finite differences

Use Alternating Direction Implicit scheme for time stepping (see

[in ’t Hout and Foulon(2010)] )

Adjusted for the forward Kolmogorov (see [Itkin. (2015)] )

de Graaf (2016) Efficient CVA December 2015 17 / 33](https://image.slidesharecdn.com/20160121presentationcsl-160317105421/85/Efficient-CVA-computation-by-risk-factor-decomposition-17-320.jpg?cb=1458217560)

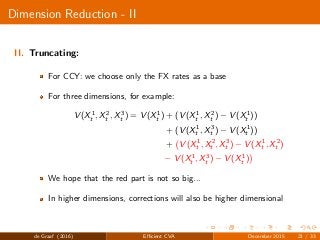

![Dimension Reduction - III

Definition

Let V (X1

t , . . . , Xn

t ) be the value of a portfolio, driven by n risk factors,

than the k-th 2d ANOVA approximation (where k ∈ [1, . . . , d]) equals:

V k

A(X1

t , . . . , Xn

t ) := V (Xk

t ) + n

i=k V (Xk

t ) − V (Xk

t , Xi

t ) (3)

= (2 − d)V (Xk

t ) + n

i=k V (Xk

t , Xi

t ), (4)

Decomposing the problem

Note that here only one and two-dimensional corrections are needed

We can also use higher order corrections

de Graaf (2016) Efficient CVA December 2015 22 / 33](https://image.slidesharecdn.com/20160121presentationcsl-160317105421/85/Efficient-CVA-computation-by-risk-factor-decomposition-22-320.jpg?cb=1458217560)