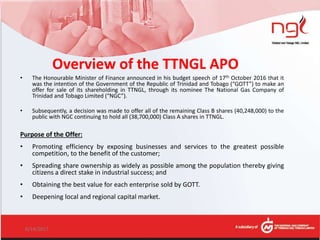

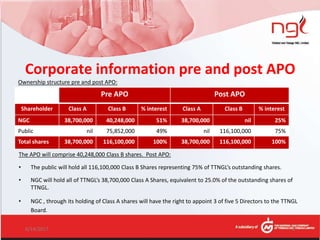

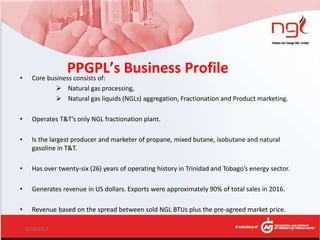

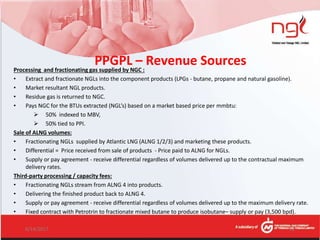

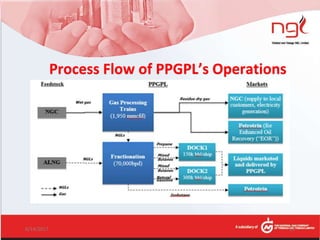

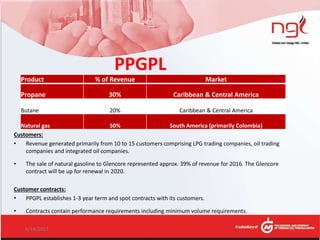

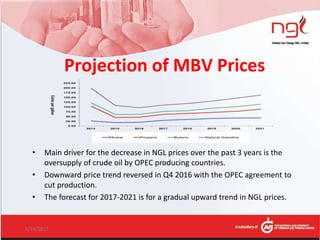

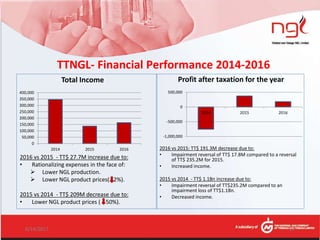

The document provides an agenda and overview of a TTNGL presentation. The agenda includes welcome remarks, a PPGPL update, TTNGL financial performance, and a Q&A. The presentation provides details on TTNGL and PPGPL, including an overview of PPGPL's operations and markets, pricing, and outlook. It also summarizes TTNGL's financial performance from 2014-2016 and in Q1 2017, noting increases in income and profit. Key risks associated with TTNGL and its reliance on PPGPL are also outlined.