Report

Share

Download to read offline

Recommended

Recommended

Hungry for Words: The Devil is in the Details, God is in the Framework -KFlinn

Hungry for Words: The Devil is in the Details, God is in the Framework -KFlinnThe International Food Blogger Conference

More Related Content

Viewers also liked

Hungry for Words: The Devil is in the Details, God is in the Framework -KFlinn

Hungry for Words: The Devil is in the Details, God is in the Framework -KFlinnThe International Food Blogger Conference

Viewers also liked (20)

Hungry for Words: The Devil is in the Details, God is in the Framework -KFlinn

Hungry for Words: The Devil is in the Details, God is in the Framework -KFlinn

All Things Trinity, All Things Conservation - Richland-Chambers

All Things Trinity, All Things Conservation - Richland-Chambers

Similar to revenue.ne.gov tax current corp_nol

Similar to revenue.ne.gov tax current corp_nol (20)

Form 990-W Estimated Tax on Unrelated Business Taxable Income for Tax-Exempt...

Form 990-W Estimated Tax on Unrelated Business Taxable Income for Tax-Exempt...

Form 1120-IC-DISC Interest Charge Domestic International Sales Corporation R...

Form 1120-IC-DISC Interest Charge Domestic International Sales Corporation R...

Application for Carry Back of Net Operating Farm Loss Refund (K-67)

Application for Carry Back of Net Operating Farm Loss Refund (K-67)

Form 8801-Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts

Form 8801-Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts

Form 8801- Credit For Prior Year Minimum Tax--Individuals, Estates and Trusts

Form 8801- Credit For Prior Year Minimum Tax--Individuals, Estates and Trusts

Form 8404 Interest Charge on DISC-Related Deferred Tax Liability

Form 8404 Interest Charge on DISC-Related Deferred Tax Liability

More from taxman taxman

More from taxman taxman (20)

Recently uploaded

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

Recently uploaded (20)

Enhancing and Restoring Safety & Quality Cultures - Dave Litwiller - May 2024...

Enhancing and Restoring Safety & Quality Cultures - Dave Litwiller - May 2024...

Call Girls From Pari Chowk Greater Noida ❤️8448577510 ⊹Best Escorts Service I...

Call Girls From Pari Chowk Greater Noida ❤️8448577510 ⊹Best Escorts Service I...

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

Business Model Canvas (BMC)- A new venture concept

Business Model Canvas (BMC)- A new venture concept

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Call Girls Zirakpur👧 Book Now📱7837612180 📞👉Call Girl Service In Zirakpur No A...

Call Girls Zirakpur👧 Book Now📱7837612180 📞👉Call Girl Service In Zirakpur No A...

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

Call Girls In Panjim North Goa 9971646499 Genuine Service

Call Girls In Panjim North Goa 9971646499 Genuine Service

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

Eluru Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Eluru Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Value Proposition canvas- Customer needs and pains

Value Proposition canvas- Customer needs and pains

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Insurers' journeys to build a mastery in the IoT usage

Insurers' journeys to build a mastery in the IoT usage

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

revenue.ne.gov tax current corp_nol

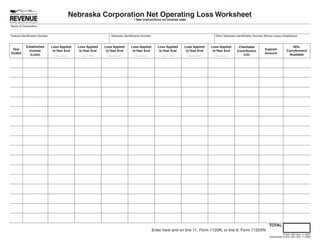

- 1. Nebraska Corporation Net Operating Loss Worksheet • See instructions on reverse side Name of Corporation Federal Identification Number Nebraska Identification Number Other Nebraska Identification Number Where Losses Established Established NOL Loss Applied Loss Applied Loss Applied Loss Applied Loss Applied Loss Applied Loss Applied Charitable Year Expired Income Carryforward to Year End to Year End to Year End to Year End to Year End to Year End to Year End Contribution Ended Amount (Loss) Available _______ _______ _______ _______ _______ _______ _______ C/O TOTAL Enter here and on line 11, Form 1120N, or line 6, Form 1120XN SAVE RESET PRINT 8-552-1997 Rev. 11-2007 Supersedes 8-552-1997 Rev. 11-2000

- 2. INSTRUCTIONS Use this worksheet to compute your Nebraska net operating identification numbers where the losses were established. A loss (NOL) carryforward. This worksheet must be attached to tax return must be filed to establish the loss before the loss the Nebraska Corporation Income Tax Return, Form 1120N can be applied to offset taxable income. or the Amended Nebraska Corporation Income Tax Return, YEAR ENDED. Enter the month and year that the tax year Form 1120XN on which the loss carryforward is used. ends. For loss years beginning in: ESTABLISHED INCOME (LOSS). On each line enter the taxable income or loss established for that year. Place the loss 1968 through 1975 — The loss may be carried back three amounts in parenthesis ( ). tax years and forward five tax years. YEAR LOSS APPLIED TO. Complete the necessary 1976 through 1986 — The loss may be carried back three columns with the month and year at the top of the column tax years and forward fifteen tax years. and the amount of the loss being applied in the column. Do 1987 to present — The loss cannot be carried back, but not include carryover year. can be carried forward five tax years. EXPIRED AMOUNT. Enter the amount of NOL which Losses must be applied in the order in which they occurred. An cannot be deducted due to expiration of the carryforward election to forego the carryback of a federal NOL is binding period. for Nebraska. NOL CARRYFORWARD AVAILABLE. Enter the amount SPECIFIC INSTRUCTIONS of NOL available to be applied to the current year. Total this Complete the name of the corporation, federal identification column at the bottom and enter on line 11 of the Form 1120N number, state identification number and any other state or line 6 of the Form 1120XN.