VA, USDA loan totals increase in first quarter, FHA down

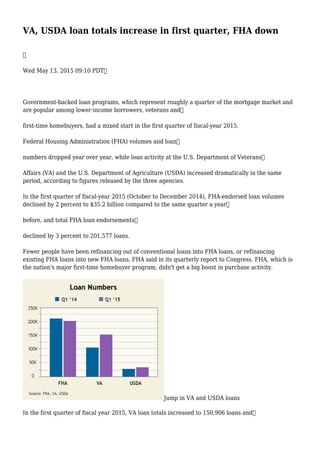

- 1. VA, USDA loan totals increase in first quarter, FHA down Wed May 13, 2015 09:10 PDT Government-backed loan programs, which represent roughly a quarter of the mortgage market and are popular among lower-income borrowers, veterans and first-time homebuyers, had a mixed start in the first quarter of fiscal-year 2015. Federal Housing Administration (FHA) volumes and loan numbers dropped year over year, while loan activity at the U.S. Department of Veterans Affairs (VA) and the U.S. Department of Agriculture (USDA) increased dramatically in the same period, according to figures released by the three agencies. In the first quarter of fiscal-year 2015 (October to December 2014), FHA-endorsed loan volumes declined by 2 percent to $35.2 billion compared to the same quarter a year before, and total FHA loan endorsements declined by 3 percent to 201,577 loans. Fewer people have been refinancing out of conventional loans into FHA loans, or refinancing existing FHA loans into new FHA loans, FHA said in its quarterly report to Congress. FHA, which is the nation's major first-time homebuyer program, didn't get a big boost in purchase activity. Jump in VA and USDA loans In the first quarter of fiscal year 2015, VA loan totals increased to 150,906 loans and

- 2. volumes increased to $35.7 billion, representing year-over-year hikes of 50 percent and 59 percent, respectively. Within the same period, USDA loan numbers increased by nearly 21 percent to 35,186 loans and volumes jumped by 22 percent to $4.8 billion. These massive increases are not entirely due to natural growth, however. The huge gains in USDA and VA loans can partially be explained by abnormally low numbers in the first quarter of fiscal-year 2014 as a result of the federal-government shutdown in October 2013. In addition, the first quarter of fiscal-year 2014 also coincided with a low point in the overall mortgage market. In fiscal-year 2014, VA loan refinancing volumes dropped by nearly 70 percent, according VA Spokesman Terry Jemison. He noted, however, that the purchase volume increased by 13 percent overall in fiscal-year 2014, and continued strong in the first quarter of fiscal-year 2015. "While purchase loan volume remains strong, VA saw that the pent-up demand for refinance loans slackened, causing an overall decline in loan volume," Jemison said. The USDA also saw a big drop in refinances in fiscal-year 2014, although the impact was smaller because the agency only refinances preexisting USDA-guarantee loans. Refinances dropped from close to 13,000 loans in FY 2013 to 1,753 in FY 2014, USDA data says. Signs of a good year The big leaps in VA and USDA loan numbers during this past first quarter,

- 3. however, also can't entirely be explained by a poor performance of government loans in the first quarter in fiscal-year 2014. VA loan volume for the first quarter of fiscal-year 2015 was slightly higher than in the first quarter of fiscal-year 2013, which was an exceptional year for the VA program. Overall, fiscal-year 2014 was not a bad year for the VA although the volumes and loan numbers were down compared to especially strong 2012 and 2013 numbers. Mortgages to Gulf War veterans have risen steeply since 2008. The USDA loan volumes and numbers have also rebounded. USDA officials said that although the government shutdown skewed up the FY 2015 quarterly numbers, the program is showing solid growth. "Loan obligations are up 5 percent [in May] over this time last year for [the guarantee program]," said Tony Hernandez, administrator, Rural Housing Services, who oversees the program. "Heading into the 2015 homeownership season, we project this upward trend will continue." FHA, though, clearly had down year in FY 2014, and that trend continued into the first three months of this fiscal year. In the first quarter, FHA purchase loan numbers increased by just 1 percent over the same quarter of fiscal 2014, which was an especially sluggish period for home-purchase loans. To boost FHA volumes this year and attract more first-time homebuyers, the Obama administration lowered the annual insurance premiums from 1.35 percent to 0.85 percent. These loan types represent an important segment of the mortgage market. In the most recent weekly survey, the Mortgage Bankers Association reported that the FHA share was 14 percent of applications, the VA, 12 percent, and the USDA, 0.8 percent.

- 4. I am a writer to a number of home mortgage blog sites throughout the United States, such as texasusdaloan.org. Throughout all the years that I have been doing mortgages, the market has actually been with bunches of ups and downs, however after a number of grueling, dull years, I have actually chosen to discuss my knowledge and also experience with everyone.