Anoopgarh K.V.Sah Samiti vs. ACIT, Sriganganagar

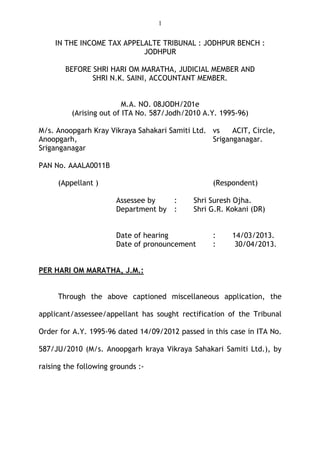

- 1. 1 IN THE INCOME TAX APPELALTE TRIBUNAL : JODHPUR BENCH : JODHPUR BEFORE SHRI HARI OM MARATHA, JUDICIAL MEMBER AND SHRI N.K. SAINI, ACCOUNTANT MEMBER. M.A. NO. 08JODH/201e (Arising out of ITA No. 587/Jodh/2010 A.Y. 1995-96) M/s. Anoopgarh Kray Vikraya Sahakari Samiti Ltd. vs ACIT, Circle, Anoopgarh, Sriganganagar. Sriganganagar PAN No. AAALA0011B (Appellant ) (Respondent) Assessee by : Shri Suresh Ojha. Department by : Shri G.R. Kokani (DR) Date of hearing : 14/03/2013. Date of pronouncement : 30/04/2013. PER HARI OM MARATHA, J.M.: Through the above captioned miscellaneous application, the applicant/assessee/appellant has sought rectification of the Tribunal Order for A.Y. 1995-96 dated 14/09/2012 passed in this case in ITA No. 587/JU/2010 (M/s. Anoopgarh kraya Vikraya Sahakari Samiti Ltd.), by raising the following grounds :-

- 2. 2 “The appellant has received order of the Hon'ble Bench dated 14.09.2012 passed in above case, whereby the appeal of the assessee was not accepted. On careful study of the order the appellant has noticed that there are following apparent mistakes in the order of the Hon'ble Bench which requires a rectificatory order to be passed correcting the mistakes :- Para 9 page 10 of the order which deals with the conclusion of the decision is reproduced from Page. 11 as under:- It is true that the assessee had disclosed the transaction regarding sale of Mill and also relating to sale of mill in the computation of income filed with the return of income. But k it has failed to show as to why and how the claim was bonafide. It is an undeniable fact that the mill was a part of block of assets separate from ginning factory and the assessee has been claiming depreciation thereon from the very beginning till the year 1987. These facts were not denied, rather, were confirmed from the report. The mill was closed for four year but the depreciation was being claimed. The question that the assessee is a cooperative society and it is run by employees will not absolve it from penal provisions of section 217(l)(c) of the Act because its accounts are audited and benefit of legal experts were available to it altogether. Thus there is no shred of bonafide belief which has been proved on record by the appellant. By saying and mentioning in a routine manner that the cooperative society being run by employees cannot be

- 3. 3 accepted as a general rule for treating any claim falling under penal provisions as bonafide action. It is submitted that the assessment year under consideration i$ 1995-96 and the Mill which was subject matter of sale was closed at the end of account year relevant to A.Y. 1987-88. The assessee has claimed depreciation in 3 years of its existence as per details given below which are available on page 3 of Paper book, on file of ITAT. 1985-86 29,672/- 1986-87 31,050/- 1987-88 30,162/- 90,884/- This fact is also mentioned on page 3 Top para of written submission made by the counsel of the assessee. The Hon'ble Bench has however considered the erroneous facts that the Mill was closed for four years but the depreciation was being claimed. No depreciation was ever claimed after A.Y. 1987-88 and WDV worked out at the end of A.Y. 1987-88 was taken to be WDV while working out capital gains in A.Y. 1995-96. The assessee was under bonafide belief that after 7 years of closure of Mill, while no depreciation is being claimed or allowed, the surplus is assessable as long term capital gains. 2. In para 9 page 12 of the order, the Hon'ble IT AT has discussed issue relating to lease money being taxed on receipt basis in earlier year and found no reason for change in the method of accounting.

- 4. 4 Here it is submitted that there is no change in accounting method. The assessee has received advance lease money for ginning of Narma. An advance is no income. In earlier year the assessee was wrongly showing advance as income. This year the assessee was advised that unless the contract is executed, the advance does not get converted into income. Thus, the advance lease money was disclosed as income on completion of contract. This is the right procedure and in accordance with Accounting Standard. If contract is not performed, the advance is recoverable. The assessee has disclosed these facts in the Income and Expenditure account and Balance Sheet. There cannot be any penalty for following correct accounting standard. An additional ground of appeal was raised vide letter dated 16.07.2012 which included written submissions in page 5, paper book with Index 36 Pages Form No. 35 and an additional ground duly signed by the Chief Manager of Society which is already on the file of the IT AT. In this ground it was claimed that penalty levied @ 150% of tax sought to be levied is excessive and unreasonable. This ground was also raised before CIT (A) too. However, in the order of the Hon'ble Bench this ground does not find mention, although in the written submission, it was requested that penalty may kindly be reduced to minimum. The assessee's case is fully covered by the decision of Hon'ble Supreme Court in the case of CIT Vs. Reliance Petro Products Pvt. Ltd. 322 ITR P. 158 Rajasthan High Court's decision in CIT Vs. Oriental Power Cables Ltd. (Raj) 303 ITR P. 49 and thus the order of the Hon'ble Bench dated 14.09.2012 requires to be

- 5. 5 amended. The appellant seeks amendment of the order accordingly.” 2. We have heard rival submissions and have also considered the written submissions. We extract the written submission of ld. AR in toto, as under :- “With reference to above it is submitted that the appeal of the assessee has been decided by the Hon'ble Bench. At the time of passing the order, Hon'ble Bench has fails to decide the additional ground of appeal which was raised vide letter dated 16.7.2012, which also includes the submission in the paper book with Form No. 36. In this respect it is also submitted that the Assistant Commissioner of Income-tax fails to dispose off the grounds. Beside the other ground taken in the memo of appeal was also not disposed off. As regards the grounds it is submitted that the following grounds were not disposed off: "Various court's decision site on which reliance was placed which was fully supported the case of the assessee were simply ignored," From the perusal of the above you will observe that this ground was not disposed off.

- 6. 6 The assessee relied before the CIT(A) as well as before this Hon'ble Bench on the following judgment of Supreme Court and Rajasthan High Court :- 1. CIT vs. Oriental Power Cable Ltd. 303 ITR 49 (Raj.). 2. CIT vs. Reliance Petro Products Pvt. Ltd. 322 ITR 158 (SC) 3. CIT vs. Shyam Sunder Gopal Das 310 ITR 5 (SC) From the perusal of the submission you will observe that this ground was not disposed off by the Hon'ble Bench while deciding the appeal. The above ground was not disposed off. Therefore the mistake is a mistake apparent from record. As far as the ground not disposed for is also falling under the definition of the mistake apparent from the record, in view of the judgment of Hon'ble Rajasthan High Court delivered in case of Commissioner Of Income-Tax vs Ramesh Chand Modi reported 249 ITR 323 (Raj. The relevant portion of head note is being reproduced hereunder : Facts The appellant challenges the order passed by the Income-tax Appellate Tribunal dated September 20, 1999, in Misc. Application No. 43/JP of 1998. the assessee-respondent preferred an appeal against the

- 7. 7 order passed by the Assessing Officer under section 158BC of the Income-tax Act, 1961. Issue Whether, recalling order for decision afresh amount to review ? Findings No. Reasoning Where a Tribunal fails to notice the question raised before it inadvertently under any misapprehension, in correcting such error by recalling the order made without deciding such question which goes to the root of the matter for deciding the same appropriately falls in such category of procedural mistakes which such Tribunal must correct ex debito justitiae, even in the absence of any power. The present case falls in that class. Thus, no substantial question of law arises in this appeal. The appeal is, therefore, dismissed in limine. If the arguments were not considered is also covered under the definition of mistake apparent from record. As regards the argument, in this respect it is submitted that I want to draw your kind attention towards the written submission submitted before the Hon'ble Bench in course of hearing. The assessee also submitted written submission in which it was also mentioned also submitted the relevant para is as under: "In pursuance of this impugned order has been passed by the CITA Bikaner on 7.10.2010 and upheld the order of Learned AO. While deciding the appeal, Learned CITA

- 8. 8 has even not decided the grounds of appeal raised as perform No. 35 filed before him." The assessee also argued and submitted that alternative ground in the last para which is being reproduced hereunder: "An alternative ground is raised in this appeal that the penalty levied is unreasonable and excessive. The AO has levied penalty @ 150% of the tax sought to be evaded. In fact it was first year when the society's income crossed taxable limit by making the addition." If the argument and ground were not disposed off is a mistake apparent from rerecord. From the above submission you will observe that argument was taken in course of hearing was also not consider and adjudicated. This too is covered by the judgment of 249 ITR 323 (Raj.). In addition to this judgment your kind attention is invited towards 199 ITR 771 C1T vs. Keshav Fruit Mart (All.) the entire judgment is being reproduced hereunder: Heard counsel for the parties. Before the Tribunal, the question for consideration was whether there was a mistake apparent from the record in that a ground raised in the memorandum of appeal before the Tribunal was not at all considered by the Tribunal. Taking the view that commission to consider the ground raised in the appeal was a mistake apparent from the record, the Tribunal set aside the order passed thereby

- 9. 9 and fixed the date for a rehearing. On these facts, the Revenue has raised the following question in an application made under section 256(2) : " Whether, on the facts and in the circumstances of the case, the Hon'ble Tribunal was in law justified in recalling their order dated July 2,1987, in I.T.A. No. 2113(All.)/1984, with a direction to rehear the case which was passed by them after a careful consideration of all the grounds of appeal taken by the Revenue ? It is urged by learned standing counsel that the arguments were duly addressed before the Tribunal on this ground. It is conceded by him that the Tribunal has not at all discussed that ground in its order and complete omission to discuss the ground set up in appeal is undoubtedly a mistake apparent from the record. There being no controversy on the fact that the Tribunal completely omitted to consider the ground, in our opinion, the aforesaid question is not referable and, therefore, the application is dismissed. No order as to costs. Lastly your kind attention is invited towards 91 ITD 398 (Amritsar Third Member) in case of B. Karamchand Piarelal vs. lncome Tax Officer in which the Hon'ble bench held as under : On a careful consideration of the entire relevant facts, which have very aptly been discussed in the order

- 10. 10 proposed by the learned Members in the aforesaid M.A. and in the interest of fairness and justice, I am of the considered opinion that the view taken by the learned Accountant Member should be preferred over the view expressed by the learned Judicial Member, so that no litigant can have a grievance that certain vital arguments made by them and important judgments cited by them have not been considered by the Tribunal. In view of above mentioned facts and circumstances you will observe that there being a mistake apparent from record as pointed out above you are requested to kindly rectify the mistake. 3. The ld. D.R. has submitted that there is no rectifiable mistake in this Tribunal Order and supported the same. 4. After considering the above submissions we are satisfied, that the ‘addition ground raised’ regarding excessiveness of the penalty levied u/s 271(1)(c) of the Act remained unadjudicated. This is a rectifiable mistake inadvertently committed, and this can be rectified under the provisions of Section 254(2) of the Act. Other submissions are simply admitted at the re-writing of the order which is not permissible under section 254(2) of the Act. Accordingly, we recall the

- 11. 11 Tribunal Order only for the limited purpose of deciding the additional legal ground raised and reject other referred mistakes. 5. In the result, this M.A. is partly allowed. Order pronounced in the open court on 30th April, 2013. Sd/- Sd/- [N.K. Saini] [Hari Om Maratha] Accountant Member Judicial Member Dated : 30th April, 2013. VL Copy to all concerned.