Mb0041 financial and management accounting

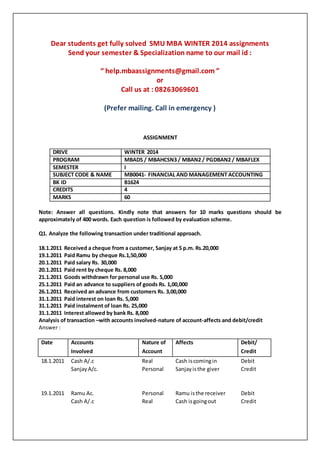

- 1. Dear students get fully solved SMU MBA WINTER 2014 assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency ) ASSIGNMENT DRIVE WINTER 2014 PROGRAM MBADS / MBAHCSN3 / MBAN2 / PGDBAN2 / MBAFLEX SEMESTER I SUBJECT CODE & NAME MB0041- FINANCIAL AND MANAGEMENT ACCOUNTING BK ID B1624 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. Q1. Analyze the following transaction under traditional approach. 18.1.2011 Received a cheque from a customer, Sanjay at 5 p.m. Rs.20,000 19.1.2011 Paid Ramu by cheque Rs.1,50,000 20.1.2011 Paid salary Rs. 30,000 20.1.2011 Paid rent by cheque Rs. 8,000 21.1.2011 Goods withdrawn for personal use Rs. 5,000 25.1.2011 Paid an advance to suppliers of goods Rs. 1,00,000 26.1.2011 Received an advance from customers Rs. 3,00,000 31.1.2011 Paid interest on loan Rs. 5,000 31.1.2011 Paid instalment of loan Rs. 25,000 31.1.2011 Interest allowed by bank Rs. 8,000 Analysis of transaction –with accounts involved-nature of account-affects and debit/credit Answer : Date Accounts Nature of Affects Debit/ Involved Account Credit 18.1.2011 Cash A/.c Real Cash iscomingin Debit SanjayA/c. Personal Sanjayisthe giver Credit 19.1.2011 Ramu Ac. Personal Ramu isthe receiver Debit Cash A/.c Real Cash isgoingout Credit

- 2. Q2. The trial balance of Nilgiris Co Ltd., as taken on 31st December, 2002 did not tally and the difference was carried to suspense account. The following errors were detected subsequently. a) Sales book total for November was under cast by Rs. 1200. b) Purchase of new equipment costing Rs. 9475 has been posted to Purchases a/c. c) Discount received Rs.1250 and discount allowed Rs. 850 in September 2002 have been posted to wrong sides of discount account. d) A cheque received from Mr. Longford for Rs. 1500 for goods sold to him on credit earlier, though entered correctly in the cash book has been posted in his account as Rs. 1050. e) Stocks worth Rs. 255 taken for use by Mr Dayananda, the Managing Director, have been entered in sales day book. f) While carrying forward, the total in Returns Inwards Book has been taken as Rs. 674 instead of Rs. 647. g) An amount paid to cashier, Mr. Ramachandra, Rs. 775 as salary for the month of November has been debited to his personal account as Rs. 757. (Pass journal entries and draw up the suspense account, Journal entries of all the transactions, Suspense account with Conclusion) Answer : Serial No. Journal Entry Debit Credit a) Suspense Account 1200 To Sales 1200 b) No Suspense AccountInvolved 3 From the given trial balance draft an Adjusted Trial Balance.

- 3. Adjustments: 1. Charge depreciation at 10% on Buildings and Furniture and fittings. 2. Write off further bad debts 1000 3. Taxes and Insurance prepaid 2000 4. Outstanding salaries 5000 5. Commission received in advance1000 Solution;-Ledger accounts Furniture and fittings a/c Particulars Rs. Particulars Rs. To bal b/d 500000 By Depreciation By bal c/d 50000 450000 Total 500000 Total 500000 4 Compute trend ratios and comment on the financial performance of Infosys Technologies Ltd. from the following extract of its income statements of five years. (inRs. Crore) Preparation of trend analysis Solution: Infosys Technologies Ltd. Trend Analysis Particulars 2010-11 2009-10 2008-09 2007-08 2006-07 Revenue 27,501 22,742 21,693 16,692 13,893

- 4. Operating Profit (PBIDT) 8,968 7,861 7,195 5,238 4,391 5 Give the meaning of cash flow analysis and put down the objectives of cash flow analysis. Explain the preparation of cash flow statement. Answer : Meaning of cash flow analysis A cash flow statement is one of the most important financial statements for a project or business. The statement can be as simple as a one page analysis or may involve several schedules that feed information into a central statement. A cash flowstatementisalistingof the flowsof cashintoand outof the businessorproject.Thinkof it as your checking account at the bank. Deposits are the cash inflow and withdrawals (checks) are the cash outflows. The balance in your checking account is your net cash flow at a specific point in time. 6 Write the assumptions of marginal costing. Differentiate between absorption costing and marginal costing. Answer : The Cost of a product of comprises of materials, labour, and over heads. On the basis of variabilitytheycanbe broadlyclassifiedasfixedandvariable costs.Fixedcostsare those costswhich remainconstantat all levelsof productionwithin a given period of time. In other words, a cost that doesnotchange intotal but become.progressivelysmallerperunitwhenthe volume of production increasesisknownas fixed cost. it is also called period cost eg. Rent, Salary, Insurance charges etc. On the otherhand variable costare those cost whichveryin accordance with the volume of output. To part it in another way. variable costs are uniform per unit. but their total fluctuates in direct position to the total of the related activity or volume Dear students get fully solved SMU MBA WINTER 2014 assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency )