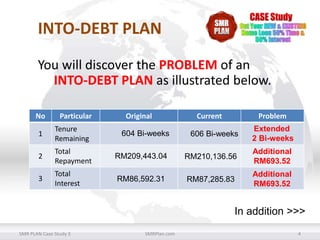

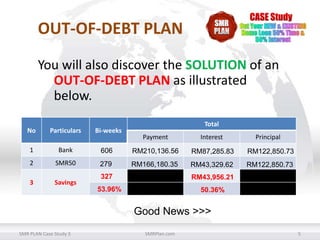

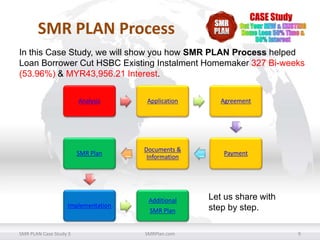

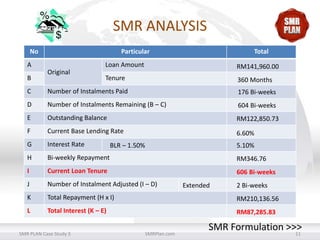

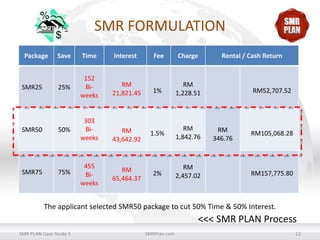

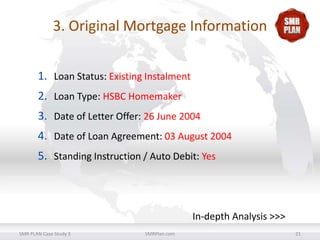

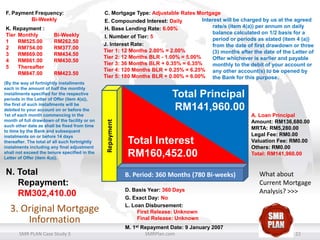

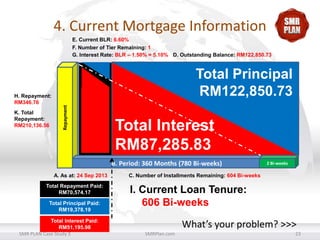

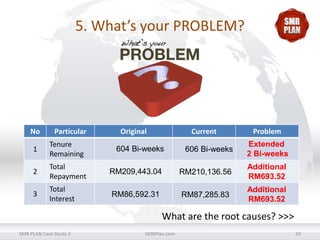

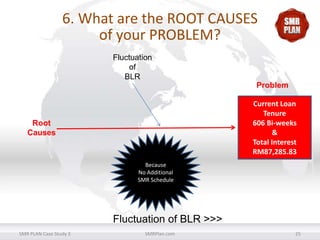

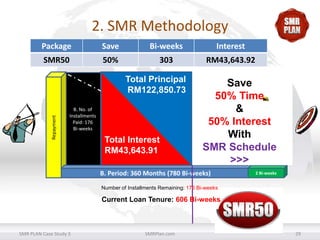

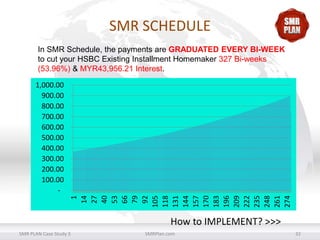

The webinar presented the SMR plan case study which helped a loan borrower reduce their HSBC homeowner installments by 327 bi-weeks (53.96%) and save MYR 43,956.21 in interest (50.36%). It emphasized the importance of having an 'out-of-debt' plan and showcased the process and benefits of the SMR plan. Participants were also offered a free SMR plan analysis as a gift for attending the webinar.