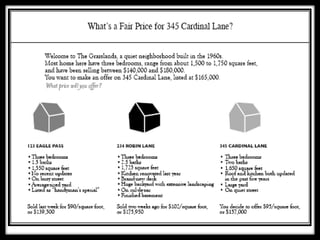

The document provides an overview of the steps to successful home ownership. It begins with addressing common fears about buying a home and provides facts to alleviate those fears. It then outlines eight steps to home ownership: deciding to buy, hiring an agent, securing financing, finding a home, making an offer, performing due diligence, closing, and protecting your investment. For each step, it provides guidance, tips, and statistics to help buyers navigate the home buying process.